Free Bond Term Sheet

I. Overview

This Bond Term Sheet provides an outline of the terms under which [YOUR COMPANY NAME] will issue bonds. This document serves as a preliminary presentation of terms and is intended for discussion and negotiation purposes. This Term Sheet is non-binding except for the confidentiality and exclusivity agreements stipulated herein.

The issuance outlined below details the specifics of the bond, including its maturity, yield, and other relevant financial metrics, designed to attract potential investors while providing [YOUR COMPANY NAME] with the necessary capital to further its financial goals and projects efficiently.

II. Issue Details

The bond terms specified herein are prepared to align the strategic financial planning of [YOUR COMPANY NAME] with the interests of its investors:

Issuer: [YOUR COMPANY NAME]

Type of Bond: [SPECIFY TYPE]

Total Issue Size: $[AMOUNT]

Denomination per Bond: $[AMOUNT]

Maturity Date: [DATE]

This bond issuance is intended to enhance the company's capability to expand and innovate within its industry sector, maintaining financial stability and ensuring continued growth. These bonds will be issued under the following terms, aiming for maximum transparency and alignment with market standards.

III. Financial Terms

The financial terms outlined below offer a structured overview of the bond's features:

Interest Rate: [PERCENTAGE]% per annum

Interest Payment Frequency: [QUARTERLY, SEMI-ANNUALLY, ANNUALLY]

Issue Price: $[AMOUNT] per bond

Yield to Maturity: [PERCENTAGE]%

The interest approach taken aims to provide a stable return to investors while supporting [YOUR COMPANY NAME] in managing its capital requirements effectively. This ensures that both investors and the company can mutually benefit, fostering long-term financial relationships.

IV. Use of Proceeds

The proceeds from the bond issue will be utilized by [YOUR COMPANY NAME] for the following purposes:

Expansion of current operational facilities

Research and development of new technologies

Repayment of outstanding debts

General corporate purposes

This strategic utilization ensures that the funds raised contribute directly to the core business objectives, enhancing operational capacity and enabling leading-edge innovations, which further defines [YOUR COMPANY NAME]'s edge in a competitive market.

V. Risk Factors

Investing in bonds issued by [YOUR COMPANY NAME] involves certain risks. Potential investors must understand the following risks:

Credit risk associated with [YOUR COMPANY NAME]'s ability to pay interest and repay principal on its due dates.

Market risk including changes in market interest rates affecting the bond’s resale value.

Liquidity risk related to the ease of selling the bond before maturity.

Prospective investors are strongly advised to review the detailed risk factors provided in the official offering document and consult with financial and legal advisors prior to making investment decisions in these bonds.

VI. Legal and Regulatory Compliance

All bond issuances will comply with applicable laws and regulations enforced by [YOUR COMPANY NAME]'s legal jurisdiction and any additional jurisdictions where the bonds will be marketed. This includes but is not limited to securities law compliance and any regulatory approvals necessary for issuing bonds.

Ensuring compliance helps protect [YOUR COMPANY NAME] and its investors against legal risks and enhances the credibility of the bond offering in the financial markets.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Maximize efficiency and precision in your financial documentation with our Bond Term Sheet Template, offered by Template.net. This downloadable and printable template streamlines the bond issuance process. Fully customizable and editable in our AI Editor Tool, it adapts seamlessly to meet your specific needs, ensuring accurate and professional outcomes every time. Ideal for financial analysts and corporate treasurers looking to optimize their bond agreements.

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

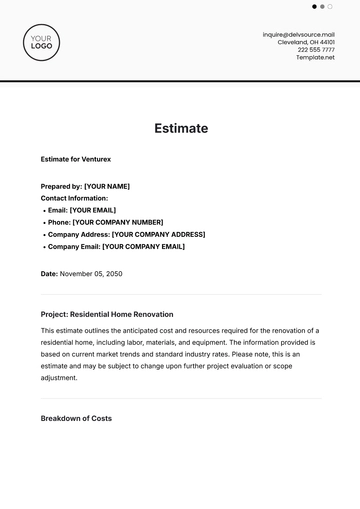

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

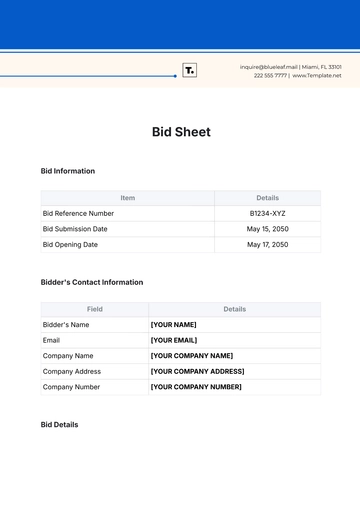

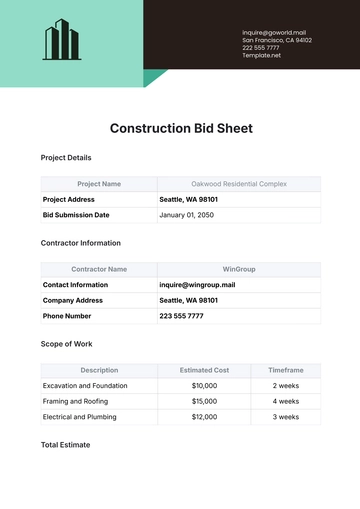

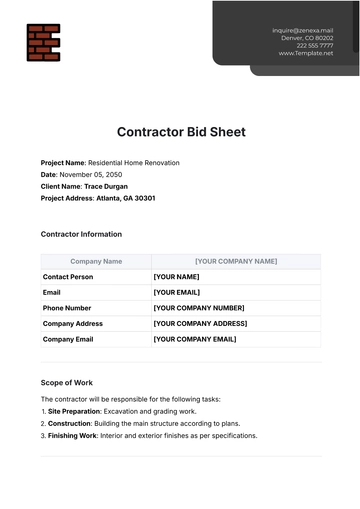

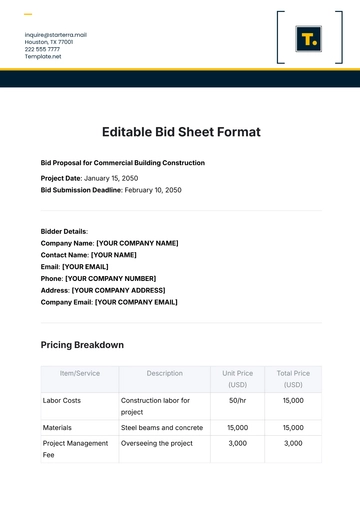

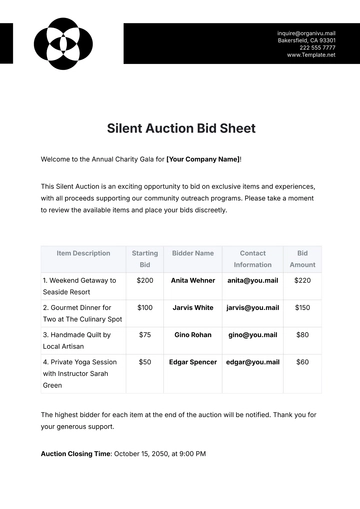

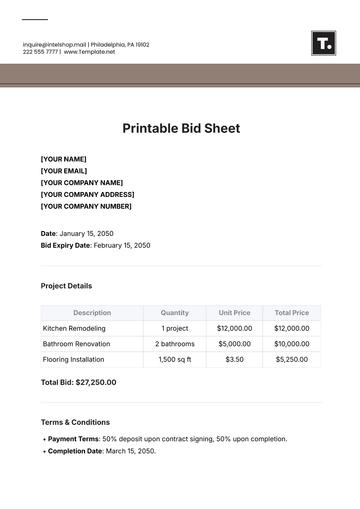

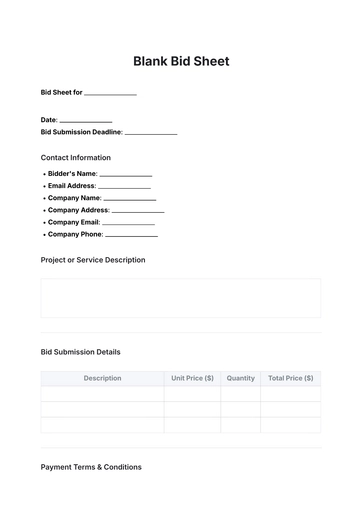

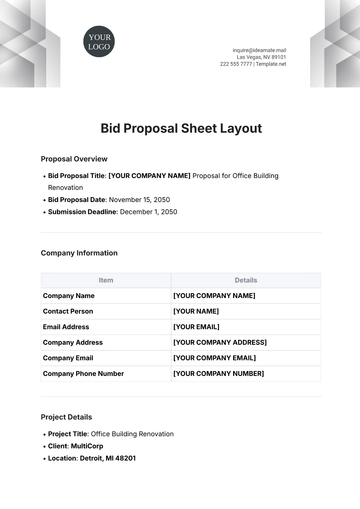

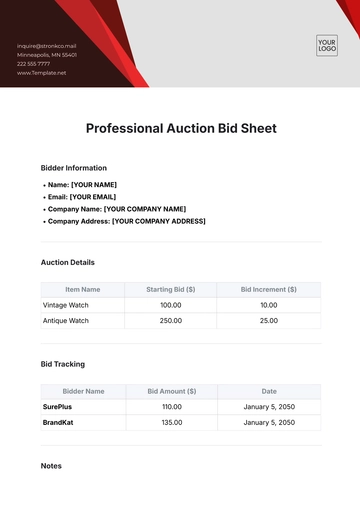

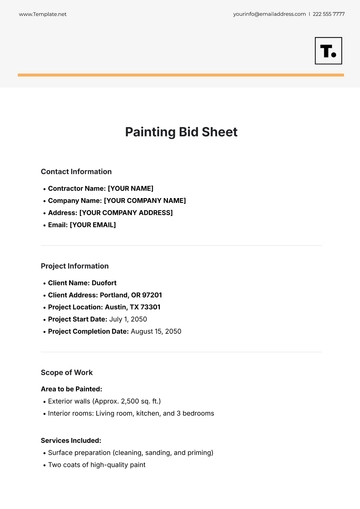

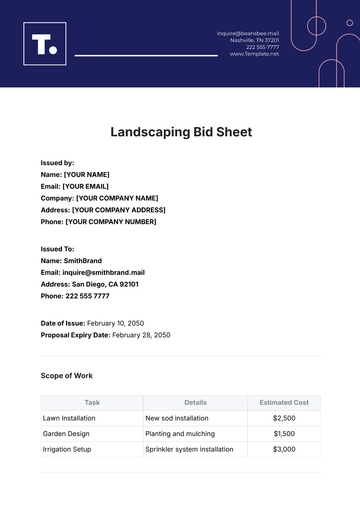

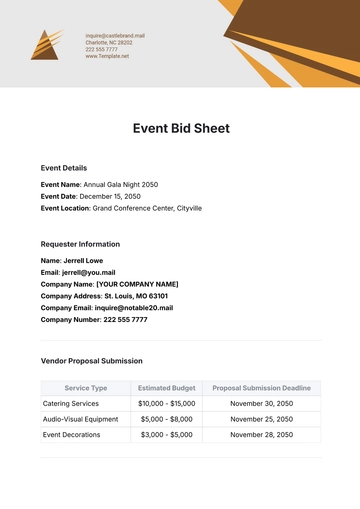

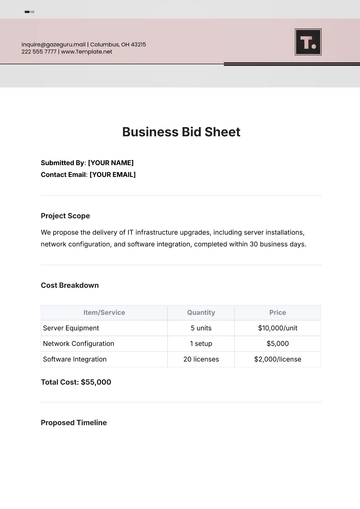

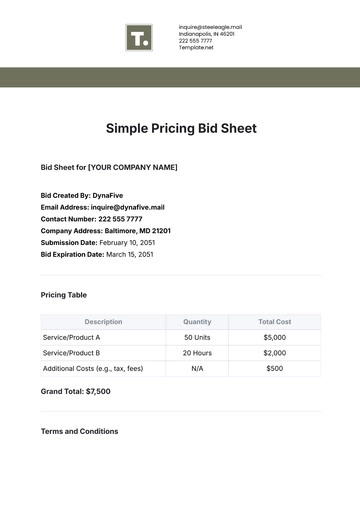

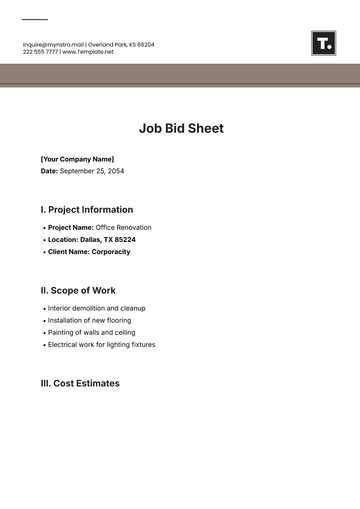

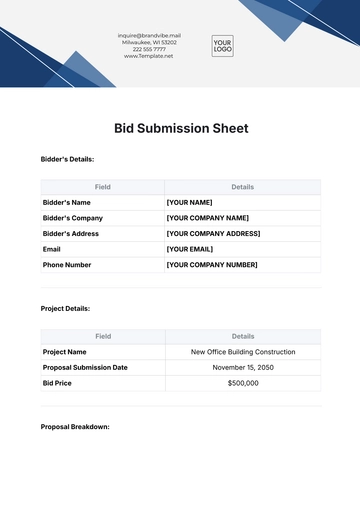

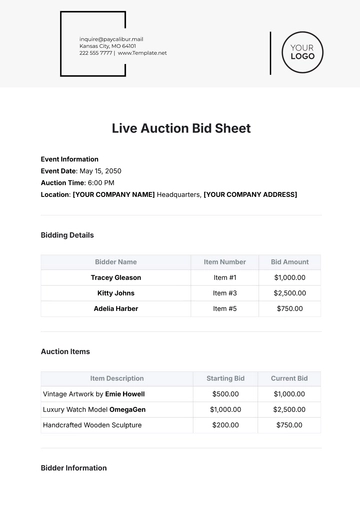

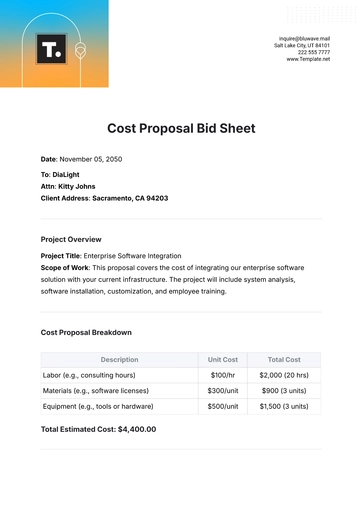

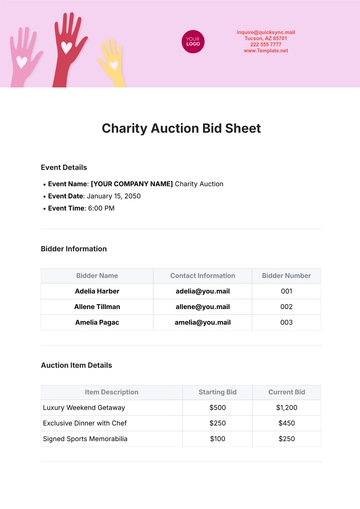

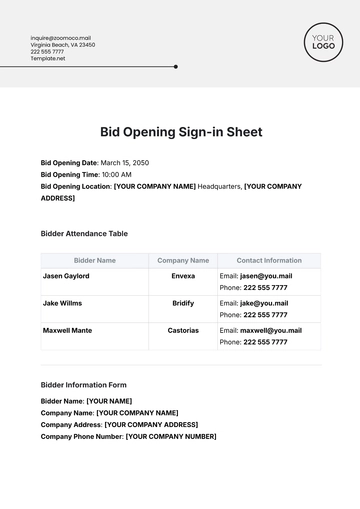

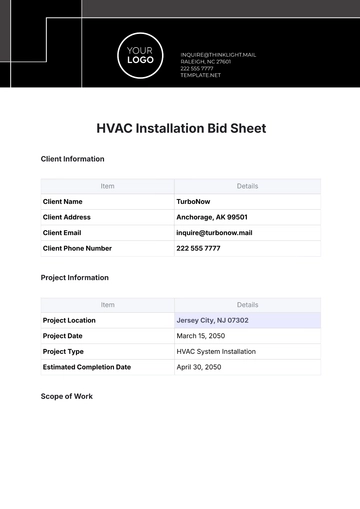

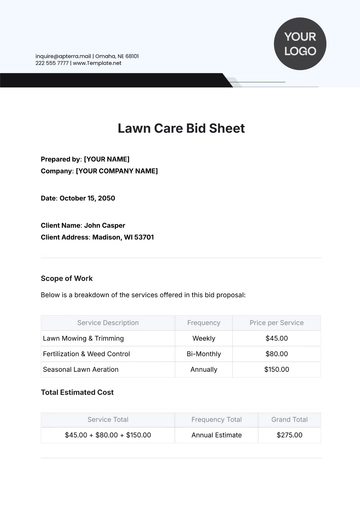

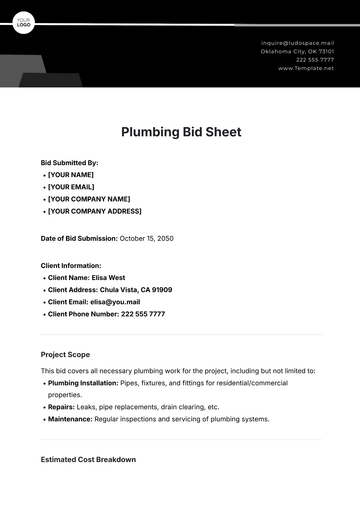

- Bid Sheet

- Call Log Sheet

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet