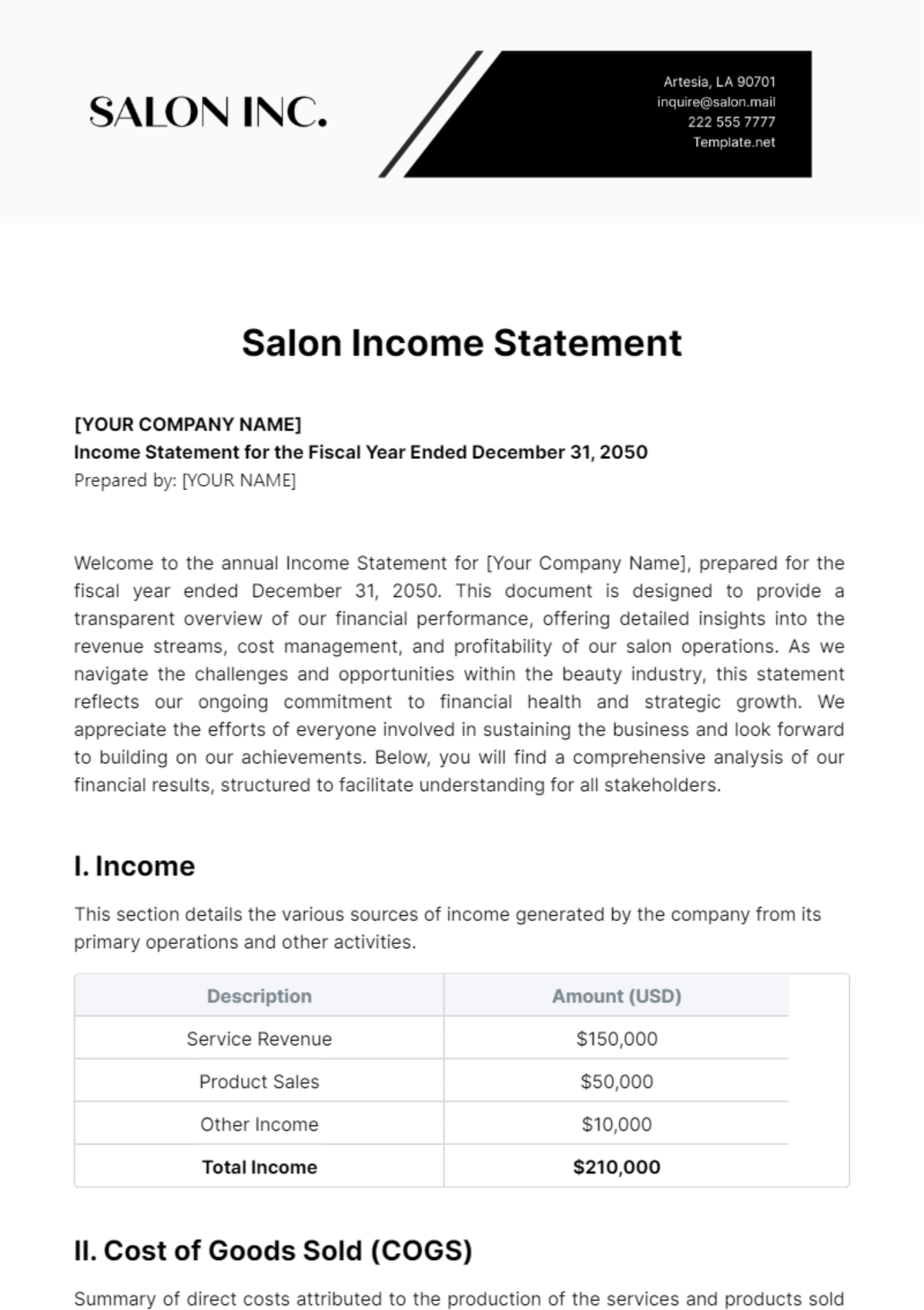

Free Salon Income Statement

[YOUR COMPANY NAME]

Income Statement for the Fiscal Year Ended December 31, 2050

Prepared by: [YOUR NAME]

Welcome to the annual Income Statement for [Your Company Name], prepared for the fiscal year ended December 31, 2050. This document is designed to provide a transparent overview of our financial performance, offering detailed insights into the revenue streams, cost management, and profitability of our salon operations. As we navigate the challenges and opportunities within the beauty industry, this statement reflects our ongoing commitment to financial health and strategic growth. We appreciate the efforts of everyone involved in sustaining the business and look forward to building on our achievements. Below, you will find a comprehensive analysis of our financial results, structured to facilitate understanding for all stakeholders.

I. Income

This section details the various sources of income generated by the company from its primary operations and other activities.

Description | Amount (USD) |

|---|---|

Service Revenue | $150,000 |

Product Sales | $50,000 |

Other Income | $10,000 |

Total Income | $210,000 |

II. Cost of Goods Sold (COGS)

Summary of direct costs attributed to the production of the services and products sold by the company.

Description | Amount (USD) |

|---|---|

Service COGS | $60,000 |

Product COGS | $20,000 |

Total COGS | $80,000 |

III. Gross Profit

Gross Profit is calculated by subtracting the total COGS from the Total Income, representing the profit before deducting operating expenses.

Description | Amount (USD) |

|---|---|

Gross Profit | $130,000 |

IV. Operating Expenses

This section lists all operating expenses incurred by the company, including overheads and administrative costs necessary for daily operations.

Description | Amount (USD) |

|---|---|

Rent | $30,000 |

Salaries and Wages | $60,000 |

Marketing and Advertising | $10,000 |

Utilities | $5,000 |

Depreciation and Amortization | $8,000 |

Other Operating Expenses | $7,000 |

Total Operating Expenses | $120,000 |

V. Net Profit Before Interest and Tax

This measures the profitability of the company before the impact of interest and tax expenses.

Description | Amount (USD) |

|---|---|

Net Profit Before Interest and Tax | $10,000 |

VI. Interest Expense

Interest Expense shows the costs related to debt borne by the company during the fiscal year.

Description | Amount (USD) |

|---|---|

Interest Expense | $2,000 |

VII. Tax Expense

This section records the total taxes applicable to the company for the fiscal year.

Description | Amount (USD) |

|---|---|

Tax Expense | $2,400 |

VIII. Net Profit After Tax

Net Profit After Tax is the remaining profit after all expenses, including interest and taxes, have been deducted.

Description | Amount (USD) |

|---|---|

Net Profit After Tax | $5,600 |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Embark on a journey towards financial clarity with Template.net's Salon Income Statement Template. Tailored for salon proprietors, this template offers a comprehensive overview of your business's financial performance. Exclusive to Template.net, it seamlessly blends functionality with elegance. Customize every detail effortlessly using our AI editor tool, ensuring it aligns perfectly with your salon's needs. Elevate your financial reporting with confidence and precision.