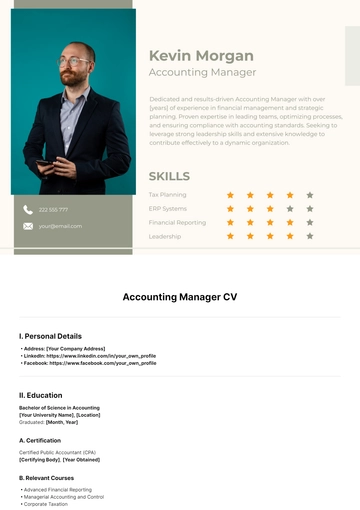

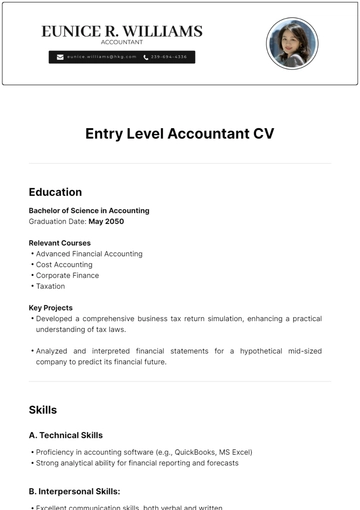

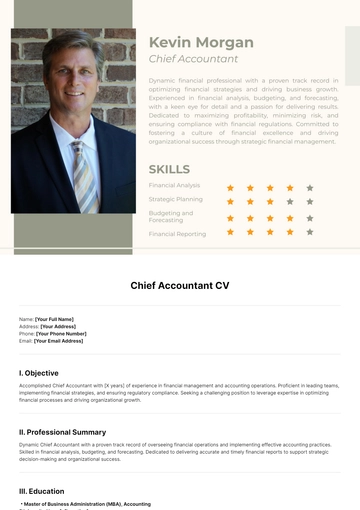

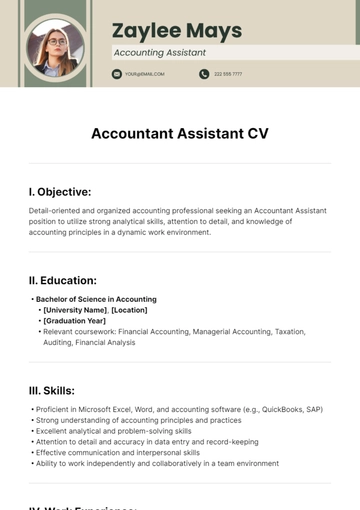

Free Senior Tax Accountant CV

I. Professional Summary

Detail-oriented Senior Tax Accountant with over [years] of experience in corporate tax planning and compliance. Proficient in interpreting complex tax laws and regulations, developing effective tax strategies to optimize client tax liabilities, and ensuring full regulatory compliance. Proven ability to analyze financial data, identify tax-saving opportunities, and deliver strategic recommendations. Seeking a challenging role to leverage expertise in tax management and contribute to the financial success of a dynamic organization.

II. Education Background

Bachelor of Science in Accounting

[University Name], [Location ]

[Graduation Date]

A. Relevant Coursework

Taxation Strategies and Planning

Advanced Accounting Principles

Corporate Finance and Financial Analysis

Auditing and Assurance Services

Business Law and Regulatory Compliance

B. Honors/Awards

Dean's List (if applicable)

Academic Scholarships (if applicable)

C. Thesis/Research Project

Title: "Impact of Tax Reform on Corporate Tax Strategies"

Description: Researched and analyzed the implications of recent tax reform on corporate tax planning strategies, presenting findings in a comprehensive report.

D. Extracurricular Activities

Treasurer, Accounting Club

Volunteer Tax Assistance Program Coordinator

III. Professional Experience

A. [Current/Previous Job Title]

[Your Company Name]

[Your Company Address]

[Employment Date]

Led tax planning initiatives for corporate clients, resulting in significant tax savings and compliance with all regulatory requirements.

Managed tax return preparation, ensuring accuracy and adherence to deadlines.

Conducted tax research and analysis to support strategic decision-making.

Collaborated with cross-functional teams to implement tax-efficient strategies for business transactions.

Guided tax implications of financial decisions and transactions.

B. [Previous Job Title]

[Previous Company Name]

[Previous Company Address]

[Employment Date]

Prepared and reviewed federal and state tax returns for individuals and businesses.

Researched and resolved complex tax issues, maintaining compliance with tax laws.

Implemented process improvements to streamline tax reporting and increase efficiency.

Communicated tax strategies and findings to clients, fostering strong client relationships.

IV. Skills

A. Technical Skills

Tax Planning and Compliance

Financial Reporting and Analysis

Tax Software Proficiency (e.g., [List relevant software])

Regulatory Knowledge (Federal, State, and International Tax Laws)

Financial Modeling

B. Interpersonal Skills

Effective Communication

Problem-solving

Attention to Detail

Team Collaboration

V. Certifications

Certified Public Accountant (CPA)

[Other relevant certifications]

VI. References

References are provided upon request.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

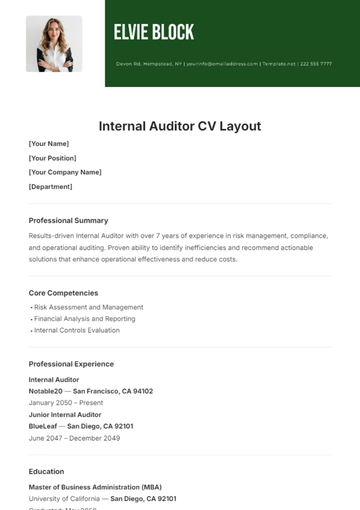

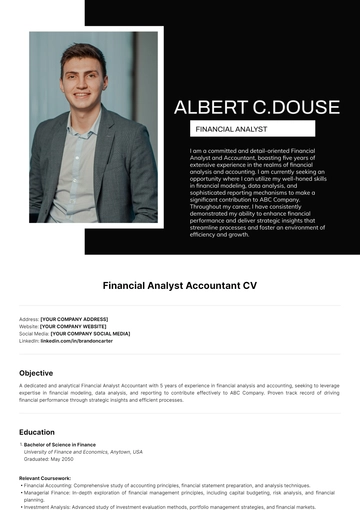

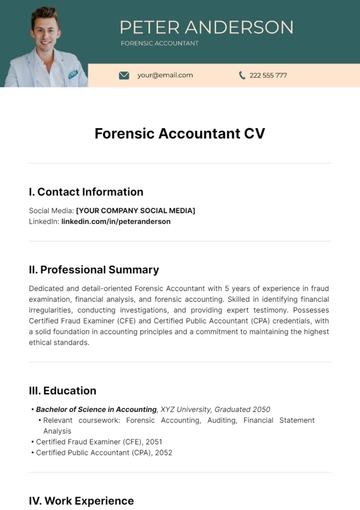

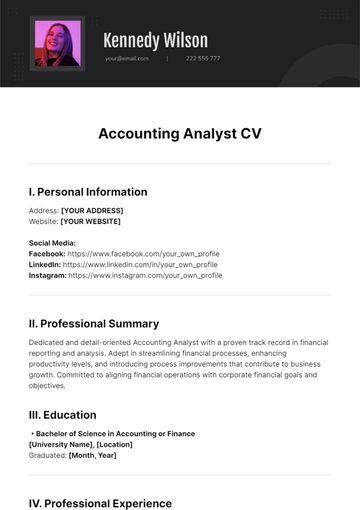

Introducing the Senior Tax Accountant CV Template from Template.net. This professionally designed template is fully editable and customizable in our AI Editor Tool. Crafted to showcase tax expertise, it offers a polished layout to highlight skills and experience. Elevate your career prospects with this premium, tailor-made CV solution for aspiring professionals.