Basic Valuation

Prepared by: [Your Name]

Company: [Your Company Name]

Date: [Date]

Department: [Your Department]

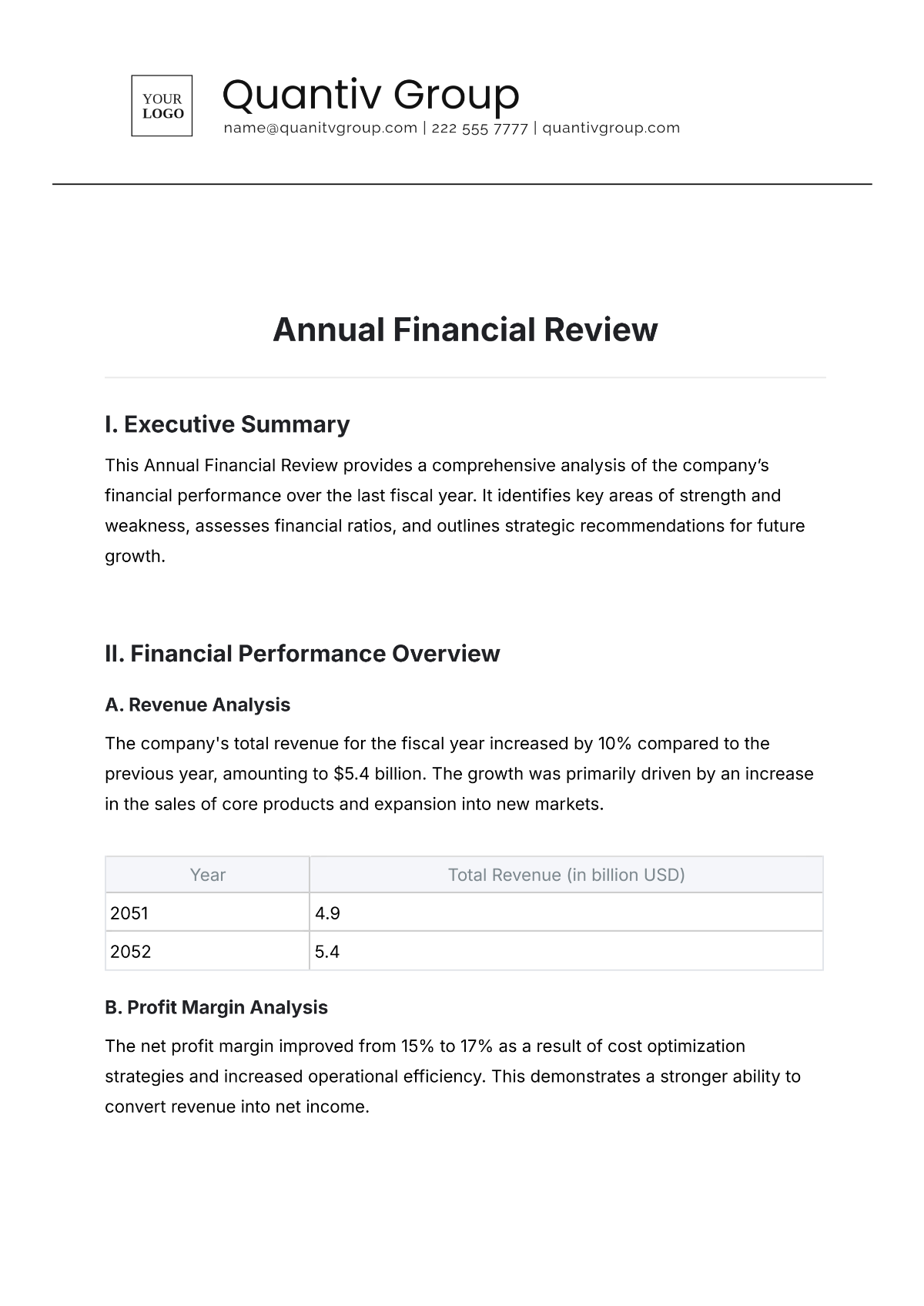

I. Executive Summary

In the Executive Summary, provide a concise overview of the valuation process, including the methodologies used and the key findings. Highlight the main points of the valuation report to give readers a quick understanding of the company's value and the factors influencing it.

II. Company Information

A. Business Description

In this section, offer a comprehensive description of the company's business model, its core operations, target market, competitive advantages, and any other relevant information. Provide insights into the industry in which the company operates, including market trends, growth prospects, and potential risks.

B. Financial Highlights

Metric | [Your Company Name] | Industry Average |

|---|---|---|

Revenue | [$XX.XX] | [$XX.XX] |

EBITDA | [$XX.XX] | [$XX.XX] |

Net Income | [$XX.XX] | [$XX.XX] |

Cash Flow | [$XX.XX] | [$XX.XX] |

Earnings per Share | [$XX.XX] | [$XX.XX] |

III. Valuation Methods

A. Comparable Company Analysis (CCA)

1. Selection of Comparable Companies

Explain the criteria used to select comparable companies for the analysis. Discuss factors such as industry, size, growth prospects, and financial metrics. Justify the selection of each comparable company and its relevance to the valuation of the subject company.

2. Valuation Multiples

Company | [Your Company Name] | Comparable Company 1 | Comparable Company 2 | Comparable Company 3 |

|---|---|---|---|---|

EV/Revenue | [X.XX] | [X.XX] | [X.XX] | [X.XX] |

EV/EBITDA | [X.XX] | [X.XX] | [X.XX] | [X.XX] |

P/E Ratio | [X.XX] | [X.XX] | [X.XX] | [X.XX] |

B. Discounted Cash Flow (DCF) Analysis

1. Cash Flow Projections

Detail the assumptions and methodologies used to generate cash flow projections for the valuation period. Discuss the key drivers of cash flow, including revenue growth, operating expenses, capital expenditures, and working capital changes. Provide a rationale for the chosen projection period and any growth rates applied.

2. Discount Rate

Explain the determination of the discount rate (discounted rate of return) used in the DCF analysis. Discuss the components of the discount rate, such as the risk-free rate, equity risk premium, beta, and company-specific risk factors. Justify the chosen discount rate based on industry benchmarks and company-specific considerations.

3. Terminal Value

Describe the calculation of the terminal value in the DCF analysis, including the perpetuity growth method or exit multiple method. Discuss the assumptions underlying the terminal value calculation and their implications for the overall valuation. Evaluate the reasonableness of the terminal value relative to the company's long-term prospects.

IV. Conclusion

Summarize the key findings of the valuation, including the results of the comparable company analysis and discounted cash flow analysis. Provide insights into the estimated value of the company and any factors that may affect its valuation. Offer recommendations based on the valuation results, such as investment decisions, strategic initiatives, or financial planning strategies.

V. Appendix

Include any additional information or supporting documents relevant to the valuation, such as detailed financial statements, sensitivity analysis, or market research reports. Ensure that all data and assumptions used in the valuation are transparent and well-documented for reference.