Alaska IOU (I Owe You)

I. Loan Details

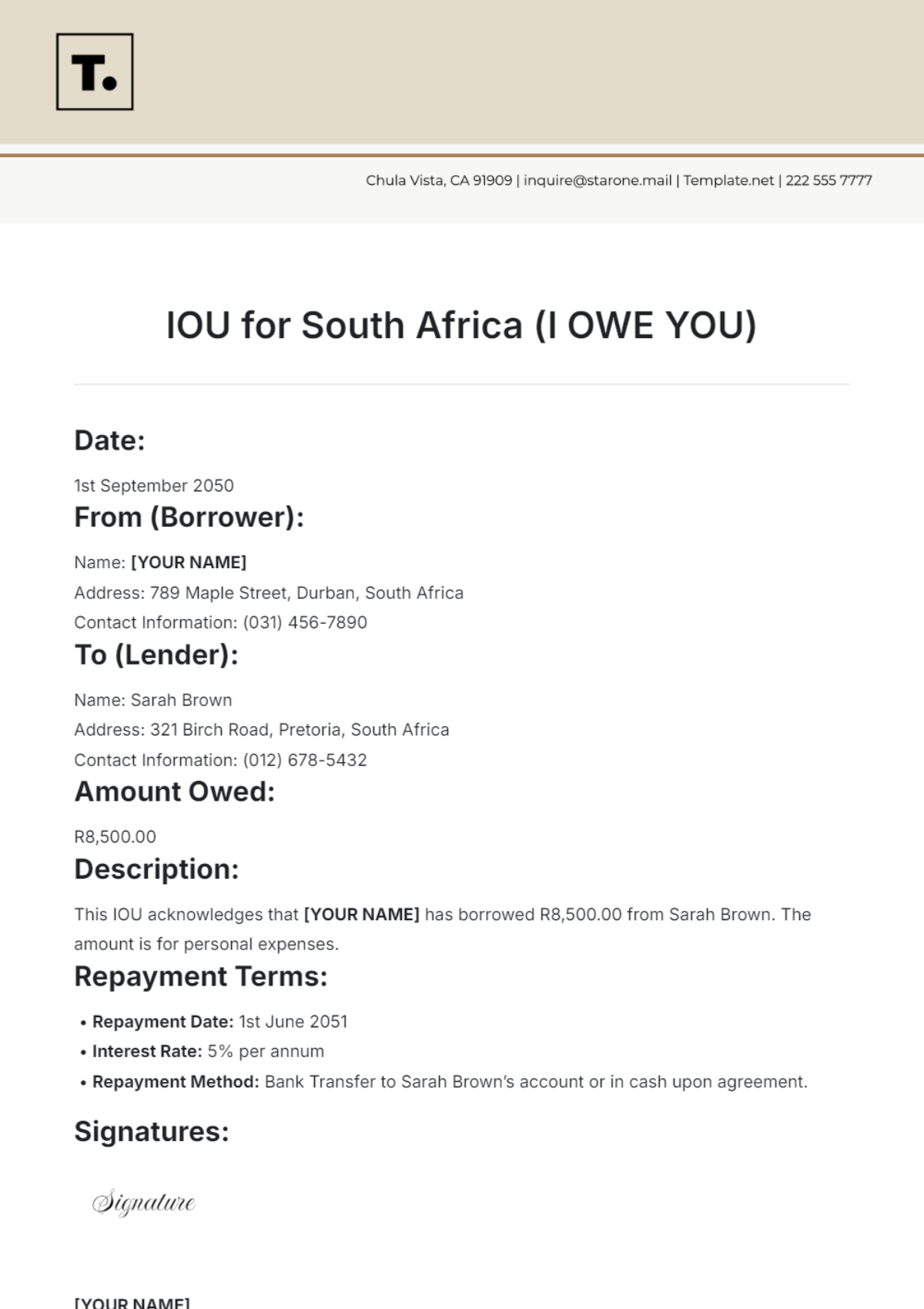

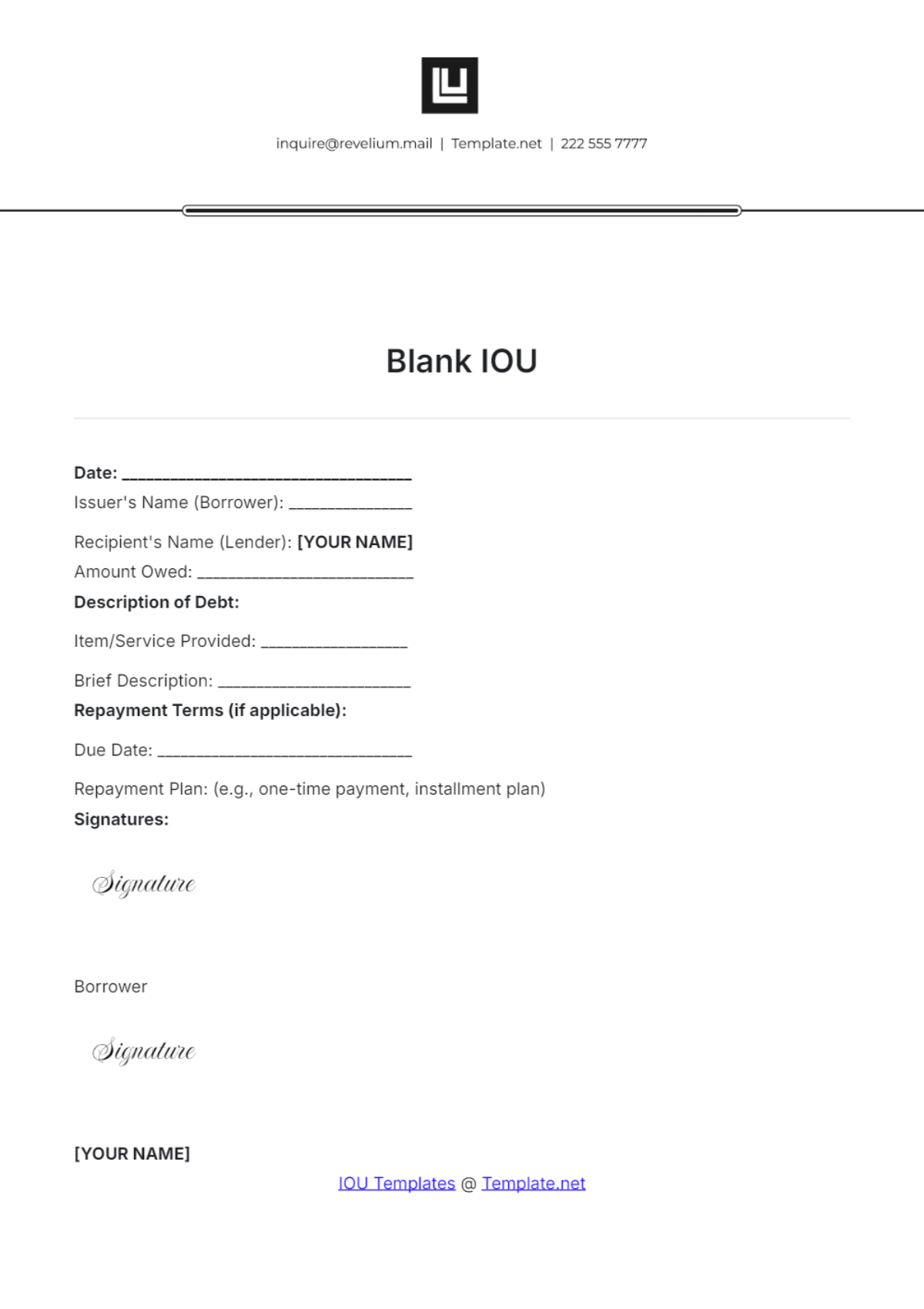

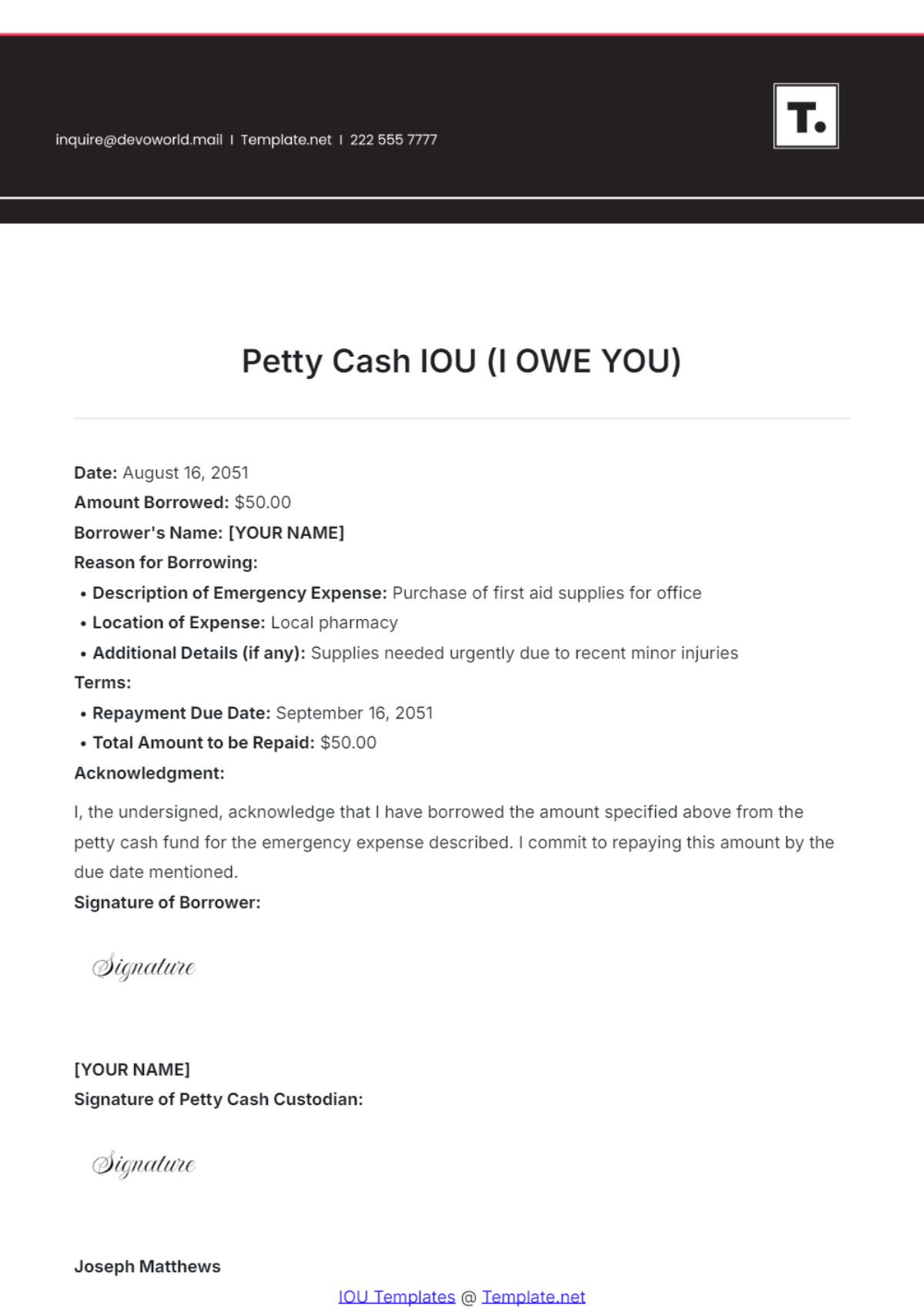

Debtor Name: [YOUR NAME]

Debtor Address: [YOUR ADDRESS]

Creditor Name: [CREDITOR'S NAME]

Creditor Address: [CREDITOR'S ADDRESS]

Loan Amount: [$AMOUNT]

Date Issued: [DATE]

Purpose of Loan: [IOU DETAILS]

This section documents the basic information about the financial transaction, including the identities and addresses of the involved parties, the amount of money being borrowed, and the date the agreement is effective. It also describes the purpose of the loan, providing clarity on why the money is being lent.

II. Terms of Agreement

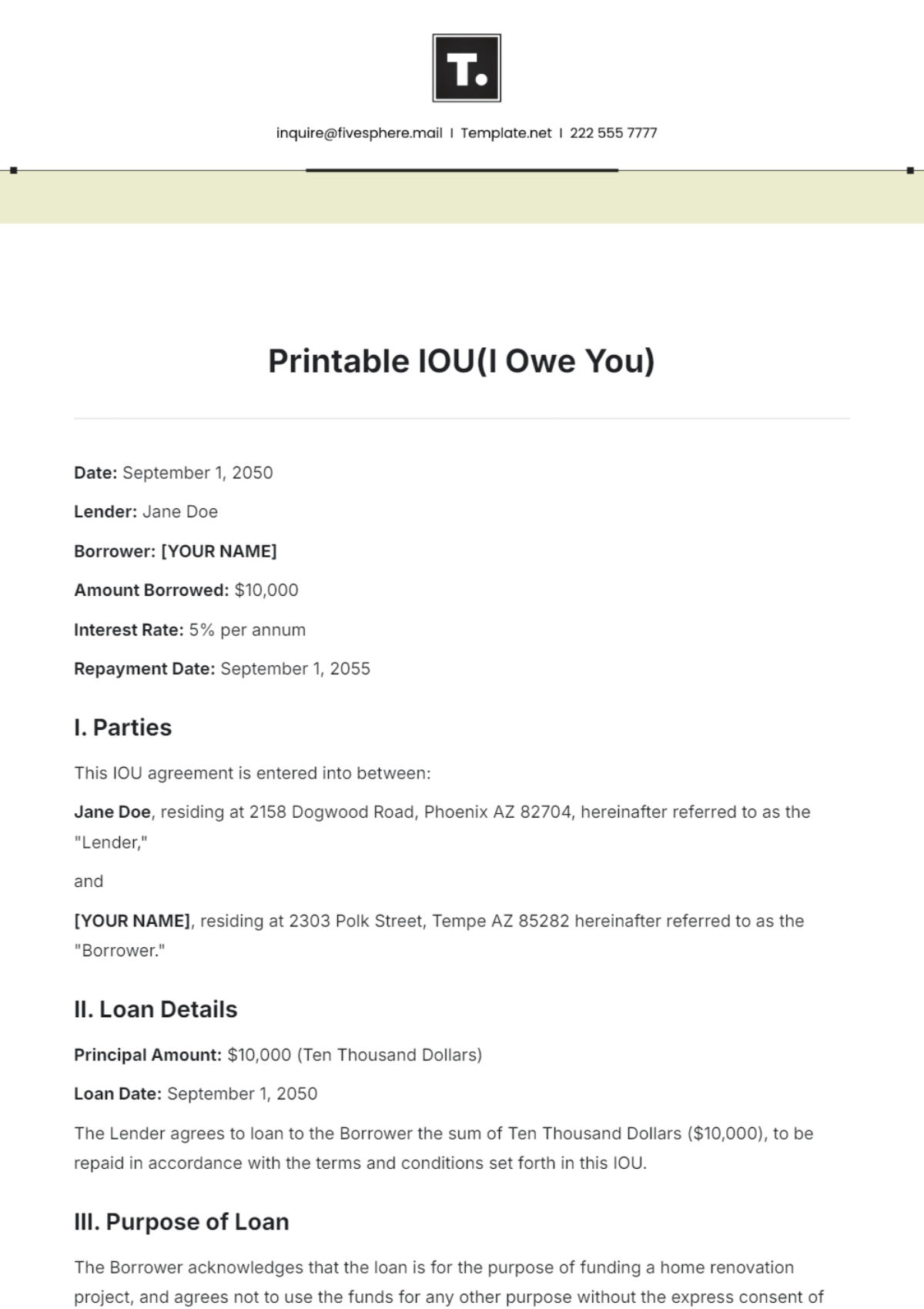

This IOU serves as an acknowledgment that [YOUR NAME] ("Debtor") is legally bound to repay [CREDITOR'S NAME] ("Creditor") the specified sum of [$AMOUNT] borrowed on [DATE]. This agreement is intended to formalize the obligation of the Debtor towards the Creditor, detailing that the loan must be repaid and that the terms of this document are binding under the appropriate legal jurisdiction.

III. Repayment Plan

The Debtor agrees to a structured repayment plan to settle the debt by [REPAYMENT DUE DATE]. Payments are to be made in [PAYMENT FREQUENCY], starting from [STARTING DATE] and each subsequent payment thereafter until the full amount is repaid. The exact terms including amounts per payment, due dates, and preferred payment methods (e.g., bank transfer, cash) are to be specified here to ensure both parties are clear on the repayment expectations.

IV. Interest

An interest rate of [INTEREST RATE]% per annum will be applied to the unpaid balance of the loan, compounding [HOW INTEREST IS CALCULATED (e.g., monthly, annually)]. This interest is charged as compensation to the Creditor for the opportunity cost of lending the money. This section should detail when the interest starts accruing and any conditions related to the modification or waiver of interest.

V. Security

To provide assurance for the repayment of the loan, the Debtor offers collateral described as [DESCRIBE COLLATERAL]. This collateral will remain in the possession of the Creditor as security against the loan amount. Conditions under which the collateral may be retained or returned should be clearly defined, including the circumstances under which the Creditor has the right to sell or dispose of the collateral if the Debtor fails to meet the repayment terms.

VI. Signatures

The signatures of both the Debtor and the Creditor at the end of this document serve as a formal execution of the agreement, signifying that both parties agree to the terms as stated and intend to uphold them. This section reinforces the legal enforceability of the document, providing a clear intent to honor the obligations set forth.

Debtor's Signature:

[DEBTOR'S NAME]

[DATE]

Creditor's Signature

[CREDITOR'S NAME]

[DATE]

IOU Templates @ Template.net