Free Commercial Mortgage Term Sheet

I. OVERVIEW

This Term Sheet outlines the principal terms and conditions proposed for the commercial mortgage loan between [Lender Name] and [Borrower Name]. The purpose of this document is to facilitate transparent communication and understanding prior to the final legal agreement. This Term Sheet is intended to serve as a framework for further negotiations and does not constitute a legally binding contract except where specifically stated.

The loan will support the acquisition and development of commercial real estate located at [Property Address]. The details provided below summarize the key aspects of the loan, including the amount, interest rate, repayment terms, and collateral details.

II. LOAN DETAILS

A. Loan Amount: The total loan amount requested by [Borrower Name] and agreed to be provided by [Lender Name] is [$ Loan Amount]. This amount has been calculated based on the cost estimates provided in the initial proposal submitted by the borrower.

B. Purpose of Loan: The proceeds from this loan will be exclusively used for the purchase, improvement, and/or development of the real estate property mentioned above. Detailed usage of funds includes construction costs, legal fees, land acquisition, and contingency funds.

C. Loan Term: The duration of the loan, starting from the date of disbursement, is 15 years. The borrower agrees to repay the principal amount along with accrued interest in monthly installments over this period.

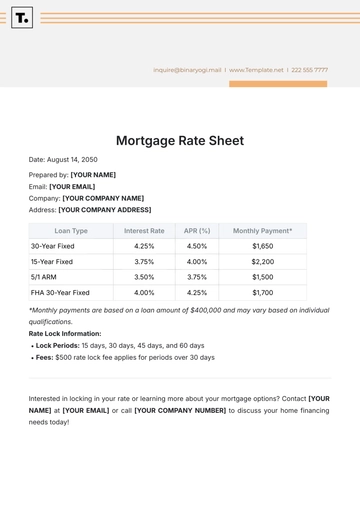

D. Interest Rate: The interest rate applicable to this loan is 4.5%, compounded annually. This rate is fixed for the entirety of the loan term unless otherwise stated in the agreement.

E. Repayment Schedule: The borrower shall make repayments in accordance with the following schedule:

Monthly Installments: $2,500

Final Payment (Balloon Payment): $50,000 (due at the end of the loan term)

This schedule outlines the amounts due at specific intervals, including any balloon payments or final payments, if applicable. The borrower is encouraged to review the repayment schedule carefully and ensure timely payments to avoid any penalties or additional charges. Additionally, any changes to the repayment schedule must be agreed upon by both the borrower and the lender and documented in writing.

III. INTEREST RATE AND REPAYMENT TERMS

A. Interest Rate: The annual interest rate will be fixed at 5.25 percent. This rate is calculated on the principal remaining each month.

B. Repayment Schedule: Repayment of the principal along with accrued interest is due over a term of 10 years, with monthly installments beginning one month after the initial disbursement.

C. Prepayment Conditions: Any early repayment of the loan shall be subject to prepayment conditions as outlined in the agreement. Prepayment may incur penalties or fees, which will be specified in the loan agreement. However, borrowers are encouraged to inquire about early repayment options as they may provide opportunities for interest savings over the life of the loan.

D. Late Payment Charges: In the event of late payment, a penalty fee of $50 will be charged for each day the payment is overdue. Late payments may also result in adverse effects on the borrower's credit score, potentially impacting their ability to secure future loans at favorable rates. Borrowers need to adhere to the repayment schedule to avoid such consequences.

IV. COLLATERAL

A. Security:

The loan will be secured by a first mortgage on the specified property. This means if the borrower defaults, the lender has the right to foreclose on the property to recover the outstanding loan amount.

The borrower agrees to maintain the property in good condition. This ensures that the property retains its value, which is important for the lender's security.

The borrower also agrees not to add any additional liens (claims against the property) without the lender's consent. This protects the lender's priority position in case of default.

B. Additional Security:

In addition to the property, the borrower may pledge additional collateral to further secure the loan. This can include business assets, personal guarantees, or other real estate properties.

By offering additional collateral, the borrower provides the lender with alternative sources of repayment in case the primary collateral (the property) is insufficient to cover the loan amount.

V. CONDITION PRECEDENT TO DISBURSEMENT

A. Proof of Insurance: Before the initial disbursement of loan funds, [Borrower Name] must provide evidence of insurance on the property, covering potential risks including but not limited to fire, flood, and other liabilities, as required by [Lender Name].

B. Legal Compliance: All relevant permits and approvals required for the proposed development must be obtained and presented to the lender. Compliance with local, state, and federal laws is mandatory, with documentation of the same due before fund release.

C. Title Verification: Before disbursement, [Borrower Name] shall furnish evidence of clear and marketable title for the property in question, verified by a reputable title company or attorney.

D. Inspection Reports: A satisfactory inspection report from a qualified inspector or engineer detailing the condition of the property and any necessary repairs or renovations must be provided to the lender before disbursement.

E. Escrow Requirements: [Borrower Name] must establish an escrow account with an agreed-upon amount to cover property taxes, insurance premiums, and other relevant expenses, with proof of establishment provided to the lender before disbursement.

VI. MISCELLANEOUS

A. Governing Law: This Term Sheet and the ensuing loan agreement will be governed by the laws of the state where the property is located, specifically [State].

B. Confidentiality: Both parties agree to maintain the confidentiality of terms and conditions in this agreement unless disclosure is required under applicable law or by a regulatory body.

This Term Sheet is valid until [Expiry Date]. Modifications to this document must be agreed upon in writing by both parties. For more information, please contact [Your Name] at [Your Email].

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Enhance and Discover the Commercial Mortgage Term Sheet Template from Template.net. Crafted for precision, this editable and customizable tool streamlines your loan negotiations effortlessly. Tailor terms to your needs with ease, all editable in our Ai Editor Tool. Simplify your process and secure your deal confidently with our comprehensive template.

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet