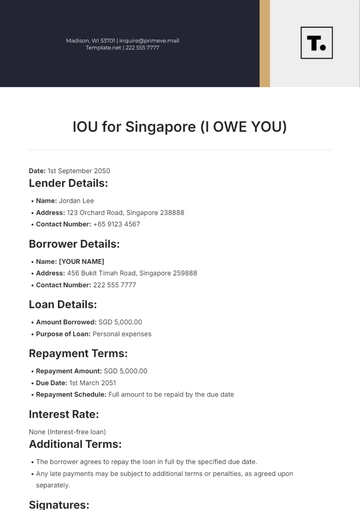

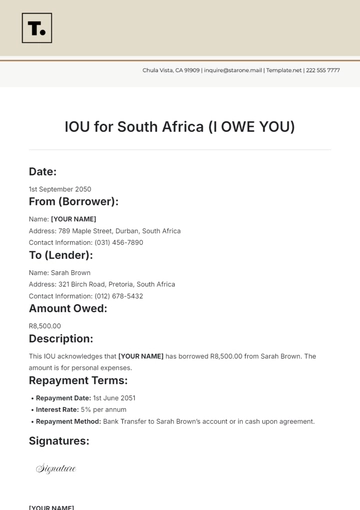

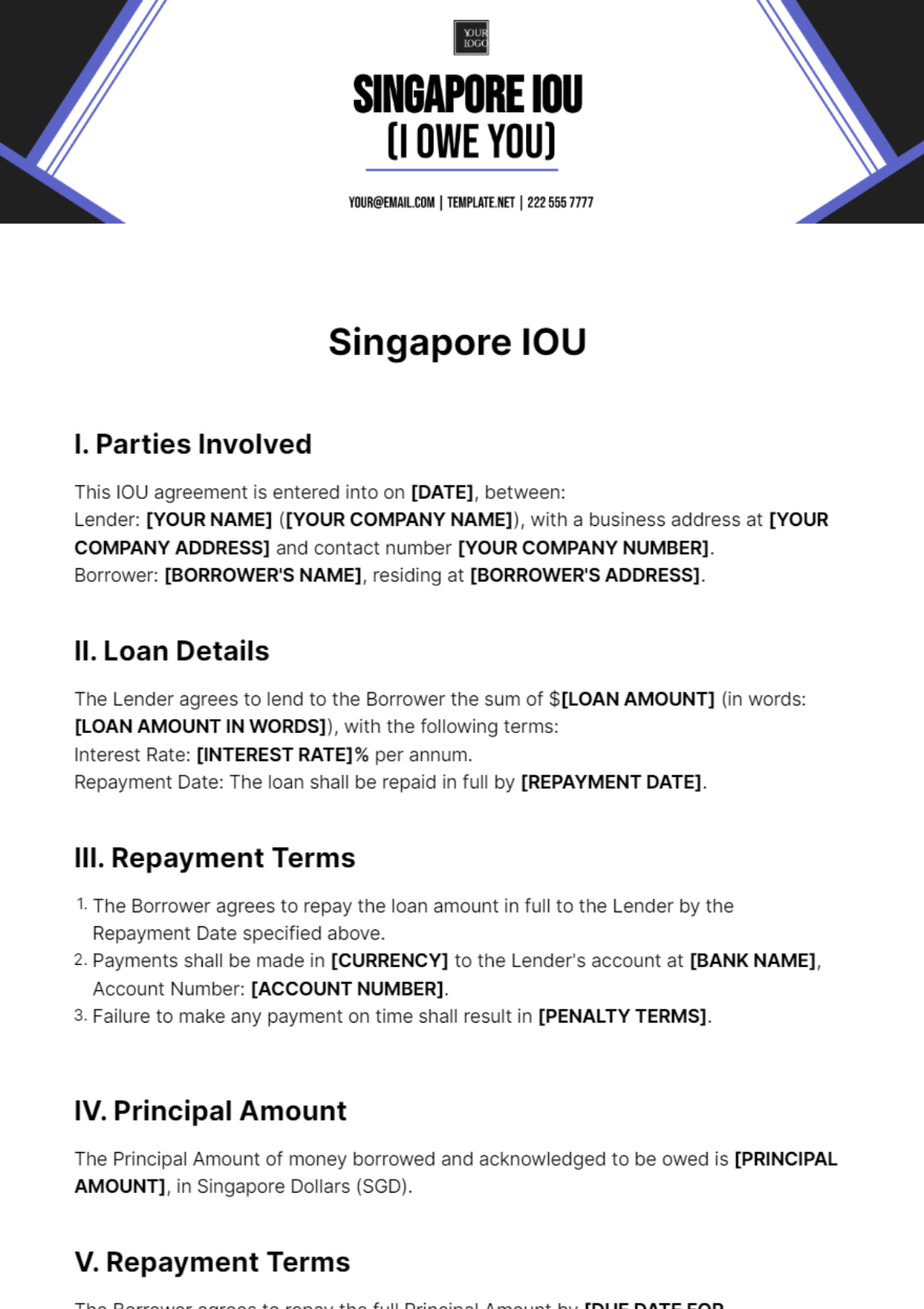

Free Singapore IOU

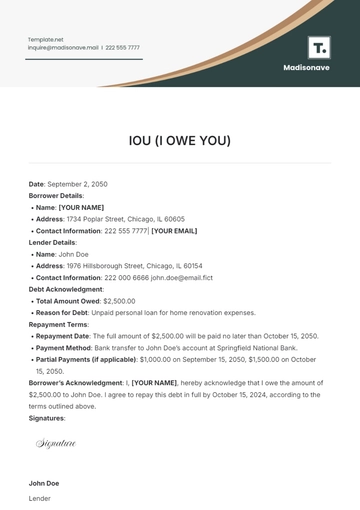

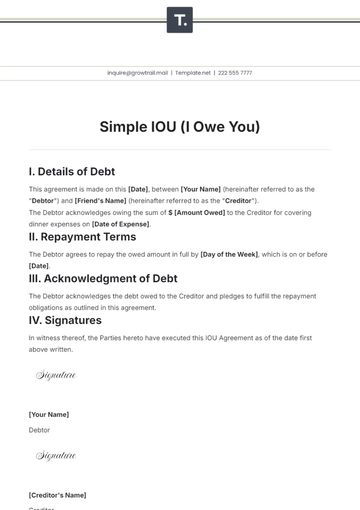

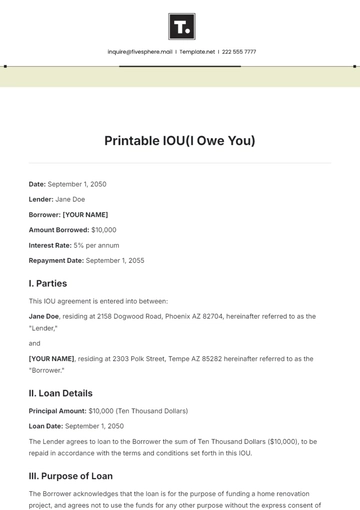

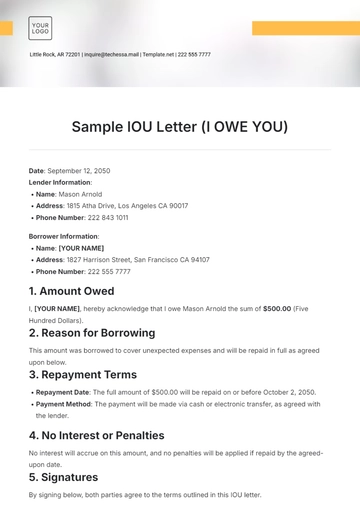

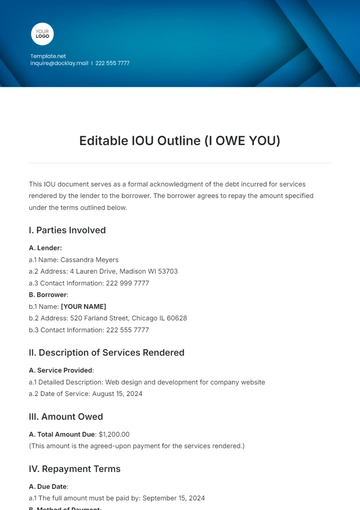

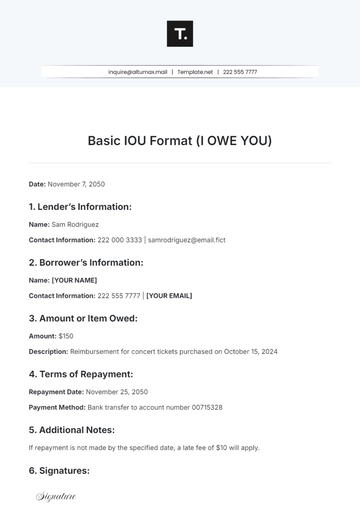

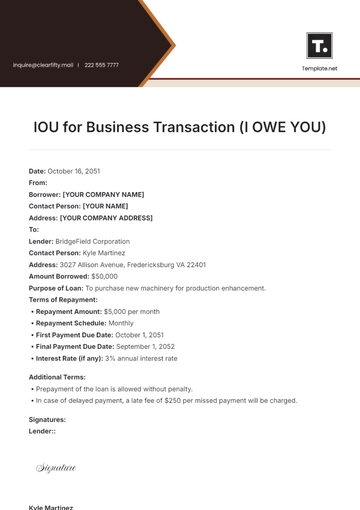

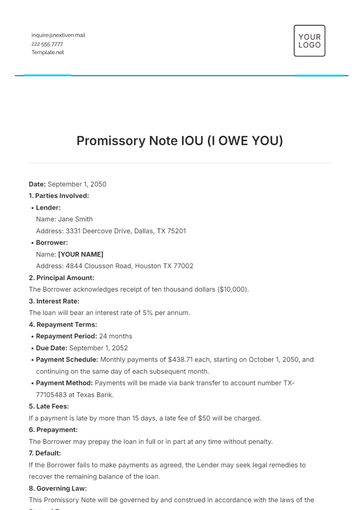

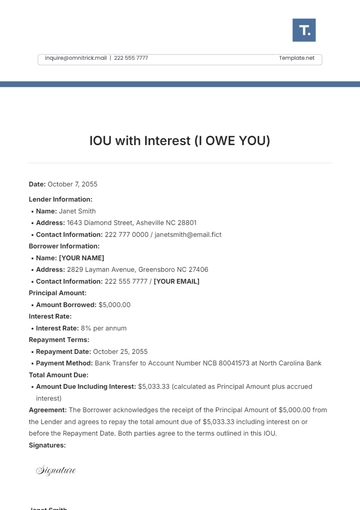

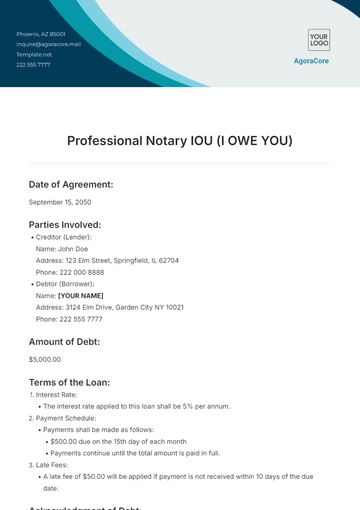

I. Parties Involved

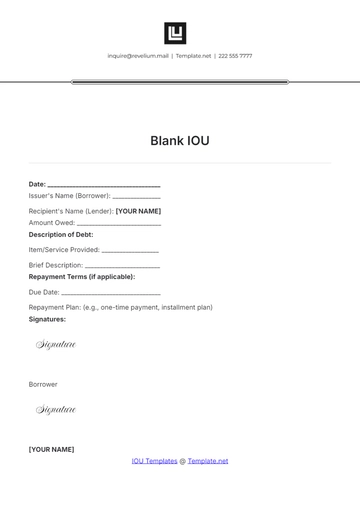

This IOU agreement is entered into on [DATE], between:

Lender: [YOUR NAME] ([YOUR COMPANY NAME]), with a business address at [YOUR COMPANY ADDRESS] and contact number [YOUR COMPANY NUMBER].

Borrower: [BORROWER'S NAME], residing at [BORROWER'S ADDRESS].

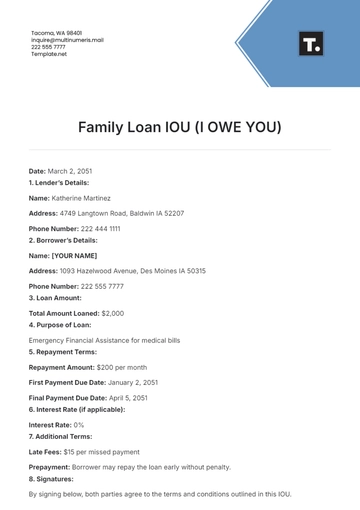

II. Loan Details

The Lender agrees to lend to the Borrower the sum of $[LOAN AMOUNT] (in words: [LOAN AMOUNT IN WORDS]), with the following terms:

Interest Rate: [INTEREST RATE]% per annum.

Repayment Date: The loan shall be repaid in full by [REPAYMENT DATE].

III. Repayment Terms

The Borrower agrees to repay the loan amount in full to the Lender by the Repayment Date specified above.

Payments shall be made in [CURRENCY] to the Lender's account at [BANK NAME], Account Number: [ACCOUNT NUMBER].

Failure to make any payment on time shall result in [PENALTY TERMS].

IV. Principal Amount

The Principal Amount of money borrowed and acknowledged to be owed is [PRINCIPAL AMOUNT], in Singapore Dollars (SGD).

V. Repayment Terms

The Borrower agrees to repay the full Principal Amount by [DUE DATE FOR REPAYMENT]. Any partial payments made in advance of this date will be recorded and deducted from the outstanding Principal Amount.

VI. Interest

This IOU is [INTEREST RATE]%' or 'non-interest bearing'.

VII. Prepayment

The Borrower reserves the right to prepay this loan in full or in part at any time without penalty.

VIII. Security

The Borrower hereby provides [COLLATERAL DETAILS] as security for the repayment of the loan.

IX. Default and Remedies

In the event of default, when the Borrower fails to pay the full Principal Amount by the due date, the Lender will have the right to demand immediate payment of the total unpaid balance and any accrued interest. Legal actions may be pursued to recover the owed amount.

X. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of Singapore.

XI. Signatures

Both parties hereby agree to the terms stated in this Agreement and execute this IOU on the agreed date:

[Your Lender]

[Date]

[Borrower's Name]

[Date]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Enhance your debt management process with Template.net's Singapore IOU Template. This editable and customizable tool offers unparalleled flexibility, allowing you to tailor IOUs to your specific needs. Effortlessly personalize your documents for clarity and precision. Plus, it's editable in our Ai Editor Tool, ensuring a seamless editing experience for maximum efficiency.