Free Venture Debt Term Sheet

I. General Information

This Term Sheet summarizes the principal terms of the venture debt financing proposed by [Your Company Name] to [Borrower Company Name]. This Term Sheet is intended as a basis for further discussion and negotiation only and does not constitute a legally binding obligation until definitive agreements are executed and delivered by all parties involved.

This financing is solely for venture debt purposes to support [Borrower Company Name] in further growing their operations and enhancing their product offerings. The financing terms outlined reflect the preliminary view of risks and rewards balancing which both parties might fine-tune during later stages.

II. Financial Terms

The key financial parameters of the proposed venture debt are as follows:

Principal Amount: [$ Principal Amount]

Interest Rate: [%] per annum (fixed/floating)

Maturity Date: [Maturity Date]

Repayment Schedule: Monthly payments commencing [Start Date]

Early Repayment Penalties: [Specify, if applicable]

Fees: Origination fee of [Amount] and commitment fee of [Amount]

The funding provided under this facility is contingent upon the borrower's fulfillment of the specified conditions precedents, including but not limited to specific financial covenants and operational milestones.

III. Use of Proceeds

The proceeds from this venture debt will be used exclusively in accordance with the planned budget which has been reviewed and approved by [Your Company Name]. The broad categories allowed include:

Research and Development costs

Scaling operations

Marketing and sales expenses

Working capital requirements

Any deviation from the approved allocation requires written permission from [Your Company Name], ensuring that funds are utilized for maximum impact toward growth objectives.

IV. Warrant Coverage

As part of this agreement, [Your Company Name] will receive warrants to purchase shares of [Borrower Company Name]’s common stock. Terms of the warrant coverage include:

Warrant Coverage Percentage: [Coverage %] of the total loan amount

Vesting Schedule: Stipulate an initial 25% vesting at the time of signing, followed by quarterly vesting of 25% thereafter.

Exercise Price: [Price] per share, subject to standard anti-dilution adjustments

This warrant coverage is aimed at aligning the interests of [Your Company Name] with those of [Borrower Company Name] and to participate in the upside potential derived from effective utilization of the debt proceeds.

V. Covenants and Conditions

As part of this term sheet, [Borrower Company Name] agrees to adhere to certain affirmative and negative covenants which include but are not limited to:

Submitting periodic financial statements (not less than quarterly)

Maintaining a debt service coverage ratio of at least [Number]

Not incurring additional indebtedness without prior written consent from [Your Company Name]

Change of Control: Borrower must immediately inform Lender of any change of control event.

These covenants are designed to mitigate financial risks and ensure fiscal discipline during the term of the loan.

VI. Legal and Regulatory Compliance

[Borrower Company Name] must ensure compliance with all relevant laws and regulations during the term of the debt funding.

This includes adherence to financial reporting standards, data protection regulations, and other industry-specific legal requirements. Regular audits may be conducted by [Your Company Name] to ensure ongoing compliance.

Failure to meet these requirements may lead to rectification obligations or, in severe cases, trigger default remedies which include accelerated repayment or other enforcement actions as outlined in the definitive agreements.

VII. Signatories

This Term Sheet is subject to the approval and execution by the authorized representatives of [Your Company Name] and [Borrower Company Name].

[Your Company Name]

[Your Name]

[Borrower Company Name]

[Borrower Printed Name]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Looking for a comprehensive Venture Debt Term Sheet Template? Look no further! Offered by Template.net, this template is fully customizable, downloadable, printable, and editable in our AI Editor Tool. Streamline your venture debt transactions with this professional and user-friendly template. Create transparent and efficient deals in no time. Download now and enhance your financing strategies effortlessly!

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

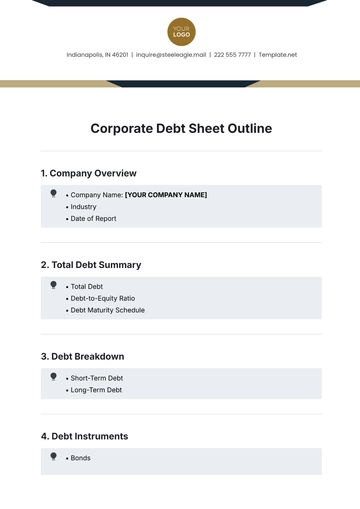

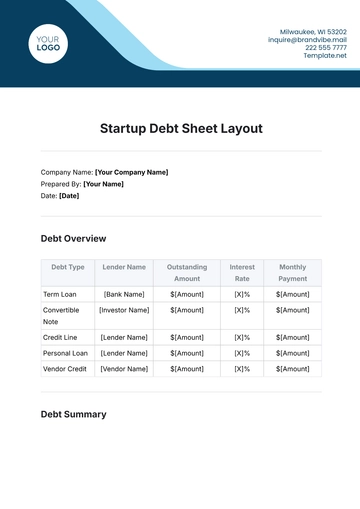

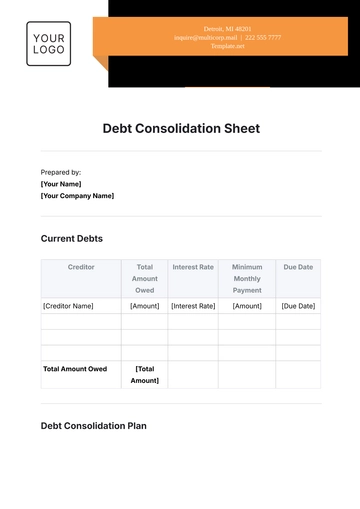

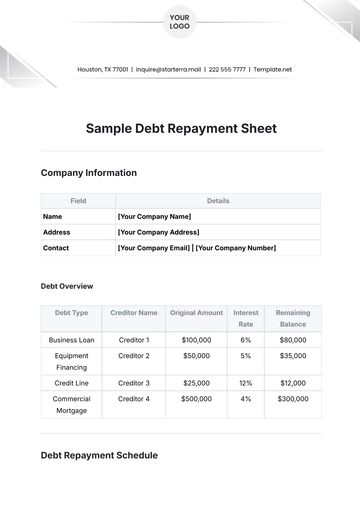

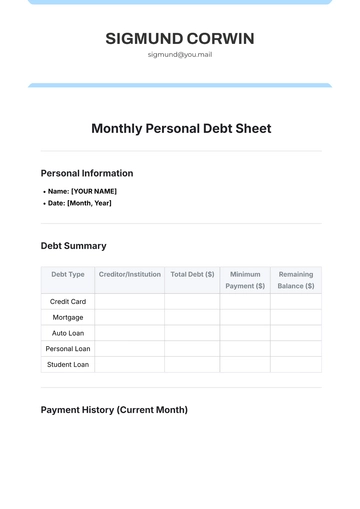

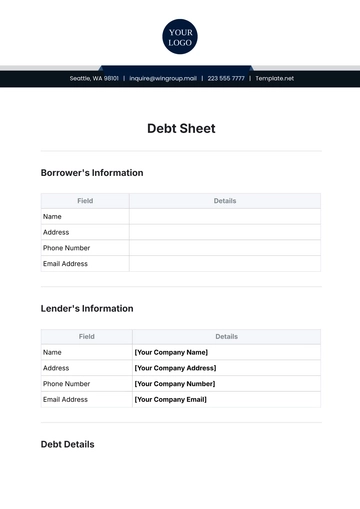

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet