Free Small Business Term Sheet

I. Introduction

This Term Sheet serves as a preliminary outline of key terms for the proposed investment in [Your Company Name]. It is a non-binding document intended to guide further negotiations and due diligence processes. The terms presented herein are subject to legal review and detailed contractual agreements to be established between the parties involved.

Parties Involved:

[Investor's Name] (hereinafter referred to as "Investor") and [Your Company Name], represented by [Your Name], [Your Title].

This Term Sheet aims to facilitate a clear understanding between the Investor and [Your Company Name] regarding the proposed investment, ownership structure, governance aspects, and other essential terms crucial for the success of the partnership.

II. Financial Terms

Investment Details:

Investment Amount: $5,000,000

Percentage Ownership Offered: 20%

Pre-investment Valuation: $25,000,000

Type of Equity Offered: Preferred Stock

Conditions Preceding Funding: Due Diligence Completion and Regulatory Approvals

Use of Funds: Research and Development, Market Expansion

The financial terms outlined above form the basis of the economic relationship between the Investor and [Your Company Name]. These terms are subject to adjustment based on further due diligence and negotiations to ensure a mutually beneficial agreement.

III. Governance and Voting Rights

Governance Framework:

Board Composition: 3 Directors from Investor, 2 Directors from [Your Company Name]

Voting Rights per Share Type: 1 vote per share for Preferred Stock, 1 vote per share for Common Stock

Shareholder Meetings: Quarterly Meetings with 30 days' notice

Access to Financial Statements and Reports: Investor granted access to quarterly financial statements and annual reports

Establishing a clear governance framework and voting rights is essential for effective decision-making and management within [Your Company Name]. The proposed terms aim to ensure transparency, accountability, and alignment of interests between the Investor and [Your Company Name].

IV. Conditions and Warranties

Key Conditions and Warranties:

Accuracy of Financial Statements: [Your Company Name] warrants the accuracy and completeness of all financial statements provided.

Compliance with Laws: [Your Company Name] assures compliance with all relevant laws and regulations impacting its business operations.

Intellectual Property Ownership: [Your Company Name] confirms ownership or valid rights to use all critical intellectual property necessary for its operations.

Fulfillment of these conditions and warranties is vital for finalizing the investment agreement and mitigating risks for both parties involved.

V. Confidentiality and Exclusivity

Confidentiality Measures:

Strict Confidentiality: All discussions, documents, and information exchanged between the Investor and [Your Company Name] are to be treated with strict confidentiality.

Exclusivity Period: 180 days agreement, during which [Your Company Name] agrees not to engage in investment discussions with other potential investors.

Non-Disclosure Agreement (NDA): Both parties must sign an NDA before entering detailed due diligence to protect proprietary information.

Maintaining confidentiality and exclusivity is crucial to safeguard sensitive information and foster trust between the Investor and [Your Company Name].

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Explore the Small Business Term Sheet Template on Template.net for comprehensive small business agreement summaries. This editable template simplifies small business terms and conditions presentation. Customize the term sheet effortlessly using our AI Editor Tool, ensuring clear and precise small business agreement summaries. Simplify your business contract documentation with this user-friendly and professional template.

You may also like

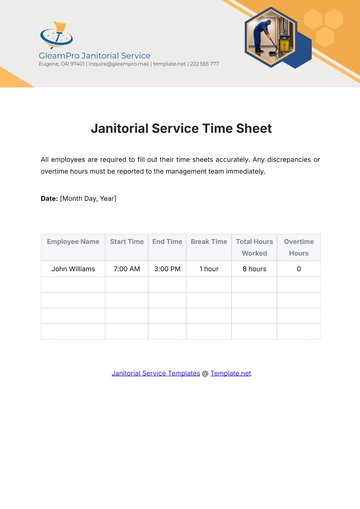

- Attendance Sheet

- Work Sheet

- Sheet Cost

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

- Bill Sheet

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

- Construction Sheet

- Cover Sheet

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

- Run Sheet

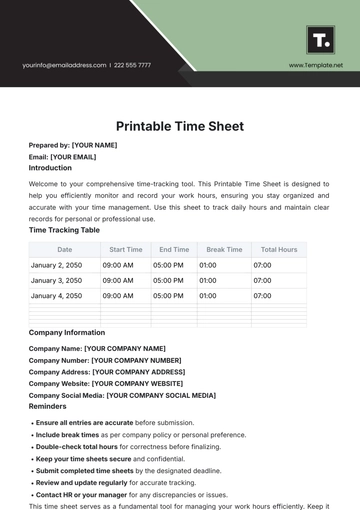

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet