Free Investor Fact Sheet

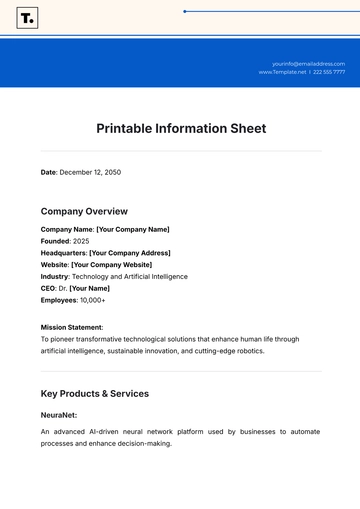

I. Company Overview

XYZ Tech Solutions is an innovative technology firm specializing in software development, data analytics, and artificial intelligence (AI) solutions. Founded in 2015, the company has quickly established itself as a leader in the tech industry, serving a wide range of clients from small businesses to Fortune 500 companies.

II. Key Facts

Founded: 2050

Headquarters: Austin, Texas, USA

Employees: 300+

Revenue (2023): $100 million

Clients: 1,000+ clients in over 20 countries

III. Core Products and Services

Enterprise Software Solutions:

Custom software designed for large enterprises.

Includes customer relationship management (CRM) and enterprise resource planning (ERP).

AI and Machine Learning Applications:

AI-powered tools for data analytics, customer insights, and automation.

Includes predictive analytics and natural language processing (NLP).

Cloud Computing Services:

Secure and scalable cloud solutions for businesses of all sizes.

Includes cloud storage, virtual servers, and data backup.

IV. Financial Highlights

Revenue Growth (2050-2051): 25%

Gross Margin: 65%

Net Profit Margin: 15%

EBITDA: $25 million

Valuation: $350 million

V. Market Opportunity

Total Addressable Market (TAM): $75 billion (expected for software and AI solutions).

Primary Industries Served: Technology, healthcare, finance, and retail.

Growth Opportunities:

Increasing demand for AI and machine learning applications.

Expansion into new international markets.

VI. Competitive Advantage

Innovation: Continuous investment in R&D and a culture of innovation.

Customer Focus: Strong customer relationships and a commitment to tailored solutions.

Strategic Partnerships: Collaborations with leading technology firms and academic institutions.

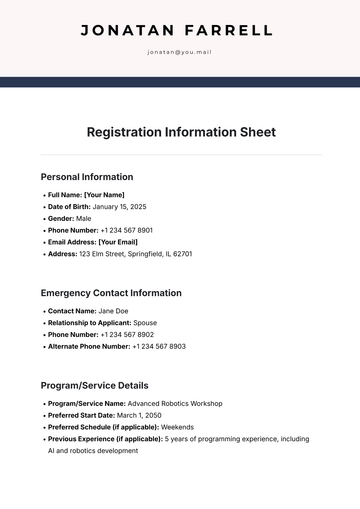

VII. Leadership Team

CEO: John Smith (Co-founder, MBA from Harvard Business School, 15 years of tech industry experience)

CTO: Lisa Johnson (PhD in Computer Science, expert in AI and machine learning)

CFO: Mark Davis (CPA, extensive experience in corporate finance and M&A)

VIII. Investment Opportunity

Investment Goal: $30 million for product development and global expansion.

Use of Funds:

40% for R&D and new product launches

40% for market expansion and customer acquisition

20% for operational improvements

Expected ROI: 20-25% within 3 years

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

An Investor Fact Sheet is a concise document that provides key information about a company to potential investors. It typically includes essential financial data, business highlights, company structure, market trends, and other relevant information that investors need to make informed decisions. The goal is to give a snapshot of the company's performance, business model, and growth prospects.

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

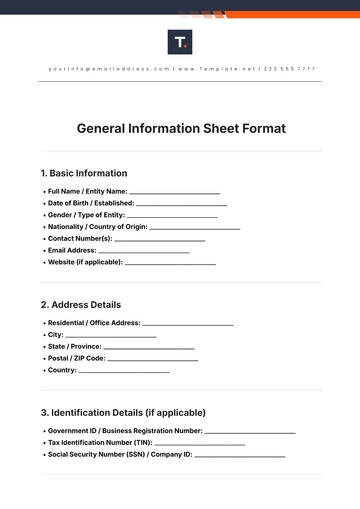

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

- Debt Sheet

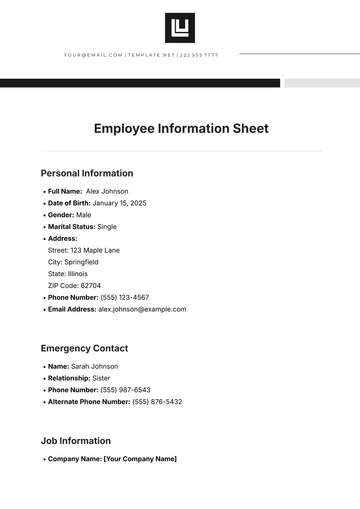

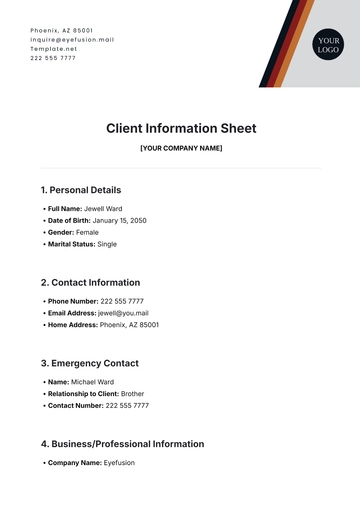

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet