Small Business Administration Fact Sheet

I. Introduction

Introducing the [Your Company Name] Small Business Administration (SBA) Fact Sheet, a comprehensive resource aimed at providing essential information about the services and resources offered by the Small Business Administration. This document is designed to assist small business owners in understanding how the SBA can support their business endeavors.

II. Overview

A. Definition:

The Small Business Administration (SBA) is a [Your Country/Region] government agency established to provide support and assistance to small businesses. It offers a wide range of programs, services, and resources aimed at helping entrepreneurs start, grow, and succeed in their ventures.

B. Importance:

The SBA plays a crucial role in fostering entrepreneurship and economic development by providing access to capital, counseling, contracting opportunities, and other forms of assistance to small businesses, which are the backbone of the [Your Country/Region] economy.

C. Key Points:

Access to Capital: The SBA facilitates access to loans, grants, and venture capital to help small businesses fund their operations and growth initiatives.

Business Counseling: Through its network of Small Business Development Centers (SBDCs) and SCORE mentors, the SBA provides free counseling, training, and mentorship to entrepreneurs.

Government Contracting: The SBA assists small businesses in securing government contracts through its various contracting assistance programs.

III. SBA Services and Programs

Explore the array of services and programs offered by the Small Business Administration:

SBA Loans: Various loan programs, including [Loan Program Names], are designed to meet the diverse financing needs of small businesses.

SBDCs and SCORE: Small Business Development Centers (SBDCs) and SCORE chapters provide counseling, training, and mentoring services to entrepreneurs.

Government Contracting Programs: Assistance programs such as [Contracting Program Names] help small businesses compete for government contracts.

IV. Benefits of SBA Assistance

Understanding the benefits of SBA assistance can help small businesses thrive:

Access to Funding: SBA loans provide favorable terms and conditions, making financing more accessible to small businesses.

Expert Guidance: Counseling and mentorship from experienced professionals can help entrepreneurs make informed decisions and overcome challenges.

Contracting Opportunities: SBA contracting programs open doors for small businesses to compete for government contracts, fostering growth and expansion.

V. Success Stories

Explore real-life success stories of small businesses that have benefited from SBA assistance:

Case Study 1: [Summary of how a small business secured an SBA loan to expand its operations and increase production capacity.]

Case Study 2: [Summary of how a startup received counseling and guidance from SCORE mentors, leading to rapid growth and market expansion.]

Case Study 3: [Summary of how a minority-owned business leveraged SBA contracting programs to win government contracts and achieve business success.]

VI. Frequently Asked Questions

How can I apply for an SBA loan?

What resources are available for veterans and minority-owned businesses through the SBA?

How can I find my local SBDC or SCORE chapter for counseling and mentorship?

VII. Statistics and Figures

Explore key figures and statistics related to the impact of SBA programs on small businesses:

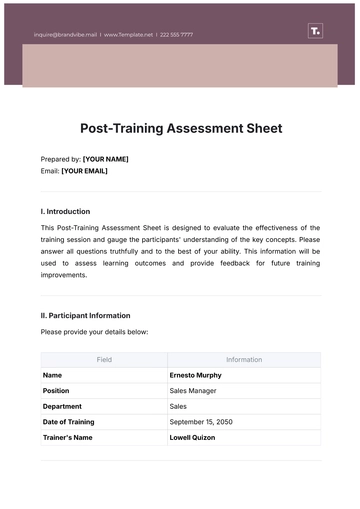

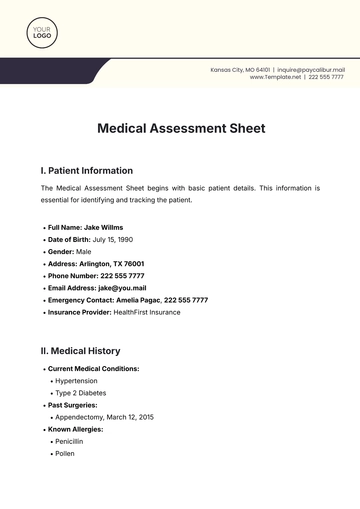

Category | Year | Loan Approval Rate | Funding Provided |

|---|

SBA Loan Approval Rates | [Year] | [Percentage]% | [Amount] |

SBDC Counseling Impact | - | - | - |

Government Contracting Success | [Year] | - | - |

This simplified table presents key statistics related to SBA loan approval rates, SBDC counseling impact, and government contracting success. Fill in the placeholders with the relevant data for each category and year.

VIII. Conclusion

In conclusion, the Small Business Administration plays a pivotal role in supporting the growth and success of small businesses across [Your Country/Region]. By leveraging the resources, services, and programs offered by the SBA, entrepreneurs can overcome challenges, seize opportunities, and achieve their business goals.

Fact Sheet Templates @ Template.net