Free Interior Design Tax Preparation Checklist

Preparation Checklist

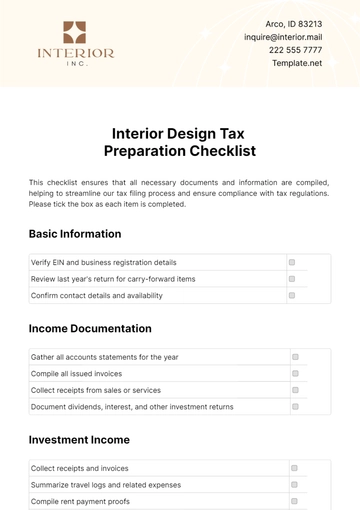

This checklist ensures that all necessary documents and information are compiled, helping to streamline our tax filing process and ensure compliance with tax regulations. Please tick the box as each item is completed.

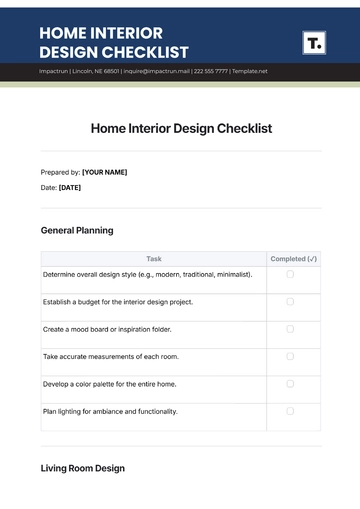

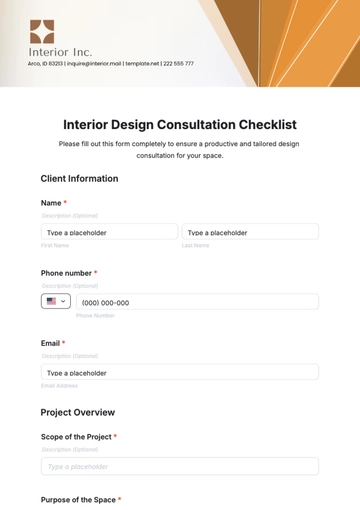

Basic Information

Verify EIN and business registration details | |

Review last year's return for carry-forward items | |

Confirm contact details and availability |

Income Documentation

Gather all accounts statements for the year | |

Compile all issued invoices | |

Collect receipts from sales or services | |

Document dividends, interest, and other investment returns |

Investment Income

Collect receipts and invoices | |

Summarize travel logs and related expenses | |

Compile rent payment proofs | |

Gather utility bills related to business premises | |

Prepare W-2s and 1099s for employees and contractors |

Deductions

Document all charitable donations made | |

Gather receipts for educational seminars or classes | |

Prepare depreciation schedules for assets |

Credits

Document any eligible energy-saving improvements | |

Review eligibility for any small business tax credits |

Additional Documents

Collect proofs of estimated tax payments | |

Include any official communications received during the year |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Interior Design Tax Preparation Checklist Template, exclusively on Template.net! Simplify tax season effortlessly with this editable and customizable tool. Tailored for interior designers, it ensures thorough preparation for tax obligations. Customize it to suit your specific needs, all editable in our intuitive AI Editor tool. Streamline your tax process and focus on what truly matters – your creative design pursuits!

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

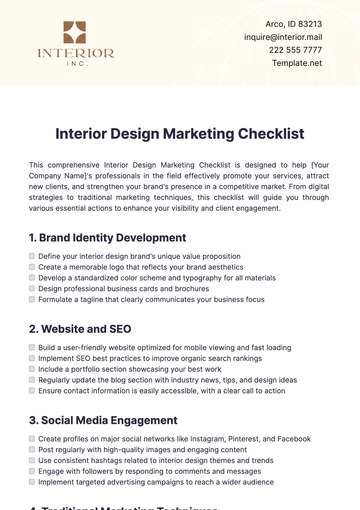

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

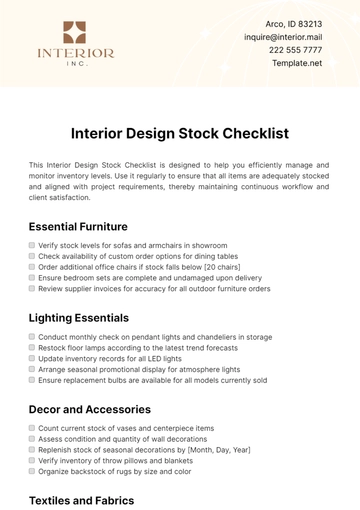

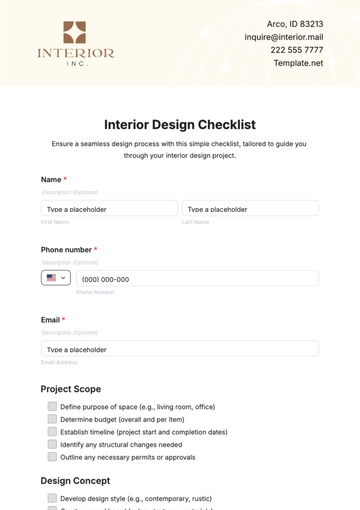

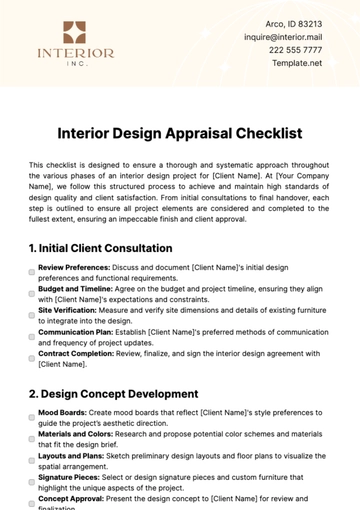

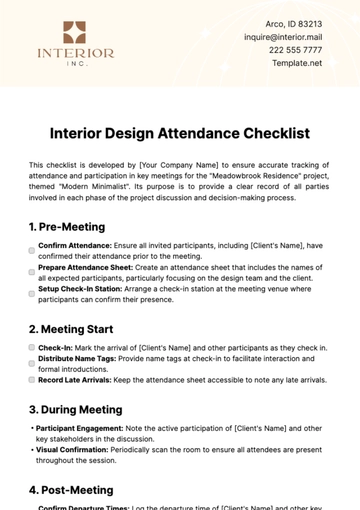

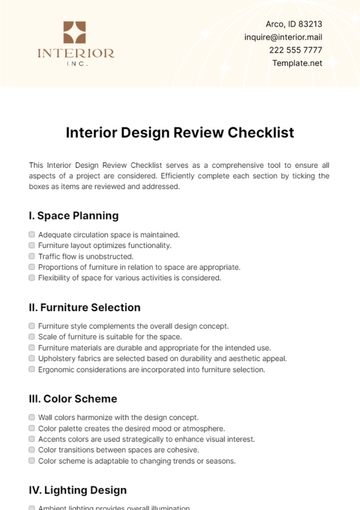

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist