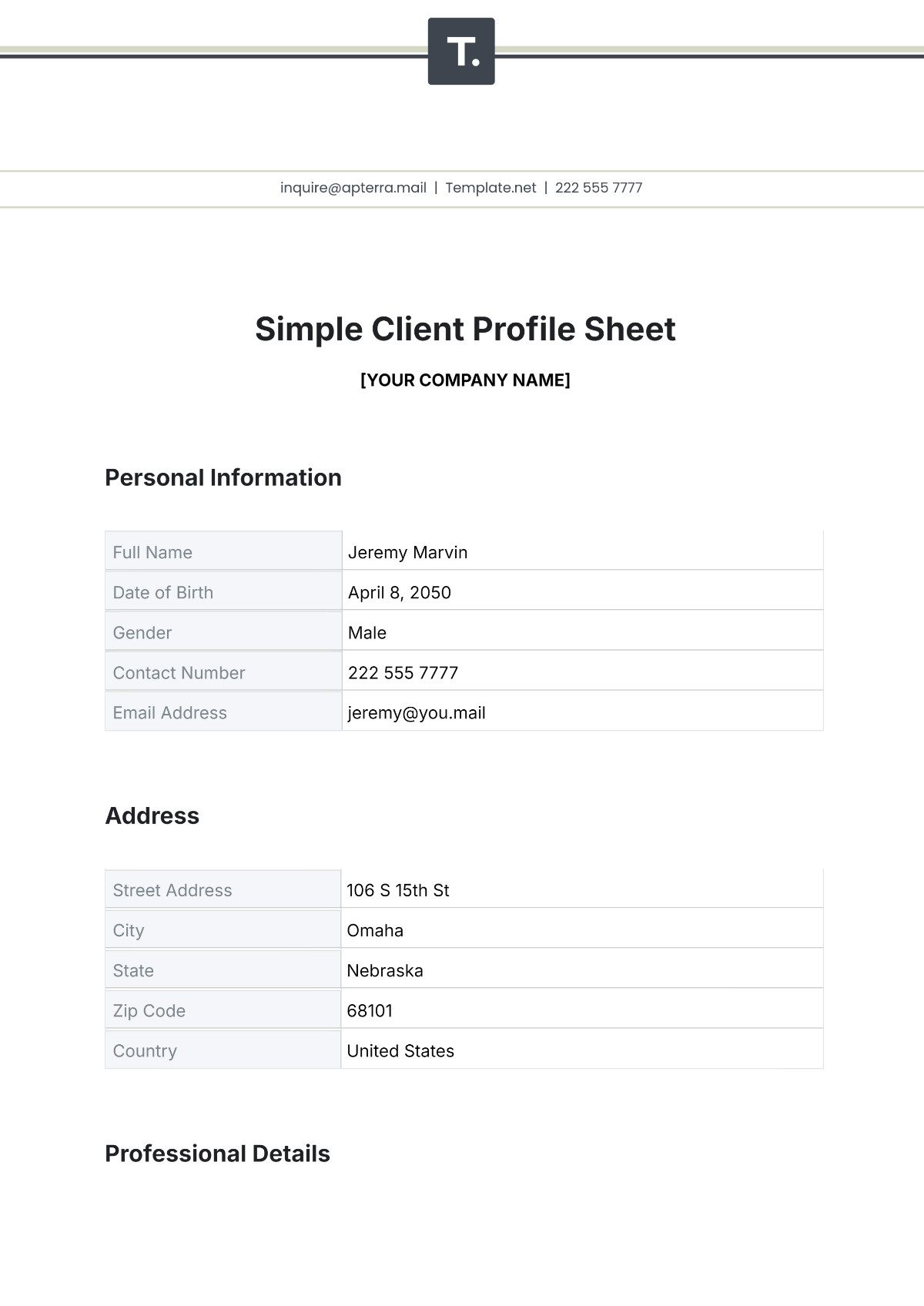

Free Standard Customer Profile

Unveil the essence of your clientele with the Standard Customer Profile Template by Template.net. This editable and customizable tool empowers you to create detailed profiles that resonate with your audience. Editable in our Ai Editor Tool, personalize every aspect to reflect the unique characteristics of your customer base effortlessly.