Feasibility Analysis

Prepared By : | Maricar David |

Company : | Dummy Company |

Department : | [YOUR DEPARTMENT] |

I. Executive Summary

This financial feasibility analysis presents a comprehensive overview of the proposed project, highlighting key insights and recommendations to guide decision-making processes at [Your Company Name].

II. Project Overview

A. Project Description

The project aims to develop a cutting-edge mobile application that revolutionizes personal finance management for users. It will offer intuitive features for budgeting, expense tracking, and investment management, ultimately empowering users to make informed financial decisions. By seamlessly integrating with existing banking systems, the app will provide a holistic view of users' finances, enhancing their financial well-being.

B. Objectives

The primary objectives of the project are to:

Enhance user financial literacy and decision-making capabilities.

Simplify personal finance management through innovative technology solutions.

Position [Your Company Name] as a leader in financial innovation and customer-centricity.

III. Market Analysis

Analyze the current market conditions relevant to the project, focusing on the demand, potential growth, and competitive landscape.

A. Demand Analysis

The current market exhibits a significant demand for user-friendly financial management solutions, driven by increasing awareness of the importance of financial planning and budgeting. Market research indicates a projected growth of X% in the personal finance app sector over the next five years, reflecting a growing trend towards digital financial tools.

B. Competitive Analysis

Key competitors in the personal finance app market include established players such as Mint and YNAB, which collectively hold a majority market share. However, our project distinguishes itself through its focus on user experience, leveraging advanced algorithms to provide personalized financial insights and recommendations. This unique value proposition positions us favorably against competitors.

IV. Financial Analysis

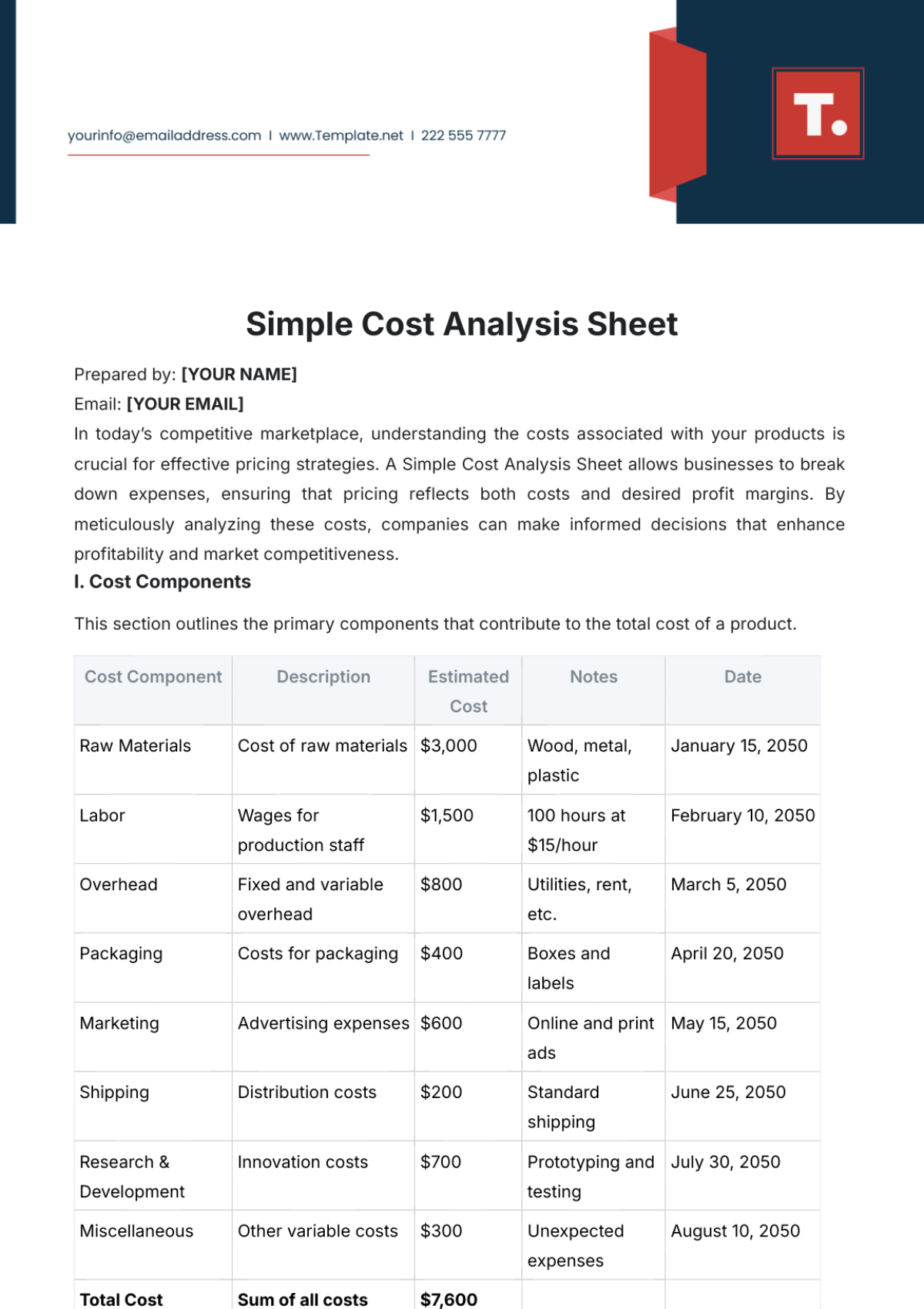

A. Cost Structure

Provide a detailed breakdown of all costs involved, including initial capital, ongoing expenses, and any potential hidden costs.

Expense Category | Estimated Cost |

|---|---|

Initial Capital Investment | |

Development Costs | $A |

Marketing Expenses | $B |

Infrastructure Setup | $C |

Total Initial Capital Investment | $X |

Operational Expenses | |

Personnel Salaries | $D annually |

Server Maintenance | $E annually |

Customer Support | $F annually |

Other Operational Costs | $G annually |

Total Annual Operational Expenses | $Y |

Contingency Funds | |

Reserved for Unforeseen Expenses | $Z |

V. Risk Assessment

Identify key risks associated with the project and propose mitigation strategies to minimize their impact on [YOUR COMPANY NAME].

Regulatory Risks:

Risk: Changes in regulatory requirements or compliance standards could affect the development and operation of the financial management application. Regulatory hurdles may delay the launch of the app or necessitate costly modifications to ensure compliance.

Mitigation Strategy: Stay updated with relevant regulations and compliance standards in the financial technology sector. Establish a legal team or consult with regulatory experts to ensure full compliance throughout the project lifecycle. Conduct regular audits to assess and address any regulatory gaps or risks.

Market Risks:

Risk: Market dynamics, such as shifts in consumer preferences, technological advancements, or the entry of new competitors, could impact the demand for the financial management application. Failure to adapt to changing market trends may lead to decreased market share or revenue loss.

Mitigation Strategy: Conduct thorough market research to understand customer needs, preferences, and evolving trends. Continuously monitor the competitive landscape and consumer feedback to identify emerging opportunities or threats. Maintain agility and flexibility in product development to quickly respond to market changes and stay ahead of competitors.

Financial Risks:

Risk: Financial risks include budget overruns, revenue shortfalls, or unexpected expenses that may strain the project's financial resources. Fluctuations in currency exchange rates, inflation, or economic downturns could also impact the project's financial stability.

Mitigation Strategy: Implement robust financial planning and budgeting processes to accurately forecast expenses and revenues. Establish contingency funds to address unforeseen expenses or revenue fluctuations. Diversify revenue streams and explore alternative funding sources, such as partnerships or grants, to mitigate financial risks. Monitor key financial metrics regularly and adjust strategies accordingly to maintain financial health.

VI. Conclusion and Recommendations

Summarize the key findings of the feasibility analysis and provide actionable recommendations based on the compiled data and the strategic interests of [YOUR COMPANY NAME].

A. Feasibility Statement

The feasibility analysis indicates that the project holds substantial potential for success. Despite certain risks, including regulatory uncertainties, market fluctuations, and financial challenges, the project appears financially viable. With diligent risk management strategies and proactive measures, these risks can be mitigated to a manageable level. Overall, the project demonstrates promise in delivering value to [Your Company Name] and its stakeholders.

B. Next Steps

Should the project be approved, the following immediate actions are recommended:

Initiate Development Phase: Begin the development of the financial management application, adhering to the project scope, timeline, and budget constraints. Engage cross-functional teams, including software developers, designers, and quality assurance testers, to ensure efficient execution.

Comprehensive Regulatory Compliance: Prioritize regulatory compliance by closely monitoring evolving regulatory requirements and integrating necessary adjustments into the development process. Collaborate with legal experts to navigate complex regulatory landscapes and mitigate compliance risks.

Market Penetration Strategy: Develop a robust marketing and distribution strategy to maximize market penetration and user adoption. Leverage targeted marketing campaigns, user acquisition tactics, and strategic partnerships to gain traction in the competitive personal finance app market.

Financial Monitoring and Reporting: Establish rigorous financial monitoring and reporting mechanisms to track project expenditures, revenues, and performance metrics. Regularly assess financial health and make data-driven decisions to optimize resource allocation and mitigate financial risks.

Stakeholder Engagement: Foster transparent communication and collaboration with internal and external stakeholders throughout the project lifecycle. Solicit feedback, address concerns, and cultivate strong relationships to ensure alignment with strategic objectives and enhance project success.