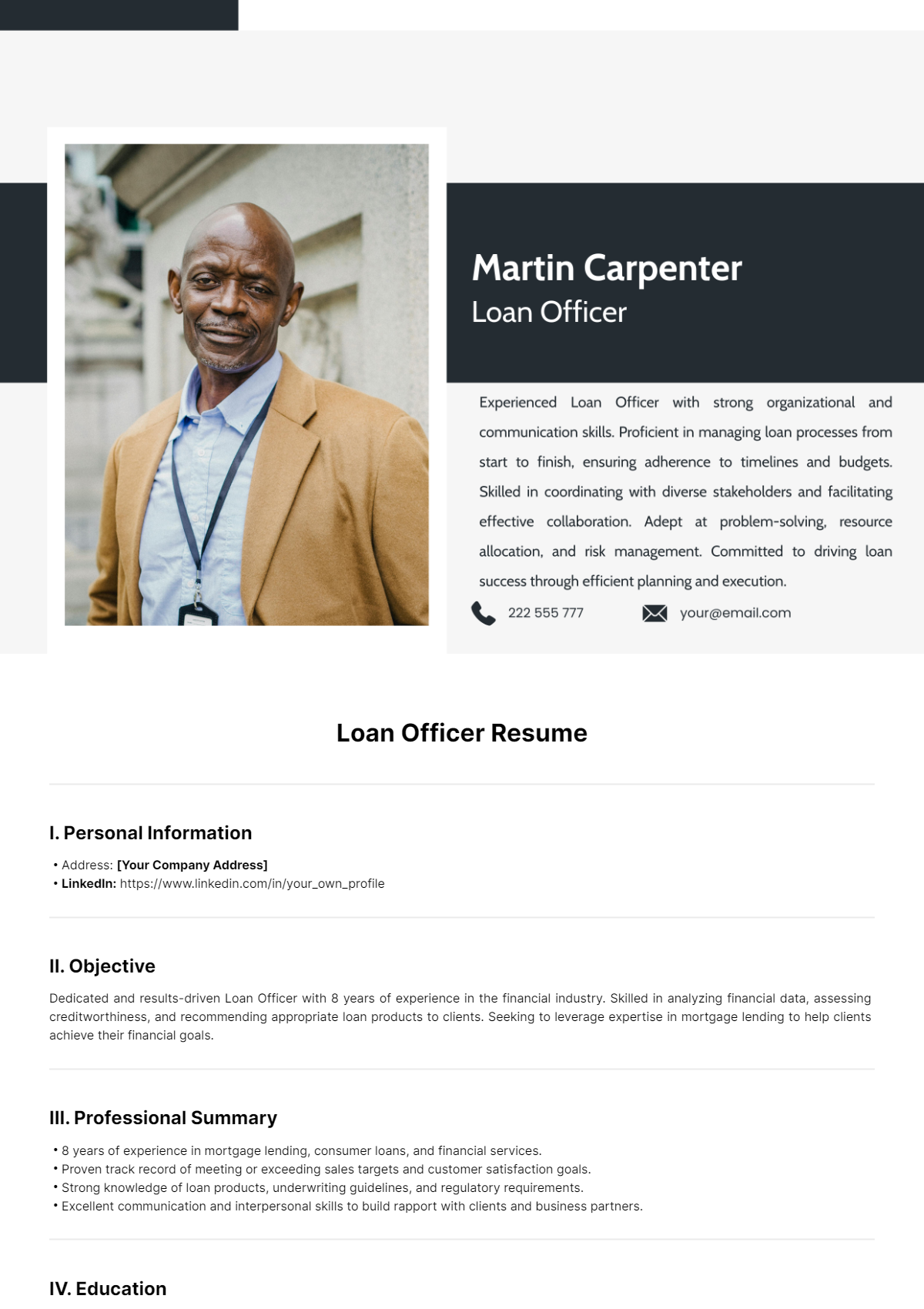

Free Loan Officer Resume

I. Personal Information

Address: [Your Company Address]

LinkedIn: https://www.linkedin.com/in/your_own_profile

II. Objective

Dedicated and results-driven Loan Officer with 8 years of experience in the financial industry. Skilled in analyzing financial data, assessing creditworthiness, and recommending appropriate loan products to clients. Seeking to leverage expertise in mortgage lending to help clients achieve their financial goals.

III. Professional Summary

8 years of experience in mortgage lending, consumer loans, and financial services.

Proven track record of meeting or exceeding sales targets and customer satisfaction goals.

Strong knowledge of loan products, underwriting guidelines, and regulatory requirements.

Excellent communication and interpersonal skills to build rapport with clients and business partners.

IV. Education

Bachelor's Degree in Finance

University of Finance and Economics, City, State

Graduation Year: 2060

Completed a comprehensive curriculum focusing on finance principles, investment analysis, risk management, and financial markets.

Specialized coursework in mortgage lending, financial institutions management, and corporate finance provided in-depth knowledge relevant to the loan officer role.

Participated in extracurricular activities such as finance clubs, student government, and volunteer initiatives to enhance leadership skills and broaden professional networks.

Conducted research projects on topics related to mortgage-backed securities, credit risk assessment models, and regulatory compliance in the financial industry.

Engaged in internships or cooperative education experiences with financial institutions to gain practical experience and apply theoretical knowledge in real-world settings.

V. Skills

Financial Analysis:

Cash Flow Analysis

Credit Risk Assessment

Loan Structuring

Financial Modeling

Customer Relationship Management:

Needs Assessment

Client Retention Strategies

Negotiation Skills

Problem-solving

Loan Processing:

Loan Application Review

Documentation Management

Compliance Monitoring

Closing Procedures

Software Proficiency:

Encompass

Microsoft Office Suite

Salesforce CRM

VI. Professional Experience

Loan Officer

ABC Mortgage Company, City, State

March 2054 - Present

Originated mortgage loans, reviewed loan applications, and evaluated borrowers' financial situations.

Analyzed credit reports, income documents, and property appraisals to determine loan eligibility.

Educated clients on available loan programs, interest rates, and closing costs.

Managed a portfolio of mortgage clients, ensuring timely processing and closing of loans.

Loan Processor

XYZ Bank, City, State

January 2050 - February 2054

Assisted Loan Officers in processing mortgage loan applications.

Collected and reviewed borrower documents, ensuring completeness and accuracy.

Communicated with clients, underwriters, and third-party service providers to facilitate loan processing.

Maintained loan files, tracked application progress, and ensured compliance with regulatory requirements.

VII. Certifications

Licensed Mortgage Loan Officer - State Licensing Authority

Received licensure as a Mortgage Loan Officer from the State Licensing Authority, demonstrating proficiency and compliance with state regulations governing mortgage lending.Certified Mortgage Banker (CMB) - Mortgage Bankers Association

Earned the prestigious Certified Mortgage Banker (CMB) designation from the Mortgage Bankers Association, signifying advanced knowledge and expertise in mortgage banking and lending practices.Certified Credit Counselor - American Association of Credit Counselors

Obtained certification as a Credit Counselor from the American Association of Credit Counselors, demonstrating competency in providing financial counseling and guidance to clients.

VIII. Professional Affiliations

Member of the Mortgage Bankers Association (MBA)

An active member of the Mortgage Bankers Association (MBA), participating in industry events, professional development opportunities, and advocacy initiatives to advance the interests of mortgage professionals.Member of the State Mortgage Lenders Association

An engaged member of the State Mortgage Lenders Association, collaborating with fellow professionals and staying abreast of regulatory updates and industry trends impacting mortgage lending in the State.

IX. Awards and Honors

Top Performer Award, 2058

Recognized for outstanding loan production and customer service excellence with the prestigious Top Performer Award in 2058. Consistently exceeded loan volume targets and demonstrated exceptional service delivery to clients.

X. Languages

English: Fluent

Proficient in English, both spoken and written, enabling effective communication with clients, colleagues, and stakeholders in diverse professional settings.

XI. Achievements

Exceeded Loan Volume Targets

Achieved an impressive 120% of loan volume targets for the fiscal year 2059, demonstrating exceptional sales acumen and performance in originating and closing mortgage loans.

Client Referrals and Positive Feedback

Received numerous client referrals and positive feedback for delivering exceptional service and demonstrating attentiveness to clients' needs. Built a reputation for professionalism, integrity, and a client-centric approach in the mortgage lending industry.

XII. References

Available upon request.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Carefully crafted by Template.net, this editable Loan Officer Resume Template offers a customizable design tailored for financial professionals. Editable in our AI Tool, it allows loan officers to showcase their expertise, achievements, and qualifications effectively. Ideal for loan officers seeking to make a strong impression and secure lucrative opportunities in the financial sector.

You may also like

- Simple Resume

- High School Resume

- Actor Resume

- Accountant Resume

- Academic Resume

- Corporate Resume

- Infographic Resume

- Sale Resume

- Business Analyst Resume

- Skills Based Resume

- Professional Resume

- ATS Resume

- Summary Resume

- Customer Service Resume

- Software Engineer Resume

- Data Analyst Resume

- Functional Resume

- Project Manager Resume

- Nurse Resume

- Federal Resume

- Server Resume

- Administrative Assistant Resume

- Sales Associate Resume

- CNA Resume

- Bartender Resume

- Graduate Resume

- Engineer Resume

- Data Science Resume

- Warehouse Resume

- Volunteer Resume

- No Experience Resume

- Chronological Resume

- Marketing Resume

- Executive Resume

- Truck Driver Resume

- Cashier Resume

- Resume Format

- Two Page Resume

- Basic Resume

- Manager Resume

- Supervisor Resume

- Director Resume

- Blank Resume

- One Page Resume

- Developer Resume

- Caregiver Resume

- Personal Resume

- Consultant Resume

- Administrator Resume

- Officer Resume

- Medical Resume

- Job Resume

- Technician Resume

- Clerk Resume

- Driver Resume

- Data Entry Resume

- Freelancer Resume

- Operator Resume

- Printable Resume

- Worker Resume

- Student Resume

- Doctor Resume

- Merchandiser Resume

- Architecture Resume

- Photographer Resume

- Chef Resume

- Lawyer Resume

- Secretary Resume

- Customer Support Resume

- Computer Operator Resume

- Programmer Resume

- Pharmacist Resume

- Electrician Resume

- Librarian Resume

- Computer Resume

- IT Resume

- Experience Resume

- Instructor Resume

- Fashion Designer Resume

- Mechanic Resume

- Attendant Resume

- Principal Resume

- Professor Resume

- Safety Resume

- Waitress Resume

- MBA Resume

- Security Guard Resume

- Editor Resume

- Tester Resume

- Auditor Resume

- Writer Resume

- Trainer Resume

- Advertising Resume

- Harvard Resume

- Receptionist Resume

- Buyer Resume

- Physician Resume

- Scientist Resume

- 2 Page Resume

- Therapist Resume

- CEO resume

- General Manager Resume

- Attorney Resume

- Project Coordinator Resume

- Bus Driver Resume

- Cook Resume

- Artist Resume

- Pastor Resume

- Recruiter Resume

- Team Leader Resume

- Apprentice Resume

- Police Resume

- Military Resume

- Personal Trainer Resume

- Contractor Resume

- Dietician Resume

- First Job Resume

- HVAC Resume

- Psychologist Resume

- Public Relations Resume

- Support Specialist Resume

- Computer Technician Resume

- Drafter Resume

- Foreman Resume

- Underwriter Resume

- Photo Resume

- Teacher Resume

- Modern Resume

- Fresher Resume

- Creative Resume

- Internship Resume

- Graphic Designer Resume

- College Resume