Free Residential Loan Term Sheet

I. Overview

This Term Sheet provides a summary of the terms proposed for the residential loan offered by [Your Company Name]. The purpose of this document is to outline the principal terms and conditions under which [Lender Name] is prepared to finance the residential property purchase. This document serves as a preliminary agreement prior to the final loan documentation. It is intended to be non-binding, with the exception of the confidentiality and exclusivity sections herein.

The final issuance of the loan is subject to the approval of the formal loan agreement and satisfaction of all conditions set forth therein. It is crucial to review these terms carefully and consider legal counseling to ensure understanding and agreement with the proposed conditions.

II. Loan Terms

The specifics of the loan proposed by [Your Company Name] are detailed as follows:

Loan Amount: The total loan amount offered is [$ Loan Amount].

Term of Loan: This loan is structured as a term of [Number] years.

Interest Rate: The interest rate applicable is [Interest Rate]%, calculated on an annual basis.

Repayment Schedule: Repayments will be made on a [Monthly/Quarterly/Annually] basis, beginning [Start Date].

Security: The loan will be secured by the residential property being purchased or other agreed-upon assets.

This section must be reviewed thoroughly to understand your financial obligations under the proposed loan agreement.

III. Conditions Precedent

To qualify for the loan, certain conditions must be met as pre-established by [Your Company Name]. These include but are not limited to:

Appraisal: Approval of a formal appraisal of the residential property addressing the minimum value requirement.

Insurance: Proof of a comprehensive homeowner's insurance policy effective from the date of purchase.

Credit Approval: Confirmation of borrower's creditworthiness and history, meeting the minimum credit score set by [Lender Name].

These conditions are critical to ensure that the parties meet all necessary prerequisites before the execution of the loan agreement.

IV. Covenants

The borrower must agree to abide by certain covenants from the loan disbursement date till the termination of the loan agreement:

Reporting Requirements: Submission of quarterly financial statements within 30 days following the end of each quarter.

Maintenance of Property: The borrower shall maintain the property in good condition, performing all reasonable repairs and maintenance.

Compliance: The borrower must comply with all local building, zoning, and other legal requirements affecting the property.

Failure to adhere to these covenants may trigger a review of the loan terms or lead to early termination of the funding agreement.

V. Legal Considerations

Both parties agree that the Term Sheet is governed by the laws of the state in which [Property Location] is situated. Any disputes, controversies, or claims arising out of or in relation to this term sheet, including the validity, invalidity, breach, or termination thereof, shall be settled by arbitration in accordance with the Arbitration Rules of the state of [State Name].

It must be noted that this Term Sheet does not constitute a legally binding offer or acceptance but merely reflects the current state of negotiations. The Term Sheet becomes binding only upon signing of the Loan Agreement, explicit with all necessary endorsements and subjected to the 'Execution' clause herein provided.

VI. Confidentiality

All information exchanged in the course of negotiating this loan shall be treated as confidential and not disclosed to third parties without prior written consent from both parties, unless required by law. This clause will survive termination of negotiations or completion of the loan process.

A breach of confidentiality can lead to legal repercussions and thus must be treated with the utmost respect and adherence.

[Your Company Name]

Date: [Date Signed]

[Lender Name]

Date: [Date Signed]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Residential Loan Term Sheet Template, offered by Template.net. This essential tool is fully customizable and editable in our AI Editor Tool, ensuring that you can tailor every detail to meet your specific needs. The template is readily downloadable and printable, making it a versatile choice for professionals seeking to streamline their loan application processes.

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

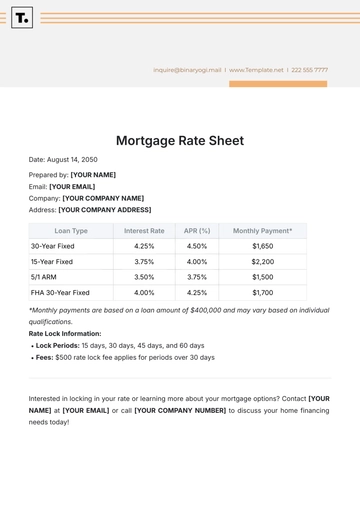

- Mortgage Sheet

- Answer Sheet

- Excel Sheet