Free Salon Expense Report

I. Introduction:

Welcome to the Salon Expense Report for [Your Company Name] for the reporting period of May 2024. This report aims to provide a comprehensive overview of the salon's financial expenditures across various categories. By meticulously tracking expenses, we can gain insights into our operational costs, identify areas for improvement, and optimize our financial strategies for sustainable growth.

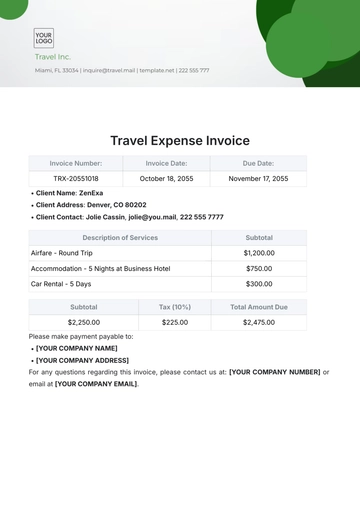

II. Rent and Utilities Expenses:

The Rent and Utilities Expenses section accounts for a significant portion of the salon's overhead costs. In May 2024, the total expenses in this category amounted to $4650.

Category | Amount ($) | Description |

|---|---|---|

Rent | 3500 | Monthly rental payment for salon space |

Electricity | 800 | Electricity bill for salon operations |

Water | 150 | Water bill for salon facilities |

Internet/Phone | 200 | Internet and phone services for communication |

Total Rent and Utilities Expenses: $4650

Rent: The monthly rental payment for the salon space stands at $3500. This cost represents a fixed expense that the salon must consistently manage. Any fluctuations in rent prices could impact the salon's overall profitability. It's crucial to evaluate the lease terms regularly to ensure they align with the salon's financial goals.

Utilities: The salon's utility expenses, including electricity, water, internet, and phone services, totaled $1150. These costs are essential for maintaining salon operations and providing a comfortable environment for clients and employees. Monitoring utility usage and exploring energy-efficient practices can help minimize expenses in this category over time.

III. Employee Expenses:

The Employee Expenses section outlines the costs associated with the salon's workforce, totaling $10,000 for May 2024. This category represents a crucial investment in the salon's human capital and plays a significant role in delivering high-quality services to clients.

Category | Amount ($) | Description |

|---|---|---|

Wages/Salaries | 8000 | Payment to salon staff for services rendered |

Benefits | 500 | Employee benefits such as insurance or bonuses |

Payroll Taxes | 1200 | Taxes withheld from employee wages |

Training/Workshops | 300 | Costs associated with staff training |

Total Employee Expenses: $10000

Wages/Salaries: The largest portion of employee expenses, totaling $8,000, reflects the compensation paid to salon staff for their services rendered. It's essential to ensure that wages are competitive to attract and retain skilled professionals in the beauty industry. Additionally, monitoring staffing levels and productivity can help optimize labor costs while maintaining service standards.

Benefits: The $500 allocated for employee benefits, such as insurance or bonuses, demonstrates the salon's commitment to supporting its workforce's well-being and morale. Offering attractive benefits can enhance employee satisfaction and loyalty, contributing to a positive work environment and customer experience.

Payroll Taxes: With $1,200 allocated for payroll taxes, it's crucial for the salon to stay compliant with tax regulations and accurately withhold and remit taxes on behalf of its employees. Proper tax management minimizes the risk of penalties and ensures financial stability for both the salon and its staff.

Training/Workshops: Investing $300 in staff training and workshops reflects the salon's dedication to continuous learning and skill development. Providing opportunities for professional growth not only enhances employee capabilities but also fosters innovation and excellence in service delivery.

IV. Supplies Expenses:

The Supplies Expenses section details the costs incurred by [Your Company Name] for necessary products and materials, totaling $2,130 in May 2024. These expenses are essential for maintaining the salon's operations and delivering high-quality services to clients.

Category | Amount ($) | Description |

|---|---|---|

Hair Products | 1200 | Cost of hair styling products and treatments |

Beauty Supplies | 700 | Expenses for skincare, makeup, and nail products |

Cleaning Supplies | 150 | Cost of cleaning materials for salon upkeep |

Office Supplies | 80 | Supplies for administrative tasks and record keeping |

Total Supplies Expenses: $2130

Hair Products: With an expenditure of $1,200 on hair styling products and treatments, the salon ensures it has a diverse range of quality products to meet clients' needs and preferences. Regularly replenishing hair products is crucial for providing up-to-date styles and achieving client satisfaction.

Beauty Supplies: Allocating $700 for skincare, makeup, and nail products reflects the salon's commitment to offering comprehensive beauty services. Investing in high-quality beauty supplies is essential for achieving professional results and enhancing the overall client experience.

Cleaning Supplies: With $150 allocated for cleaning materials, the salon prioritizes cleanliness and hygiene to maintain a safe and inviting environment for clients and staff. Regular cleaning and sanitation practices are critical for compliance with health and safety regulations and ensuring client comfort and satisfaction.

Office Supplies: The $80 expenditure on office supplies supports administrative tasks and record-keeping processes essential for salon operations. From appointment scheduling to inventory management, having the necessary office supplies facilitates smooth and efficient salon management.

V. Marketing and Advertising Expenses:

The Marketing and Advertising Expenses section outlines the investments made by [Your Company Name] in promoting its services and attracting clients, totaling $1,500 in May 2024. These expenses play a crucial role in increasing brand visibility, driving customer engagement, and ultimately, growing the salon's clientele.

Category | Amount ($) | Description |

|---|---|---|

Print Advertising | 400 | Cost of flyers, posters, and print media |

Digital Marketing | 600 | Expenses for online ads and social media marketing |

Promotions | 300 | Discounts or special offers to attract customers |

Website/SEO | 200 | Maintenance and optimization of salon website |

Total Marketing and Advertising Expenses: $1500

Print Advertising: Allocating $400 towards print advertising reflects the salon's strategy to reach potential clients through traditional mediums such as flyers, posters, and local publications. Print materials serve as tangible touchpoints for potential customers and can effectively convey the salon's services and special offers.

Digital Marketing: With $600 dedicated to digital marketing efforts, including online ads and social media marketing, the salon recognizes the importance of establishing a strong digital presence. Digital platforms offer extensive reach and targeting capabilities, allowing the salon to connect with its target audience, engage with existing clients, and attract new customers through targeted campaigns.

Promotions: Setting aside $300 for promotions, such as discounts or special offers, demonstrates the salon's commitment to incentivizing client visits and fostering customer loyalty. Promotional activities can encourage repeat business, generate word-of-mouth referrals, and create excitement around the salon's services, driving both short-term revenue and long-term growth.

Website/SEO: Investing $200 in maintaining and optimizing the salon's website and search engine optimization (SEO) efforts underscores the salon's recognition of the importance of a user-friendly, informative, and discoverable online presence. A well-designed website and strong SEO ensure that the salon can be easily found by potential clients searching for beauty services online, enhancing its visibility and credibility in the digital space.

VI. Equipment Expenses:

The Equipment Expenses section outlines the investments made by [Your Company Name] in acquiring essential equipment and tools necessary for providing high-quality services, totaling $4,800 in May 2024. These expenses are critical for ensuring operational efficiency, enhancing service quality, and meeting client expectations.

Category | Amount ($) | Description |

|---|---|---|

Salon Furniture | 2500 | Cost of chairs, tables, and other salon furniture |

Hair Tools | 800 | Expenses for styling tools and equipment |

Point-of-Sale (POS) System | 1500 | Cost of POS system for sales and inventory management |

Total Equipment Expenses: $4800

Salon Furniture: The largest portion of equipment expenses, amounting to $2,500, represents investments in salon furniture such as chairs, tables, and other furnishings. Quality salon furniture not only contributes to the aesthetic appeal of the salon but also plays a vital role in ensuring client comfort and satisfaction during their visit.

Hair Tools: With an expenditure of $800 on hair styling tools and equipment, the salon ensures it has the necessary instruments to execute a wide range of hair services effectively. Investing in high-quality hair tools not only enhances the salon's service capabilities but also contributes to the longevity and durability of equipment, reducing the need for frequent replacements.

Point-of-Sale (POS) System: Allocating $1,500 towards a Point-of-Sale (POS) system reflects the salon's commitment to streamlining sales transactions and inventory management processes. A robust POS system enables efficient tracking of sales, inventory levels, and customer data, facilitating informed business decisions and enhancing the overall salon experience for clients and staff.

VII. Miscellaneous Expenses:

The Miscellaneous Expenses section outlines the diverse range of expenditures incurred by [Your Company Name] outside of the primary operational categories, totaling $2,200 in May 2024. While these expenses may vary in nature, they collectively contribute to the salon's overall functioning and support its day-to-day operations.

Category | Amount ($) | Description |

|---|---|---|

Insurance | 900 | Insurance premiums for salon protection |

Maintenance | 300 | Repairs and maintenance services for salon equipment |

Licenses/Permits | 400 | Fees for operating licenses and permits |

Professional Fees | 600 | Payments to consultants or legal professionals |

Total Miscellaneous Expenses: $2200

Insurance: Allocating $900 towards insurance premiums reflects the salon's commitment to protecting its assets, staff, and clients against potential risks and liabilities. Comprehensive insurance coverage provides financial security and peace of mind, safeguarding the salon's interests in the event of unforeseen incidents or accidents.

Maintenance: With $300 allocated for repairs and maintenance services, the salon demonstrates its dedication to preserving the condition and functionality of its equipment, facilities, and infrastructure. Regular maintenance checks and timely repairs are essential for preventing downtime, prolonging equipment lifespan, and ensuring a safe and comfortable environment for clients and staff.

Licenses/Permits: Setting aside $400 for operating licenses and permits underscores the salon's compliance with regulatory requirements and legal obligations. Obtaining the necessary licenses and permits ensures that the salon operates within the bounds of the law and maintains its credibility and reputation in the industry.

Professional Fees: Investing $600 in professional fees, such as payments to consultants or legal professionals, reflects the salon's willingness to seek expert advice and guidance to support its business objectives. Engaging external expertise can provide valuable insights, strategic direction, and specialized services that complement the salon's internal capabilities and drive business growth.

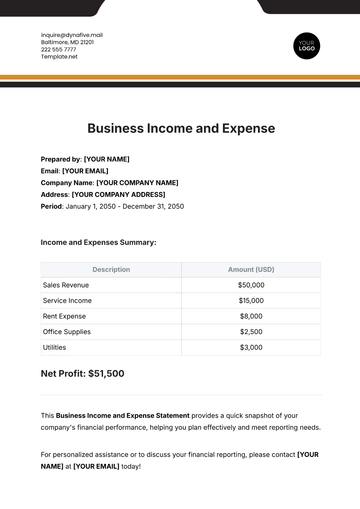

VIII. Summary and Analysis:

In summary, the total expenses incurred by [Your Company Name] during May 2024 amounted to $19980. By analyzing these expenses, we can identify areas of both strength and opportunity for improvement. Moving forward, we will focus on optimizing our costs, enhancing operational efficiency, and investing strategically to drive growth and profitability.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Efficiently manage your salon's expenses with Template.net's Salon Expense Report Template. Editable and customizable in our AI Editor Tool, this versatile template provides a structured format for tracking and analyzing salon expenditures, including supplies, utilities, payroll, and more. Streamline expense management, identify cost-saving opportunities, and maintain financial health using Template.net!