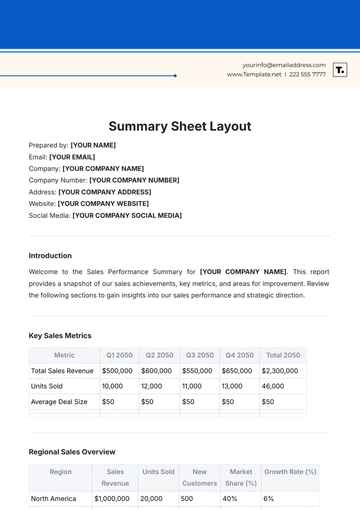

Free Quarterly Investment Fact Sheet

Introduction

Before diving into the Quarterly Investment Fact Sheet, we at [Your Company Name] would like to provide you with a comprehensive overview of our latest investment performance. This Fact Sheet is designed to offer key insights into our investment strategy, portfolio holdings, expenses, and risk management measures. We trust that this information will assist you in making well-informed investment decisions.

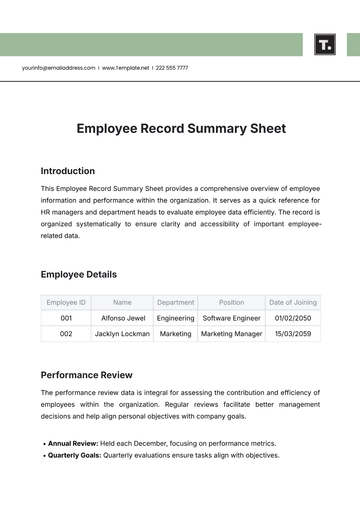

I. Investment Overview

Alpha Growth Fund

Mutual Fund

Quarter Ending Date: March 31, 2050

Total Assets Under Management (AUM): $500 million

Investment Objective: Long-term capital appreciation

Benchmark Index: S&P 500

II. Performance Summary

Quarterly Return: 8.5%

Year-to-Date (YTD) Return: 12.2%

Annualized Return: 10.3%

Comparison with Benchmark: Outperformed by 1.2%

III. Portfolio Holdings

A. Asset Allocation

This subsection outlines how the investment is distributed across different asset classes. It helps investors understand the level of diversification within the portfolio and the associated risk exposures. In this example:

B. Top Holdings

The Top Holdings table highlights the investment's largest positions by name, ticker symbol, and percentage allocation. This information gives investors insight into the key companies or assets driving the fund's performance. In this example:

IV. Expenses and Fees

Management Fee: 0.75% annually

Expense Ratio: 1.2%

Other Fees: None

V. Investment Risks

Market Risk: The fund's performance is influenced by fluctuations in the overall stock market.

Interest Rate Risk: Changes in interest rates may impact bond prices and, consequently, the fund's returns.

Credit Risk: There is a risk of default by issuers of fixed-income securities held by the fund.

Liquidity Risk: Investments may become illiquid, affecting the fund's ability to meet redemption requests.

VI. Updates and Changes

Notable Updates/Changes During the Quarter: The fund increased its exposure to emerging markets equities and adjusted its sector allocations in response to changing market conditions.

[Your Company Name]

[Your Name]

[Your Title/Position]

[Your Email]

[Your Number]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Access the Quarterly Investment Fact Sheet Template on Template.net for succinctly presenting investment details. This editable template streamlines investment information organization. Customize the fact sheet effortlessly using our AI Editor Tool, ensuring precise communication of investment specifics. Simplify investment reporting and analysis with this professional and user-friendly template.

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet