Free Payroll Specialist Resume

_____________________________________________________________________________________

I. Personal Information

Age: [AGE]

Date of Birth: [DATE OF BIRTH]

Address: [YOUR ADDRESS]

Marital Status: [STATUS]

Nationality: [NATIONALITY]

Language(s): [LANGUAGE]

LinkedIn Profile: https://www.linkedin.com/in/your_own_profile

II. Objective

Dedicated and detail-oriented Payroll Specialist with over [Number of Years] experience in payroll administration seeking to leverage expertise in managing payroll processes to contribute effectively to [Your Company Name]. Proven track record of ensuring accurate and timely payroll processing while adhering to all relevant regulations and compliance standards.

III. Professional Summary

Experienced Payroll Specialist with comprehensive knowledge of payroll procedures, tax regulations, and accounting principles. Proficient in utilizing payroll software and systems to streamline payroll operations and minimize errors. Strong analytical skills combined with exceptional attention to detail to ensure payroll accuracy and compliance.

IV. Education

Bachelor’s Degree in Business Administration, [University Name], [Location], [Year of Graduation]

V. Certifications

Certified Payroll Professional (CPP) - American Payroll Association, [Year Obtained] [Additional relevant certifications, if any]

VI. Skills

Proficient in payroll processing software such as ADP, Paychex, and QuickBooks

In-depth understanding of federal, state, and local tax regulations

Strong mathematical and analytical skills

Excellent attention to detail and accuracy

Effective communication and interpersonal skills

Ability to work efficiently under pressure and meet deadlines

Knowledge of accounting principles and financial reporting

VII. Experience

Payroll Specialist [Previous Company Name], [Location] [Month, Year] - [Month, Year]

Processed bi-weekly and semi-monthly payroll for [number] employees using [payroll software], ensuring accuracy and compliance with company policies and regulatory requirements.

Calculated and processed payroll deductions, including taxes, benefits, and garnishments, and reconciled payroll accounts to ensure accuracy.

Responded to employee inquiries regarding payroll matters, including pay discrepancies, tax withholdings, and deductions, providing prompt and accurate resolution.

Prepared and distributed payroll reports to management and finance department for review and approval, ensuring transparency and accountability in payroll processes.

Collaborated with the HR team to update employee payroll information, including new hires, terminations, and changes in compensation or benefits.

Conducted regular audits of payroll records and procedures to identify discrepancies or areas for improvement and implemented corrective actions as needed.

VIII. References

Available upon request.

_____________________________________________________________________________________

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Payroll Specialist Resume Template from Template.net – your ultimate solution for crafting a standout resume. This editable and customizable template is meticulously designed to showcase your expertise in managing payroll functions. Seamlessly edit in our Ai Editor Tool, ensuring precision and professionalism in every detail. Elevate your career prospects with a resume tailored to perfection.

You may also like

- Simple Resume

- High School Resume

- Actor Resume

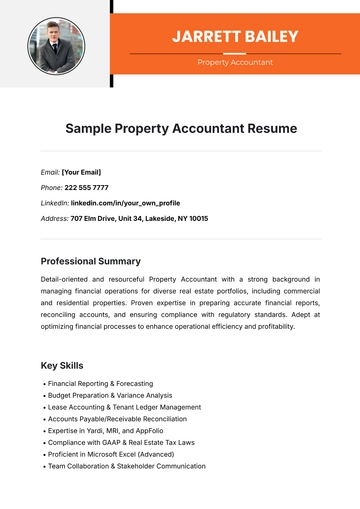

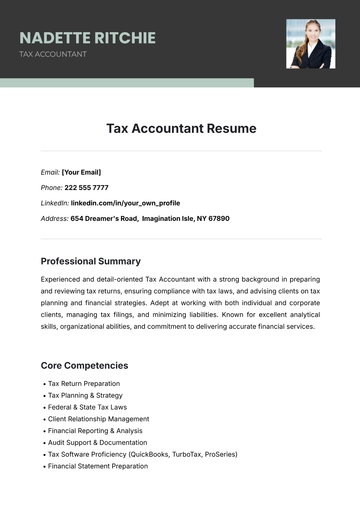

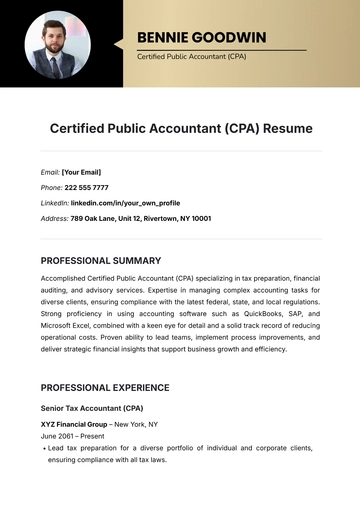

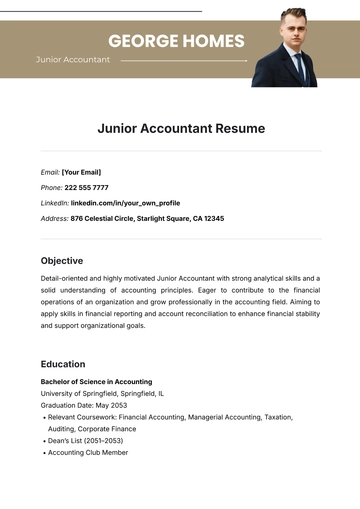

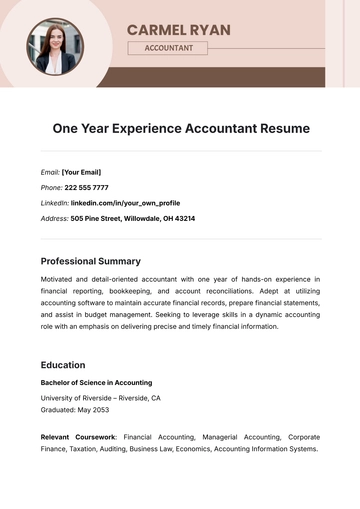

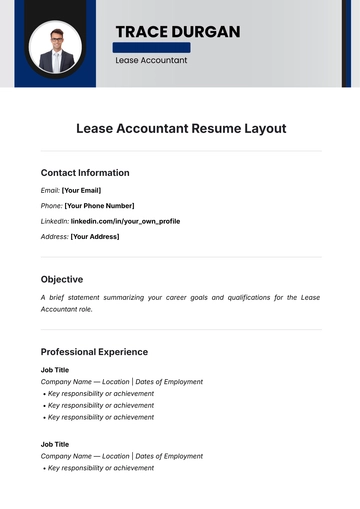

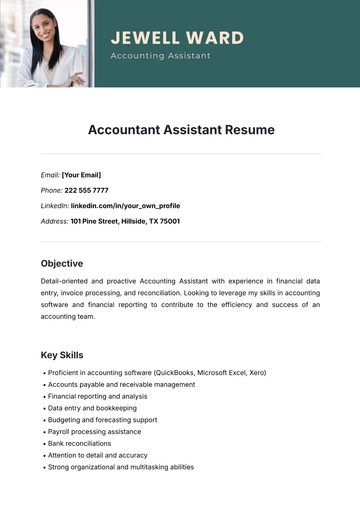

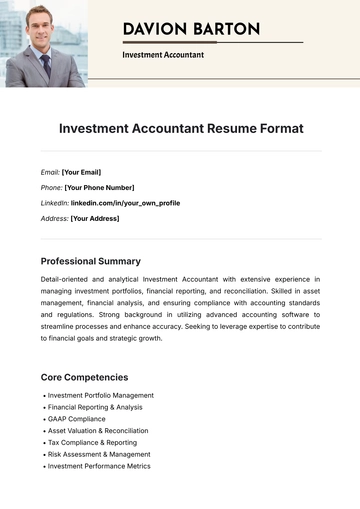

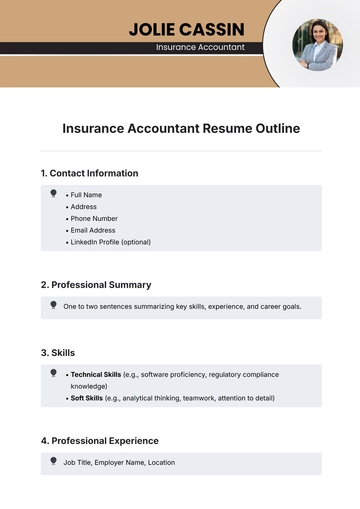

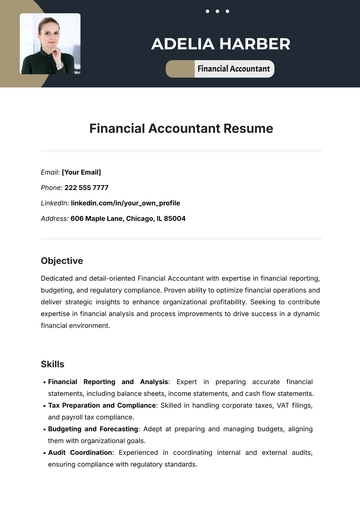

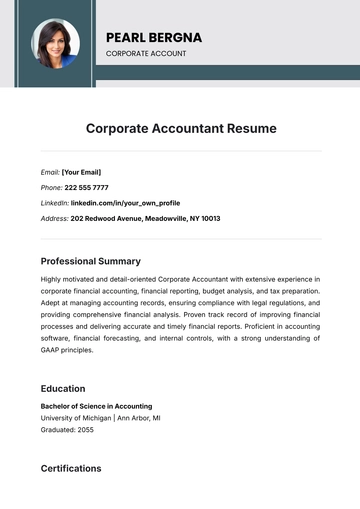

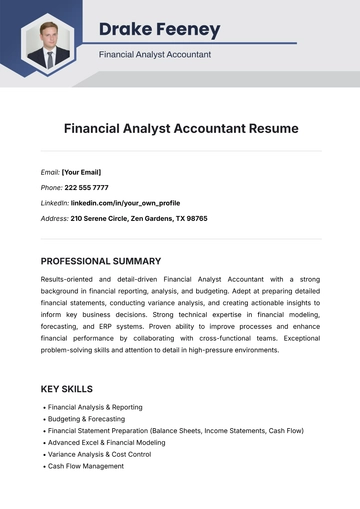

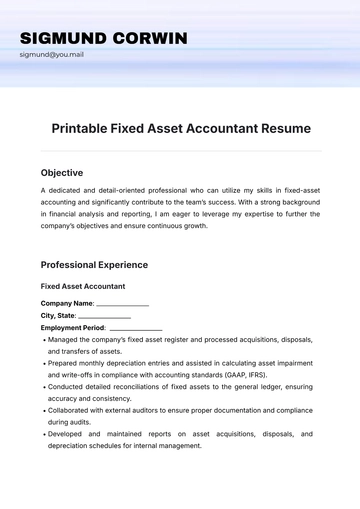

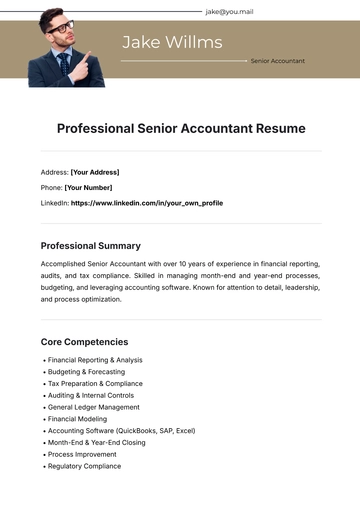

- Accountant Resume

- Academic Resume

- Corporate Resume

- Infographic Resume

- Sale Resume

- Business Analyst Resume

- Skills Based Resume

- Professional Resume

- ATS Resume

- Summary Resume

- Customer Service Resume

- Software Engineer Resume

- Data Analyst Resume

- Functional Resume

- Project Manager Resume

- Nurse Resume

- Federal Resume

- Server Resume

- Administrative Assistant Resume

- Sales Associate Resume

- CNA Resume

- Bartender Resume

- Graduate Resume

- Engineer Resume

- Data Science Resume

- Warehouse Resume

- Volunteer Resume

- No Experience Resume

- Chronological Resume

- Marketing Resume

- Executive Resume

- Truck Driver Resume

- Cashier Resume

- Resume Format

- Two Page Resume

- Basic Resume

- Manager Resume

- Supervisor Resume

- Director Resume

- Blank Resume

- One Page Resume

- Developer Resume

- Caregiver Resume

- Personal Resume

- Consultant Resume

- Administrator Resume

- Officer Resume

- Medical Resume

- Job Resume

- Technician Resume

- Clerk Resume

- Driver Resume

- Data Entry Resume

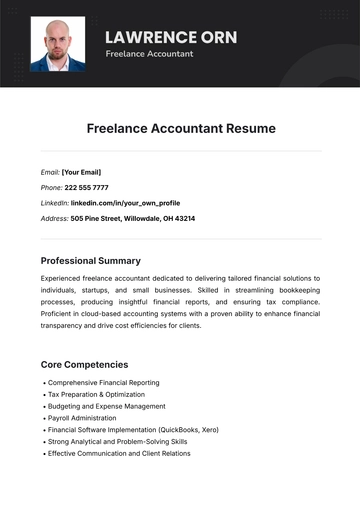

- Freelancer Resume

- Operator Resume

- Printable Resume

- Worker Resume

- Student Resume

- Doctor Resume

- Merchandiser Resume

- Architecture Resume

- Photographer Resume

- Chef Resume

- Lawyer Resume

- Secretary Resume

- Customer Support Resume

- Computer Operator Resume

- Programmer Resume

- Pharmacist Resume

- Electrician Resume

- Librarian Resume

- Computer Resume

- IT Resume

- Experience Resume

- Instructor Resume

- Fashion Designer Resume

- Mechanic Resume

- Attendant Resume

- Principal Resume

- Professor Resume

- Safety Resume

- Waitress Resume

- MBA Resume

- Security Guard Resume

- Editor Resume

- Tester Resume

- Auditor Resume

- Writer Resume

- Trainer Resume

- Advertising Resume

- Harvard Resume

- Receptionist Resume

- Buyer Resume

- Physician Resume

- Scientist Resume

- 2 Page Resume

- Therapist Resume

- CEO resume

- General Manager Resume

- Attorney Resume

- Project Coordinator Resume

- Bus Driver Resume

- Cook Resume

- Artist Resume

- Pastor Resume

- Recruiter Resume

- Team Leader Resume

- Apprentice Resume

- Police Resume

- Military Resume

- Personal Trainer Resume

- Contractor Resume

- Dietician Resume

- First Job Resume

- HVAC Resume

- Psychologist Resume

- Public Relations Resume

- Support Specialist Resume

- Computer Technician Resume

- Drafter Resume

- Foreman Resume

- Underwriter Resume

- Photo Resume

- Teacher Resume

- Modern Resume

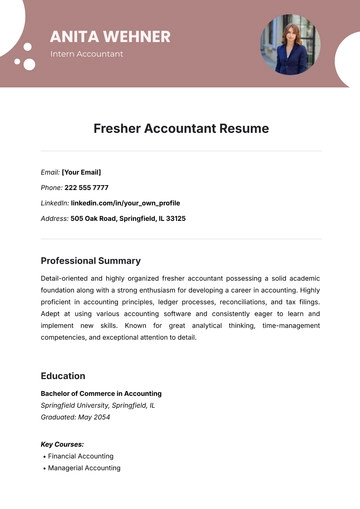

- Fresher Resume

- Creative Resume

- Internship Resume

- Graphic Designer Resume

- College Resume