Free Finance Customer Credit Profile

_____________________________________________________________________________________

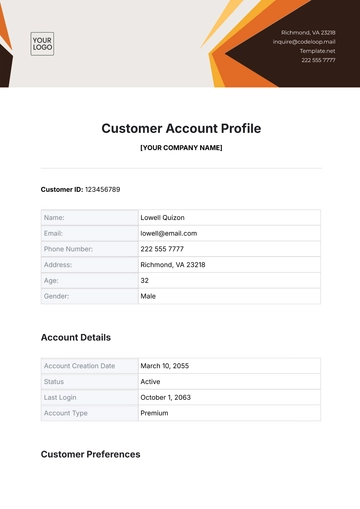

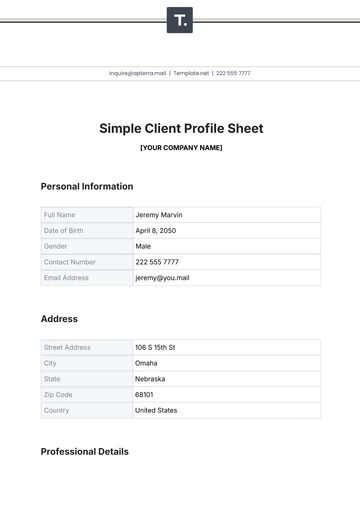

I. Customer Identification

A. Basic Information

Complete the following basic information to ensure accurate identification of the customer:

Full Name: [Customer's Full Name]

Date of Birth: [Customer's Date of Birth]

Social Security Number/ID: [SSN/ID]

Contact Details: [Customer's Contact Information]

Residential Address: [Customer's Residential Address]

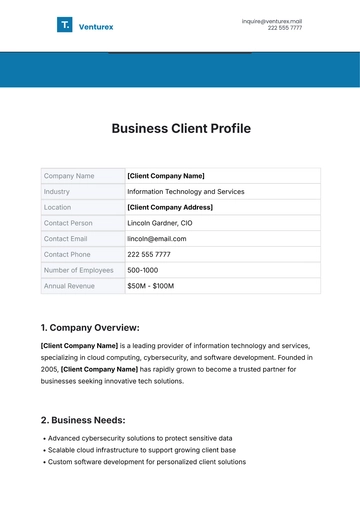

B. Employment Status

Understanding the customer's employment helps in assessing financial stability:

Current Employer: [Current Employer]

Role/Title: [Job Title]

Employment Duration: [Duration of Employment]

Annual Income: [Annual Income]

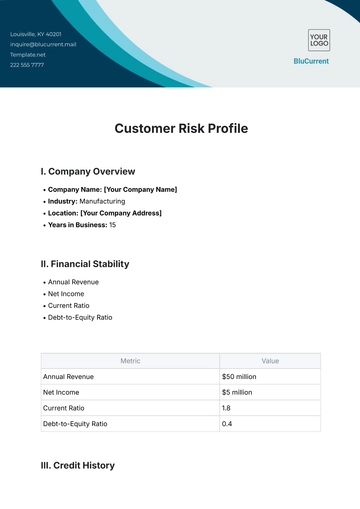

II. Financial Snapshot

A. Financial Snapshot

An overview of the customer's financial status helps in understanding their current financial situation:

Income

Annual Income: [Annual Income]

Source of Income: [Source(s) of Income]

Expenses

Monthly Expenses: [Monthly Expenses]

Major Expense Categories: [Major Expense Categories]

Assets

Real Estate: [Real Estate Assets]

Investments: [Investments]

Savings Accounts: [Savings Accounts]

Retirement Accounts: [Retirement Accounts]

Liabilities

Mortgage: [Mortgage]

Auto Loans: [Auto Loans]

Student Loans: [Student Loans]

Credit Card Debt: [Credit Card Debt]

Other Loans: [Other Loans]

III. Credit History

Analyze the customer's credit history to evaluate their previous credit behavior and reliability:

Credit Score: [Credit Score]

Total Credit Lines: [Total Number of Credit Lines]

Credit Utilization Ratio: [Credit Utilization Ratio]

IV. Assessment of Creditworthiness

Evaluate the collected financial data to ascertain the risk and potential of approving credit:

Risk Category: [Risk Category]

Likelihood of Timely Payments: [Payment Reliability]

Recommendation for Credit Approval: [Approval Recommendation]

V. Regulatory Compliance Checks

Ensure the following checks are conducted to comply with financial regulations:

Anti-Money Laundering (AML) Clearance: [AML Clearance Status]

KYC Verification Status: [KYC Status]

Adherence to Lending Standards: [Compliance with Lending Standards]

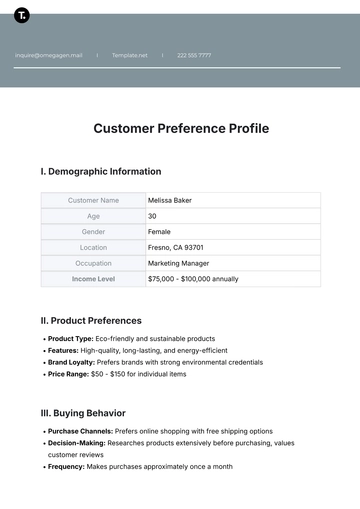

VI. Financial Goals and Objectives

Understanding the customer's financial goals and objectives helps in tailoring suitable financial products and services:

Short-term Financial Goals: [Short-term Goals]

Medium-term Financial Goals: [Medium-term Goals]

Long-term Financial Goals: [Long-term Goals]

Investment Objectives: [Investment Objectives]

Risk Tolerance: [Risk Tolerance Level]

VII. Decision Making and Communication

The final section summarizes the decision-making process and outlines the communication flow:

Final Decision on Lending: [Final Lending Decision]

Justification for Decision: [Decision Justification]

Departmental Notes: [Internal Comments]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Finance Customer Credit Profile Template, exclusively from Template.net. This editable and customizable tool empowers you to craft detailed credit profiles effortlessly. Seamlessly editable in our AI tool, it streamlines data entry and analysis. Unlock precision in financial assessment with this dynamic template, designed to optimize your credit evaluation process.