Internal Audit SWOT Analysis

Prepared By : | [Your Name] |

Company : | [Your Company Name] |

Department : | [Your Department] |

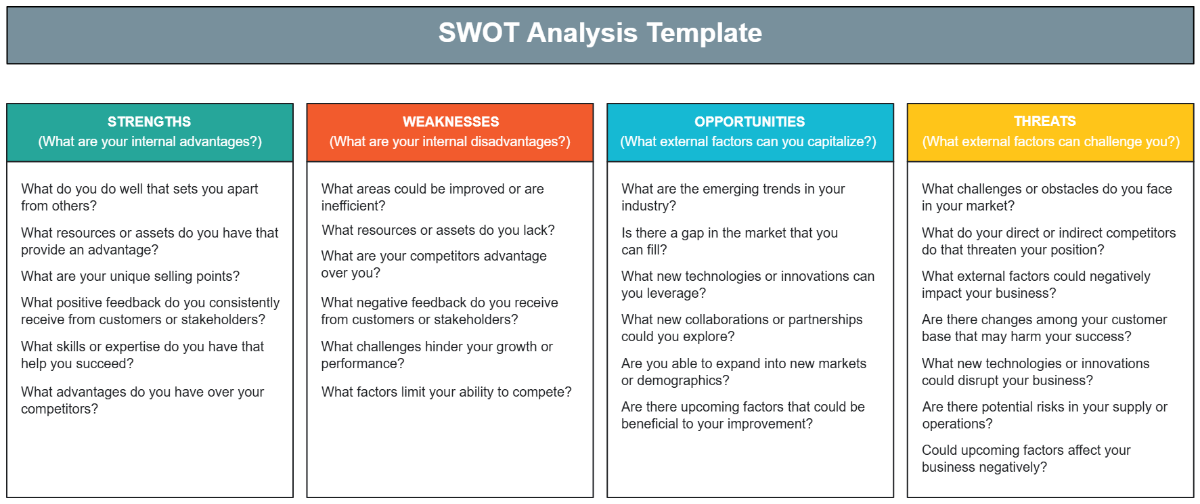

I. Introduction

Provide an overview of the purpose and scope of the Internal Audit SWOT Analysis, aiming to assess the internal audit function's performance within [Your Company Name].

Specify the audience for whom the analysis is intended, including senior management, the board of directors, audit committee members, internal auditors, and relevant personnel involved in governance, risk management, and internal control processes.

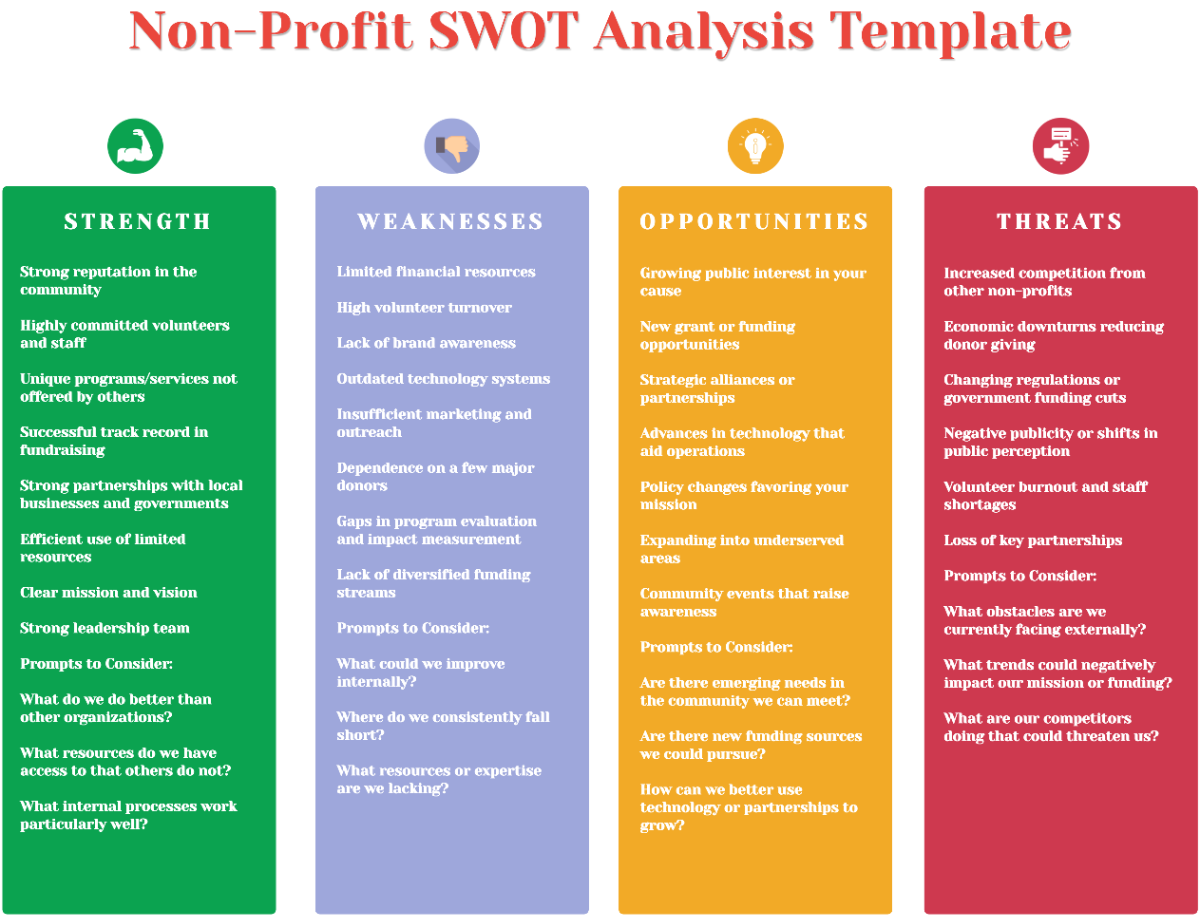

Briefly outline the structure of the analysis, which will focus on evaluating the strengths, weaknesses, opportunities, and threats associated with the internal audit function.

II. Internal Audit Function Overview

Describe the role and responsibilities of the internal audit function within [Your Company Name], emphasizing its importance in providing independent assurance and consulting services designed to add value and improve operations.

Role | Number of Staff | Qualifications/Experience | Key Responsibilities |

|---|---|---|---|

Chief Audit Executive | 1 | Certified Internal Auditor (CIA), Certified Public Accountant (CPA), Bachelor's degree in Accounting or related field. | - Provide strategic leadership and direction to the internal audit function. - Oversee the development and implementation of risk-based audit plans. - Report audit findings and recommendations to senior management and the audit committee. |

Senior Internal Auditor | 2 | Certified Internal Auditor (CIA), Bachelor's degree in Finance or related field. | - Lead and conduct complex audits across various business units. - Review work papers and guide junior auditors. - Assist in the development of audit programs and methodologies. |

Internal Auditor | 3 | Bachelor's degree in Accounting, Finance, or related field. | - Perform detailed testing of controls and procedures. - Document audit findings and observations. - Collaborate with process owners to develop corrective action plans. |

IT Auditor | 1 | Certified Information Systems Auditor (CISA), Bachelor's degree in Information Technology or related field. | - Conduct IT audits to assess the effectiveness of information systems controls. - Evaluate IT governance processes and data security measures. - Recommend improvements to IT controls and processes. |

Provide background information on the current structure, staffing, and methodologies used in internal audit processes, highlighting any recent changes or initiatives aimed at enhancing effectiveness and efficiency.

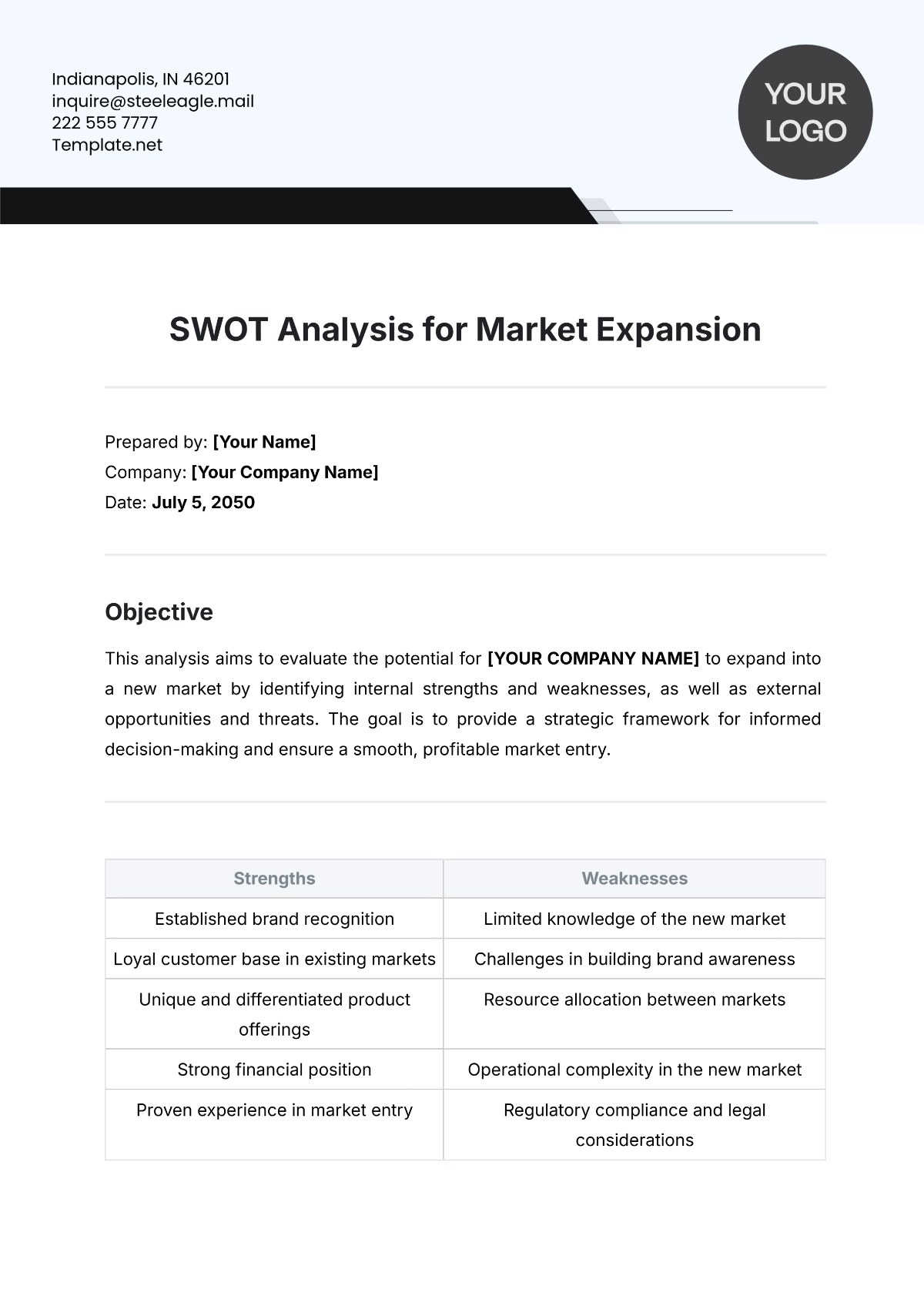

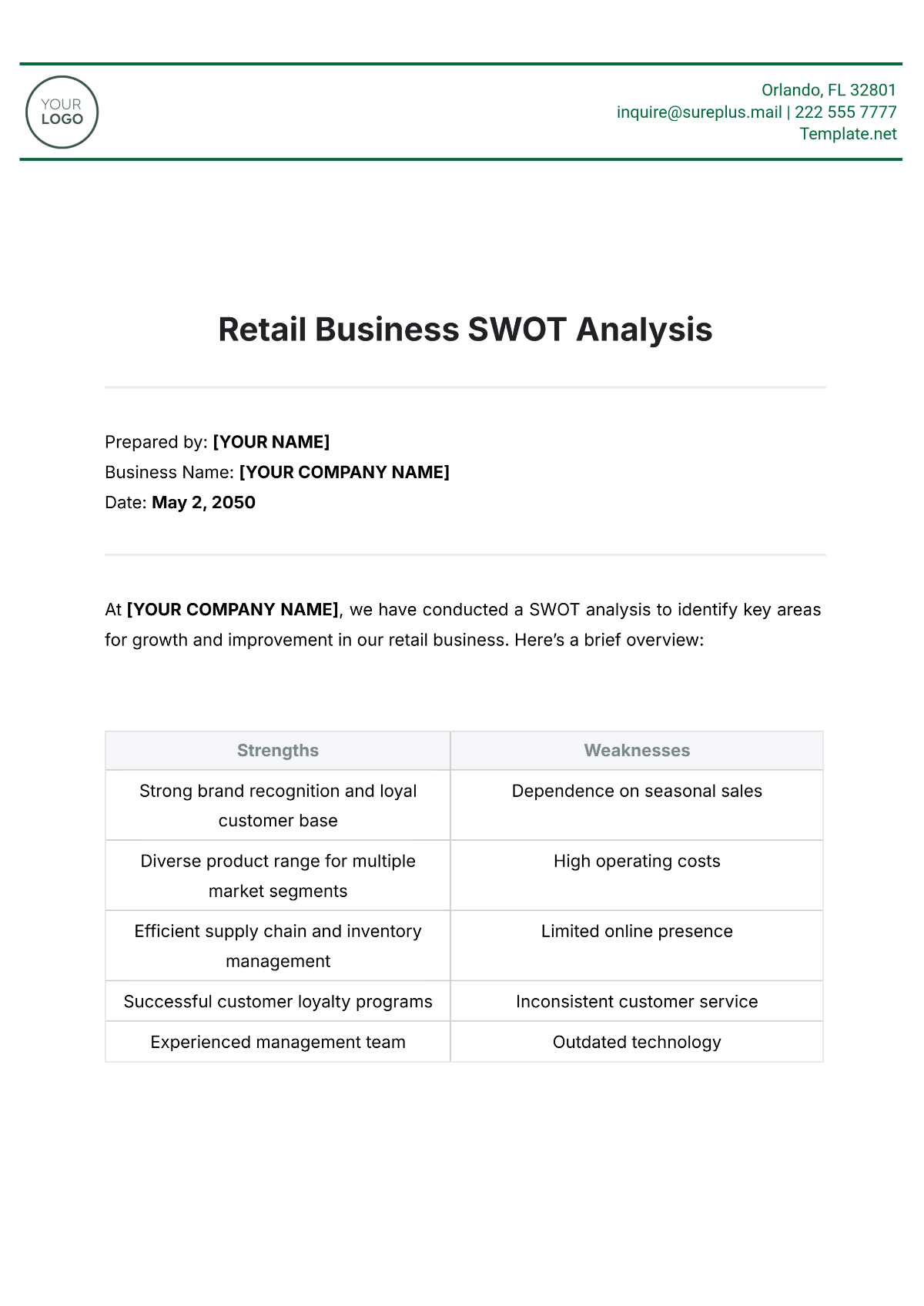

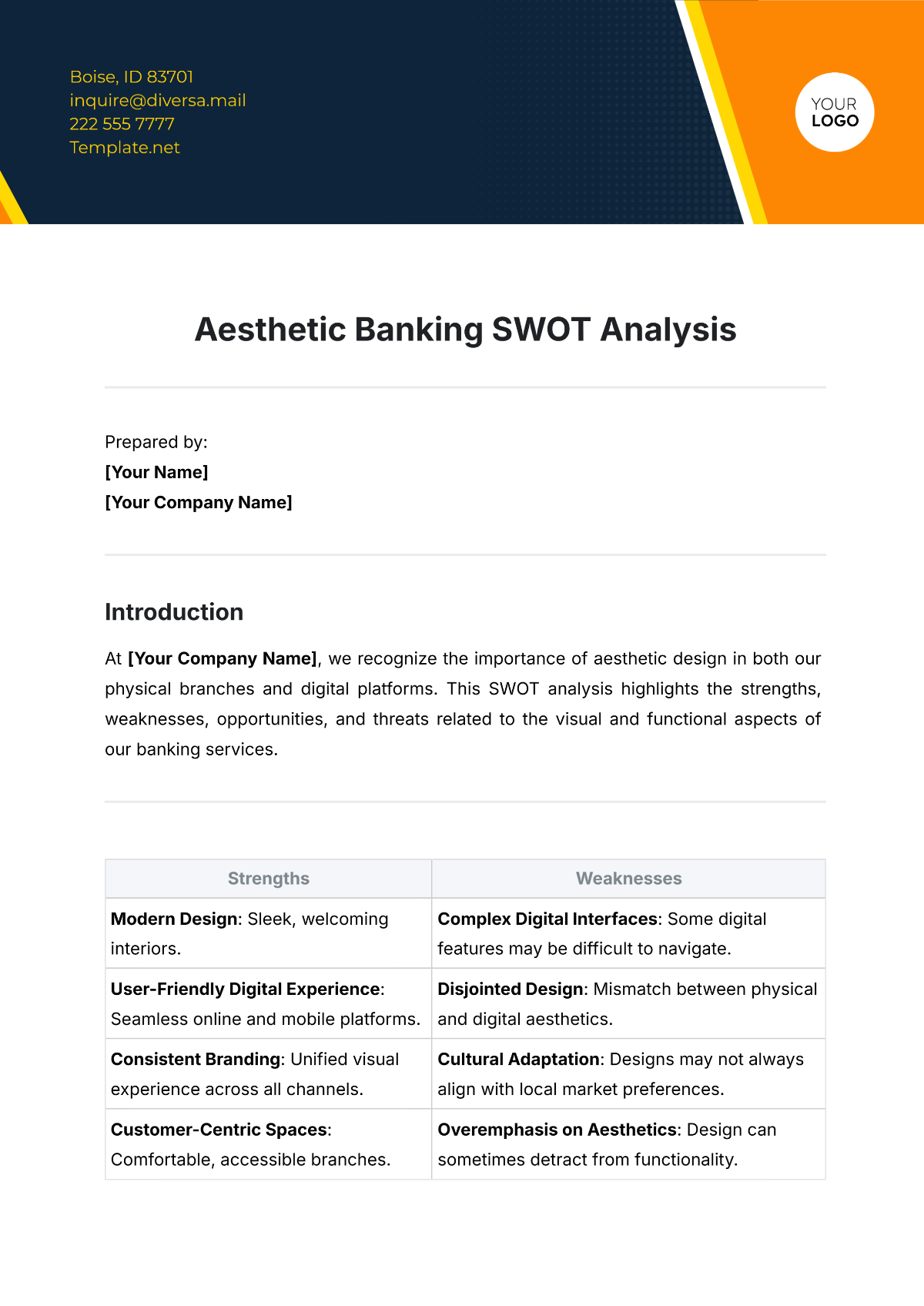

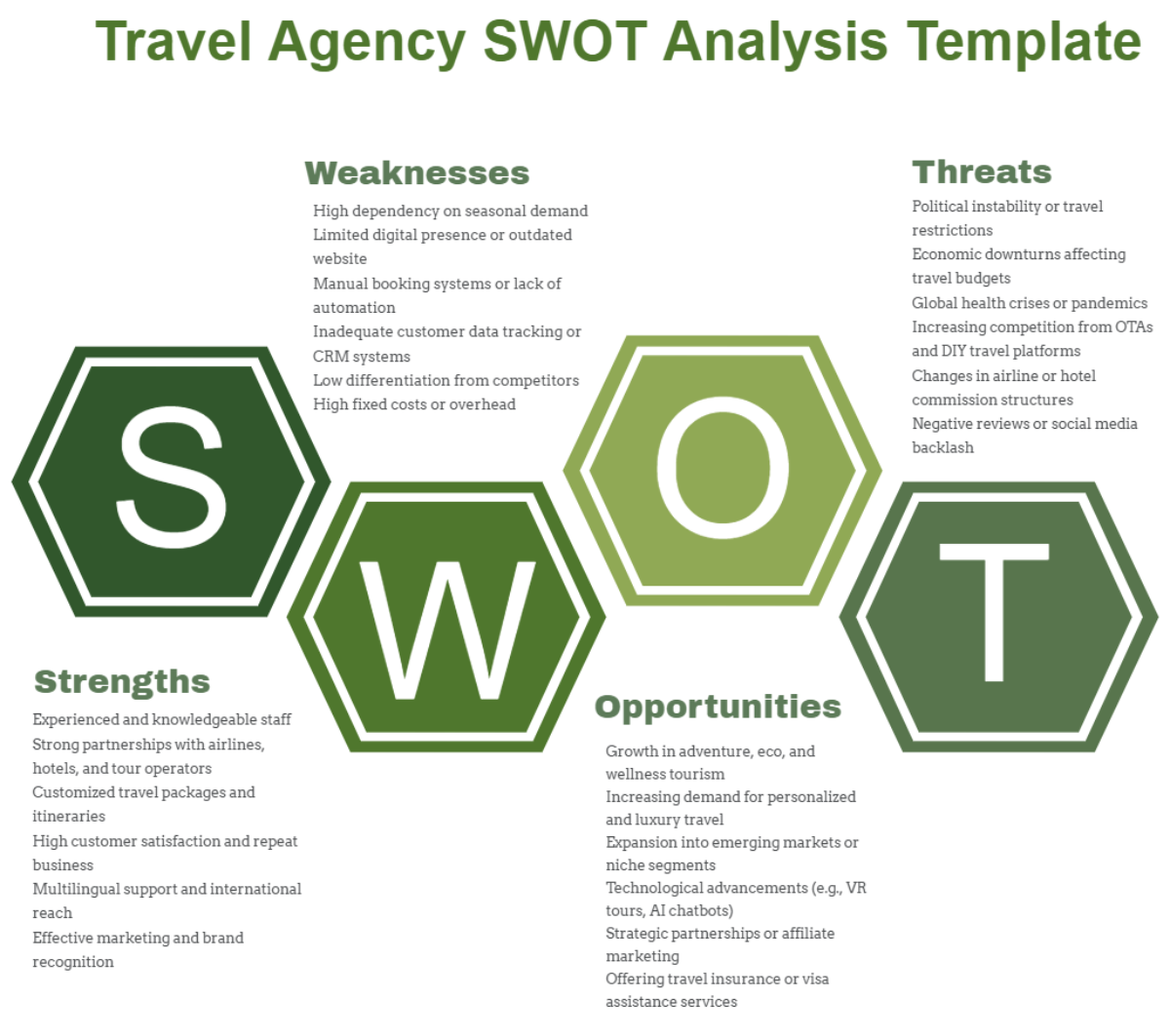

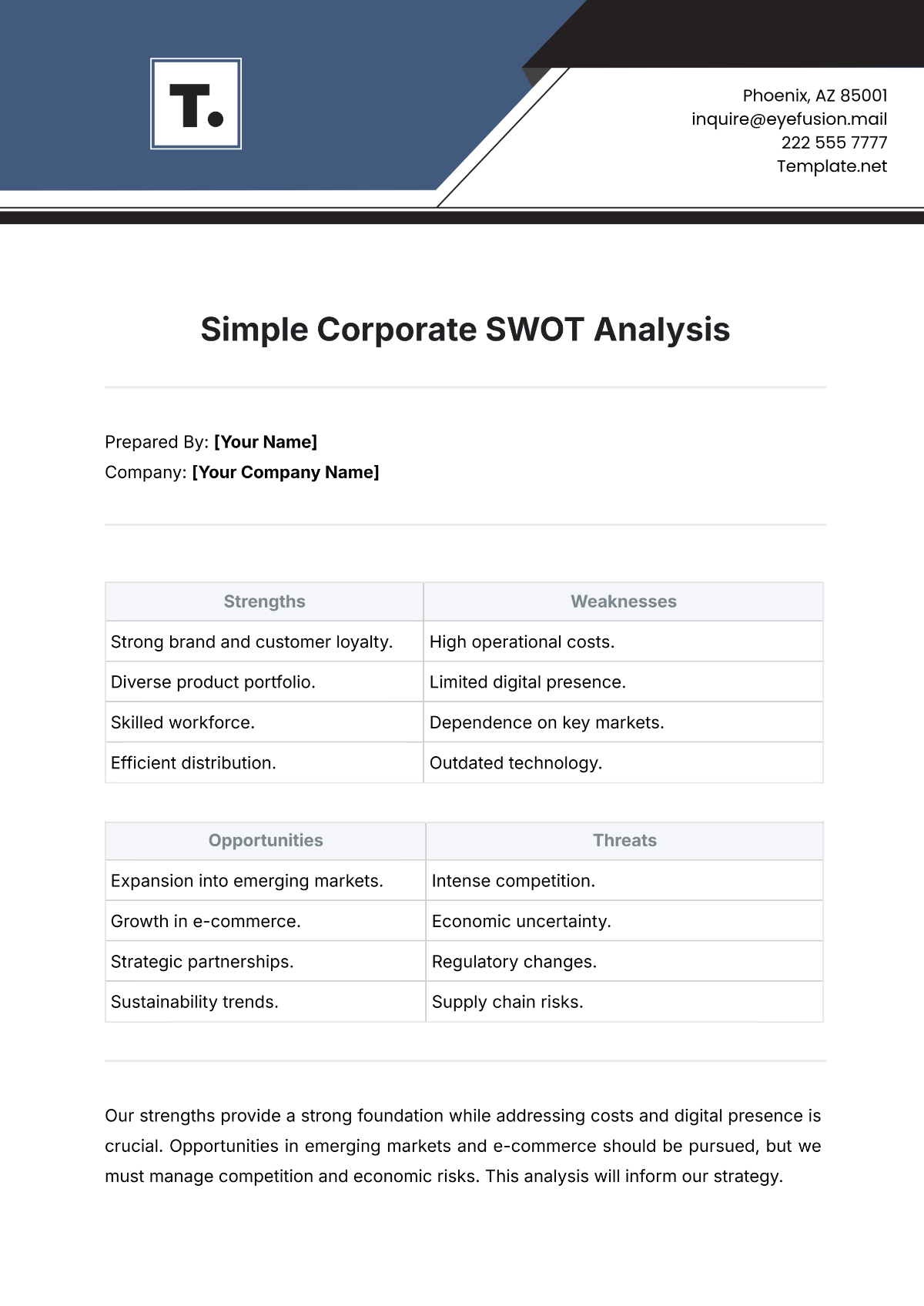

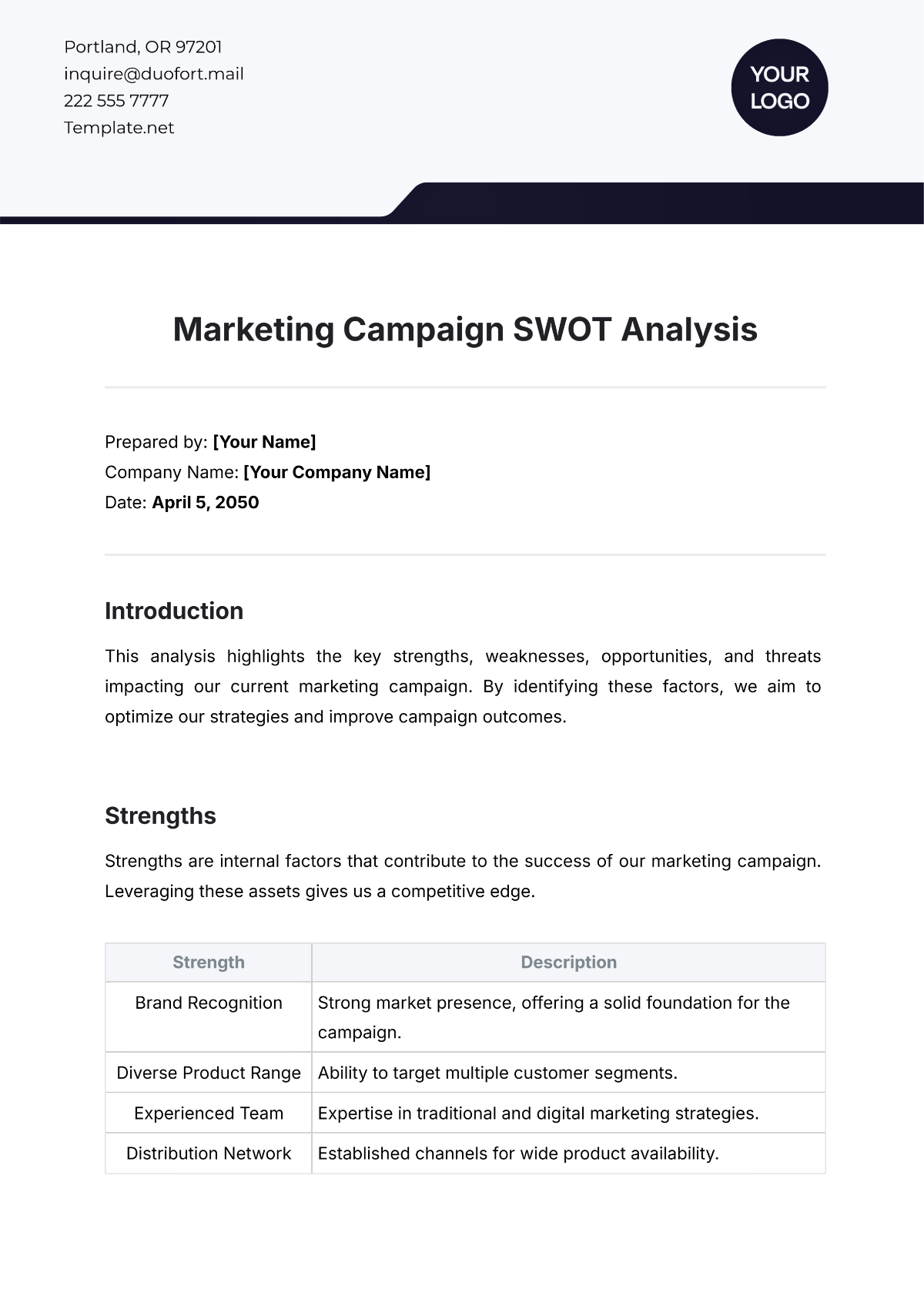

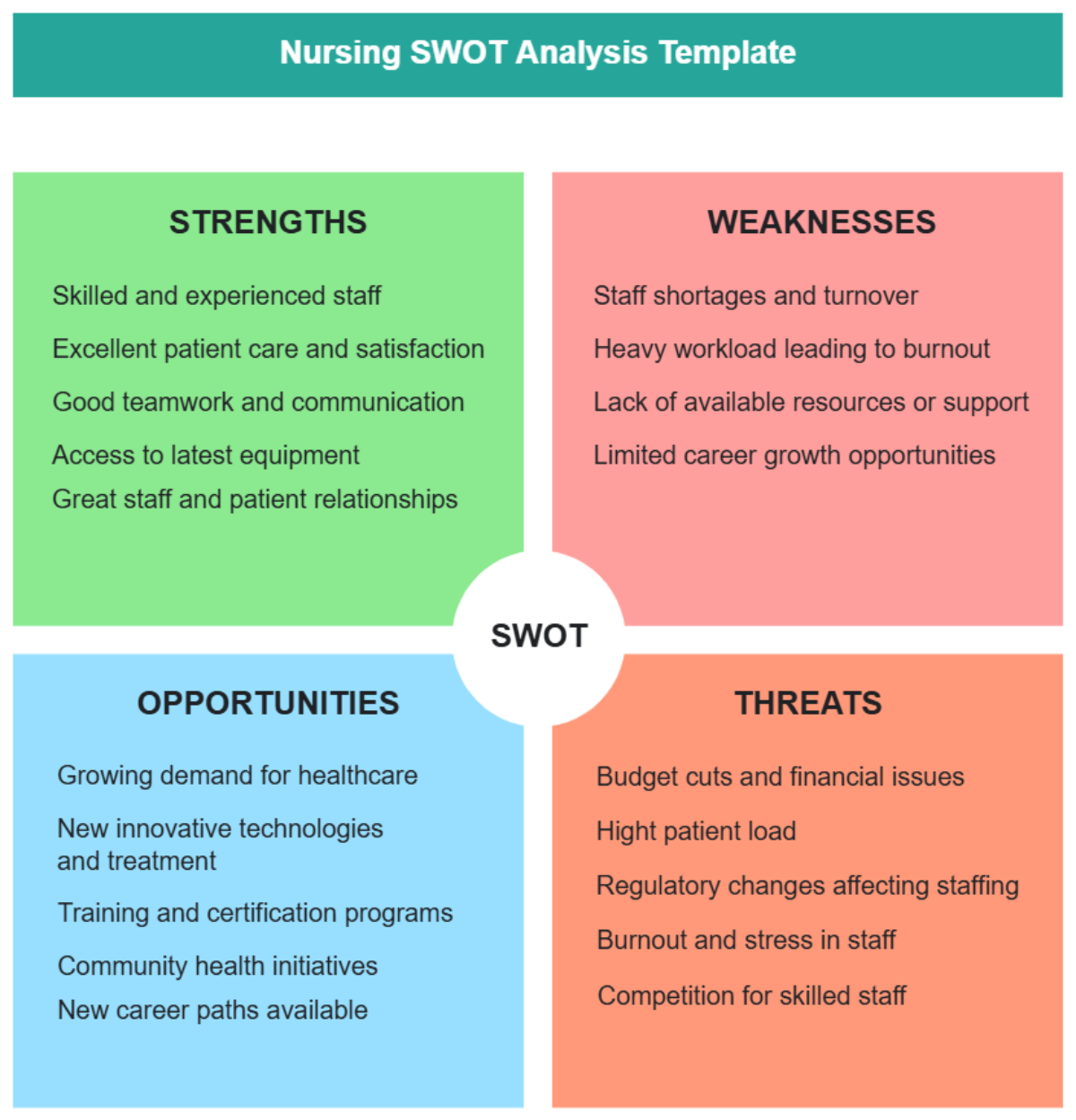

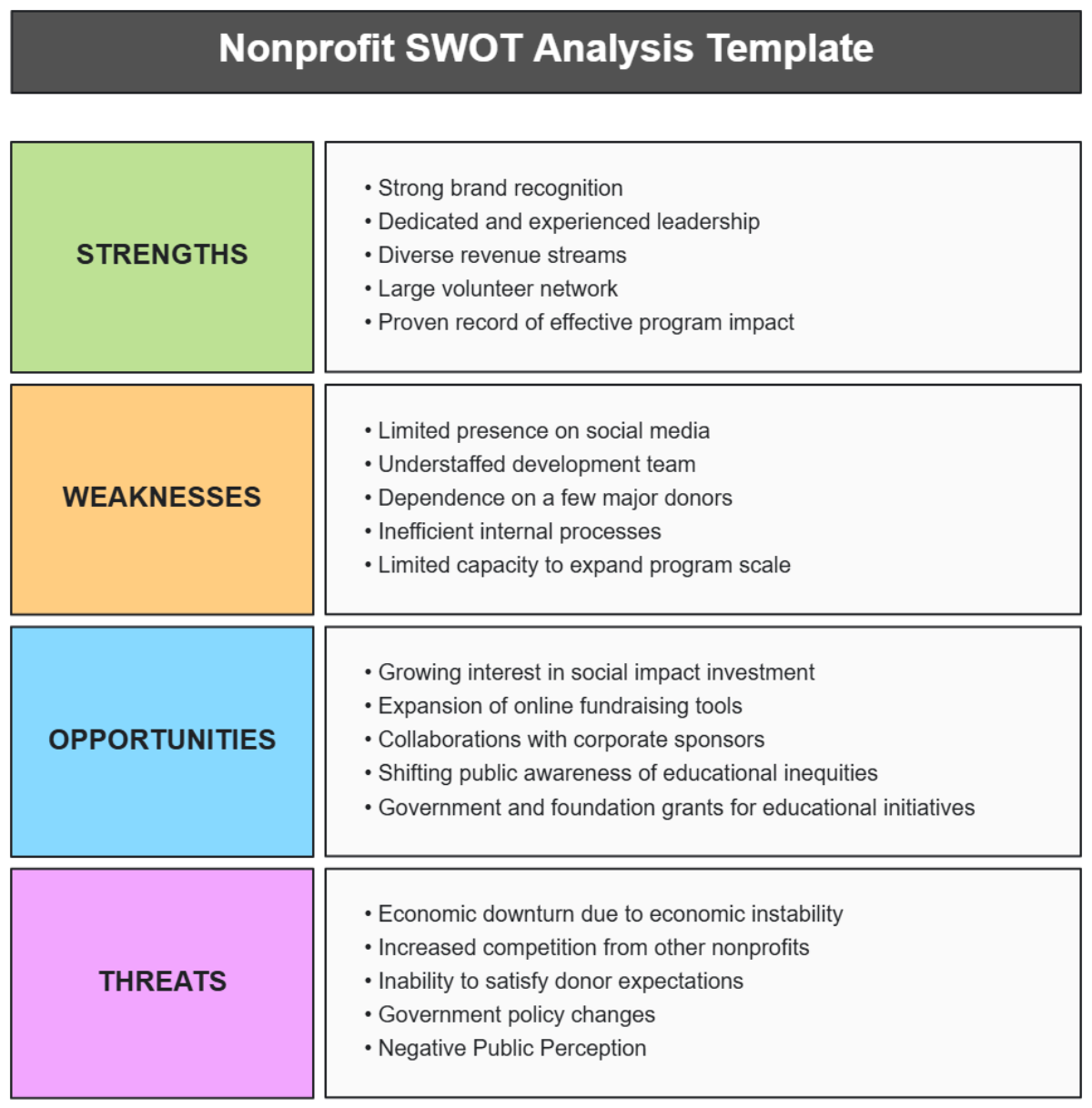

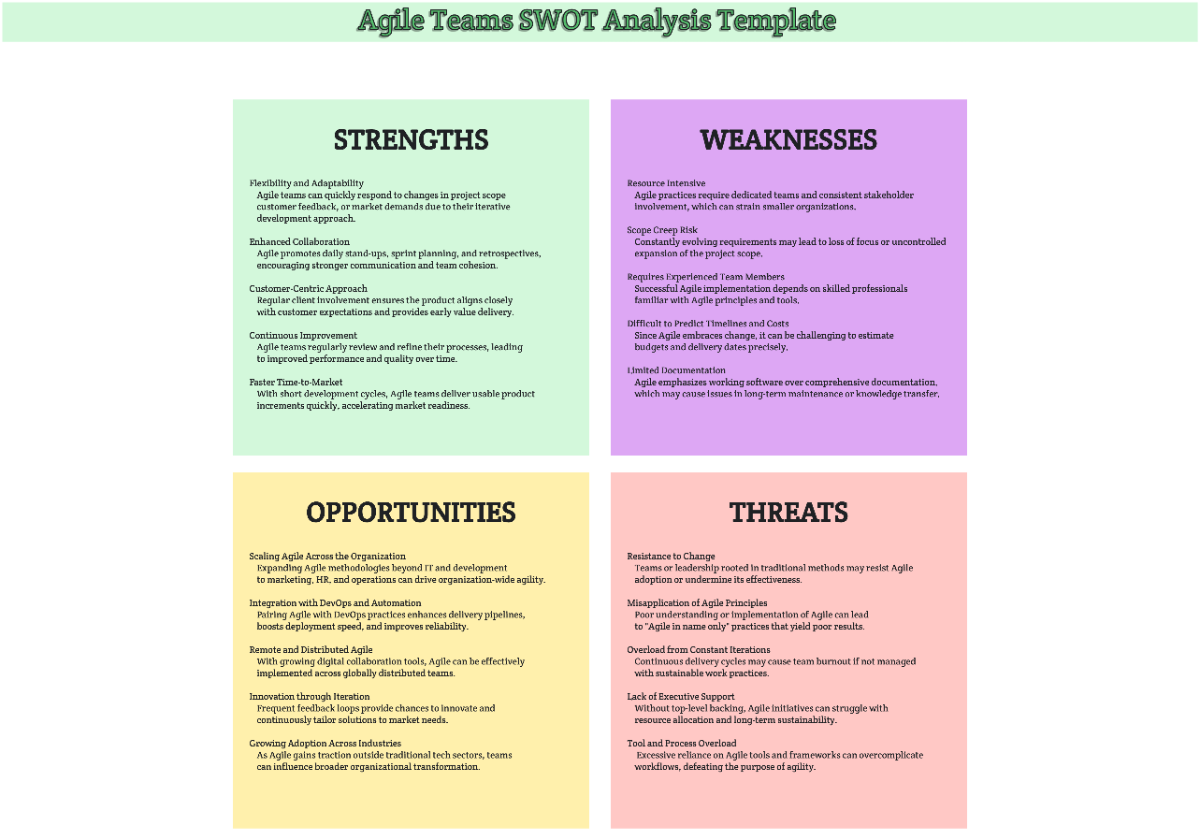

III. Strengths

Skilled Personnel: Highly qualified internal auditors with expertise in various domains, including finance, operations, and compliance. Continuous training and development programs ensure their skills remain up-to-date.

Robust Methodologies: Well-defined audit methodologies and frameworks, such as COSO or ISO standards, ensure consistency and thoroughness in audit processes. Regular reviews and updates are conducted to adapt to evolving risks and business environments.

Advanced Technology Tools: Utilization of cutting-edge audit software, such as data analytics tools and robotic process automation (RPA), enhances audit efficiency and allows for more extensive analysis of large datasets.

Management Support: Strong backing from senior management for internal audit initiatives, demonstrated through adequate resource allocation, clear communication of expectations, and support for implementing audit recommendations.

IV. Weaknesses

Resource Constraints: Limited budget and staffing for conducting comprehensive audits, leading to constraints in covering all risk areas adequately. This limitation may result in prioritization challenges and gaps in audit coverage.

Skill Gaps: Identified areas where internal auditors may lack expertise or training, particularly in emerging risk areas such as cybersecurity or sustainability. Addressing these gaps requires targeted training programs or recruiting individuals with specialized skills.

Process Inefficiencies: Bottlenecks or outdated processes hindering audit effectiveness, such as manual documentation and reporting processes. Streamlining these processes through automation and standardization can improve efficiency and focus internal auditors' efforts on value-added activities.

Lack of Independence: Potential conflicts of interest compromise audit objectivity, particularly in cases where auditors have close relationships with auditees or are involved in operational decision-making. Implementing clear policies and procedures to ensure independence and objectivity are maintained is essential.

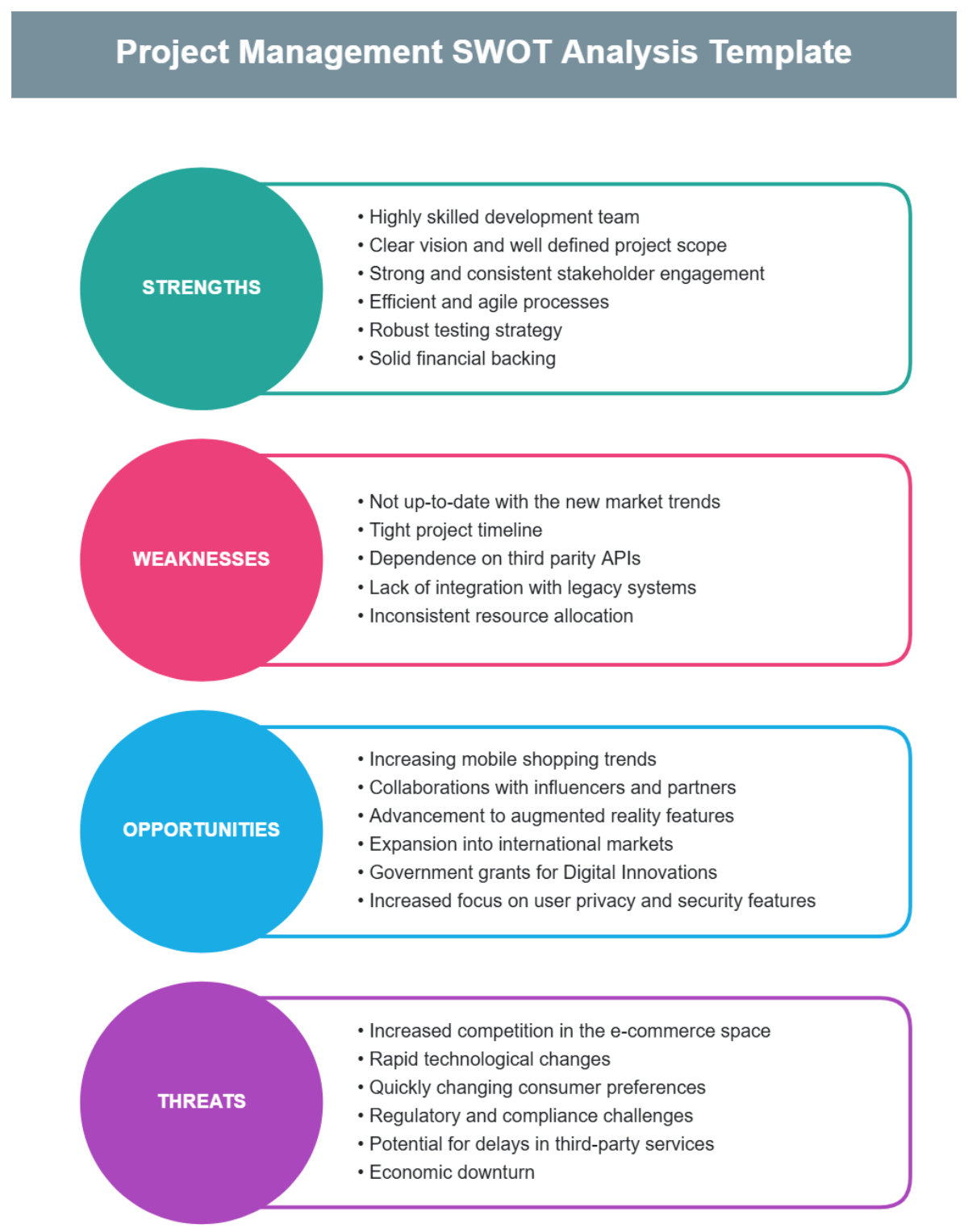

V. Opportunities

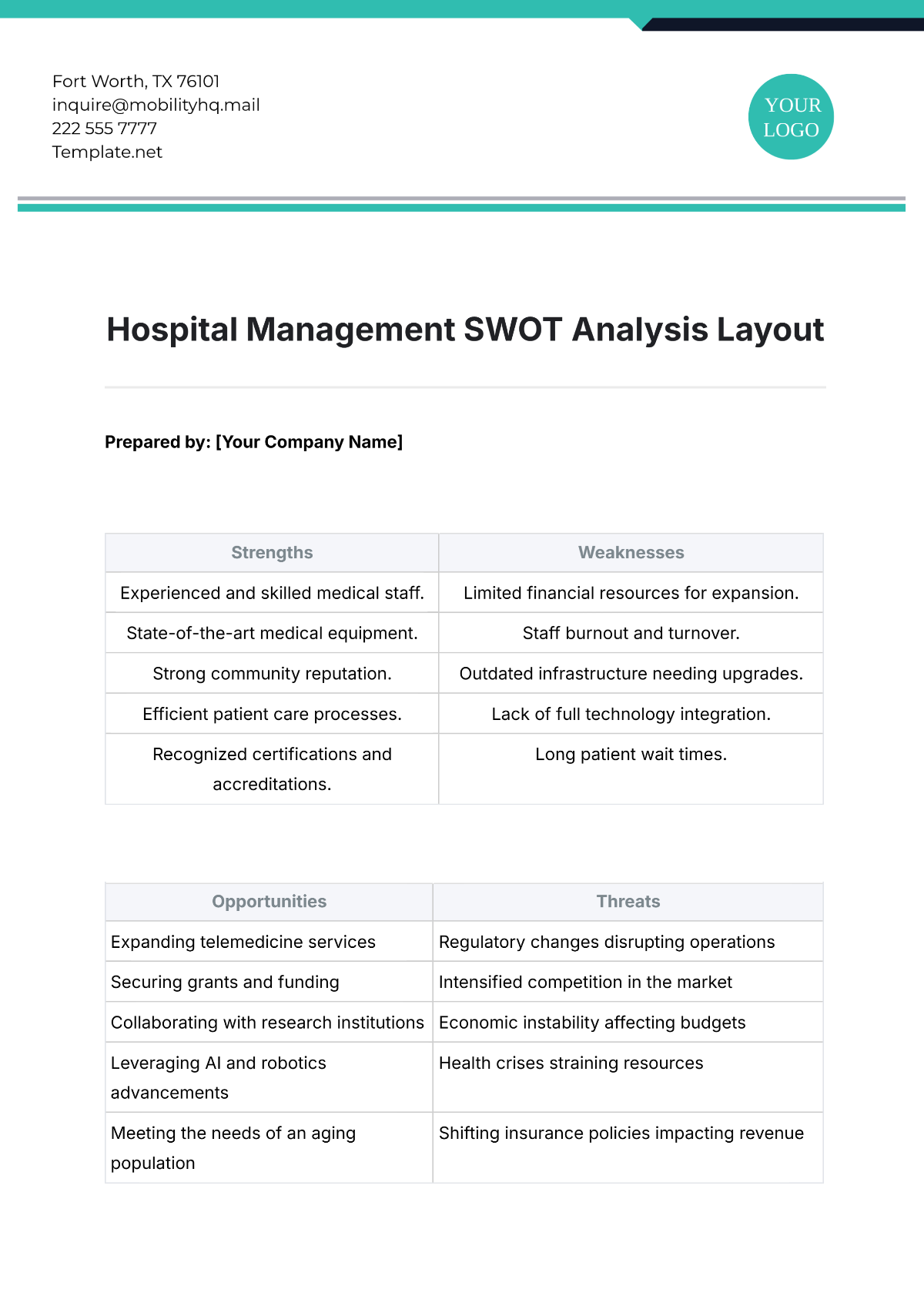

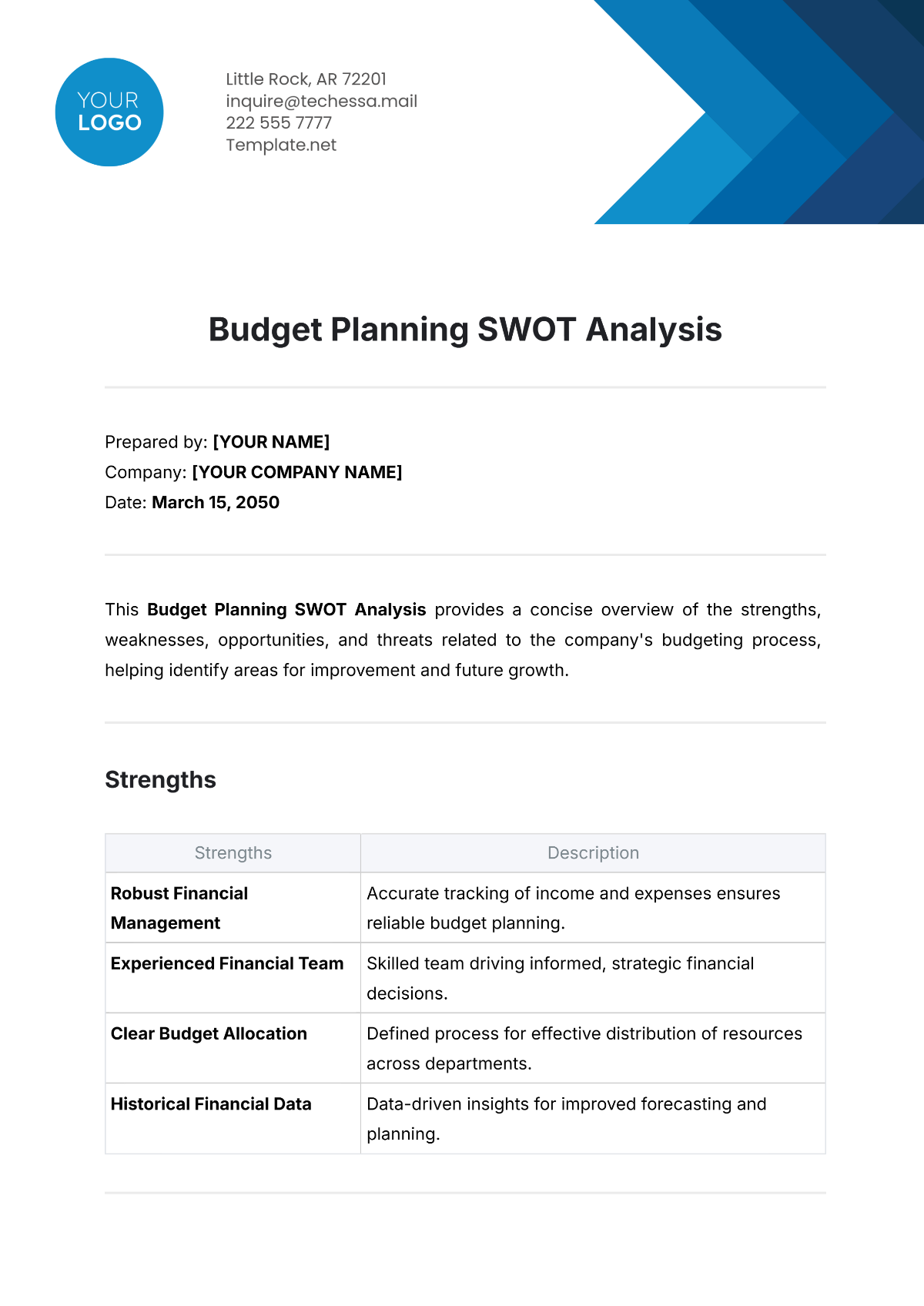

Initiative | Description | Target Audience | Timeline |

|---|---|---|---|

Advanced-Data Analytics Training | Hands-on training on data analytics tools | Internal Auditors | Q3 2050 |

Cybersecurity Awareness Program | Awareness sessions on cybersecurity best practices | All Staff | Q4 2051 |

Fraud Examination Certification | Certification program for fraud examination skills | Selected Internal Auditors | Q1 2052 |

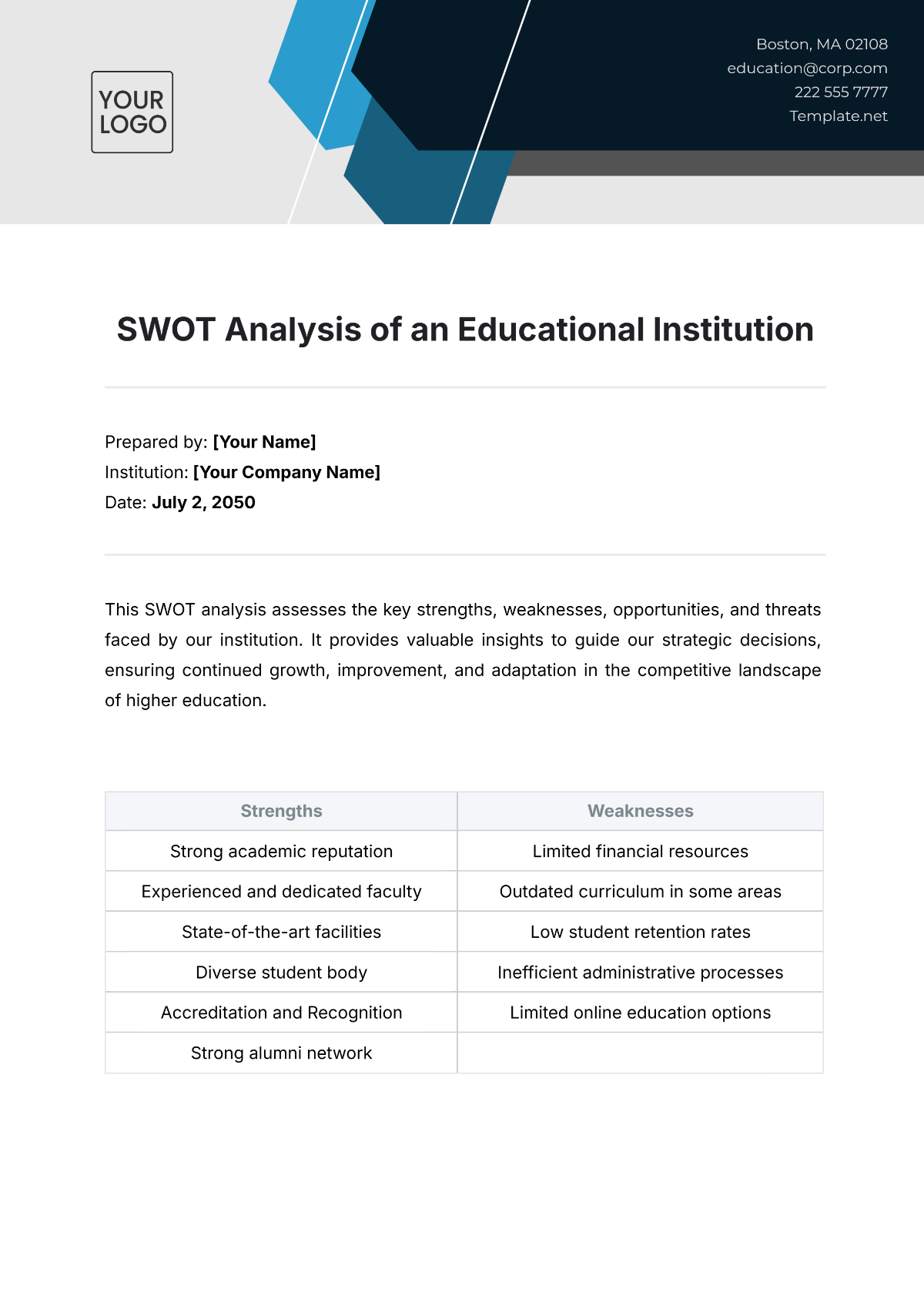

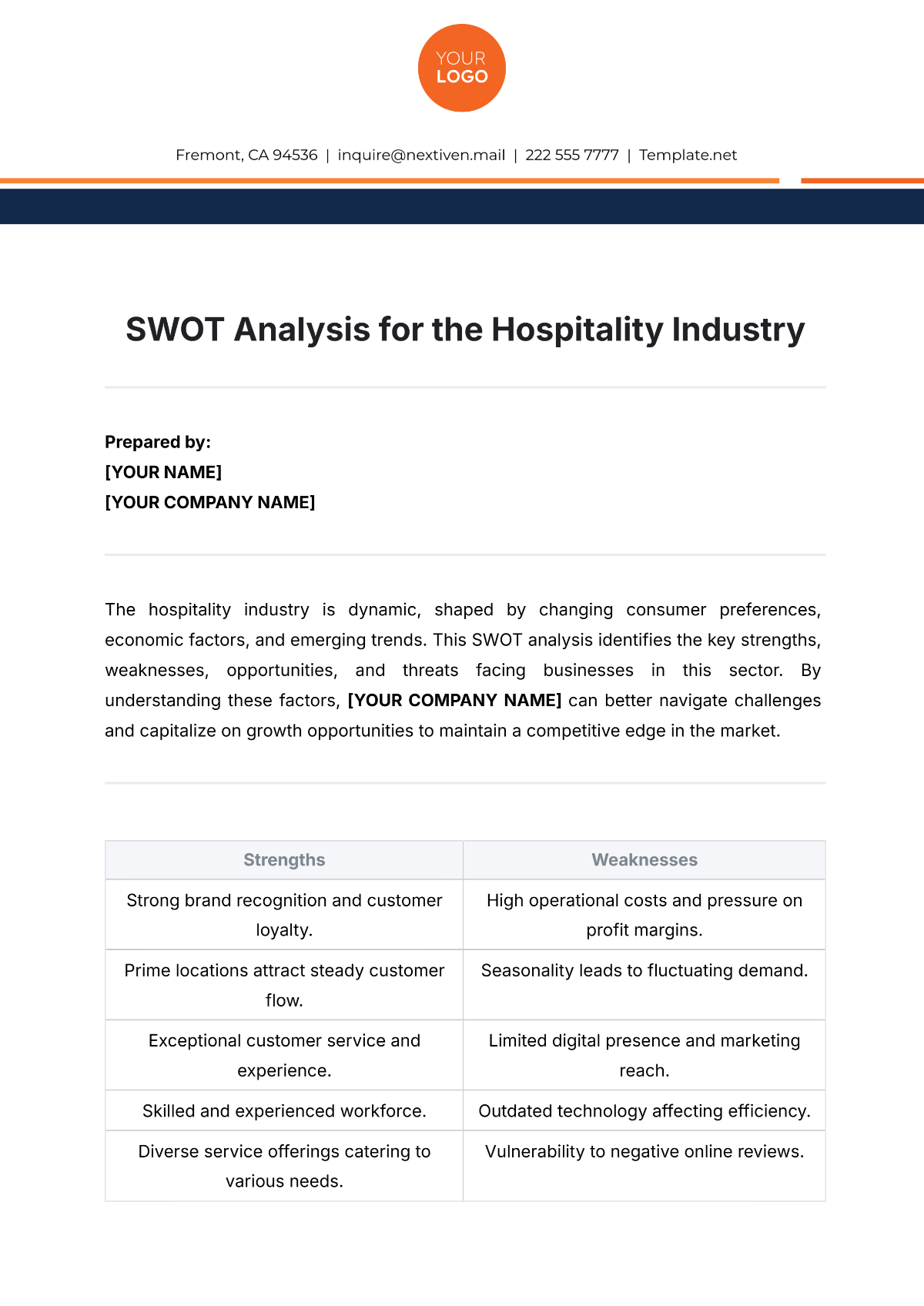

Regulatory Changes: Anticipation of upcoming regulatory updates, such as changes in accounting standards or industry-specific regulations, creates opportunities for proactive compliance efforts and alignment with best practices.

Technological Advancements: Integration of new technologies to enhance audit efficiency and effectiveness, such as implementing artificial intelligence (AI) for predictive analytics or blockchain for enhancing audit trail transparency.

Organizational Growth: Expansion into new markets or business lines requiring tailored audit approaches, such as conducting risk assessments for new product launches or acquisitions.

Training and Development: Investing in professional development opportunities for internal auditors to enhance skill sets, such as certifications in specialized areas like IT auditing or fraud examination.

VI. Threats

Budget Cuts: Potential reductions in funding impact the scope and quality of audit activities, leading to compromises in audit coverage or the ability to address emerging risks adequately.

Staff Turnover: Loss of key personnel leading to knowledge gaps and disruptions in audit continuity, necessitating succession planning and knowledge transfer initiatives to mitigate the impact of turnover.

Emerging Risks: Identification of new risks or uncertainties challenging the effectiveness of current audit processes, such as cybersecurity threats or geopolitical instability. Continuous monitoring and updating of risk assessments are essential to address these evolving risks.

Changing Priorities: Shifts in organizational objectives impact the focus and resources allocated to internal audits, potentially leading to misalignment with strategic goals or neglect of critical risk areas.

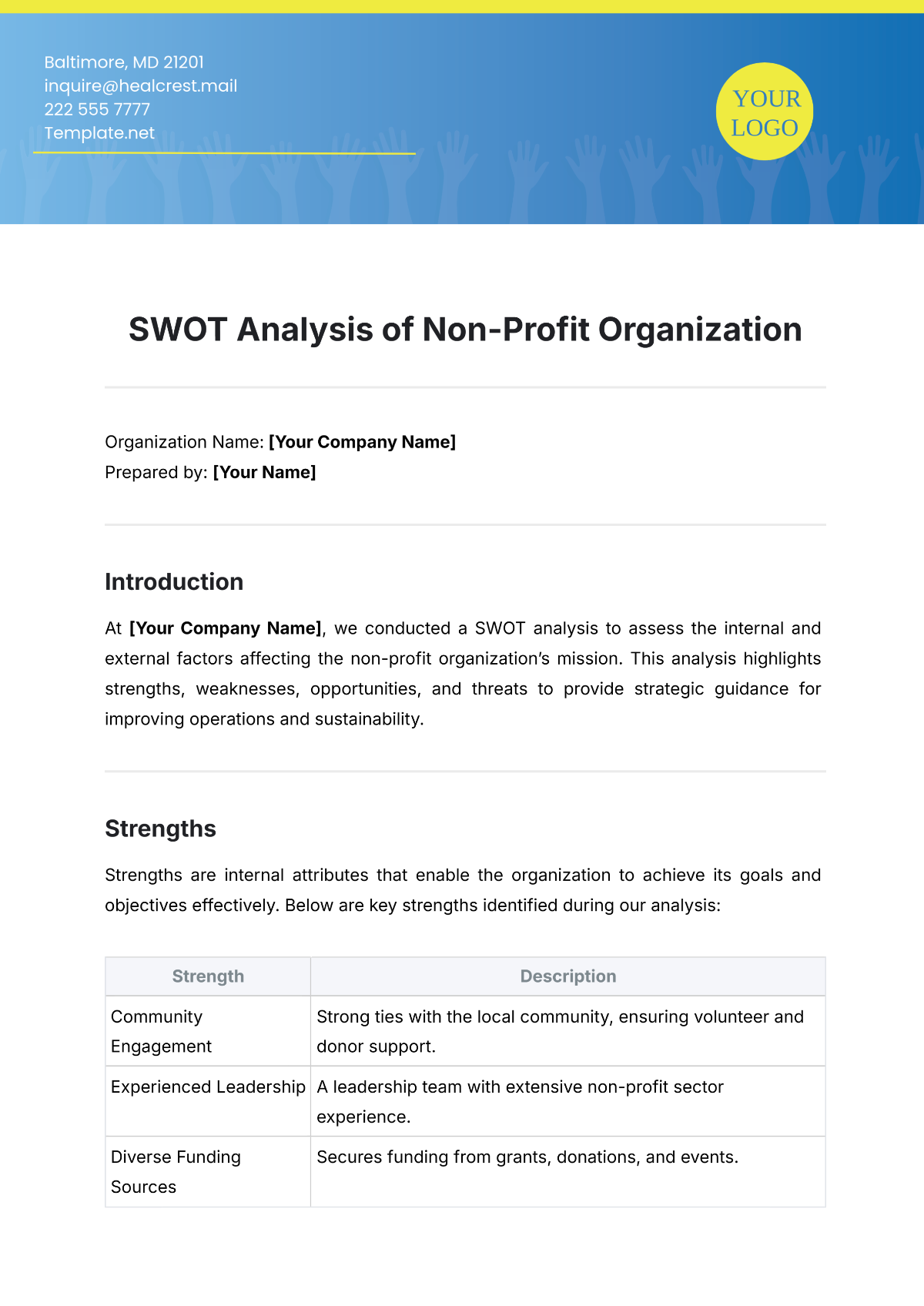

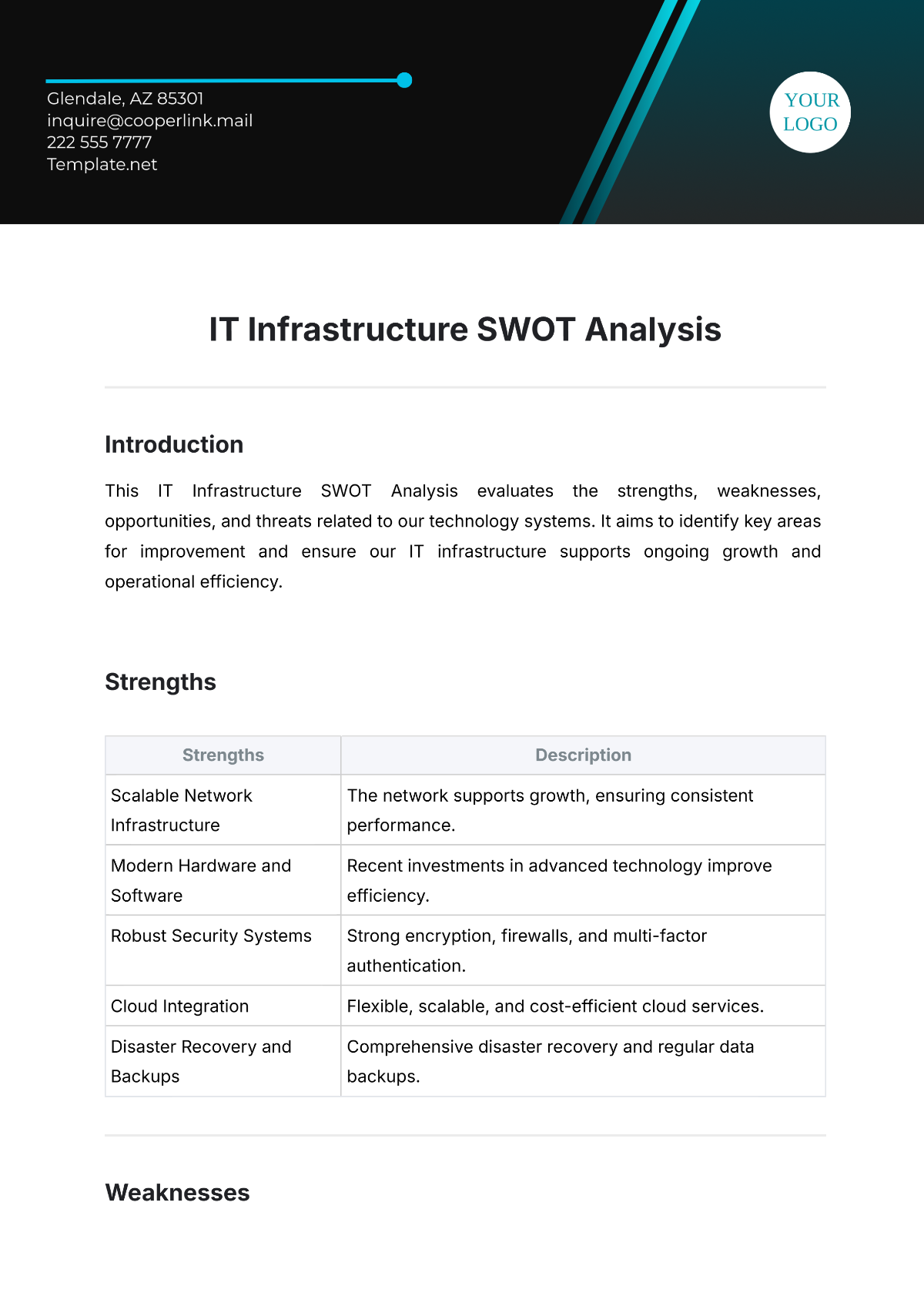

Regulation/Standard | Description | Implications for Internal Audit |

|---|---|---|

GDPR | The General Data Protection Regulation (GDPR) enhances data protection and privacy for individuals in the EU and EEA, imposing strict data processing, consent, and breach notification rules. | Internal audits must ensure GDPR compliance by evaluating data processes, conducting privacy assessments, and monitoring protection measures. |

SOX (Sarbanes-Oxley Act) | The Sarbanes-Oxley Act of 2050 enhances corporate governance and financial transparency by requiring stringent internal controls and mandating management and auditors to evaluate and disclose their effectiveness. | Internal audit is crucial for assessing internal controls, ensuring SOX compliance, and ensuring the reliability of financial reporting to management and external auditors. |

IFRS 16 | IFRS 16 mandates lessees to include lease liabilities and right-of-use assets on balance sheets, enhancing financial statement transparency and comparability. | Internal audit must evaluate how adopting IFRS 16 affects financial reporting, focusing on lease accounting policies, data management, and disclosures, while also assessing control effectiveness and compliance with the new standard. |

Basel III | Basel III is an international regulatory framework created by the Basel Committee on Banking Supervision that strengthens bank capital norms, enhances risk management, and boosts the banking sector's resilience to financial shocks. | Internal audit must evaluate compliance with Basel III standards, including capital adequacy, liquidity, and risk management, by assessing risk measurement, reporting frameworks, stress testing, and capital planning effectiveness. |

FCPA (Foreign Corrupt Practices Act) | The Foreign Corrupt Practices Act (FCPA) bans foreign official bribery, mandates accurate record-keeping and internal controls for U.S.-listed companies, and seeks to curb corruption and enhance transparency in global business. | Internal audit is key for evaluating FCPA compliance, third-party due diligence, and the efficacy of anti-corruption measures. |

VII. Conclusion

Summarize key findings from the Internal Audit SWOT Analysis, emphasizing the importance of leveraging strengths, addressing weaknesses, capitalizing on opportunities, and mitigating threats to enhance the internal audit function's effectiveness.

Highlight actionable insights and recommendations for enhancing the internal audit function's performance, such as investing in technology upgrades, enhancing training programs, and strengthening independence and objectivity.

Emphasize the importance of ongoing monitoring and review to address identified weaknesses and capitalize on opportunities, ensuring the internal audit function remains aligned with organizational objectives and stakeholders' expectations.