Free Blank Loan Term Sheet

I. Overview

This Loan Term Sheet ("Term Sheet") is prepared by [Your Company Name] and serves as the preliminary document outlining the terms and conditions under which a mortgage loan will be provided for facilitating real estate transactions. This document is intended to serve as a basis for further negotiation and agreement between [Lender's Name] (the "Lender") and [Borrower's Name] (the "Borrower").

It should be noted that this Term Sheet is for discussion purposes only and does not constitute a legally binding offer, nor does it imply an obligation to proceed with the loan until a definitive agreement is signed by both parties.

II. Loan Terms

The loan terms presented below are indicative and subject to change following detailed due diligence and final approval processes:

Loan Amount: The total loan amount requested by the Borrower shall be $150.

Interest Rate: The interest rate applied to the principal balance will be 30% per annum.

Loan Term: The duration of the loan will be [Loan Term] years/months.

Repayment Schedule: Repayments are to be made monthly and consist of both principal and interest components.

III. Use of Loan

The loan obtained under this Term Sheet is to be used exclusively for the purchase or refinancing of the real estate property located at [Property Address]. The details and documentation of the property should align with the due diligence requirements set forth during the detailed loan processing phase.

The Borrower agrees not to use the funds for any purpose other than those explicitly stated here, without obtaining prior written consent from the Lender.

IV. Conditions Precedent to Funding

Before the disbursement of the loan amount, the following conditions must be met:

Completion of all necessary due diligence checks to the Lender's satisfaction.

Execution of a definitive loan agreement that incorporates the terms set out in this Term Sheet and other terms as agreed upon mutually by the Borrower and the Lender.

Provision of a valid appraisal report of the property confirming its market value and suitability for mortgage purposes.

Obtaining necessary insurance policies covering the property.

V. Representations and Warranties

The Borrower assures that all information provided during the application process is true, accurate, and complete.

The Borrower also agrees to update the Lender of any significant changes to their financial condition, the status of the property, or any other factors that could affect the terms of the loan agreement.

Any misrepresentation by the Borrower might lead to potential modifications of the loan terms or, in certain cases, a recall of the loan amount dispensed.

VI. Confidentiality

Both parties agree to maintain the confidentiality of the terms and conditions outlined in this Term Sheet and all subsequent negotiations unless mutually agreed otherwise. The confidential information shall not be disclosed to any third party without the prior written consent of the other party.

This confidentiality clause will survive the expiration or termination of the negotiations or definitive agreements resulting from this Term Sheet.

VII. Governing Law

This Term Sheet, and any disputes arising out of its terms or negotiations, will be governed by the laws of [Jurisdiction] without regard to its conflict of law principles. Any disputes will be resolved in the courts located in [Jurisdiction].

VIII. Signatures

This Term Sheet must be signed by duly authorized representatives from both the Lender and Borrower parties as an acknowledgment of the terms discussed herein:

Party | Name | Signature | Date |

|---|---|---|---|

Lender | [Lender's Authorized Representative] |

| [Date] |

Borrower | [Borrower's Authorized Representative] |

| [Date] |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the ultimate tool for crafting comprehensive loan agreements with Template.net's Loan Term Sheet Template. Effortlessly tailor loan terms to your needs with this editable and customizable template. Perfect for financial institutions and individuals alike, it's easily editable in our Ai Editor Tool, ensuring seamless customization. Simplify your loan processes and create professional-grade agreements with ease.

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

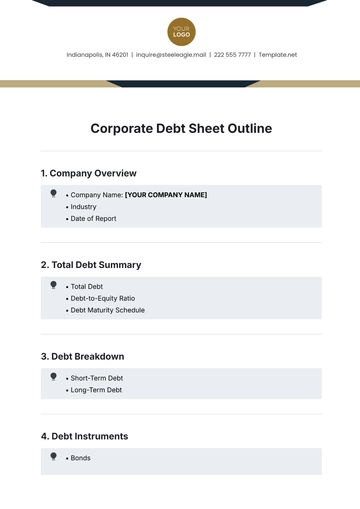

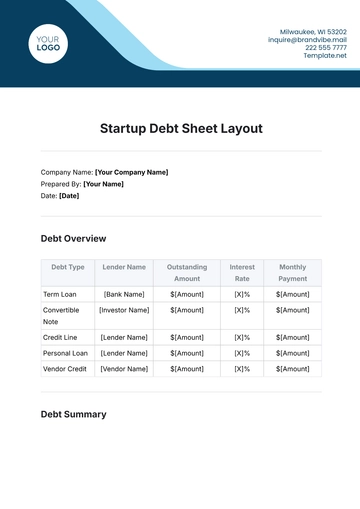

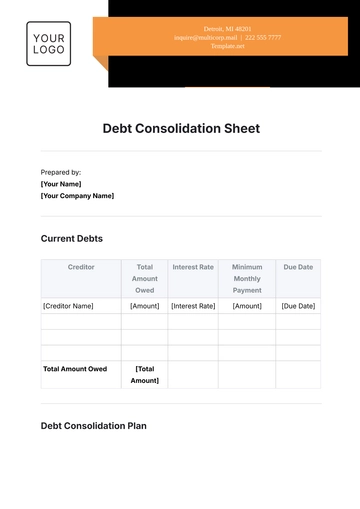

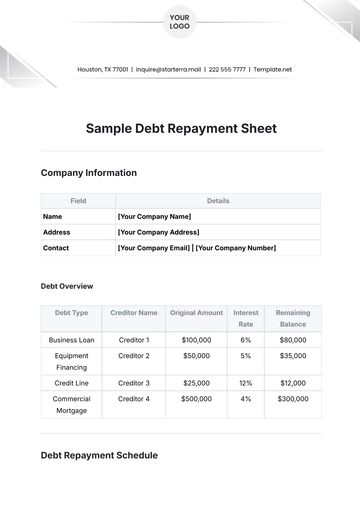

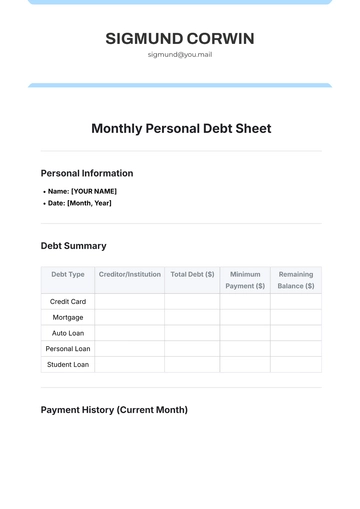

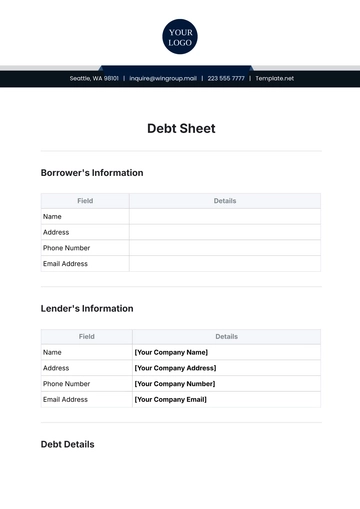

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet