Free Bank Customer Profile

Created by [YOUR NAME] at [YOUR COMPANY NAME], this Bank Customer Profile is designed to systematically collect and organize essential information about bank customers. This enables a deeper understanding of their needs, preferences, and financial behaviors, facilitating tailored banking services and improved customer relationship management.

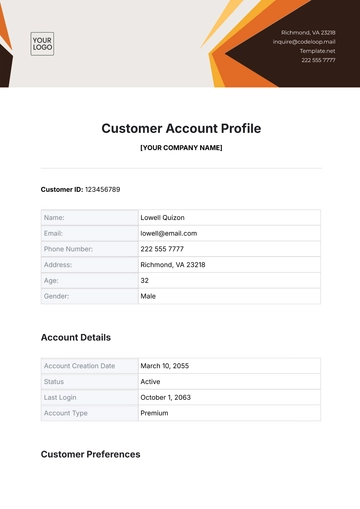

I. Customer Identification

A. Basic Information

Full Name: [Customer Full Name]

Date of Birth: [Customer DOB]

ID Number: [Customer ID Number]

Occupation: [Customer Occupation]

B. Contact Details

Address: [Customer Address]

Email: [Customer Email Address]

Phone Number: [Customer Phone Number]

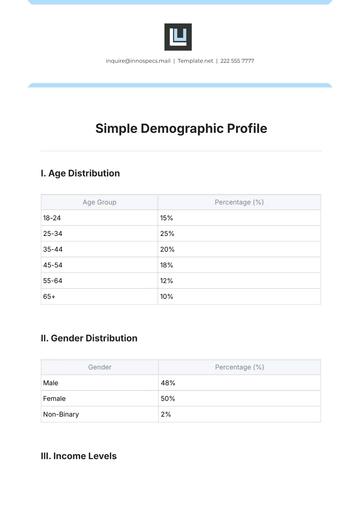

II. Financial Information

A. Bank Accounts

Account Type | Account Number | Branch |

|---|---|---|

Checking | 123456789 | Downtown Branch |

Savings | 987654321 | Northside Branch |

B. Credit Information

Credit Score: 750

Total Credit Limit: $50,000

Outstanding Debt: $10,000

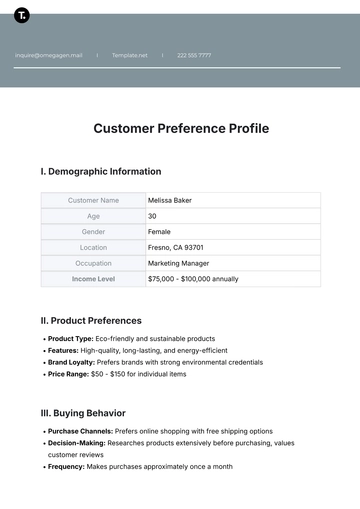

III. Banking Preferences

Preferred Banking Method: Online Banking

Interest in Digital Banking Services: High

Feedback on Current Services: "Very satisfied with the online banking features, but the mobile app could be more user-friendly."

IV. Behavioral Insights

Regular Transaction Patterns: Frequent small transactions for groceries and dining; monthly larger transactions for mortgage and utility bills.

Response to Marketing: Highly responsive to email campaigns offering low-interest loans.

Investment Interests: Primarily interested in low-risk investments, such as bonds and savings certificates.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Bank Customer Profile Template offered by Template.net. This downloadable and printable template is fully customizable and editable in our AI Editor Tool, ensuring you can tailor it perfectly to meet your specific needs. Ideal for banking professionals seeking to maintain accurate and efficient customer records, this tool enhances service delivery by keeping vital customer information organized and accessible.