Free Investment Fact Sheet

The primary objective of [Your Company Name] is to [briefly describe the investment's goal, such as capital appreciation, income generation, or a combination of both].

I. Executive Summary

The following document provides a comprehensive comparison and analysis of selected investment options tailored to assist financial advisors in recommending the most suitable choices for their clients. This analysis focuses on performance metrics, risk assessments, and market position to ensure informed decision-making.

II. Investment Options Overview

This section provides brief introductions to the various investment options available for evaluation. Each option has been carefully selected based on recent market trends and the financial goals of the clients.

[Investment Option 1]: Description, primary focus areas, and recent performance.

[Investment Option 2]: Description, primary focus areas, and recent performance.

[Investment Option 3]: Description, primary focus areas, and recent performance.

III. Comparative Analysis

Detailed comparison of each investment option based on selected criteria crucial for advising clients. These include performance over the past years, risk levels, potential returns, and adaptability to market changes.

Criteria | [Investment Option 1] | [Investment Option 2] | [Investment Option 3] |

|---|---|---|---|

Annual Return (%) | [Data] | [Data] | [Data] |

Risk Level | [Low/Medium/High] | [Low/Medium/High] | [Low/Medium/High] |

Market Adaptability | [Score] | [Score] | [Score] |

IV. Risks

[Identify and briefly explain key risks associated with the investment, such as market risk, credit risk, or liquidity risk].

[Include any specific risk management strategies employed by the investment manager].

V. Investment Strategy Recommendations

Based on the comparative analysis, recommendations are provided for different client profiles. These strategies consider both short-term and long-term goals of the clients, balancing between risk tolerance and investment returns.

Strategy for low-risk tolerance clients: [Recommendation].

Strategy for medium-risk tolerance clients: [Recommendation].

Strategy for high-risk tolerance clients: [Recommendation].

VI. Conclusion

The provided comparative analysis and strategy recommendations should assist financial advisors in guiding their clients to make well-informed investment decisions that align with their financial goals and risk profiles.

VII. Contact Information

For further information or additional insights, please contact:

Email: [Your Company Email]

Phone: [Your Company Number]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Investment Fact Sheet Template from Template.net: your ultimate solution for concise, professional financial reporting. This editable and customizable template streamlines your data presentation, ensuring clarity and impact. Crafted with precision, it's easily editable in our Ai Editor Tool, empowering you to tailor your investment insights with ease. Elevate your reports effortlessly with Template.net.

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

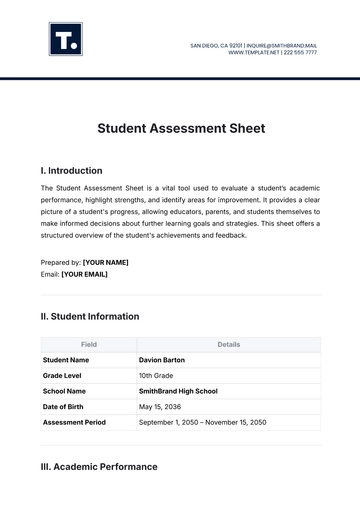

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

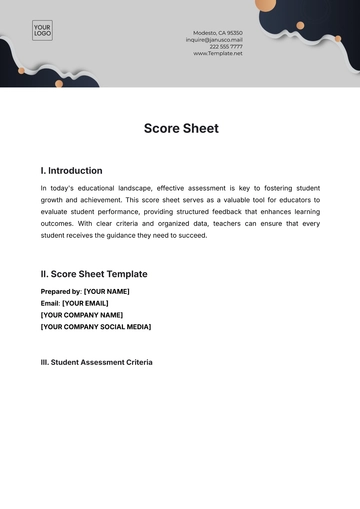

- Score Sheet

- Estimate Sheet

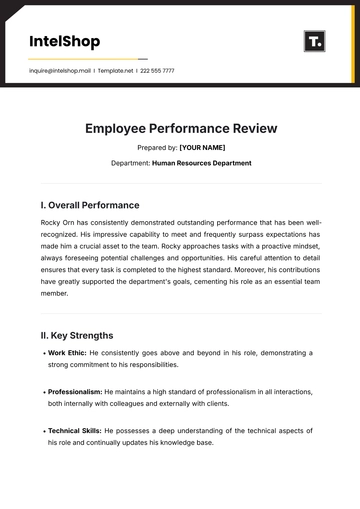

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

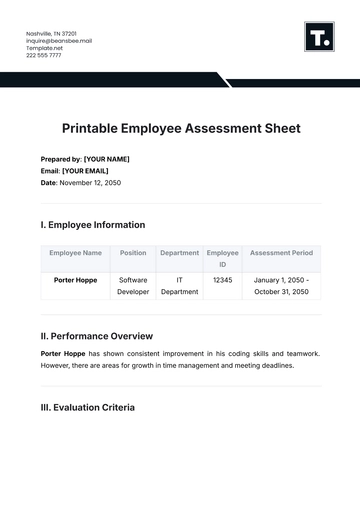

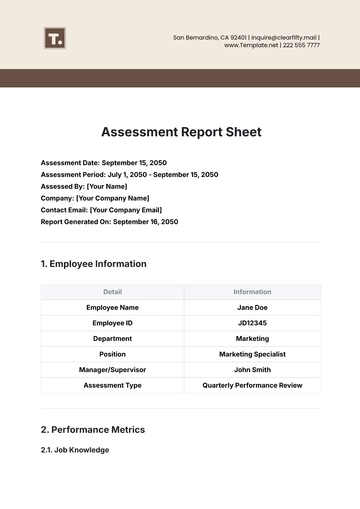

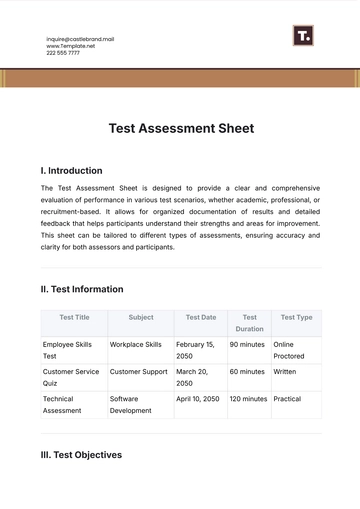

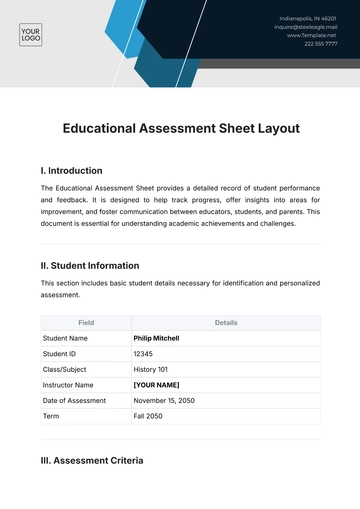

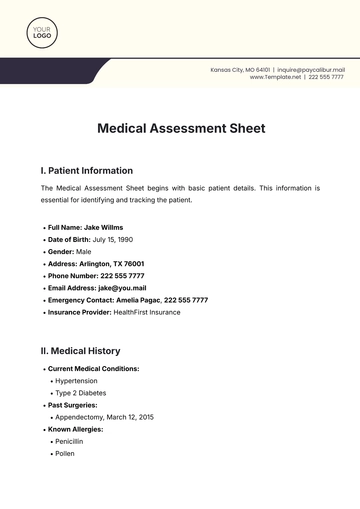

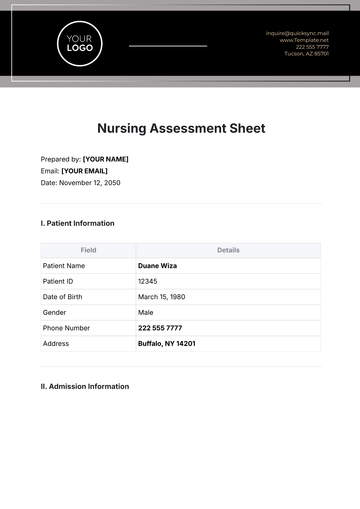

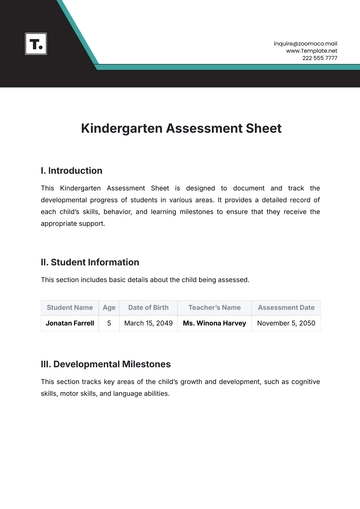

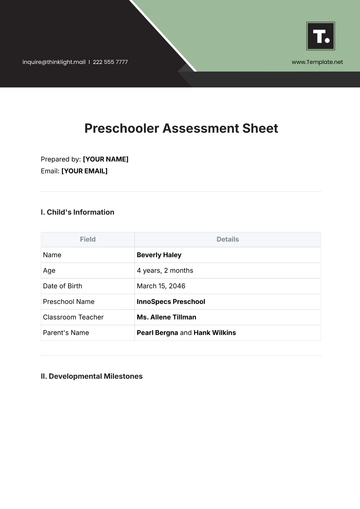

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet