Customer Profitability Analysis

Prepared By : | [Your Name] |

Company : | [Your Company Name] |

Department : | [YOUR DEPARTMENT] |

Address: | [Your Company Address] |

Email: | [Your Company Email] |

I. Executive Summary

A. Overview

This Customer Profitability Analysis aims to classify customers into segments based on profitability for [Your Company Name]. The analysis identifies high-value customers, highlights areas for cost reduction, and offers strategic recommendations to enhance profitability.

B. Key Findings

High-Value Customers

Segment A contributes 50% of the total revenue despite representing only 20% of the customer base.Low-Value Customers:

Segment C incurs higher service costs, leading to negative profit margins.Strategic Recommendations:

Focus marketing efforts on Segment A and reduce service costs for Segment C.

II. Methodology

A. Data Collection

Sales Records: Monthly sales data from the past two years.

Customer Surveys: Feedback collected from customer satisfaction surveys.

Financial Statements: Cost data from quarterly financial reports.

B. Analytical Techniques

Segmentation Analysis: Cluster analysis to group customers based on purchase behavior.

Cost Allocation Models: Activity-based costing to assign costs accurately to each customer segment.

Profitability Metrics: Calculation of profit margins, customer lifetime value (CLV), and return on investment (ROI).

C. Assumptions

Customer Acquisition Costs: Assumed to be $50 per customer based on historical marketing expenses.

Service Costs: The average service cost per transaction is estimated at $10.

Lifetime Value Estimates: Customers in Segment A are expected to remain loyal for an average of 5 years.

III. Customer Segmentation

A. Segmentation Criteria

Purchase Frequency: Number of purchases made by the customer in a year.

Average Transaction Value: Average amount spent per transaction by the customer.

Customer Lifetime Value (CLV): Total revenue expected from a customer over their relationship with the company.

B. Segment Descriptions

Segment A: High-Value Customers

Criteria: Top 20% of customers by revenue.

Characteristics: Frequent purchases, high average transaction value, high customer lifetime value.

Behavior: Loyal customers who often participate in loyalty programs and respond well to promotions.

Segment B: Medium-Value Customers

Criteria: Middle 60% of customers by revenue.

Characteristics: Regular purchases, moderate transaction value, moderate customer lifetime value.

Behavior: Customers who occasionally respond to promotions and show moderate brand loyalty.

Segment C: Low-Value Customers

Criteria: Bottom 20% of customers by revenue.

Characteristics: Infrequent purchases, low transaction value, low customer lifetime value.

Behavior: Price-sensitive customers with low engagement and loyalty.

IV. Revenue Analysis

A. Total Revenue by Segment

Customer Segment | Total Revenue | Percentage of Total Revenue |

|---|---|---|

Segment A | $1,000,000 | 50% |

Segment B | $750,000 | 37.5% |

Segment C | $250,000 | 12.5% |

B. Revenue Trends

Segment A: Consistently high revenue with a steady growth rate of 5% per quarter.

Segment B: Moderate revenue with slight fluctuations, stable over the past year.

Segment C: Low and declining revenue, suggesting a need for targeted marketing or cost reduction strategies.

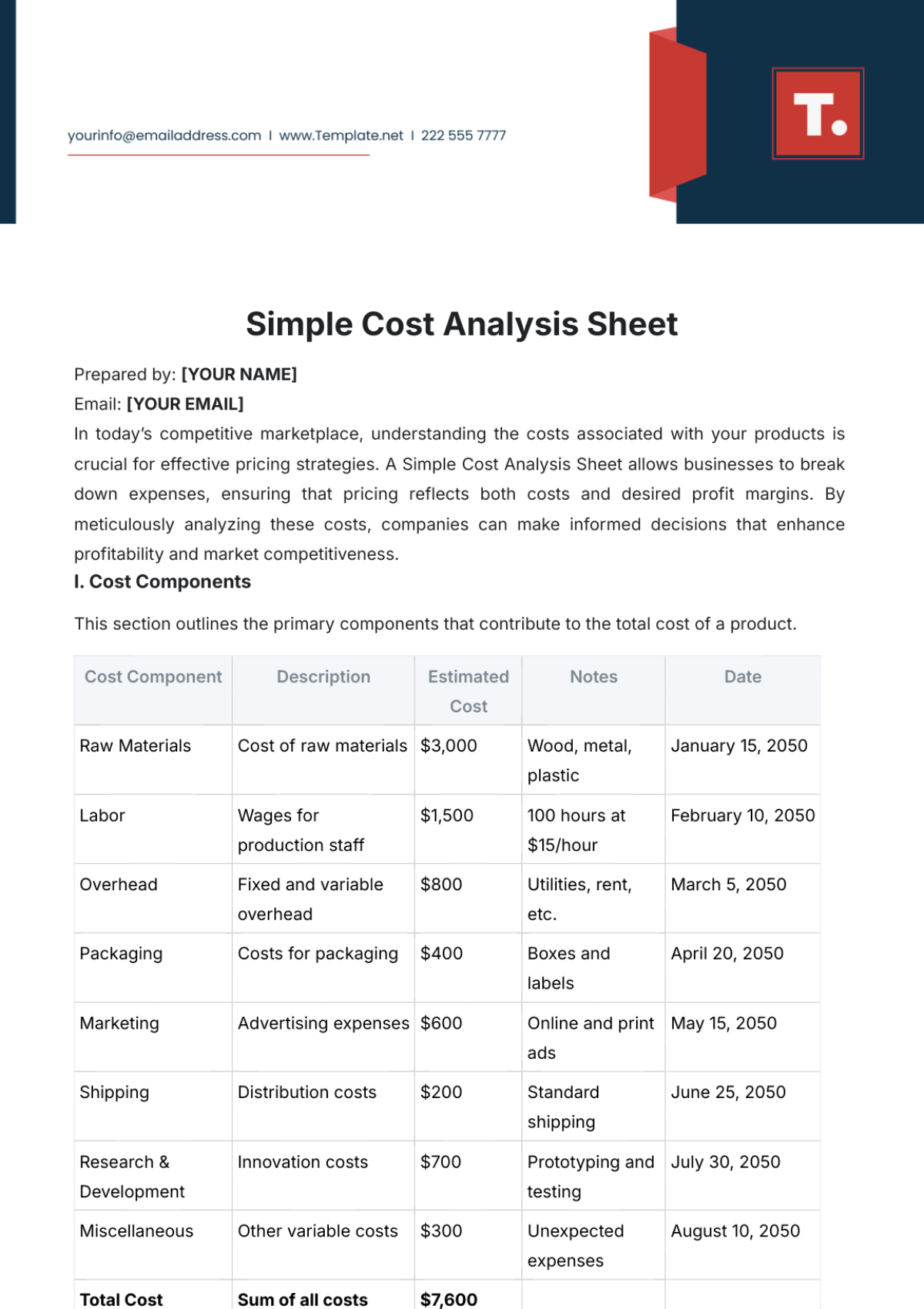

V. Cost Analysis

A. Cost Allocation

Direct Costs: Costs directly associated with each transaction, such as product costs and shipping.

Indirect Costs: Overhead costs such as customer service, marketing, and administrative expenses are allocated based on usage patterns.

B. Total Cost by Segment

Customer Segment | Total Cost | Percentage of Total Cost |

|---|---|---|

Segment A | $500,000 | 33.3% |

Segment B | $600,000 | 40% |

Segment C | $400,000 | 26.7% |

C. Cost Trends

Segment A: Efficient cost management with high profitability.

Segment B: Moderate costs with potential for cost reduction in service delivery.

Segment C: High service costs lead to negative profit margins, indicating a need for process improvement.

VI. Profitability Metrics

A. Profit Margins

Customer Segment | Total Revenue | Total Cost | Profit Margin |

|---|---|---|---|

Segment A | $1,000,000 | $500,000 | 50% |

Segment B | $750,000 | $600,000 | 20% |

Segment C | $250,000 | $400,000 | -60% |

B. Customer Lifetime Value (CLV)

Segment A: CLV calculated as (Average Annual Revenue per Customer) x (Average Customer Lifespan). Estimated CLV: $5,000.

Segment B: Estimated CLV: $2,000.

Segment C: Estimated CLV: $500.

C. Key Profitability Metrics

Return on Investment (ROI): ROI for Segment A is 200%.

Customer Acquisition Cost (CAC): The average CAC is $50 per customer.

Profit per Customer: Segment A: $4,500, Segment B: $1,400, Segment C: -$300.

VII. Recommendations

A. Strategic Actions

Focus on High-Value Customers

Increase marketing efforts targeted at Segment A.

Develop loyalty programs to retain high-value customers.

Improve Cost Efficiency

Optimize service delivery to reduce costs for Segment B.

Re-evaluate service levels for Segment C to ensure cost-effectiveness.

Enhance Customer Experience

Tailor products and services to meet the needs of high-value customers.

Implement feedback mechanisms to understand customer needs better.

B. Implementation Plan

Phase 1: Enhance marketing strategies for Segment A (Q1)

Phase 2: Implement cost reduction measures for Segment B (Q2)

Phase 3: Revise service offerings for Segment C (Q3)

Responsible Teams: Marketing, Finance, Customer Service

C. Expected Outcomes

Increased Revenue: Expected 10% revenue growth from Segment A.

Cost Savings: Projected 15% reduction in service costs for Segment B.

Improved Profitability: Turnaround for Segment C to achieve positive profit margins.

VIII. Appendices

A. Data Tables

Detailed customer transaction data

Cost allocation breakdowns

B. Glossary

CLV: Customer Lifetime Value

CAC: Customer Acquisition Cost

C. References

Financial records from [Your Company Name]

Industry benchmarks and reports