Free Strategic Income Fund Fact Sheet

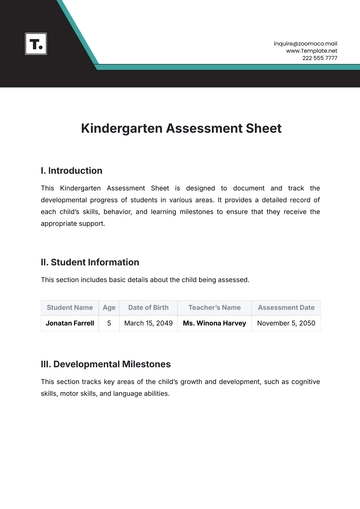

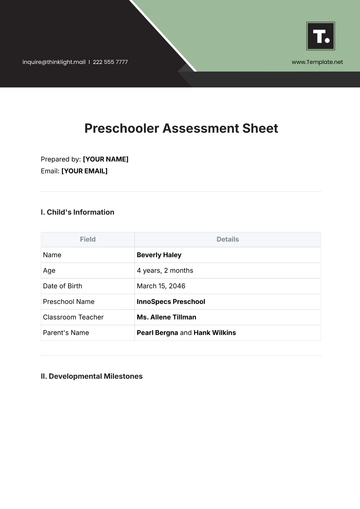

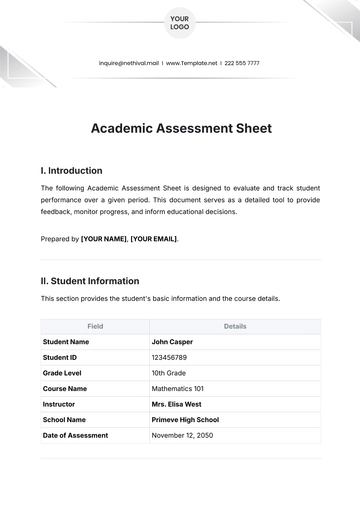

I. Overview

Fund Name: Strategic Income Fund

Objective: Provide investors with a diversified portfolio of income-generating assets while seeking to preserve capital and manage risk

Inception Date: January 1, 2050

Fund Manager: [Your Name]

Ticker Symbol: SIFX

Morningstar Rating: 4 Stars

II. Investment Strategy

The Strategic Income Fund employs a disciplined investment approach focused on:

Asset Allocation: Allocation across various asset classes including bonds, equities, and alternative investments.

Risk Management: Utilization of hedging strategies and diversification to mitigate downside risk.

Income Generation: Emphasis on selecting securities with attractive yields while maintaining a focus on credit quality.

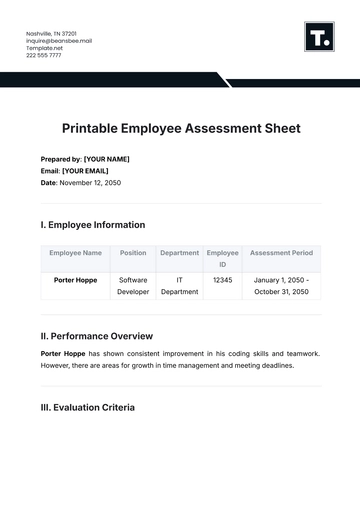

III. Performance

A. Historical Performance

Year | Fund Return (%) | Benchmark Return (%) |

|---|---|---|

2050 | 6.75 | 6.00 |

2051 | 5.25 | 4.80 |

2052 | 7.00 | 6.50 |

B. Top Holdings

The fund's top holdings include:

Apple Inc. (AAPL)

Microsoft Corp. (MSFT)

Amazon.com Inc. (AMZN)

IV. Portfolio Characteristics

Asset Allocation:

Equities: 60%

Bonds: 30%

Alternative Investments: 10%

Credit Quality Distribution:

AAA: 40%

AA: 30%

A: 20%

Below Investment Grade: 10%

V. Fees and Expenses

Expense Ratio: 0.75%

Front-end Load: 1.00%

Back-end Load: 0.50%

VI. Risk Considerations

Investors should consider the following risks associated with investing in the Strategic Income Fund:

Market Risk: Fluctuations in market conditions may impact fund performance.

Interest Rate Risk: Changes in interest rates may affect the value of fixed-income securities.

Credit Risk: The possibility of issuer default could lead to losses.

Liquidity Risk: Difficulty in selling securities at desired prices due to market conditions.

VII. Contact Information

For inquiries or additional information, please contact:

[Your Name], [Your Position]

[Your Company Name]

[Your Department]

Phone: [Your Phone Number]

Email: [Your Email]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

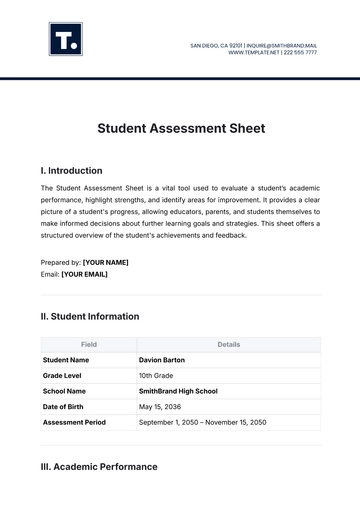

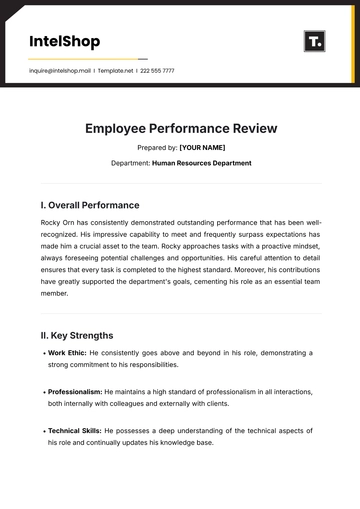

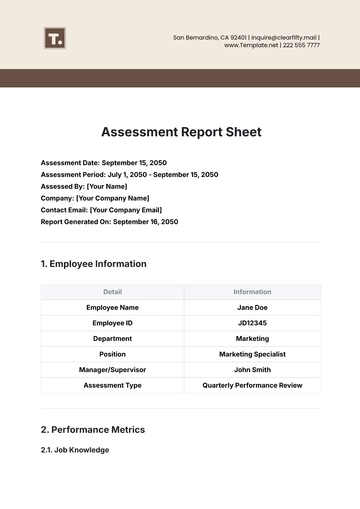

A Strategic Income Fund Fact Sheet is a concise document that provides key information about a specific strategic income fund. It typically includes an overview of the fund's investment strategy, objectives, asset allocation, risk profile, performance metrics, management team, fees, and other essential details. The purpose of the fact sheet is to offer investors and stakeholders a clear and accessible summary of the fund's characteristics and recent performance.

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

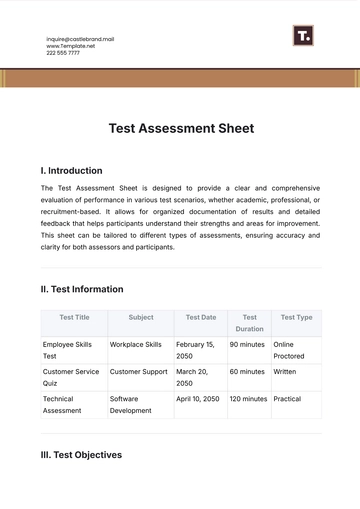

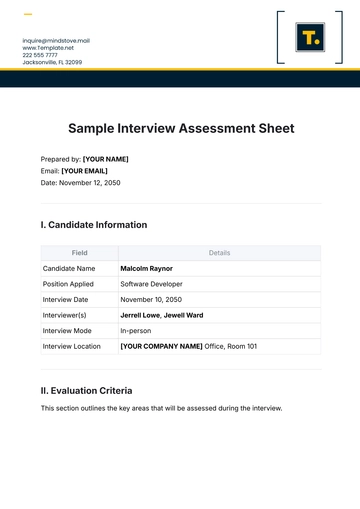

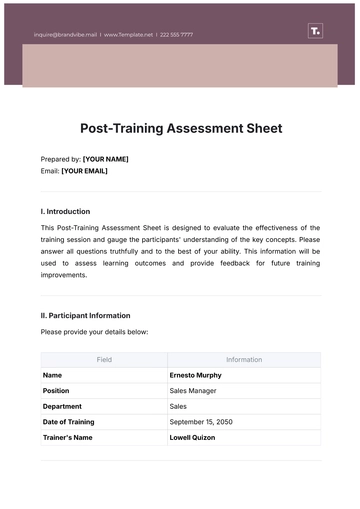

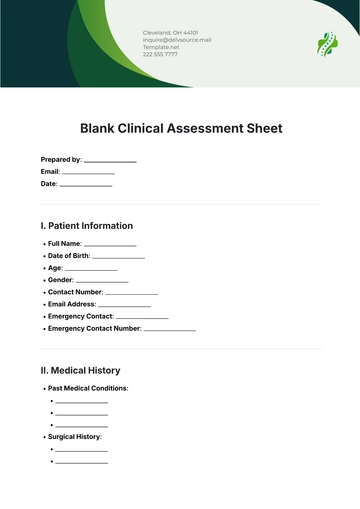

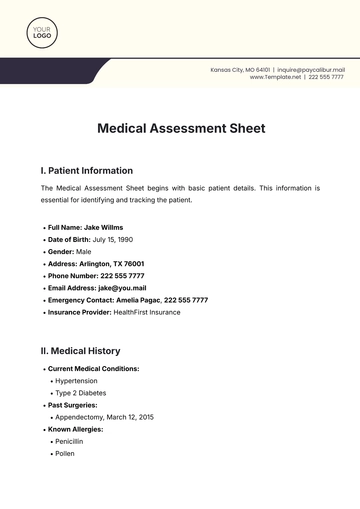

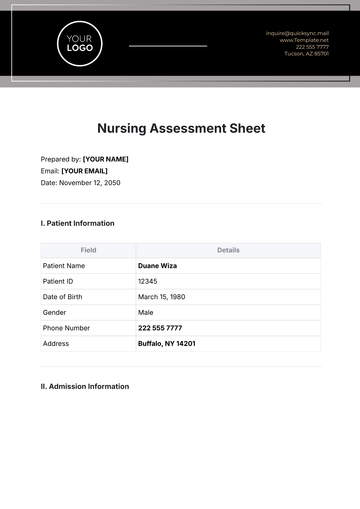

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet