Free Financial Gap Analysis

Prepared By: | [Your Name] |

Company: | [Your Company Name] |

Department: | [Your Department] |

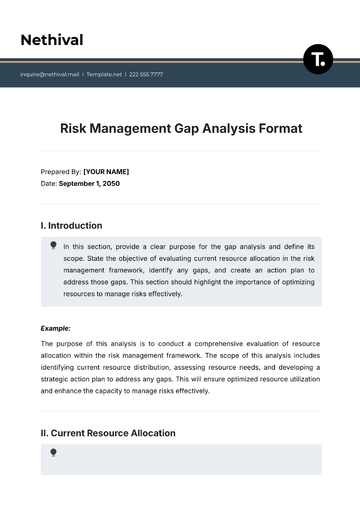

I. Executive Summary

This financial gap analysis aims to identify the discrepancies between the current financial capabilities and the desired financial targets of [Your Company Name]. The primary focus is on enhancing financial performance and achieving strategic goals through meticulous financial planning and adjustment strategies.

II. Current Financial Overview

A. Current Revenue Streams

Product Sales: [Your Company Name] currently generates revenue through the sale of its flagship products, including [Product A] and [Product B].

Service Charges: The company offers premium technical support services and consulting to clients, contributing to its revenue stream.

Subscription Models: [Your Company Name] also leverages subscription-based models for access to software updates and additional features, ensuring recurring revenue.

B. Current Expense Analysis

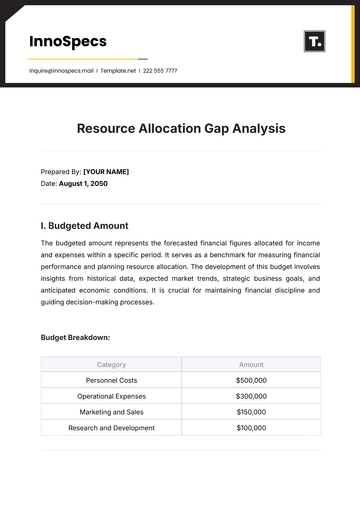

Operational Costs: [Your Company Name]'s operational expenses encompass overhead costs, utilities, and administrative expenses necessary for day-to-day operations.

Human Resources: The company invests in its workforce through salaries, benefits, and training programs to maintain a skilled and motivated team.

Marketing and Sales: Expenditure on marketing campaigns, advertising, and sales activities is essential for customer acquisition and brand visibility.

Technology and Infrastructure: [Your Company Name] allocates funds for research and development, as well as maintaining and upgrading its technological infrastructure to stay competitive.

C. Profit Margins

The current profit margin stands at [Current Percentage]%, derived from the total revenue minus operational costs.

III. Desired Financial Targets

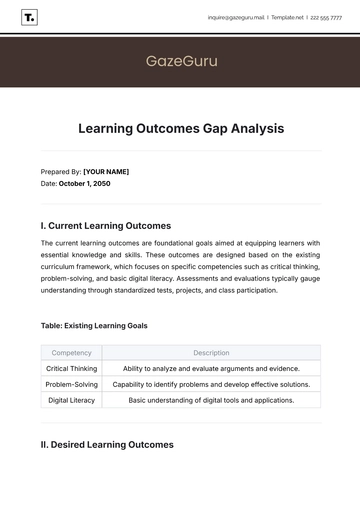

Based on strategic aspirations and future growth projections, [Your Company Name] aims to achieve:

Increase revenue by 50% within 6 Months.

Reduce operational costs by 35% in the next 2 years.

Expand market presence in [Specific Markets].

IV. Gap Analysis

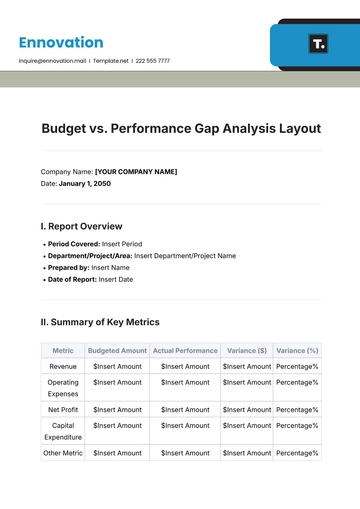

A. Revenue Gaps

Identified gaps in potential and actual revenue streams, including opportunities for penetrating new markets and optimizing existing product offerings to meet customer demands.

B. Cost Efficiency Gaps

Areas where operational costs can be optimized through process improvements, resource reallocation, and adopting cost-effective technologies while maintaining service quality.

C. Resource Allocation

Identified inefficiencies in resource allocation, highlighting areas where reallocating human and financial resources could better align with company goals and enhance overall performance.

V. Strategic Recommendations

A. Enhancing Revenue

Diversification of revenue streams by exploring new product lines or expanding into complementary services.

Focusing on high-margin products and services to maximize profitability.

Expansion into new geographic markets with tailored marketing and localization strategies.

B. Cost Reduction Strategies

Adoption of automation and AI technologies to streamline operations and reduce labor costs.

Negotiating better terms with suppliers and vendors to lower procurement expenses.

Streamlining operations through lean practices and optimizing supply chain management to minimize overheads.

C. Optimizing Resource Allocation

Re-evaluating staffing levels and skill sets to align with business needs and growth objectives.

Allocating capital and human resources based on ROI analysis and strategic priorities.

Implementing performance metrics to monitor resource utilization and adjust allocation accordingly.

VI. Conclusion

The financial gap analysis provided herein details the critical financial disparities faced by [Your Company Name] and offers a strategic pathway to achieving the set financial and operational goals efficiently and effectively. By implementing the recommended strategies, [Your Company Name] can enhance its financial performance, capitalize on growth opportunities, and solidify its position in the market.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Navigate financial landscapes with confidence using our Financial Gap Analysis Template from Template.net. Designed for precision, this editable and customizable tool illuminates gaps and opportunities within your finances. With seamless editing in our Ai Editor Tool, dissect financial data effortlessly to optimize strategies and drive fiscal growth.