Free Insurance White Paper

____________________________________________________________________________________

Emerging Trends in the Insurance Industry

Prepared by: [Your Name]

For: [Your Company Name]

Date: [Date]

Department: [Your Department]

_____________________________________________________________________________________

I. Executive Summary

This white paper serves as an essential compass in navigating the evolving terrain of the insurance industry. Crafted through meticulous research efforts by [Your Company Name], it illuminates the transformative trends reshaping the industry landscape, empowering stakeholders with actionable insights to navigate challenges and seize opportunities.

II. Introduction

Amidst the confluence of technological innovation, regulatory dynamics, and shifting consumer behaviors, the insurance sector stands at a pivotal juncture. This paper elucidates the key trends propelling the industry forward, offering invaluable perspectives for industry leaders and policymakers alike.

III. Industry Overview

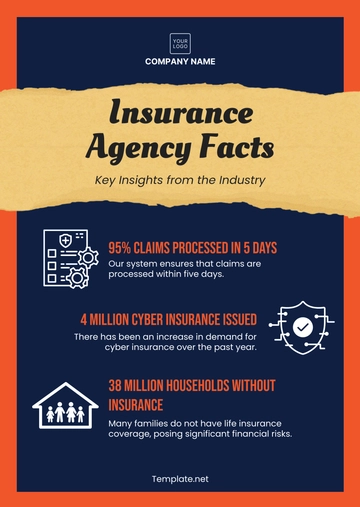

The global insurance market is undergoing a seismic transformation, propelled by rapid technological advancements and shifting market dynamics. This section provides a comprehensive overview of the industry's current state, size, structure, and the profound impact of recent global events on insurers and policyholders.

IV. Analysis of Emerging Trends

A. Technology Integration

Artificial Intelligence and Machine Learning

AI and machine learning redefine risk assessment paradigms, enhancing accuracy and efficiency in underwriting processes.

Blockchain for Fraud Prevention and Claims Management

Blockchain technology emerges as a potent tool in combating fraud and streamlining claims management processes, fostering trust and transparency across the insurance ecosystem.

Internet of Things (IoT) in Risk Assessment and Management

IoT sensors revolutionize risk assessment, enabling insurers to proactively identify and mitigate potential risks in real time.

B. Product Innovation

Emergence of On-Demand Insurance Products

On-demand insurance products cater to the evolving needs of modern consumers, offering flexibility and customization options.

Customized Policies Based on Real-Time Data

Real-time data analytics empower insurers to tailor policies dynamically, aligning coverage with evolving customer needs.

Focus on Sustainability and Climate Change

Insurers pioneer sustainability initiatives and innovative risk mitigation strategies to address the escalating impacts of climate change.

C. Regulatory Landscape

Impact of Global Regulations on Operational Compliance

Stringent regulatory frameworks necessitate agile adaptations and proactive measures to ensure operational compliance.

New Insurance Models Under Regulatory Scrutiny

Innovative insurance models navigate regulatory complexities, fostering dialogues to balance innovation with compliance.

Risk Management Strategies in a Dynamic Regulatory Environment

Dynamic regulatory landscapes mandate agile risk management strategies to navigate evolving compliance requirements effectively.

D. Market Expansion and Consumer Behavior

Shift in Consumer Preferences and Expectations

Consumer-centricity drives insurers to deliver personalized experiences through digital platforms, fostering enduring customer relationships.

Growth in Emerging Markets and Non-Traditional Demographics

Untapped markets present growth opportunities, prompting insurers to tailor offerings to diverse demographics and expand market reach.

Customer Engagement Through Digital Platforms

Digital platforms serve as the cornerstone of customer engagement strategies, facilitating seamless interactions and enhancing brand loyalty.

V. Case Study: Leveraging IoT for Risk Mitigation in Property Insurance

Background

ABC Insurance Company, a leading property insurer, faced mounting challenges in accurately assessing and mitigating risks associated with property damage claims. Traditional risk assessment methodologies proved inadequate in the face of evolving environmental factors and the increasing frequency of natural disasters.

Objective

To leverage IoT technology to enhance risk assessment accuracy, mitigate property damage risks, and optimize claims management processes.

Implementation

ABC Insurance collaborated with IoT solution providers to deploy a network of sensors across insured properties. These sensors monitored environmental variables such as temperature, humidity, and seismic activity in real-time, enabling ABC Insurance to proactively identify and mitigate potential risks.

Results

1. Enhanced Risk Assessment Accuracy

Real-time data insights from IoT sensors facilitated unparalleled accuracy in risk assessment, enabling proactive risk mitigation measures to be implemented swiftly.

2. Improved Risk Mitigation Strategies

Granular insights gleaned from IoT sensors enabled the identification of high-risk areas susceptible to environmental hazards, empowering ABC Insurance to tailor risk mitigation strategies accordingly.

3. Streamlined Claims Management Processes

Real-time data expedited claims processing timelines, enabling ABC Insurance to deliver prompt and efficient claims resolution, enhancing customer satisfaction and loyalty.

The implementation of IoT-enabled risk mitigation strategies resulted in a significant reduction in property damage claims, as depicted in the chart below.

Title: ''Reduction in Property Damage Claims''

Conclusion

By embracing IoT technology, ABC Insurance transformed its risk assessment and claims management processes, achieving unprecedented levels of accuracy, efficiency, and customer satisfaction. This case study underscores the transformative potential of IoT in revolutionizing the insurance industry's approach to risk management.

VI. Challenges and Opportunities

A. Challenges

Cybersecurity Threats and Data Privacy Concerns

Escalating cybersecurity threats underscores the imperative for insurers to fortify digital infrastructure and implement robust data protection protocols.

Economic Instability and Its Impact on Insurance Premiums

Economic instability poses challenges, necessitating agile pricing strategies and risk mitigation measures to navigate fluctuating market dynamics.

Resistance to Change Within Traditional Insurance Institutions

Institutional inertia poses barriers to innovation, compelling insurers to cultivate a culture of agility to remain competitive.

B. Opportunities

Expanding Into New Markets With Tailored Insurance Products

Untapped markets present growth opportunities, enabling insurers to expand offerings tailored to diverse demographics.

Leveraging Technology to Enhance Customer Experience

Technology offers avenues to elevate the customer experience paradigm, fostering meaningful interactions and brand loyalty.

Partnerships With Tech Startups to Foster Innovation

Collaborative partnerships with tech startups catalyze innovation, offering access to cutting-edge technologies and disruptive business models.

VII. Strategic Recommendations

Informed by comprehensive insights, strategic recommendations are delineated to empower [Your Company Name] to capitalize on emerging opportunities and navigate challenges adeptly.

VIII. Conclusion

In conclusion, this white paper provides a comprehensive roadmap for stakeholders to navigate the evolving insurance landscape. Armed with actionable insights, stakeholders are poised to chart a course toward sustainable growth and enduring success amidst transformative change.

IX. References

Document all sources of information, data, and research used in the white paper. Adhere to a consistent citation style.

_____________________________________________________________________________________

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the Insurance White Paper Template, exclusively crafted by Template.net for industry professionals. This editable and customizable masterpiece streamlines your document creation process effortlessly. Tailor content seamlessly with our AI Editor Tool, ensuring your white paper reflects your brand's vision and expertise. Elevate your insurance insights with this versatile template, designed to captivate and inform.