Free Small Business Loan Fact Sheet

I. Introduction

Welcome to the Small Business Loan created by [Your Company Name]. This document aims to provide comprehensive information about small business loans and how they can benefit your business.

II. Overview of Small Business Loans

Small business loans are financial products designed to help small businesses access the capital they need to grow, expand, or manage cash flow. Here are some key points to consider:

Types of Loans Available:

Term loans

SBA loans

Lines of credit

Eligibility Criteria:

Annual revenue of at least $50,000

Minimum credit score of 600

Business must be operational for at least 6 months

Benefits:

Flexible repayment options

Competitive interest rates

Opportunity to build credit history

III. Application Process

Securing a small business loan involves several steps. Here's an overview:

Preparation:

Gather business financial statements

Prepare a business plan

Organize tax returns

Research:

Compare interest rates and fees from different lenders

Review loan terms and conditions carefully

Application Submission:

Complete the online application form

Submit required documents

Review and Approval:

The lender evaluates application and creditworthiness

Approval typically within 1-2 weeks

IV. Loan Terms and Conditions

Understanding the terms and conditions of a small business loan is crucial. Here's what you need to know:

Loan Amount:

Minimum: $5,000

Maximum: $500,000

Interest Rate:

Fixed interest rate of 6.5%

Repayment Terms:

Monthly payments over 1-5 years

Collateral Requirements:

A personal guarantee is required for loans over $100,000

V. Funding Timeline

Once approved, the funding timeline for a small business loan can vary. Here's what to expect:

Approval Timeframe:

1-2 weeks from application submission

Funding Disbursement:

Funds disbursed within 1-3 business days after approval

VI. Additional Resources

To learn more about small business loans and financial management, consider these resources:

[Your Company Name] Blog:

Articles on small business financing tips and strategies

Small Business Administration (SBA):

SBA's guide to small business loans and funding options

Financial Advisers:

Consult with our financial experts for personalized loan advice

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Illuminate your small business loan offerings with the Small Business Loan Fact Sheet Template from Template.net. This comprehensive document simplifies the creation of fact sheets, allowing you to showcase essential information about your loan programs, terms, and eligibility criteria. Crafted for flexibility, it's editable and customizable, empowering you to tailor every detail to resonate with prospective borrowers and investors. With our Ai Editor Tool, making adjustments is seamless, ensuring your fact sheet reflects the unique strengths and benefits of your small business loan offerings. Trust Template.net to provide the framework for presenting your loan options in a professional and compelling manner. Simplify your marketing efforts and attract potential borrowers with confidence, knowing you're supported every step of the way.

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

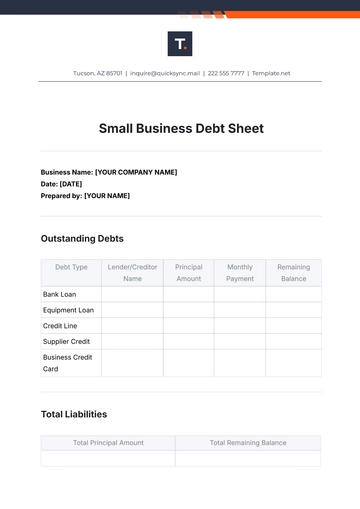

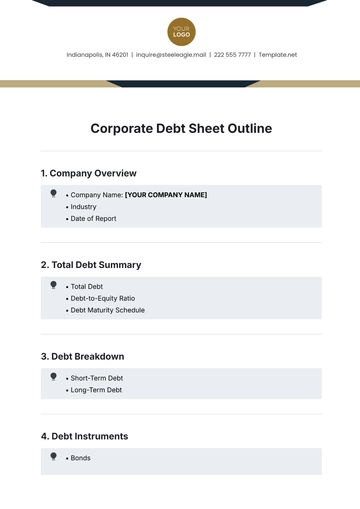

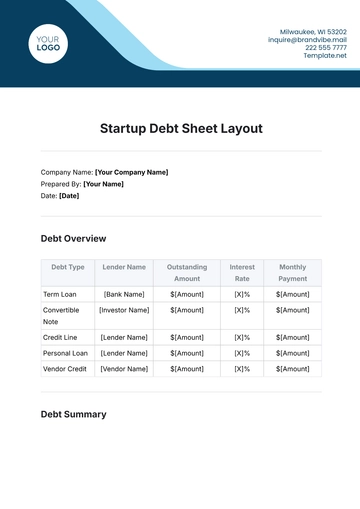

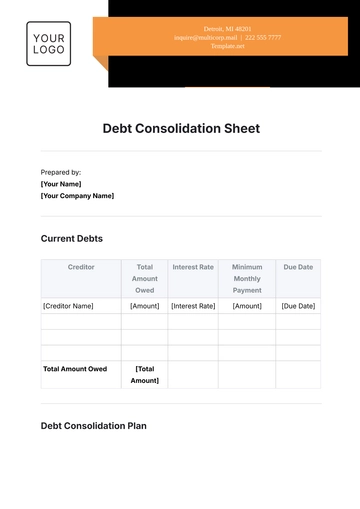

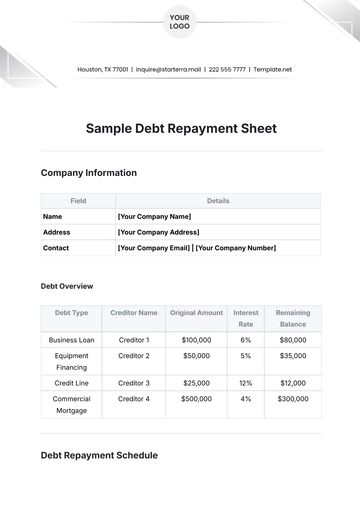

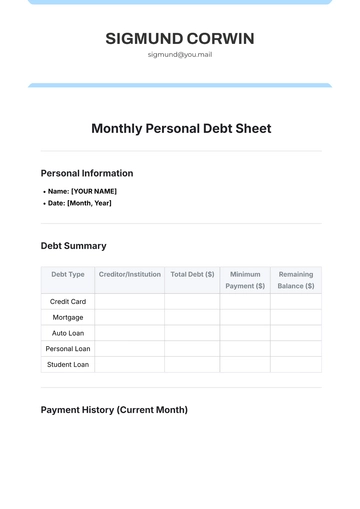

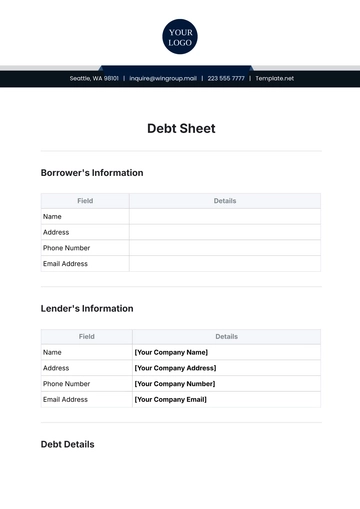

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet