Free Senior Facilities Term Sheet

I. Introduction

This Term Sheet outlines the proposed terms under which the Lender, [Your Name], will provide senior secured facilities to the Borrower, [Borrower Name]. This document serves to guide the final negotiation and drafting of the definitive agreements. It is important to note that this Term Sheet is intended to be a summary of key terms and conditions and does not constitute a binding offer until all parties execute the definitive agreements.

The senior facilities discussed herein are intended to support [Borrower Name]'s operational needs and future growth initiatives. The specifics outlined are designed to ensure both parties understand their responsibilities and the structure of the proposed financing. This Term Sheet remains subject to due diligence, corporate approvals, and the negotiation of satisfactory documentation.

II. Amount and Type of Facility

Total Facility Amount: The total committed amount under this facility will be [$Amount].

Facility Types:

Term Loan Facility: An amount of [$Term Loan Amount] available for drawdown in a single tranche.

Revolving Credit Facility: A revolving credit line up to [$Revolving Credit Amount] for general corporate purposes and working capital needs.

III. Purpose and Use of Proceeds

Purpose: The proceeds from the senior facilities will be used to refinance existing debt, support capital expenditures, and for general corporate purposes as further outlined below:

Refinancing of [Existing Debt Details]

Funding of capital expenditures related to [Specific Projects or Investments]

Provision for working capital to enhance operational flexibility

IV. Pricing

Interest Rates:

Term Loan: Priced at LIBOR + [Spread %], subject to a LIBOR floor of [%].

Revolving Credit: Priced at LIBOR + [Spread %], with no LIBOR floor.

Fees:

Commitment Fee: A fee of [%] on the undrawn portion of the revolving facility, payable quarterly.

Upfront Fee: An upfront fee of [%] of the total facility amount, payable at closing.

V. Terms and Repayment

Maturity: The facilities will have a final maturity of [Number of Years] years from the date of closing.

Repayment Schedule:

Term Loan: Amortized over the term with quarterly payments of principal, starting [Start Date].

Revolving Credit: Bullet repayment at the end of the term, with interest paid quarterly.

VI. Security and Guarantees

Collateral: The facilities will be secured by all assets of [Borrower Name], including but not limited to accounts receivable, inventory, equipment, and intellectual property.

Guarantees: All obligations under the facilities will be guaranteed by [Parent Company Name] and key subsidiaries.

VII. Covenants

Financial Covenants:

Minimum liquidity ratio of [Ratio]:1 at all times.

Maximum leverage ratio not to exceed [Ratio]:1 on a quarterly basis.

Affirmative and Negative Covenants:

Regular financial reporting requirements.

Restrictions on additional indebtedness, asset sales, and certain types of investments and transactions without lender consent.

VIII. Conditions Precedent to Funding

Completion of satisfactory due diligence by [Your Name].

Execution and delivery of definitive documentation, including loan agreements, security agreements, and guarantees.

Receipt of all necessary corporate approvals and regulatory consents.

IX. Miscellaneous

Governing Law: These facilities shall be governed by the laws of [Applicable Jurisdiction].

Exclusivity: [Borrower Name] agrees not to solicit or accept any other proposals regarding the subject matter of this Term Sheet from the date hereof until the closing date.

Confidentiality: Both parties agree to maintain the confidentiality of the terms outlined in this Term Sheet and any related negotiations.

This Term Sheet is intended as a proposal to form the basis for further discussion and does not constitute a legally binding obligation until all parties execute the definitive agreements.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Ensure a smooth operation of your senior care facilities with the Senior Facilities Term Sheet Template, offered by Template.net. This essential document is fully customizable and editable in our AI Editor Tool, allowing you to tailor every detail to your specific needs. Downloadable and printable, this template streamlines the management process, saving you time and effort in organizing vital agreements.

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

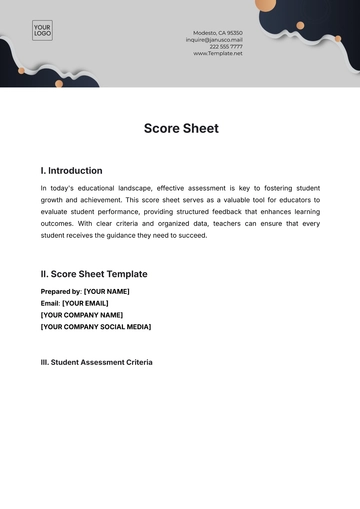

- Score Sheet

- Estimate Sheet

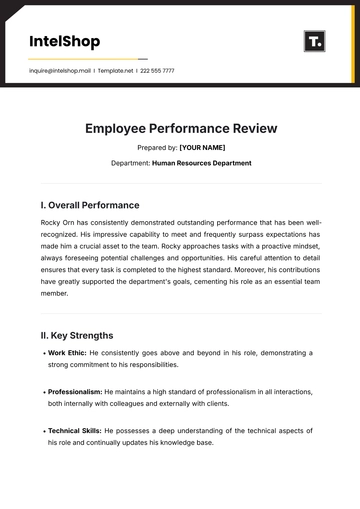

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

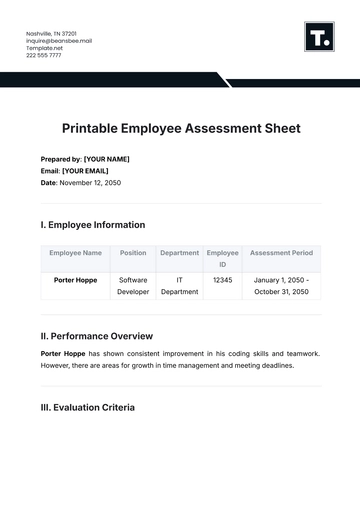

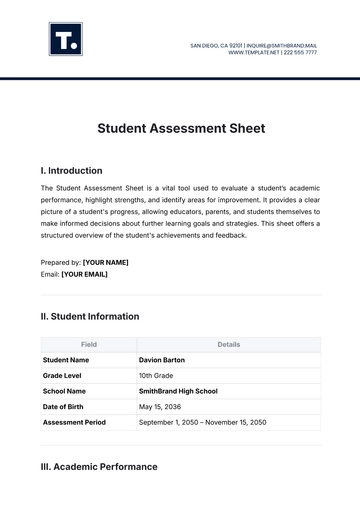

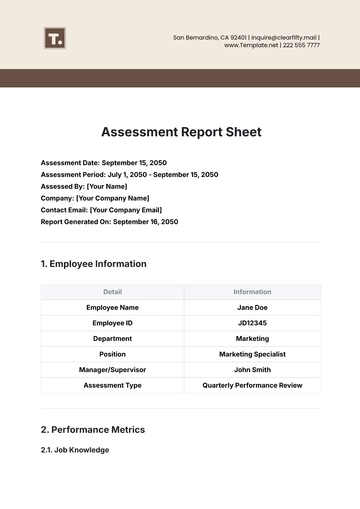

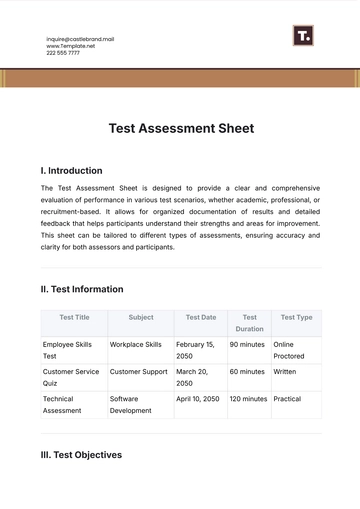

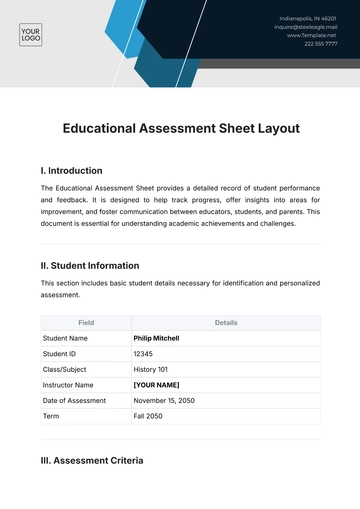

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet