Free Financial Fact Sheet

I. Overview

The Financial Fact Sheet provided by [YOUR COMPANY NAME] is a document that presents a thorough summary of the company's financial performance and highlights critical metrics. This information pertains to the period that concludes on December 31, 2053.

II. Executive Summary

[YOUR COMPANY NAME]:

A leading technology company specializing in software development and IT solutions.

Established in 2050, serving clients globally with offices in North America, Europe, and Asia.

Financial Highlights:

Revenue: $100 million

Expenses: $75 million

Net Income: $25 million

Assets: $300 million

Liabilities: $150 million

III. Financial Performance

A. Revenue Analysis

Total Revenue: $100 million

Revenue Breakdown:

Product Sales: $60 million

Services Revenue: $30 million

Other Income: $10 million

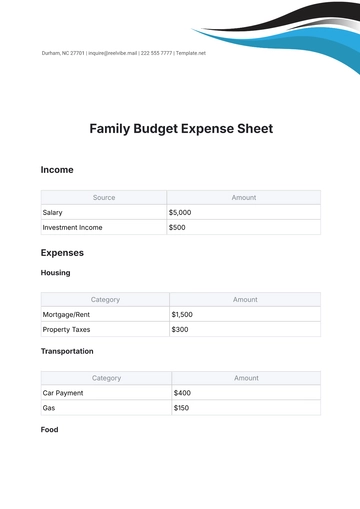

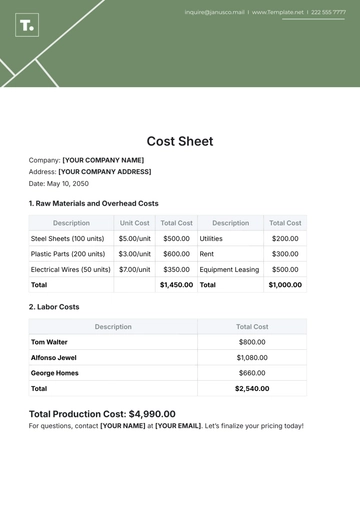

B. Expense Analysis

Total Expenses: $75 million

Expense Breakdown:

Cost of Goods Sold (COGS): $35 million

Operating Expenses: $25 million

Other Expenses: $15 million

C. Profitability Ratios

Gross Profit Margin: 40%

Net Profit Margin: 25%

Return on Assets (ROA): 8.33%

Return on Equity (ROE): 16.67%

IV. Financial Position

A. Assets

Current Assets:

Cash and Cash Equivalents: $50 million

Accounts Receivable: $30 million

Inventory: $20 million

Other Current Assets: $10 million

Non-Current Assets:

Property, Plant & Equipment: $150 million

Intangible Assets: $50 million

Investments: $20 million

B. Liabilities

Current Liabilities:

Accounts Payable: $40 million

Short-term Debt: $30 million

Accrued Expenses: $20 million

Non-Current Liabilities:

Long-term Debt: $80 million

Deferred Tax Liabilities: $10 million

Other Long-term Liabilities: $30 million

C. Equity

Total Equity: $150 million

Shareholder's Equity: $120 million

Retained Earnings: $30 million

V. Key Financial Ratios

A. Liquidity Ratios

Current Ratio: 2.0

Quick Ratio: 1.5

Cash Ratio: 1.0

B. Solvency Ratios

Debt to Equity Ratio: 0.67

Interest Coverage Ratio: 5.0

C. Efficiency Ratios

Inventory Turnover Ratio: 3.0

Accounts Receivable Turnover Ratio: 6.0

Days Sales Outstanding (DSO): 60 days

VI. Future Outlook

[YOUR COMPANY NAME] is committed to maintaining a strong financial position, driving profitability, and pursuing strategic initiatives to achieve sustainable growth in the coming quarters. The outlook remains positive based on market trends and our competitive advantages.

VII. Contact Information

For further inquiries or information, please contact:

[YOUR NAME]

Chief Financial Officer

Email: [YOUR EMAIL]

Phone: [YOUR COMPANY NUMBER]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

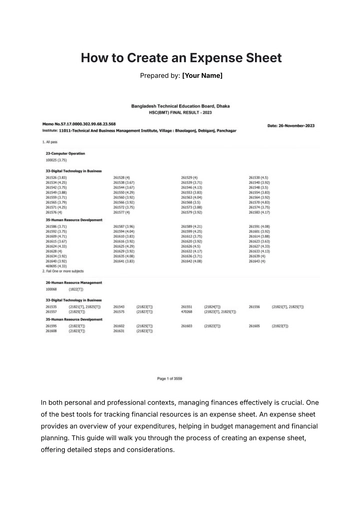

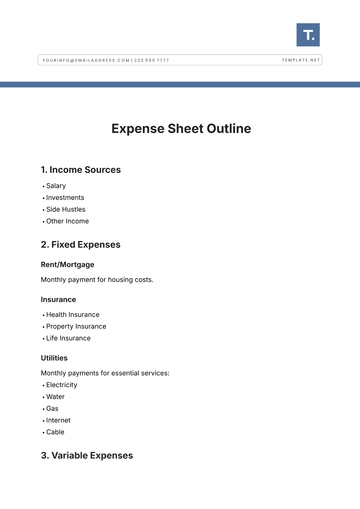

Explore the Financial Fact Sheet Template on Template.net for concise financial data presentation. This editable and customizable template aids financial analysts in organizing and summarizing key financial information. Personalize the fact sheet effortlessly using our AI Editor Tool, ensuring clear and insightful financial analysis. Simplify financial reporting and communication with this user-friendly and comprehensive template.

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

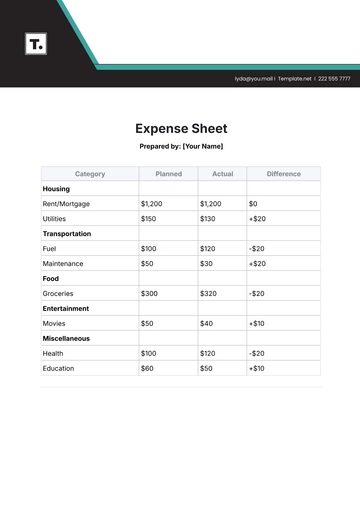

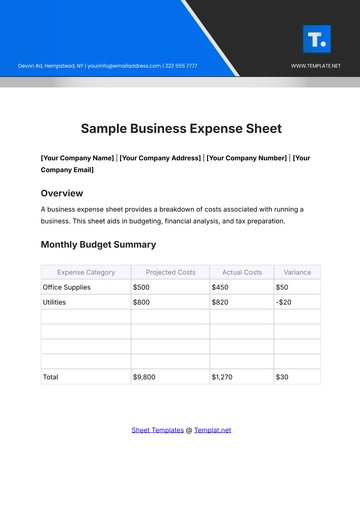

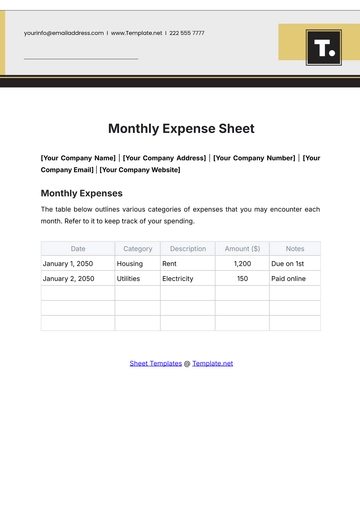

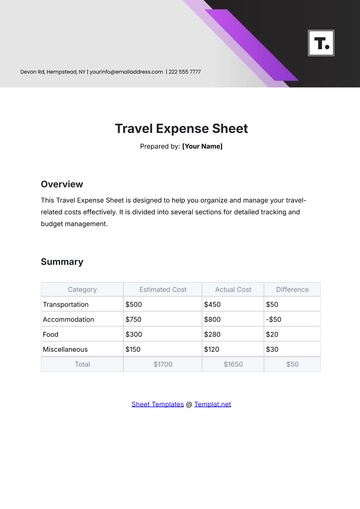

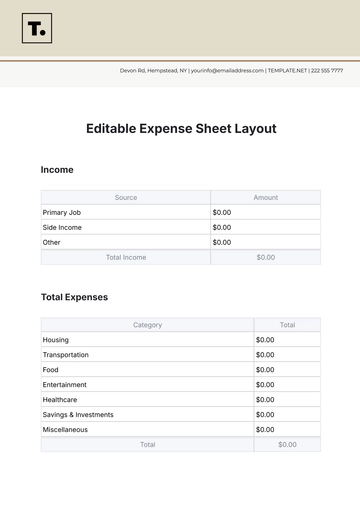

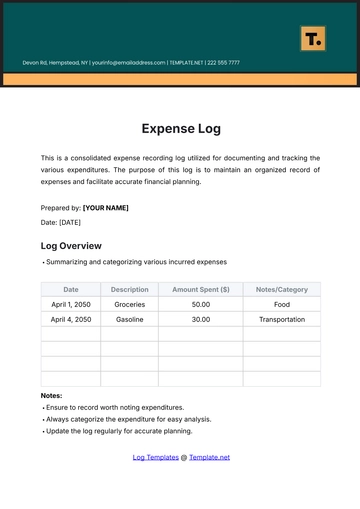

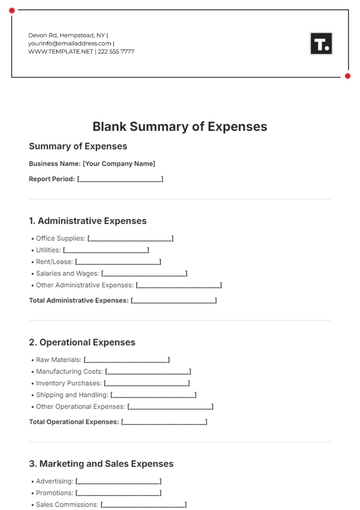

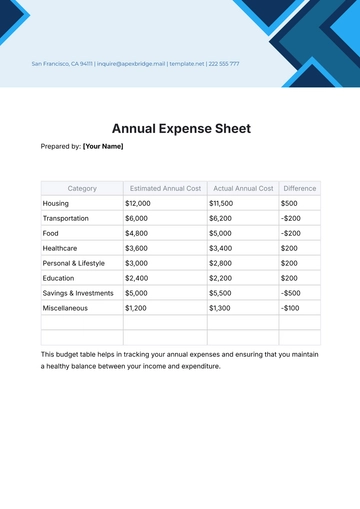

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet