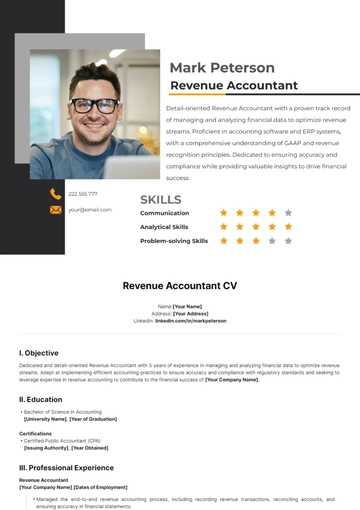

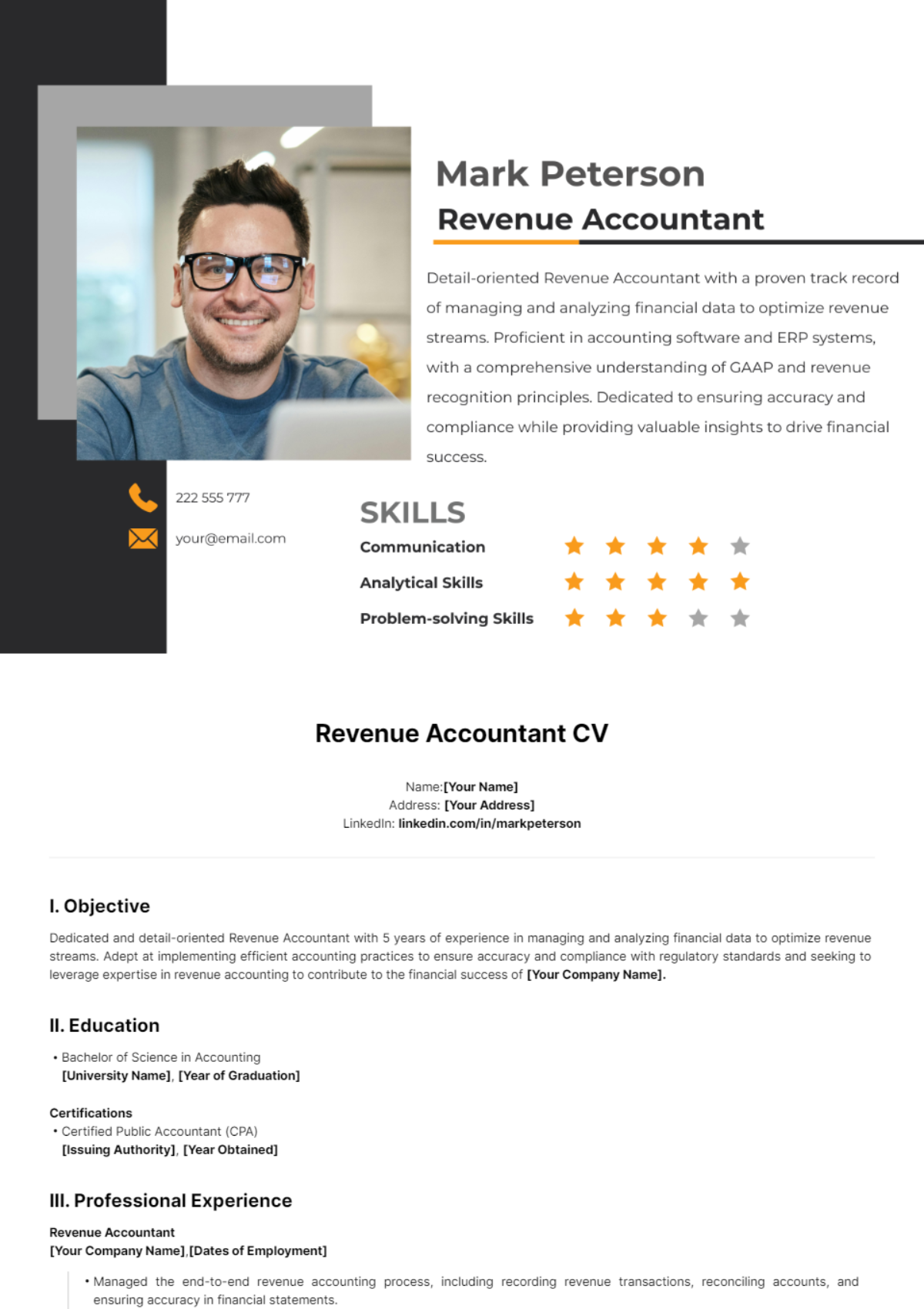

Free Revenue Accountant CV

Name:[Your Name]

Address: [Your Address]

LinkedIn: linkedin.com/in/markpeterson

I. Objective

Dedicated and detail-oriented Revenue Accountant with 5 years of experience in managing and analyzing financial data to optimize revenue streams. Adept at implementing efficient accounting practices to ensure accuracy and compliance with regulatory standards and seeking to leverage expertise in revenue accounting to contribute to the financial success of [Your Company Name].

II. Education

Bachelor of Science in Accounting

[University Name], [Year of Graduation]

Certifications

Certified Public Accountant (CPA)

[Issuing Authority], [Year Obtained]

III. Professional Experience

Revenue Accountant

[Your Company Name],[Dates of Employment]

Managed the end-to-end revenue accounting process, including recording revenue transactions, reconciling accounts, and ensuring accuracy in financial statements.

Analyzed revenue trends and variances to identify opportunities for improvement and mitigate risks.

Collaborated with cross-functional teams to streamline revenue recognition processes and ensure compliance with accounting standards.

Prepared monthly, quarterly, and annual revenue reports for management review, providing insights into financial performance and forecasting.

Junior Accountant

[Previous Company Name],[Dates of Employment]

Assisted in the preparation of financial statements, including balance sheets, income statements, and cash flow statements.

Conducted reconciliations of accounts receivable and accounts payable to ensure the accuracy and completeness of financial records.

Participated in the budgeting and forecasting process, analyzing revenue projections and providing recommendations for cost-saving measures.

Supported external auditors during annual audits by providing documentation and explanations of revenue-related transactions.

IV. Skills

Proficient in Microsoft Excel, QuickBooks, and ERP systems

Strong analytical and problem-solving skills

Excellent attention to detail and accuracy

Knowledge of GAAP and revenue recognition principles

Effective communication and interpersonal abilities

Ability to work independently and as part of a team

V. Reference

Available upon request.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Revenue Accountant CV Template from Template.net! Crafted for precision and professionalism, this editable gem offers seamless customization to suit your unique career journey. Tailor your resume effortlessly with our AI Editor Tool, ensuring your skills and experience shine. Elevate your job search with a CV that speaks volumes. Unlock your potential today!