Free Investment Policy Statement

Prepared by: [YOUR NAME]

Company: [YOUR COMPANY NAME]

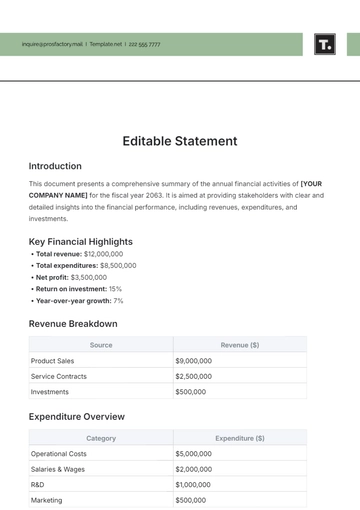

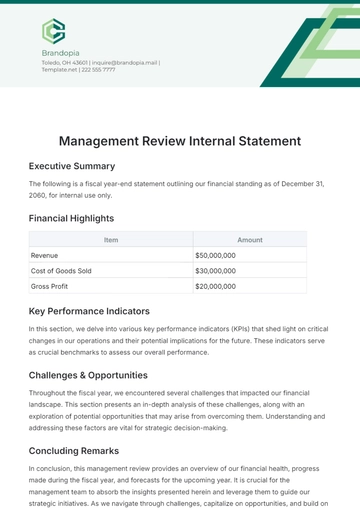

I. Introduction

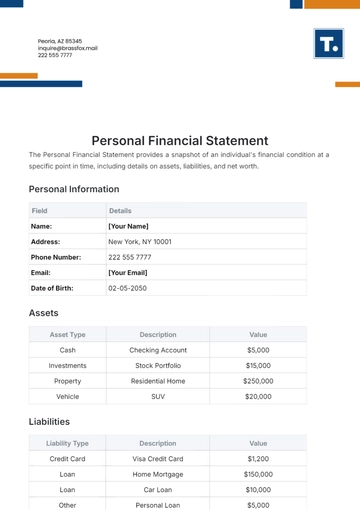

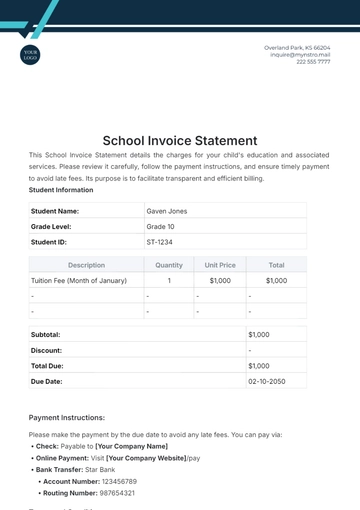

This Investment Policy Statement (IPS) sets forth the investment objectives, distribution policies, and investment strategies that will guide the management of the portfolio of [YOUR COMPANY NAME]. The IPS is designed to establish a clear understanding among all stakeholders regarding the management of company funds to align with the overarching financial goals and risk tolerances of the organization.

II. Statement of Goals

The primary goals of our investment policy are as follows:

To preserve capital while striving to achieve real growth of portfolio assets.

To achieve a reasonable rate of return, considering the risk tolerance and the strategic objectives of [YOUR COMPANY NAME].

To maintain sufficient liquidity to meet the company's operational and contractual obligations.

III. Governance

The investment activities of [YOUR COMPANY NAME] shall be overseen by a designated Investment Committee. The committee's responsibilities include:

Reviewing and revising the IPS annually.

Selecting and monitoring investment managers and advisors.

Ensuring compliance with all legal and regulatory requirements.

IV. Investment Strategies

The investment strategies outlined in this IPS are crafted to align with the risk tolerance and financial goals set forth in Section II. Specifically, the strategies include:

Diversification across asset classes to mitigate risk.

Employing a balance of active and passive management methodologies.

Considering ethical and sustainable investment opportunities aligning with [YOUR COMPANY NAME]'s CSR policies.

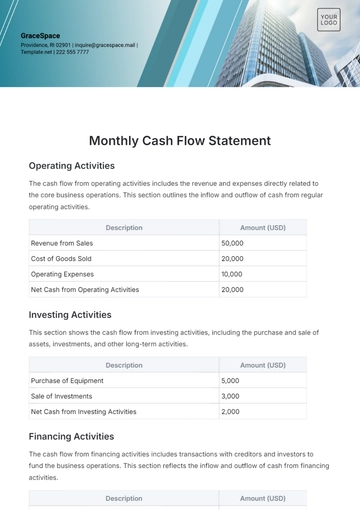

V. Asset Allocation

The asset allocation for [YOUR COMPANY NAME]'s investment portfolio shall be as follows:

Equity Securities: 50%

Fixed Income Securities: 30%

Alternative Investments: 15%

Cash or Cash Equivalents: 5%

VI. Performance Review and Reporting

The performance of the investment portfolio shall be monitored and reviewed on a quarterly basis by the Investment Committee. The key aspects of review include:

Comparison of portfolio returns against established benchmarks.

Analysis of investment risk and assessment of risk-adjusted returns.

Alignment of investment outcomes with the strategic goals of the company.

VII. Amending the Investment Policy

This IPS may be amended from time to time based on changes in strategic direction, financial status, or other significant factors. Any amendments must be approved by the Investment Committee and documented accordingly.

VIII. Acknowledgment

By their execution below, the undersigned members of the Investment Committee agree to the terms and conditions of the Investment Policy Statement as outlined above.

Signatures:

[Your Company Name]

[Date Signed]

[Investor Name]

[Date Signed]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

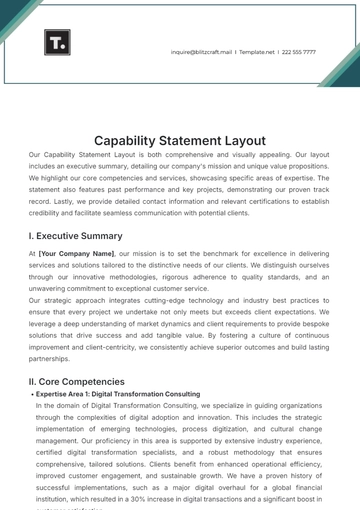

Elevate your financial planning with the Investment Policy Statement Template offered by Template.net. This downloadable and printable resource ensures precision and ease in defining investment goals and strategies. Fully customizable and editable in our AI Editor Tool, it's designed to cater to both individual investors and financial advisors seeking to optimize their portfolio management and document their investment policies efficiently.