Free Bid Invest Term Sheet

I. Introduction

This Bid Investment Term Sheet ("Term Sheet") sets forth the preliminary terms and conditions for a proposed investment by [INVESTOR'S NAME] in [YOUR COMPANY NAME] (the "Company"). It is intended to facilitate discussions between the parties and is not legally binding.

II. Investment Details

Investment Amount: The investor proposes to invest $10,000,000 in the Company, subject to due diligence and final agreement.

Valuation: The pre-money valuation of the Company is $50,000,000.

Equity Ownership: In consideration of the investment, the investor will receive 20% equity ownership in the Company.

Use of Funds: The investment will primarily be allocated for:

Product development to enhance existing offerings and introduce new features.

Market expansion to target new customer segments and geographical markets.

Working capital to support increased operational activities and scalability of the business.

III. Investor Rights

Board Representation: The investor shall have the right to appoint two (2) directors to the Company's board of directors. These directors will serve as representatives of the investor's interests and contribute to strategic decision-making.

Veto Powers: The investor will have veto power over certain major decisions of the Company, including but not limited to:

Any change in the Company's core business strategy.

Approval of significant capital expenditures exceeding $5,000,000.

Issuance of new shares or securities that dilute the investor's equity stake by more than 10%.

Entry into contracts or agreements with a value exceeding $2,000,000.

IV. Conditions Precedent

Before the finalization of the investment, the following conditions must be met:

Due Diligence: The investor will conduct comprehensive due diligence on the Company's financial and legal affairs.

Regulatory Approvals: Obtaining any necessary regulatory approvals for the investment.

V. Exit Strategy

Before finalizing the investment agreement, the parties involved will engage in discussions and come to a mutual agreement on various potential exit strategies, which may include options such as acquisition, initial public offerings (IPO), or arrangements for a buyback.

VI. Confidentiality

Both parties have reached a mutual agreement that all terms and discussions involved in this agreement will be kept confidential, with the exception only being made in circumstances where disclosure is mandated by applicable laws or regulatory requirements.

VII. Miscellaneous

Governing Law: This Term Sheet shall be subject to, and interpreted following, the laws of [JURISDICTION].

Expenses: Each party involved shall be responsible for covering all of its expenses that are incurred in connection with the negotiation and execution of this Term Sheet.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

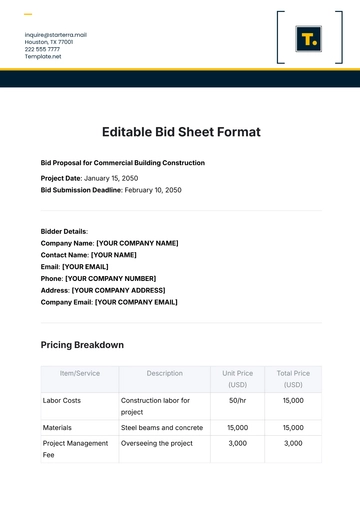

Explore the Bid Invest Term Sheet Template on Template.net, designed for streamlined investment proposals. This editable and customizable tool simplifies document creation. Effortlessly modify and personalize the template using our AI Editor Tool. Streamline your bid investment process, enhance collaboration, and optimize workflow with this versatile resource. Simplify your investment documentation and accelerate your business growth with ease.

You may also like

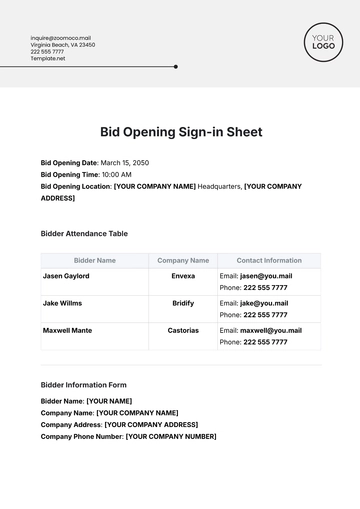

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

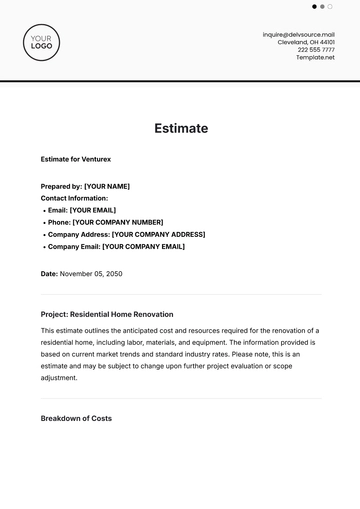

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

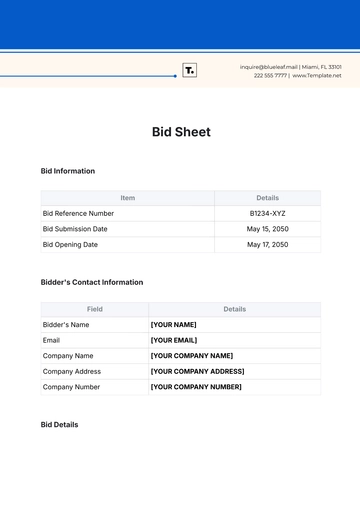

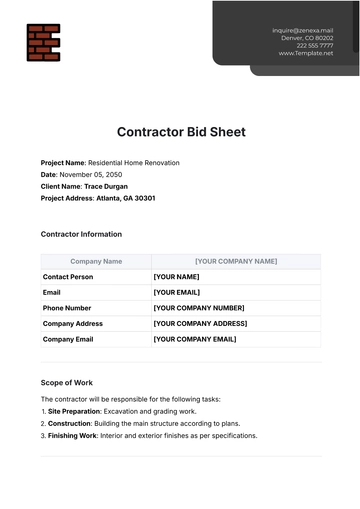

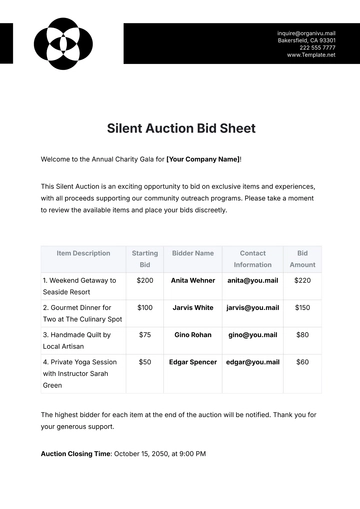

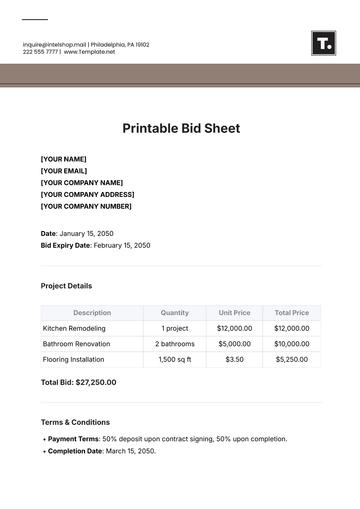

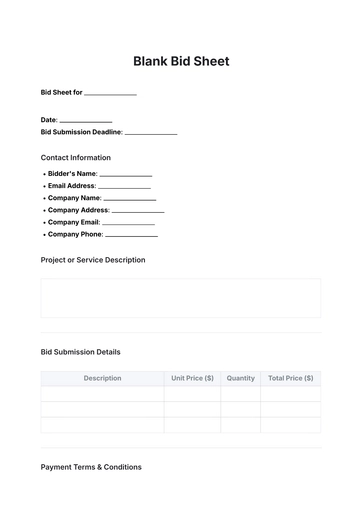

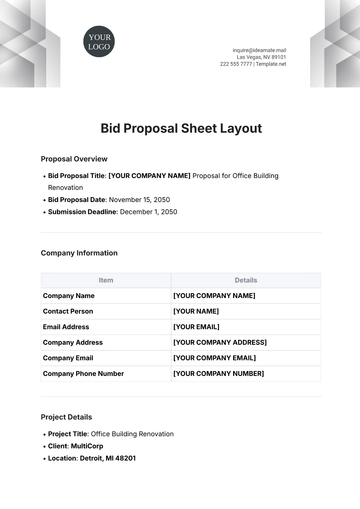

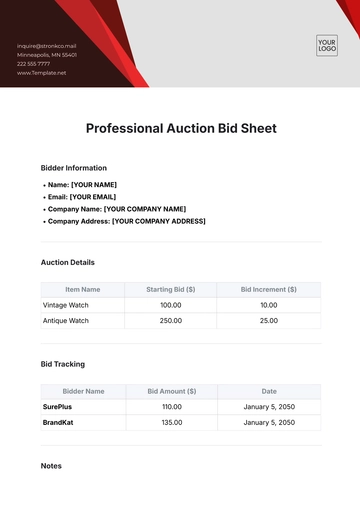

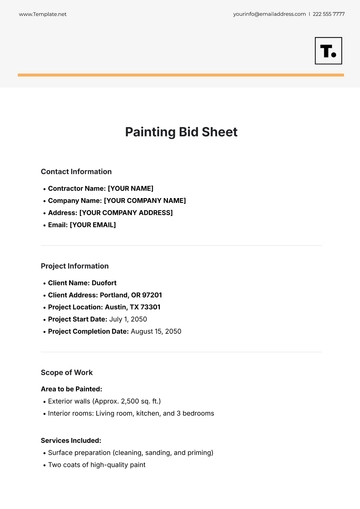

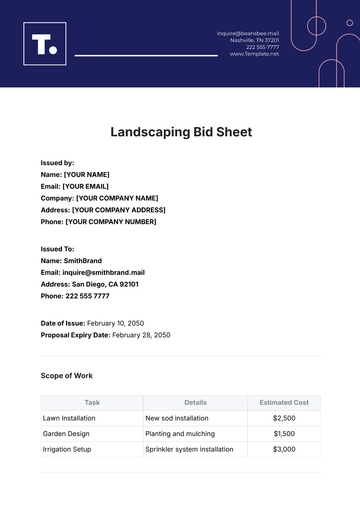

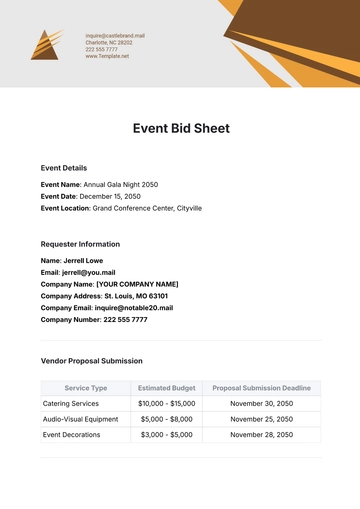

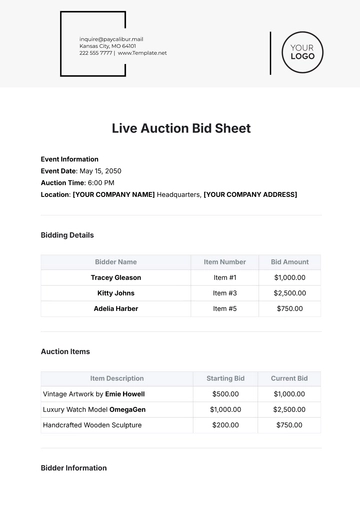

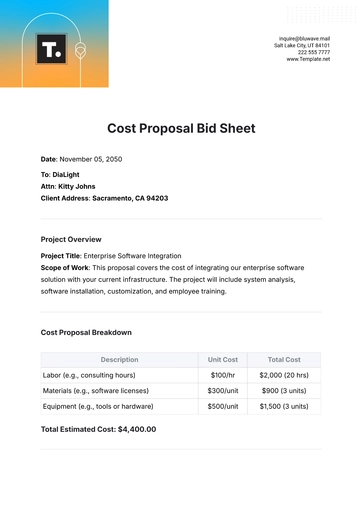

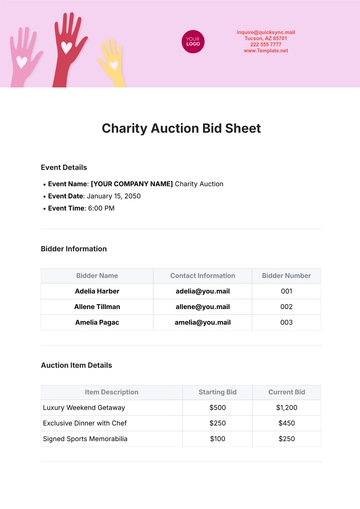

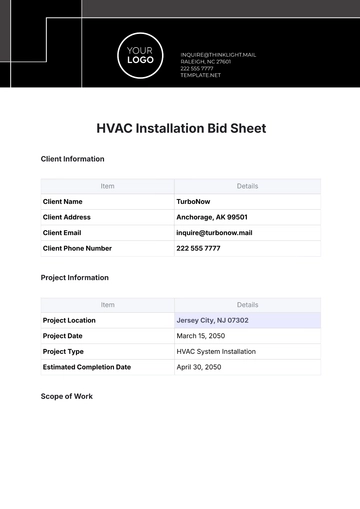

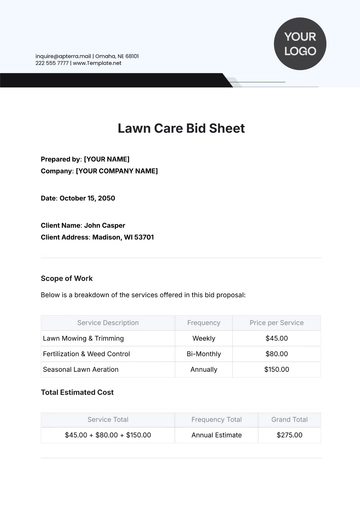

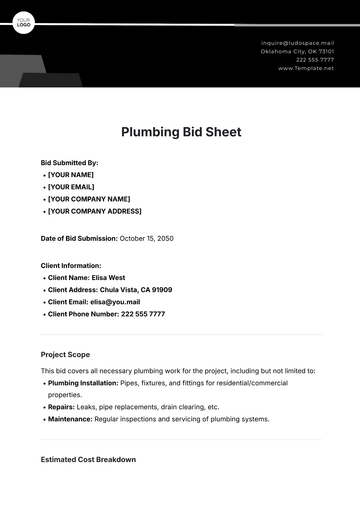

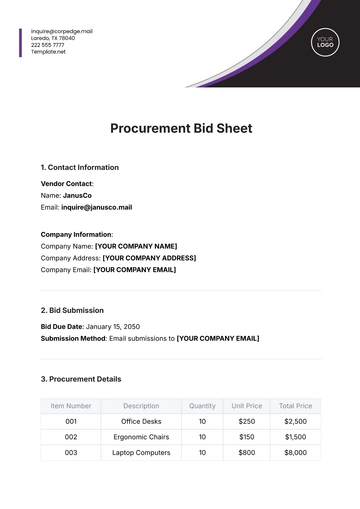

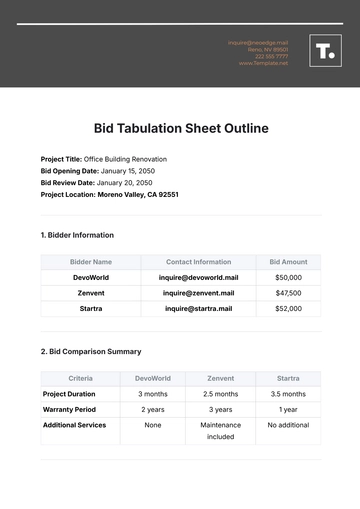

- Bid Sheet

- Call Log Sheet

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

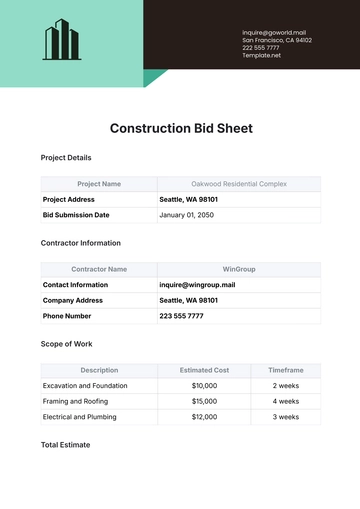

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet