Free Business Acquisition Term Sheet

I. Introduction

In this Business Acquisition Term Sheet, Acme Enterprises Inc. ("Buyer") outlines the proposed acquisition of Tech Innovators Ltd. ("Target") under the terms and conditions provided herein. This document serves as a preliminary agreement and does not constitute a legally binding contract unless otherwise specified.

II. Transaction Overview

Acquisition Structure: The acquisition shall be structured as a Stock Purchase, with the Buyer acquiring all outstanding shares of Target.

Purchase Price: The total purchase price for the acquisition of Target is set at USD 15,000,000, subject to adjustments as detailed in Section IV.

Payment Terms: The purchase price shall be paid in cash, with 60% due upon closing and the remaining balance to be paid in three equal installments over the following 12 months.

III. Due Diligence

Due Diligence Period: Buyer shall have a due diligence period of 60 days from the date of this agreement to conduct a comprehensive review of Target's financial records, contracts, intellectual property, personnel, and any other relevant information.

Access to Information: Target agrees to provide Buyer with access to all necessary documents and information during the due diligence period, including but not limited to financial statements, tax returns, employee records, and customer contracts.

Confidentiality: Both parties shall maintain strict confidentiality regarding all information exchanged during the due diligence process and shall not disclose any findings to third parties without prior written consent.

IV. Purchase Price Adjustment

Working Capital Adjustment: The purchase price shall be adjusted based on Target's working capital at the time of closing, with adjustments made for any deviations from an agreed-upon target working capital amount of USD 3,000,000.

Indebtedness Adjustment: The purchase price shall be adjusted to account for Target's outstanding indebtedness at the time of closing, with the Buyer assuming all existing liabilities and obligations of Target as of the closing date.

Subject to Adjustments Clause:

The Purchase Price for the acquisition of Target is subject to adjustments to account for any changes in certain specified factors, such as:

Working Capital: The purchase price may be adjusted based on the difference between the actual working capital of the Target at the time of closing and a predetermined target working capital.

Indebtedness: Any increase or decrease in Target's indebtedness, including loans, liabilities, or obligations, may result in an adjustment to the purchase price.

Closing Date Adjustments: Certain expenses or revenues incurred or earned by Target between the signing of the agreement and the closing date may be subject to adjustment.

Regulatory Approvals: Any costs or expenses incurred due to delays or additional requirements in obtaining necessary regulatory approvals may lead to adjustments in the purchase price.

Material Adverse Changes: If there are material adverse changes in the financial condition, business operations, or assets of Target between the signing of the agreement and the closing date, the purchase price may be adjusted accordingly.

V. Representations and Warranties

A. Seller's Representations and Warranties

Target represents and warrants that:

Target is a duly organized and validly existing entity in good standing under the laws of its jurisdiction.

Target has all necessary power and authority to enter into and perform its obligations under this agreement.

There are no pending or threatened legal actions, claims, or proceedings against Target, except as disclosed to Buyer in writing.

B. Buyer's Representations and Warranties

Buyer represents and warrants that:

Buyer has the financial capacity and expertise necessary to complete the acquisition of Target.

The buyer is not subject to any legal restrictions or regulatory approvals that would prevent it from completing the transaction.

VI. Closing Conditions

A. Conditions Precedent: The closing of the acquisition is subject to the satisfaction of certain conditions precedent, including but not limited to:

Approval of the merger by the shareholders of both Buyer and Target.

Receipt of all necessary regulatory approvals and clearances, including antitrust approvals.

Execution of definitive agreements, including a merger agreement and any ancillary documents.

B. Termination: If the closing conditions are not satisfied within 90 days from the date of this agreement, either party may terminate the agreement upon written notice to the other party.

VII. Miscellaneous

Governing Law: This Term Sheet shall be governed by and construed under the laws of the State of California.

Entire Agreement: This Term Sheet constitutes the entire agreement between the parties concerning the proposed transaction and supersedes all prior discussions, negotiations, and agreements, whether written or oral.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Enhance and Discover the ultimate solution for sealing your business acquisitions seamlessly with Template.net's Business Acquisition Term Sheet Template. Crafted with precision, this editable and customizable document ensures every detail is tailored to your needs. Easily fine-tune specifics using our Ai Editor Tool for a deal that's as unique as your vision.

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

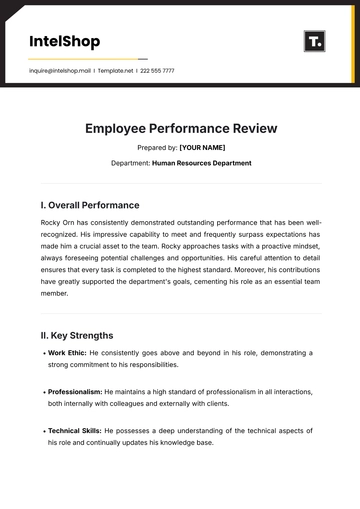

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

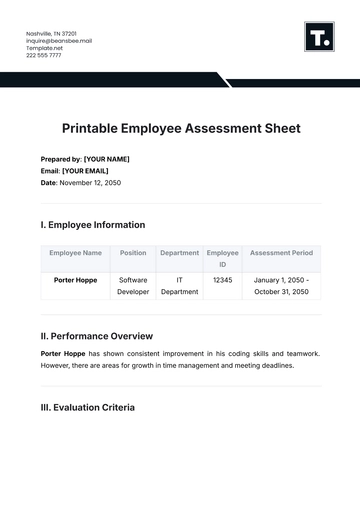

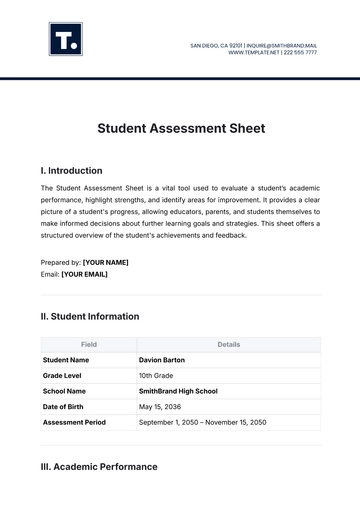

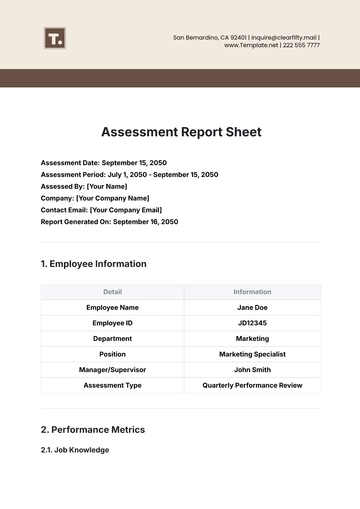

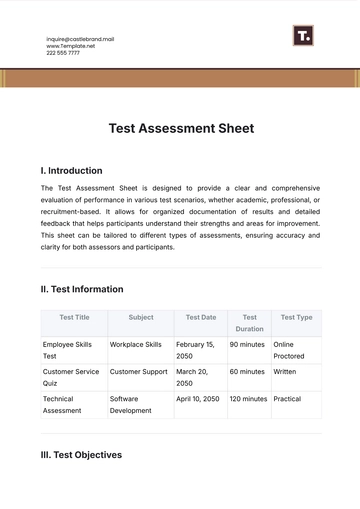

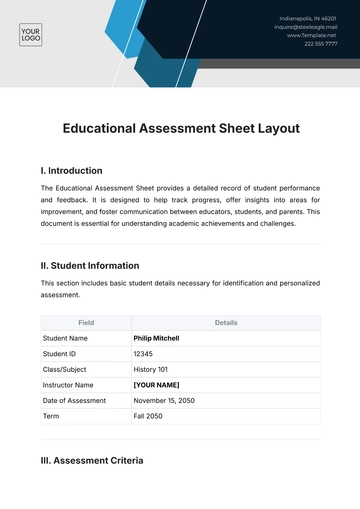

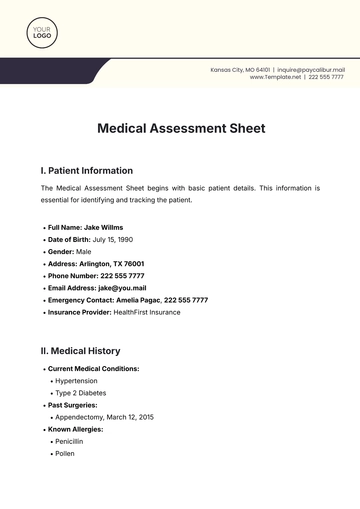

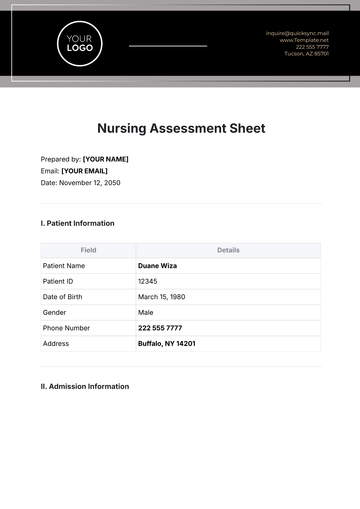

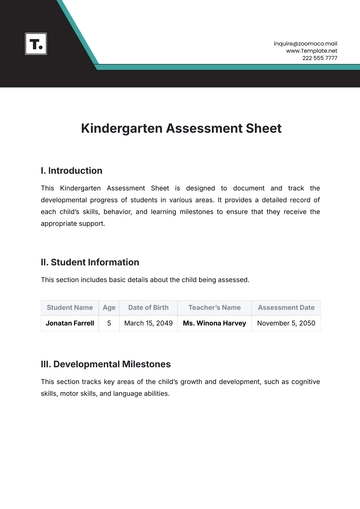

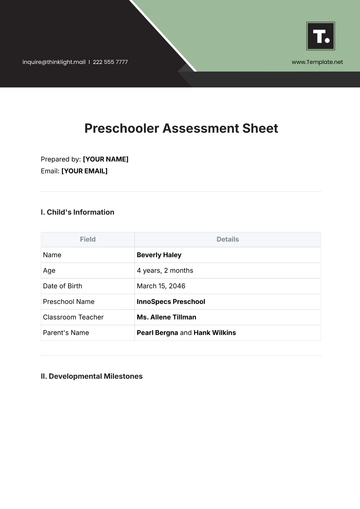

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet