Free Anatomy Of An Investor Term Sheet

This Term Sheet template is designed to facilitate discussions and outline the terms between [YOUR COMPANY NAME] (the "Company") and a [Investor Name] ("Investor") for a proposed investment. It serves as a preliminary non-binding document leading up to a definitive agreement. Please tailor each section in bold to better fit the negotiation specifics and legal requirements.

I. Objective

The objective of this Term Sheet is to establish clear communication between all parties involved, ensure mutual understanding of structure, responsibilities, and distribution, and accelerate the transaction timeline to the satisfaction of all involved stakeholders. This Term Sheet does not imply a commitment until all parties sign a final agreement.

II. Basic Information

[Investor Name]: Full legal name of the investing party.

[Your Company Name]: Full legal name of the company seeking investment.

[Date]: The date on which the term sheet is issued.

[Address]: Registered address or principal place of business for both parties.

III. Investment Details

The specifics of the investment are laid out in this section, providing clarity on the amounts involved and the funding schedule. This clarity is crucial for creating financial plans post-investment and should be carefully negotiated between the involved parties.

[Amount Being Invested]: Total sum of money the Investor agrees to invest.

[Type of Security]: Type of securities issued e.g., preferred shares, ordinary shares, convertible notes.

[Price Per Share]: Cost of each share at the time of the investment.

[Valuation of the Company with Pre-Money and Post-Money]: Company valuation before and after investment.

[Closing Date]: Expected date on which the deal will be finalized and funds transferred.

IV. Use of Proceeds

Explanation of how the investment received will be utilized by [YOUR COMPANY NAME]. Detailed allocation demonstrates prudent financial management and builds trust with investors, encouraging them to commit funds.

[General Working Capital]

[Product Development]

[Marketing and Sales]

[Expansion Costs]

[Other Specific Uses]

V. Governance

The governance structure post-investment plays a critical role in ensuring that both the investor’s rights are respected and that the founding team retains effective control over the business operations. This section outlines the roles and responsibilities as agreed upon by both parties.

[Board Composition]: Details on how the board will be structured post-investment, including the number of board seats and specific nominations.

[Voting Rights and Restrictions]: Explanation of any changes in voting rights following the investment.

[Information Rights]: Regular reporting expected from the company to the investor, including financials and performance metrics.

VI. Conditions Precedent

This section lists all necessary conditions that must be met for the closure of the investment. It includes due diligence findings, approval processes, and other legal necessities. It protects all parties by ensuring that all checkboxes are ticked before the transaction concludes.

[Completion of Due Diligence]: Confirm that all due diligence processes have been satisfactorily completed.

[Legal and Regulatory Approvals]: Enumerate all required legal and regulatory checks and balances that need clearance.

[Other Conditions]: Any other specific conditions that need to be addressed before finalizing the investment.

VII. Confidentiality

Both parties agree to maintain the confidentiality of the terms and discussions surrounding this investment until formalized in an agreement. This section underscores the privacy commitments held by each party about the sensitive information exchanged during negotiations.

Details of the confidentiality terms and the expected duration of such terms.

VIII. Exclusivity

The Exclusivity clause ensures that for a specified duration, [YOUR COMPANY NAME] will not engage in similar discussions with other potential investors. This allows the current investor a clear and undisturbed path to completing their due diligence and other preparatory processes.

[Exclusivity Period]: Duration for which the exclusivity is applicable.

IX. Legal and Signatory

The conclusion of this Term Sheet requires signatures from duly authorized representatives. Both parties are expected to review the document with legal counsel to ensure complete agreement and understanding. The signing of this document underlines the preliminary agreement on the terms listed above but does not constitute a legal obligation to proceed unless explicitly stated.

[YOUR COMPANY NAME]

[DATE SIGNED]

[Investor Name]

[DATE SIGNED]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the Anatomy Of An Investor Term Sheet Template at Template.net! Crafted for discerning entrepreneurs, this editable and customizable gem simplifies negotiations. Tailor clauses effortlessly with our AI Editor Tool. Empower your pitch with precision, and secure investments seamlessly. Unleash your potential with the ultimate tool for savvy deal-makers. Get started today!

You may also like

- Attendance Sheet

- Work Sheet

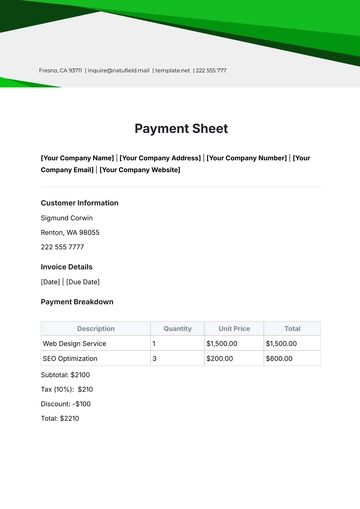

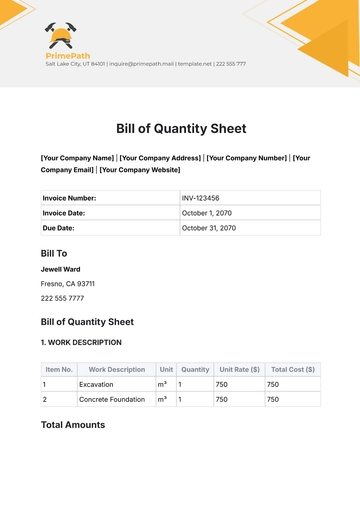

- Sheet Cost

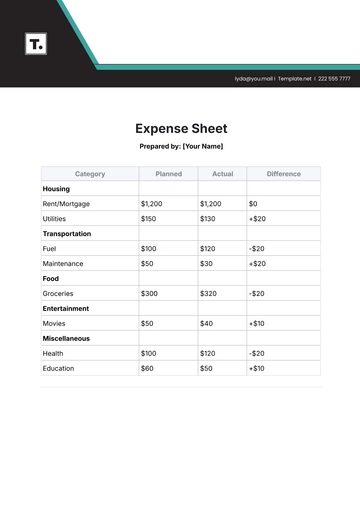

- Expense Sheet

- Tracker Sheet

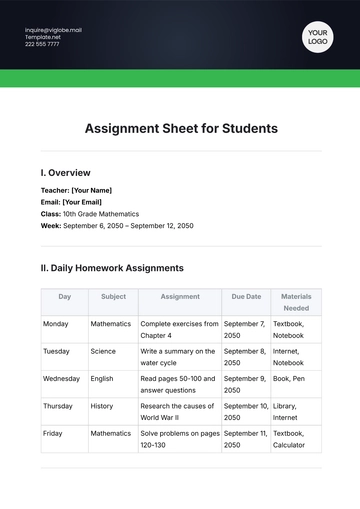

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

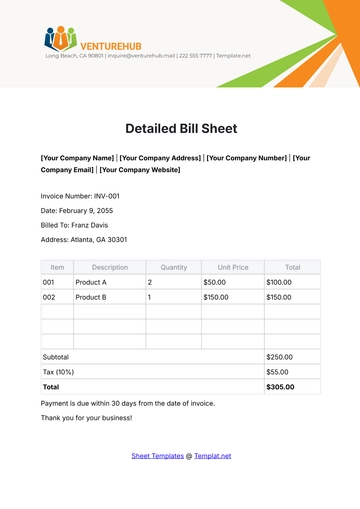

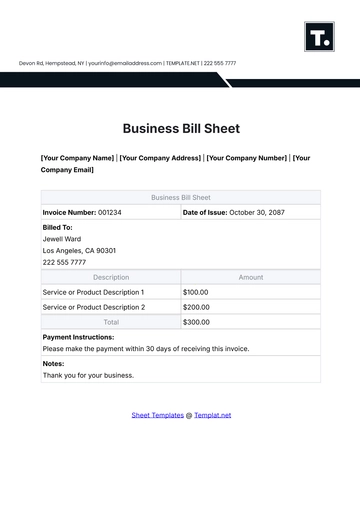

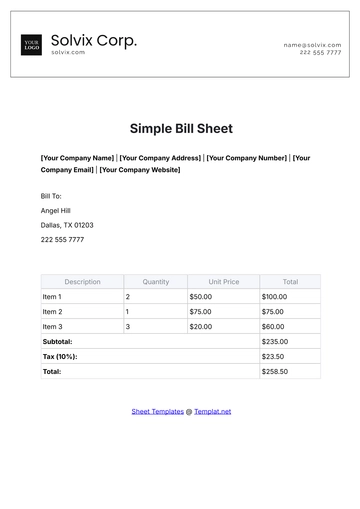

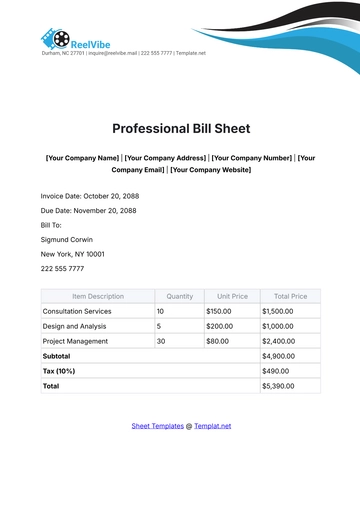

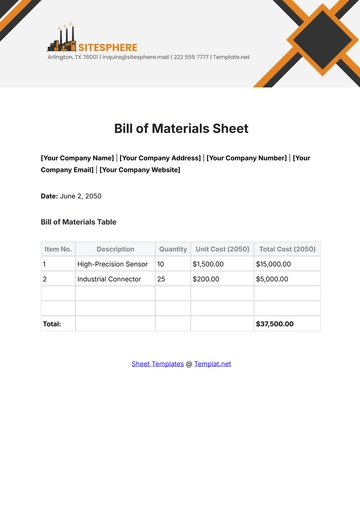

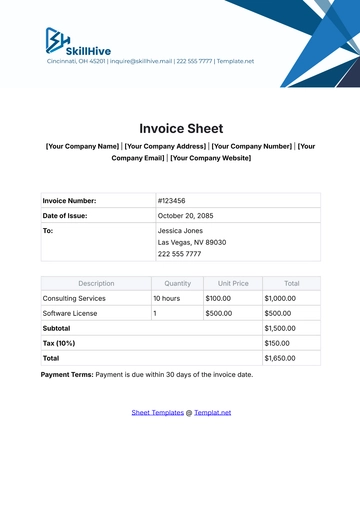

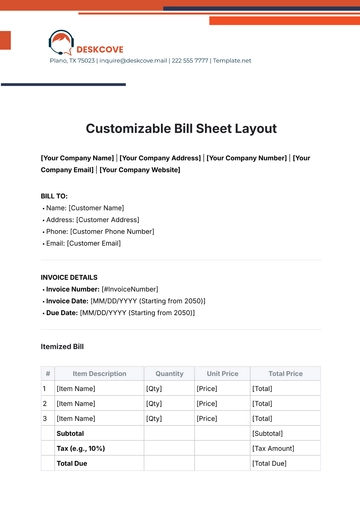

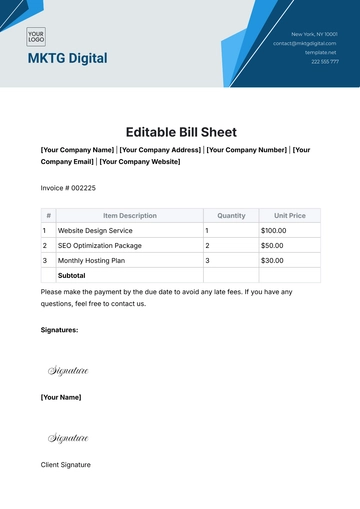

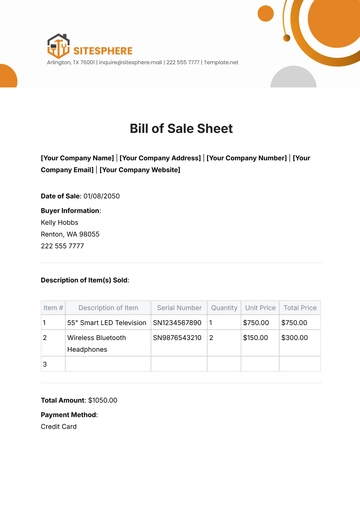

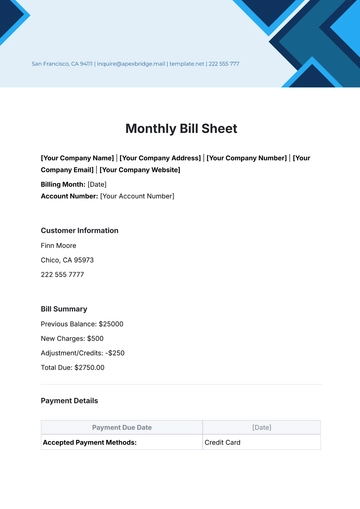

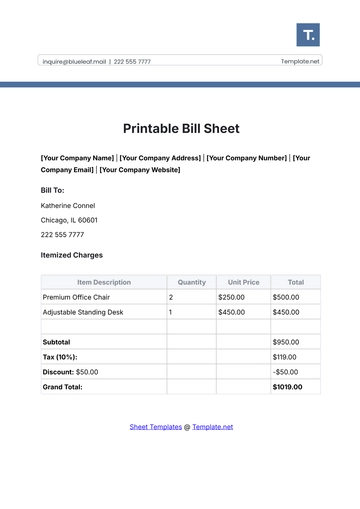

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

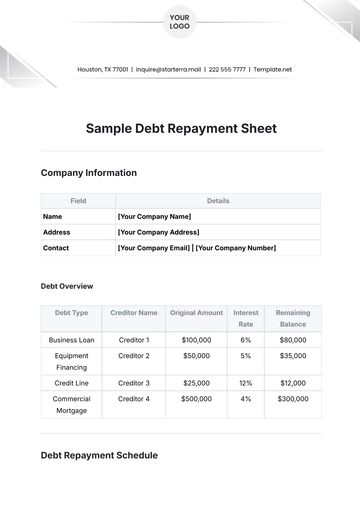

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

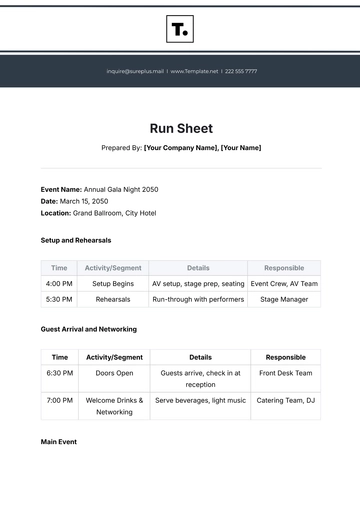

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

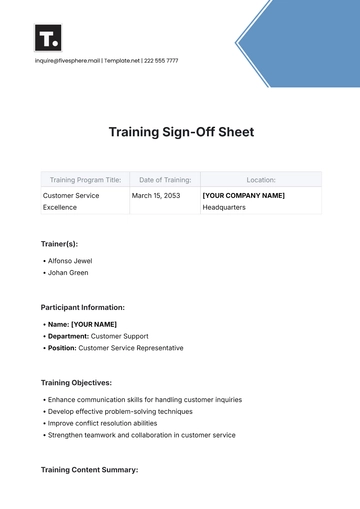

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet