Free Financial Services Fact Sheet

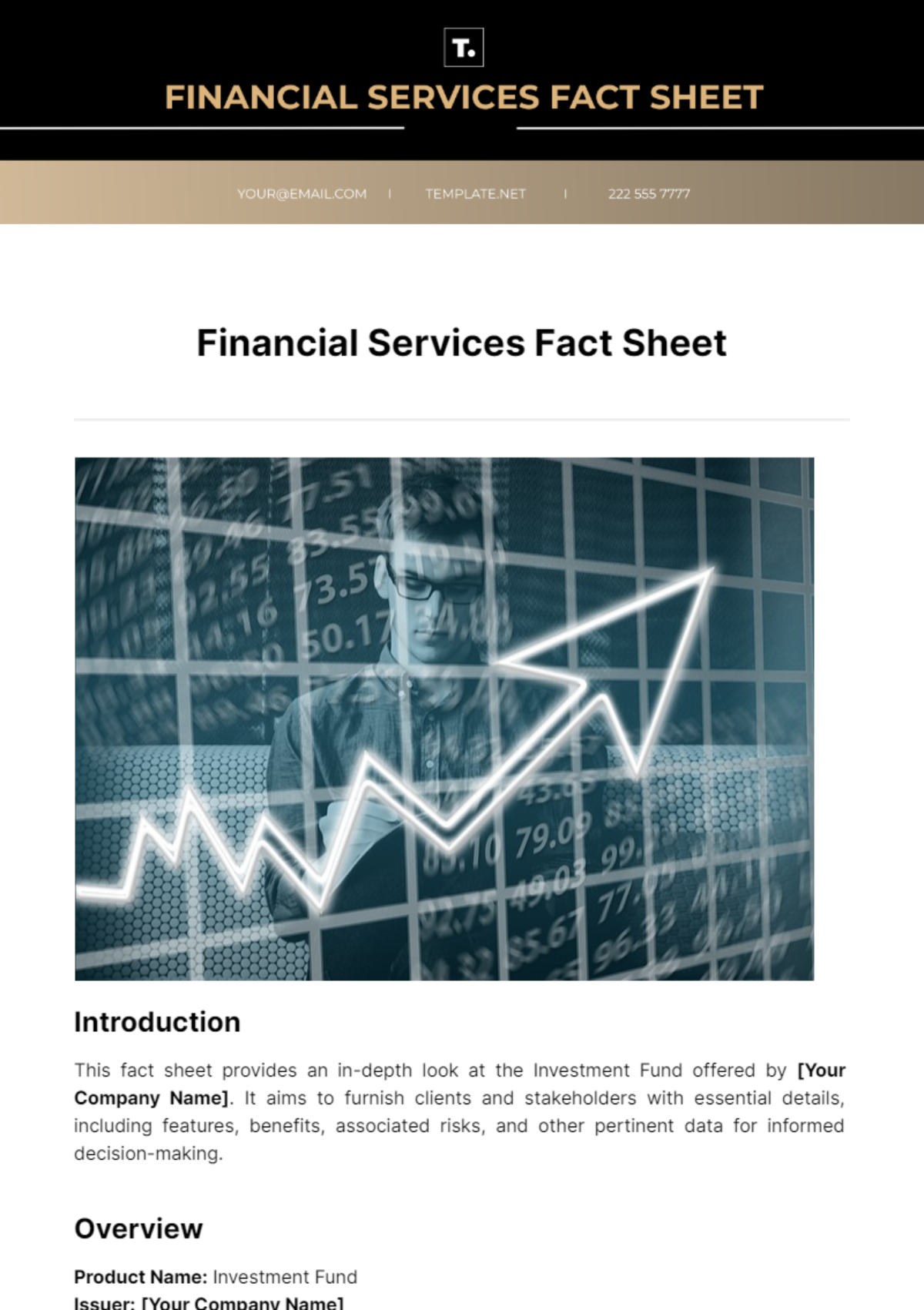

Introduction

This fact sheet provides an in-depth look at the Investment Fund offered by [Your Company Name]. It aims to furnish clients and stakeholders with essential details, including features, benefits, associated risks, and other pertinent data for informed decision-making.

Overview

Product Name: Investment Fund

Issuer: [Your Company Name]

Investment Objective: Long-term capital appreciation through diversified investments.

Target Audience: Individual and institutional investors seeking growth-oriented investment opportunities.

Key Features

Feature | Details |

|---|---|

Investment Strategy | Diversified portfolio across equities and fixed-income securities. |

Asset Allocation | 60% Equities, 40% Fixed Income |

Geographic Focus | Global Markets with an emphasis on North America and Europe. |

Investment Minimum | $1,000 (Initial Investment) |

Investment Horizon | Recommended minimum holding period of 3 years. |

Dividend Policy | Annual distribution of income and capital gains. |

Benefits

Diversification: Offers exposure to a diversified mix of asset classes and geographical regions, reducing overall portfolio risk.

Potential for Growth: Seeks long-term capital appreciation through strategic investment allocations.

Professional Management: Managed by experienced investment professionals who actively monitor and adjust the portfolio based on market conditions.

Income Generation: Provides regular income through dividend distributions and potential capital gains.

Global Opportunity: Access to global investment opportunities in both developed and emerging markets.

Liquidity: Ability to redeem shares based on the fund's liquidity terms, providing flexibility to investors.

Transparency: Clear and transparent fee structure and reporting to ensure investor confidence and understanding.

Risks

Market Risk: Fluctuations in stock and bond markets may affect fund performance.

Interest Rate Risk: Changes in interest rates may impact fixed-income investments.

Liquidity Risk: Difficulty in selling securities at desired prices due to market conditions.

Currency Risk: Exposure to exchange rate fluctuations in foreign investments.

Performance

Performance Metric | 1 Year (%) | 3 Years (%) | 5 Years (%) |

|---|---|---|---|

Fund Return (Net of Fees) | 10.5% | 8.2% | 7.9% |

Benchmark Comparison | S&P 500 Index (10.0%) | - | - |

Fees

Fee Type | Fee Rate |

|---|---|

Management Fee | 1.0% per annum |

Expense Ratio | 1.5% per annum |

Additional Information

Investment Style: Actively managed, seeking opportunities across growth and value sectors.

Distribution Policy: Quarterly dividends based on fund performance.

Tax Considerations: Investors are advised to consult with tax professionals regarding implications.

Contact Information

For more information or queries, reach out to:

Phone: [Your Company Number]

Email: [Your Company Email]

Office Address: [Your Company Address]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the Financial Services Fact Sheet Template on Template.net! Craft professional fact sheets swiftly with this versatile tool. It's fully editable and customizable, empowering you to present financial data effectively. Use our Ai Editor Tool to personalize content effortlessly. Ideal for financial institutions, advisors, and analysts. Simplify your reporting process and elevate financial presentations today!

You may also like

- Attendance Sheet

- Work Sheet

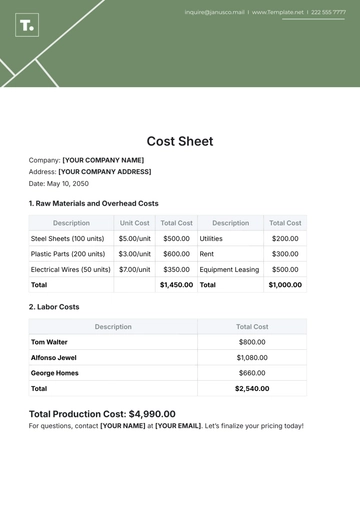

- Sheet Cost

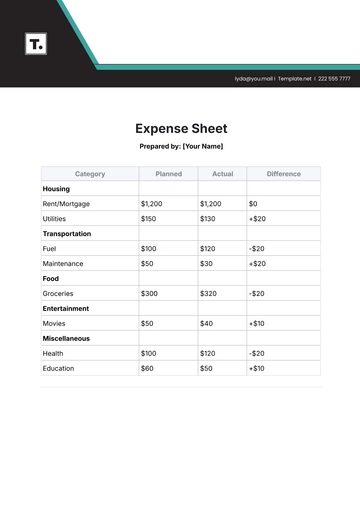

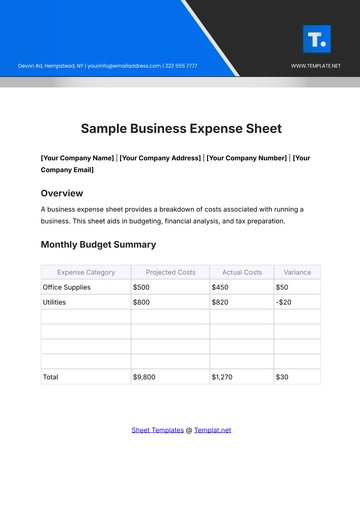

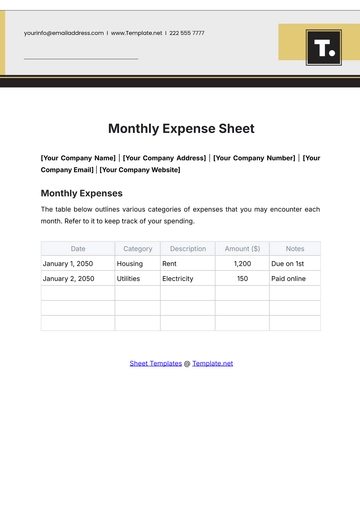

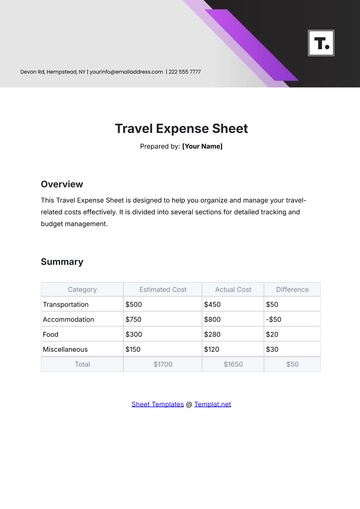

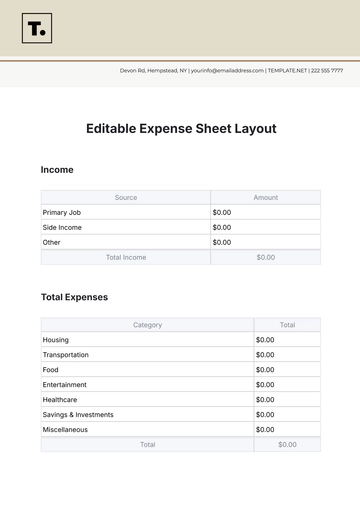

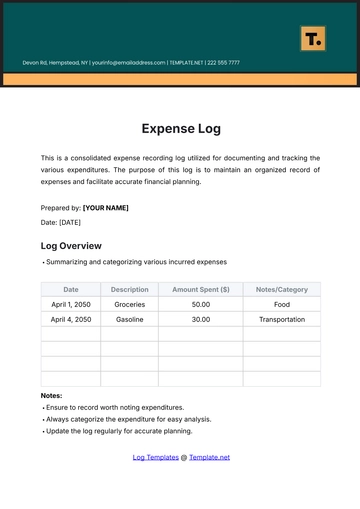

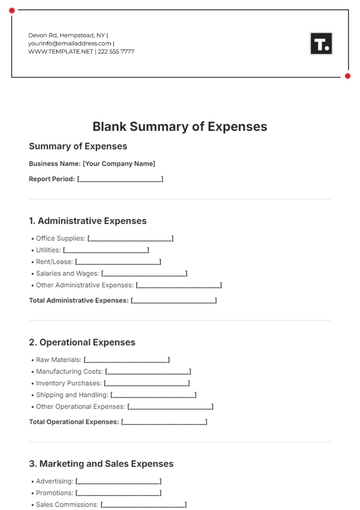

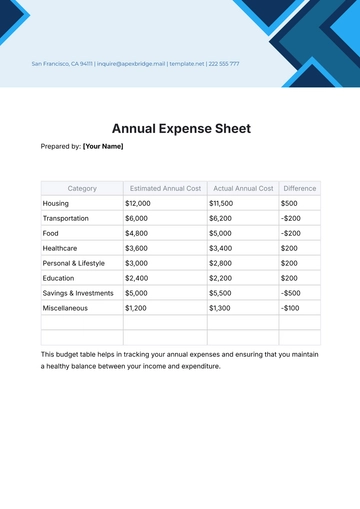

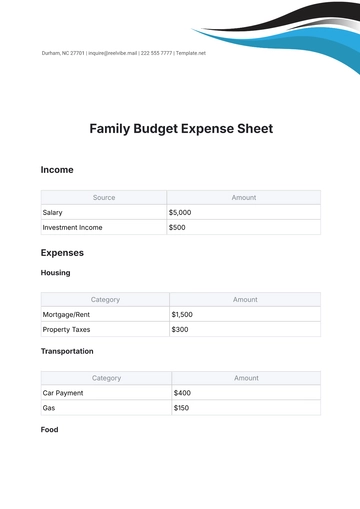

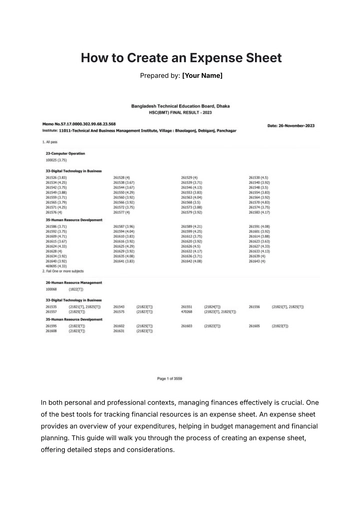

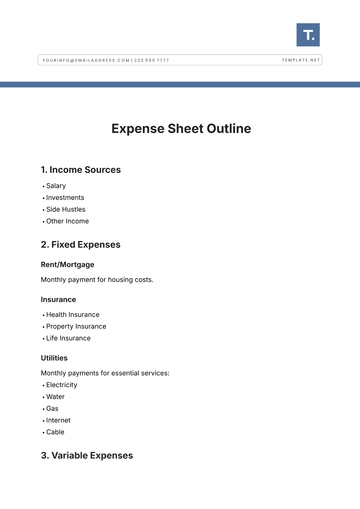

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet