Free Term Sheet for Small Investors

I. Introduction

The following Term Sheet delineates the proposed terms and conditions governing an investment agreement between [Your Company Name] ("Company"), a forward-thinking entity in [Your Industry], and [Investor Name] ("Investor"), an esteemed individual/group with a keen interest in strategic investments. This collaboration is centered around a revolutionary AI-powered software solution, marking an exciting opportunity for both parties to align their goals and drive mutual growth. It is imperative to note that while this Term Sheet sets the groundwork, it is not legally binding and is subject to further discussion and formalization in a comprehensive investment contract.

II. Investment Details

Investment Amount: The Investor commits to inject a substantial sum of $500,000 into the Company, providing vital fuel for expansion, innovation, and market penetration initiatives.

Equity Stake: In return for the investment, the Investor will acquire a 15% equity stake in the Company, solidifying their position as a strategic partner and aligning incentives for long-term success.

Investment Structure: The investment structure is designed to optimize mutual benefits and may take the form of Preferred Stock, providing additional protections and benefits.

Valuation: Based on rigorous financial assessments, the Company's pre-money valuation stands at $3 million, which translates to a post-money valuation of $3.5 million post-investment, providing a clear understanding of the Company's worth.

Investment Tranches: To ensure strategic alignment and milestone-driven progress, the investment will be disbursed in two tranches, each linked to predefined milestones and timelines, fostering accountability and transparency.

III. Rights and Preferences

Voting Rights: The Investor's voting rights, pegged at one vote per share of Preferred Stock held, empower them to actively participate in strategic decision-making processes, ensuring their voice is heard and valued.

Liquidation Preference: In scenarios necessitating liquidation, the Investor enjoys a 1.5x liquidation preference over common shareholders, safeguarding their investment and providing a measure of security.

Dividend Rights: The Investor is entitled to receive 10% of any dividends declared by the Company, bolstering their return on investment and incentivizing long-term partnership.

IV. Governance and Control

Board Representation: Recognizing the Investor's expertise and strategic insights, they shall have the right to appoint one seasoned member to the Company's Board of Directors, fostering a collaborative governance model.

Information Rights: The Investor will receive comprehensive financial and operational updates, including quarterly reports, annual audits, and strategic planning sessions, ensuring transparency and alignment with the Company's goals.

Exit Strategy: The Term Sheet paves the way for constructive discussions on an agreeable exit strategy, encompassing potential options such as IPO, acquisition, or buyback, aligning interests for future growth and value realization.

V. Legal and Miscellaneous

Confidentiality: Both parties commit to upholding strict confidentiality regarding all proprietary information exchanged during negotiations and subsequent partnerships, ensuring trust and safeguarding intellectual assets.

Governing Law: This Term Sheet shall be governed by and construed under the laws of [Your Jurisdiction], providing a solid legal framework for seamless collaboration and dispute resolution if needed.

Exclusive Negotiation: Upon mutual acceptance of this Term Sheet, both parties agree to enter into exclusive negotiations for 30 days, dedicating focused attention to finalizing the investment agreement.

VI. Signatures

By signing below, the Company and Investor acknowledge their commitment to exploring this investment opportunity and agree to commence detailed negotiations leading to the formalization of a comprehensive investment contract.

[Your Name]

[Your Title]

[Your Company Name]

[Investor's Name]

[Investor's Title]

[Investor Name]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Access the Term Sheet for Small Investors Template on Template.net for detailed small investor agreement outlines. This editable template streamlines terms and conditions presentation for small investor agreements. Customize the term sheet effortlessly using our AI Editor Tool, ensuring clear and precise small investor agreement summaries. Simplify your investor agreement documentation with this professional and user-friendly template.

You may also like

- Attendance Sheet

- Work Sheet

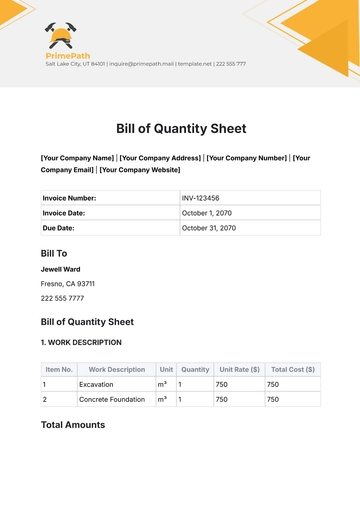

- Sheet Cost

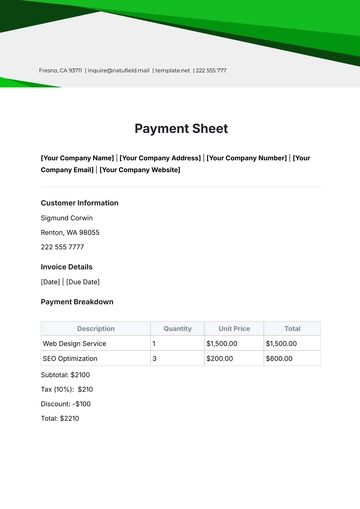

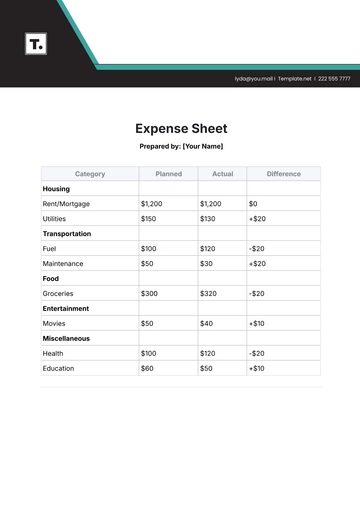

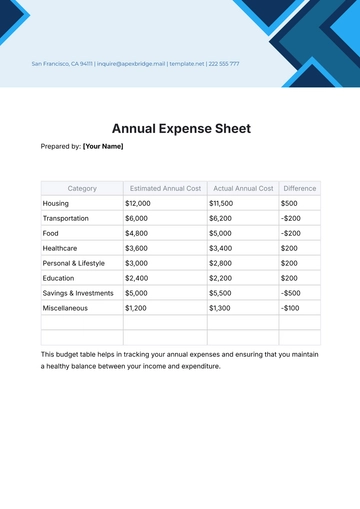

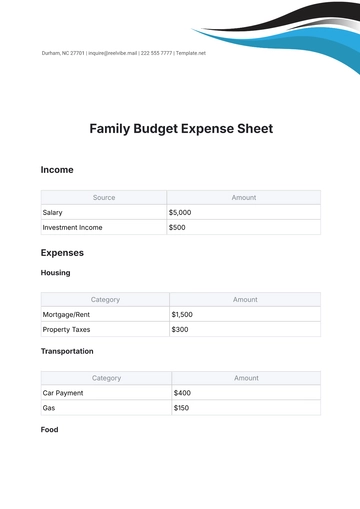

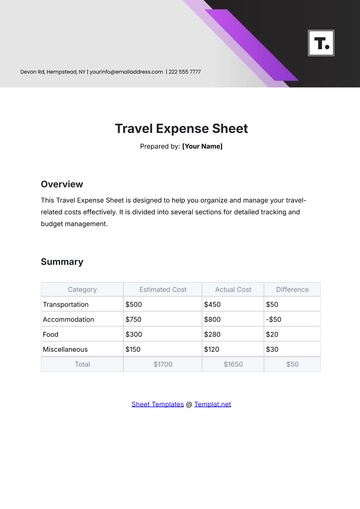

- Expense Sheet

- Tracker Sheet

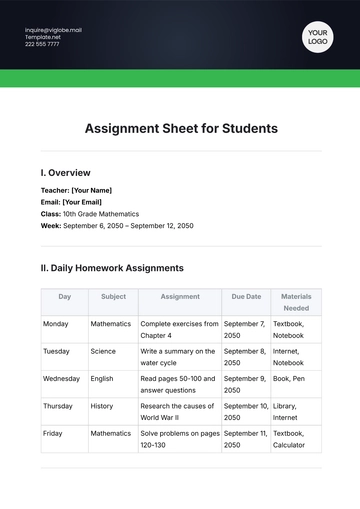

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

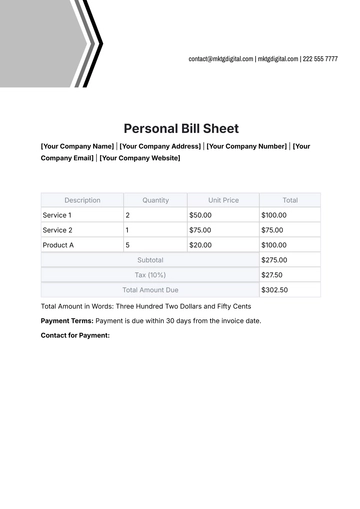

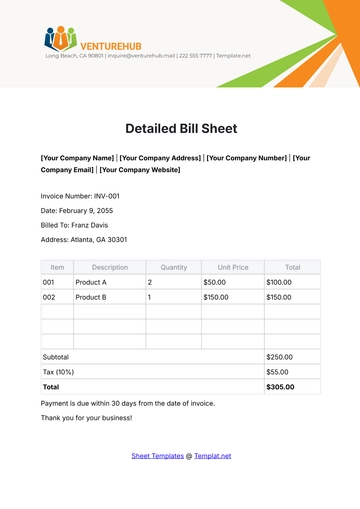

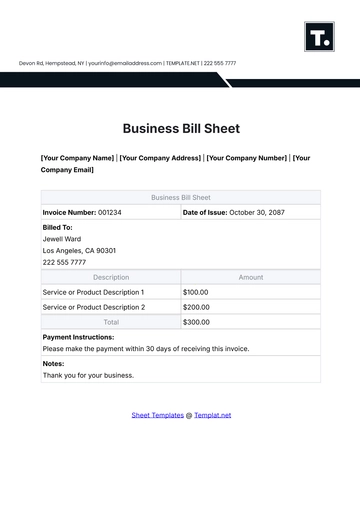

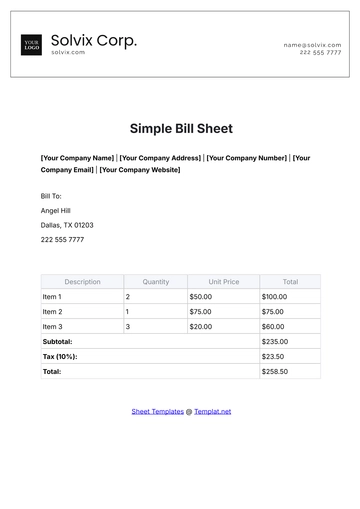

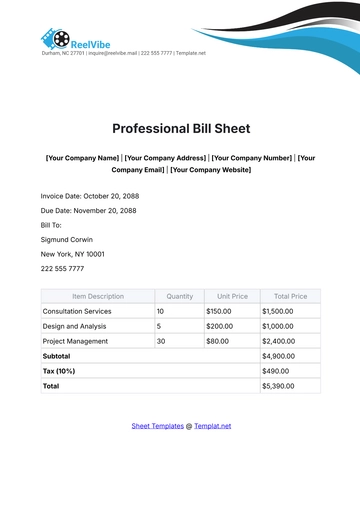

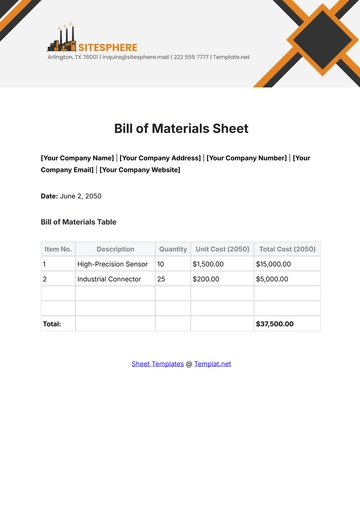

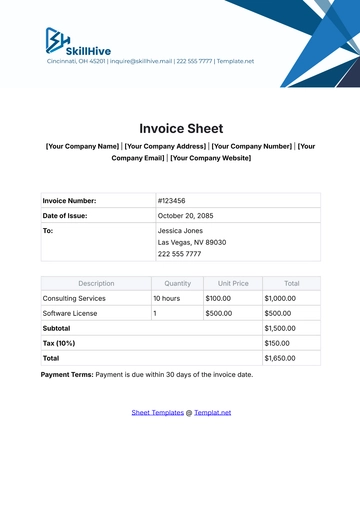

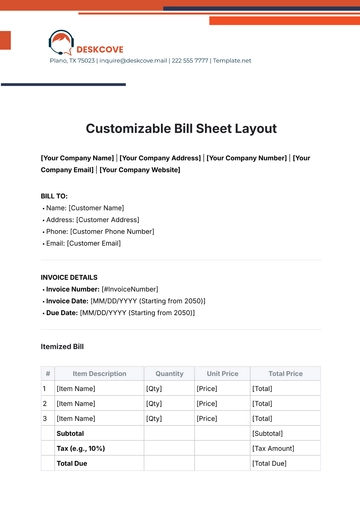

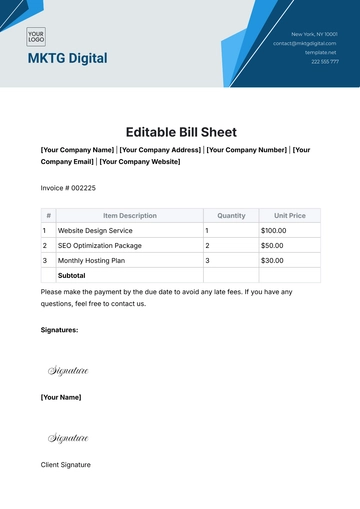

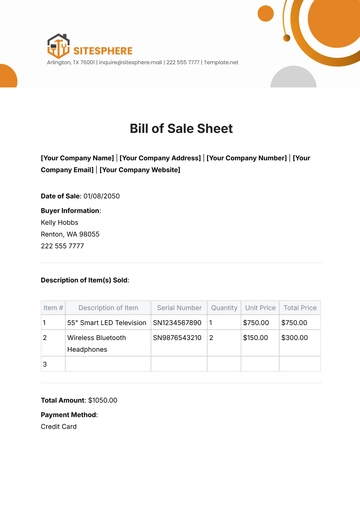

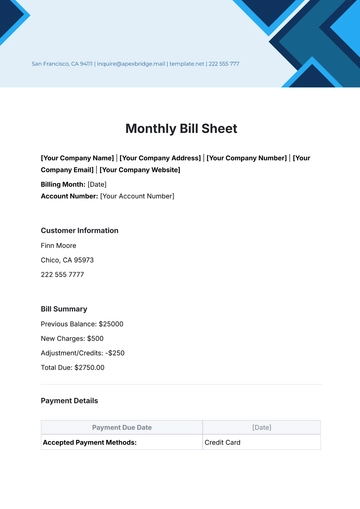

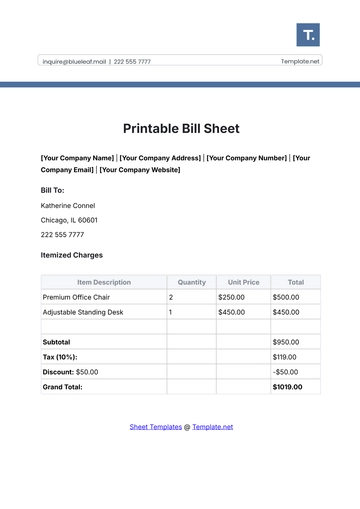

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

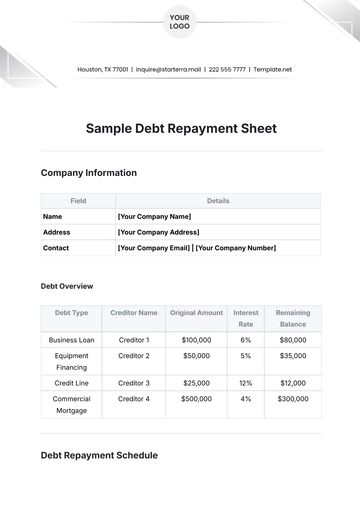

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

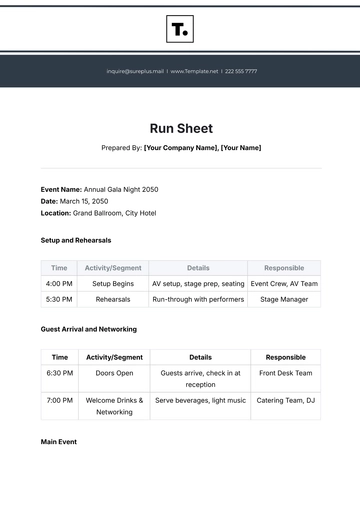

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

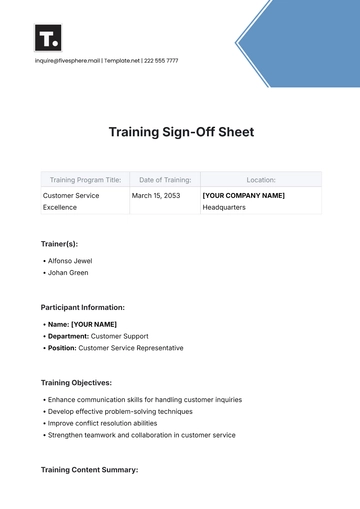

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet