Free Financial Strength Fact Sheet

I. Introduction

Welcome to the Financial Strength Fact Sheet for [Your Company Name]. This document serves as a comprehensive guide providing investors with transparent and reliable information about our company's financial performance, capital structure, liquidity position, and future outlook.

II. Executive Summary

A. Company Overview

[Your Company Name] is a global leader in [industry/sector], delivering innovative solutions since [year].

Our diverse portfolio includes [list of key products/services].

We operate in [number] countries and employ over [number] talented individuals worldwide.

Our commitment to sustainability is evident through [specific initiatives].

B. Financial Highlights

Revenue: In the fiscal year ending [date], our revenue reached [$150 billion], reflecting a [percentage increase/decrease] from the previous year.

Net Income: We achieved a net income of [$200 billion], demonstrating [financial strength/highlights].

Earnings per Share (EPS): Our EPS stood at [$100], showcasing [financial performance/highlights].

Cash Flow: Operating cash flow totaled [$550], indicating [liquidity position/highlights].

III. Financial Performance

A. Balance Sheet

Item | Amount |

|---|---|

Total Assets | $150 Billion |

Total Liabilities | $200 Billion |

Shareholder Equity | $320 Billion |

B. Income Statement

Revenue: Our revenue streams are diversified across [geographical regions/product lines], with [$X.XX billion] generated from [specific source].

Operating Income: Operating income for the fiscal year amounted to [$X.XX billion], reflecting [efficiency/highlights].

Net Income: We achieved a net income of [$X.XX billion], driven by [specific factors/highlights].

C. Cash Flow Statement

Operating Activities: Operating cash flow generated [$X.XX billion], demonstrating our ability to effectively manage day-to-day operations.

Investing Activities: Investment in [key projects/initiatives] totaled [$X.XX billion].

Financing Activities: Financing activities resulted in [$X.XX billion], reflecting [specific transactions/highlights].

IV. Capital Structure

A. Debt Profile

Total Debt: Our total debt stands at [$X.XX billion], with [details on debt maturity/structure].

Debt-to-Equity Ratio: The debt-to-equity ratio is [X.XX], indicating [financial leverage/strength].

Interest Coverage Ratio: The interest coverage ratio stands at [X.XX], highlighting [financial stability/coverage].

B. Equity Structure

Common Stock: [$X.XX billion] allocated to common stock, representing [percentage].

Preferred Stock: Preferred stock holdings amount to [$X.XX billion], providing [specific benefits/highlights].

V. Liquidity Position

A. Current Assets

Cash and Cash Equivalents: Cash and cash equivalents totaled [$X.XX billion], ensuring [liquidity/highlights].

Accounts Receivable: Accounts receivable amounted to [$X.XX billion], reflecting [efficiency/highlights].

B. Current Liabilities

Accounts Payable: Accounts payable stood at [$X.XX billion], indicating [financial obligations/highlights].

Short-term Debt: Short-term debt obligations amounted to [$X.XX billion], demonstrating [financial management/highlights].

VI. Future Outlook

A. Market Trends

Despite [current market challenges/trends], we anticipate [specific opportunities/growth areas].

Our market expansion strategy includes [specific initiatives/plans] to capitalize on emerging trends.

B. Growth Strategies

We remain committed to [innovation/expansion], with [specific growth initiatives/projects].

Investments in [research and development/marketing] will drive sustainable growth and market leadership.

C. Risk Factors

While we mitigate risks through [diversification/strategic planning], potential challenges include [specific risks] which we actively monitor and address.

VII. Contact Information

For further inquiries, please contact:

[Your Name]

[Your Position]

[Your Department]

[Your Company Email]

[Your Company Number]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Demonstrate your financial prowess confidently with Template.net's Financial Strength Fact Sheet Template. This editable and customizable template, accessible via our Ai Editor Tool, empowers you to showcase key metrics and achievements seamlessly. Tailor content effortlessly to reflect your organization's stability and success. Streamline your reporting process and convey your financial strength with clarity and precision.

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

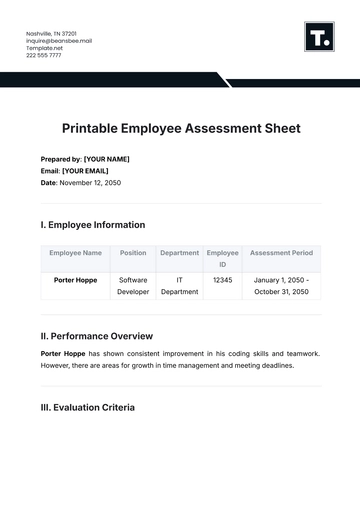

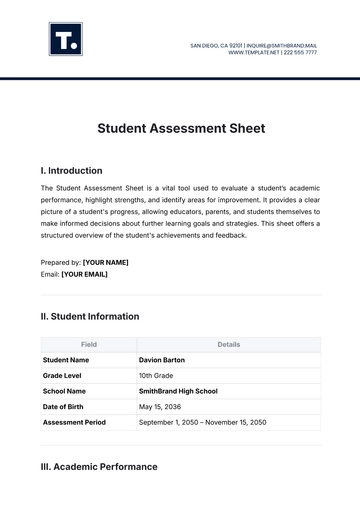

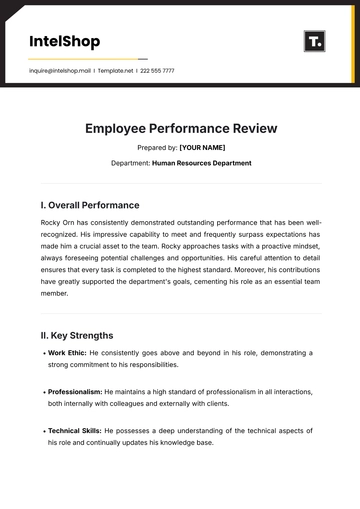

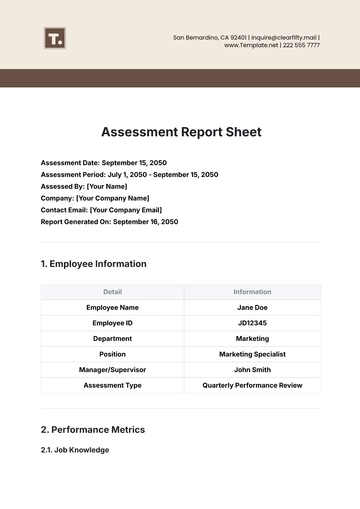

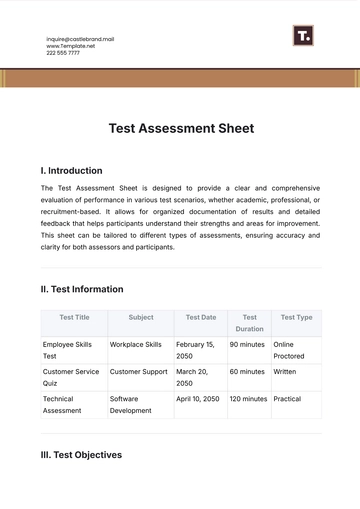

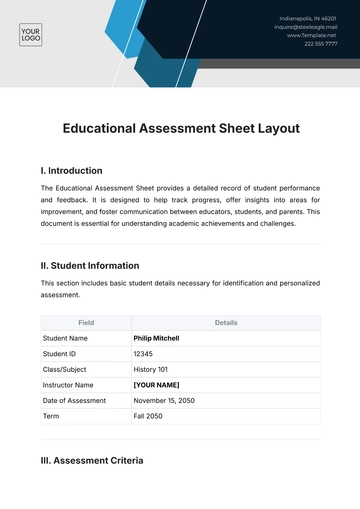

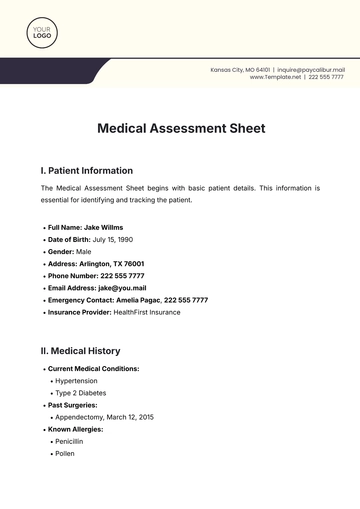

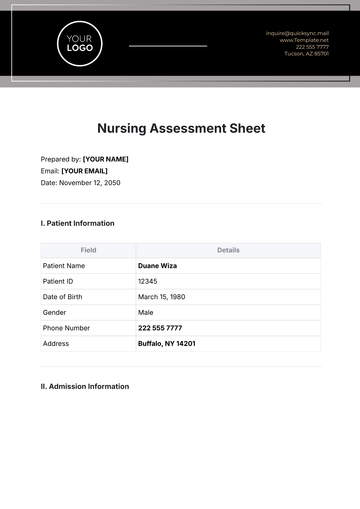

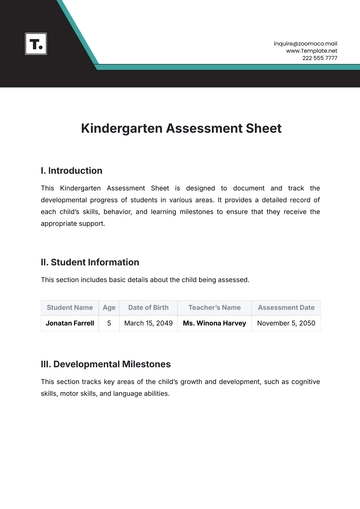

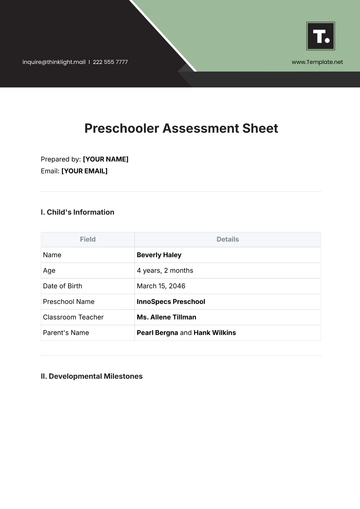

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet