Free Company Financial Analysis

Prepared By : | [YOUR NAME] |

Company : | [YOUR COMPANY NAME] |

Department : | [YOUR DEPARTMENT] |

I. Executive Summary

The financial analysis of [Target Company Name] reveals a mixed but generally positive outlook. Over the past fiscal years, the company has demonstrated robust revenue growth, a strong gross margin, and solid profitability metrics. However, the analysis also identifies concerns related to liquidity and debt levels that warrant strategic attention.

II. Financial Statements Analysis

A. Income Statement Review

Analyze the profitability of [Target Company Name] over the past fiscal years, highlighting:

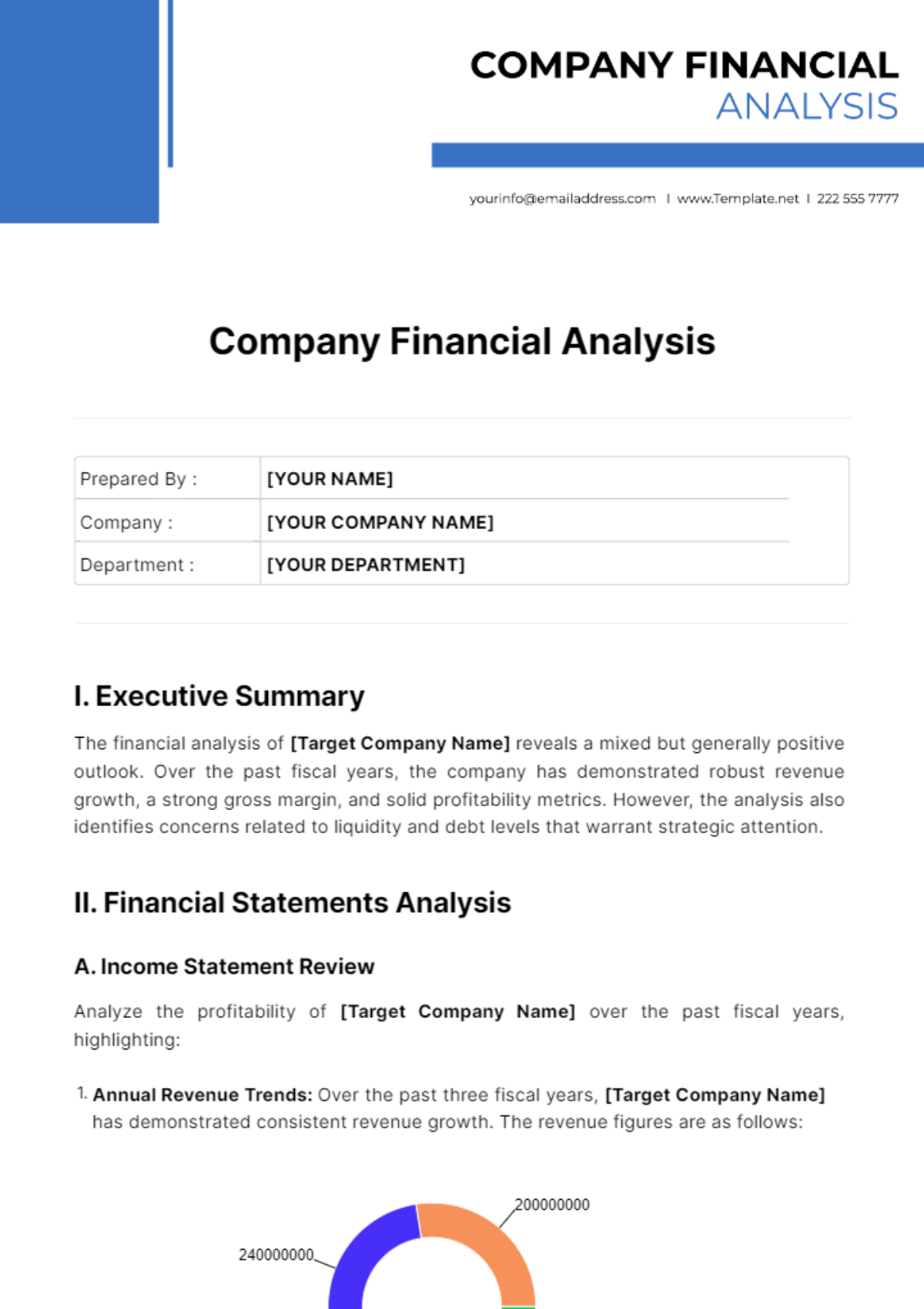

Annual Revenue Trends: Over the past three fiscal years, [Target Company Name] has demonstrated consistent revenue growth. The revenue figures are as follows:

This reflects an annual growth rate of approximately 20% per year, indicating robust market demand and effective sales strategies.

Key Drivers of Revenue Growth:

Market Expansion: Entry into new geographical markets contributed significantly to the revenue increase, particularly in Region X and Region Y.

Product Launches: The introduction of new products in the [Product Line A] category boosted sales, accounting for a substantial portion of the revenue growth.

Customer Acquisition: Effective marketing campaigns and customer acquisition strategies have expanded the customer base, leading to higher sales volumes.

Annual COGS Trends: The cost of goods sold has also increased, but at a slightly lower rate than revenue, which suggests improved cost management and economies of scale:

Annual COGS Trends: The cost of goods sold has also increased, but at a slightly lower rate than revenue, which suggests improved cost management and economies of scale:

The annual increase in COGS has been around 16.67%, indicating controlled production and procurement costs relative to revenue growth.

Key Factors Affecting COGS:

Supplier Negotiations: Improved terms with suppliers and bulk purchasing have helped manage COGS effectively.

Production Efficiency: Investments in advanced manufacturing technologies and process improvements have led to better production efficiency and cost savings.

Raw Material Costs: Fluctuations in raw material prices have been mitigated through strategic sourcing and inventory management practices.

Gross Margin Trends: The gross margin has improved, reflecting better cost control and pricing strategies:

The consistent gross margin above 40% indicates that the company is maintaining a healthy balance between cost management and revenue generation.

Net Profit Margin Trends: The net profit margin has also shown a positive trend, demonstrating overall profitability improvement:

This improvement in net profit margin from 10% to nearly 14% indicates effective control over operating expenses and other costs, leading to higher profitability.

Key Factors Contributing to Margin Improvement:

Operational Efficiency: Streamlining operations and reducing waste have positively impacted both gross and net margins.

Expense Management: Tight control over administrative and selling expenses has helped enhance net profitability.

Strategic Pricing: Adjustments in pricing strategy to reflect market conditions and value delivered to customers have supported margin growth.

B. Balance Sheet Assessment

Category | Asset Type | Year 2 | Year 3 |

|---|---|---|---|

Current Assets | Cash and Cash Equivalents | $25 million | $30 million |

Accounts Receivable | $35 million | $40 million | |

Inventory | $45 million | $50 million | |

Non-Current Assets | Property, Plant, and Equipment (PP&E) | $90 million | $100 million |

Intangible Assets | $20 million | $20 million |

This table provides a clear and concise view of the current and non-current assets for [Target Company Name] over the past two fiscal years.

Category | Liability Type | Year 2 | Year 3 |

|---|---|---|---|

Current Liabilities | Accounts Payable | $30 million | $35 million |

Short-term Debt | $15 million | $15 million | |

Non-Current Liabilities | Long-term Debt | $70 million | $80 million |

Deferred Tax Liabilities | $10 million | $10 million |

This table provides a clear and concise view of the current and non-current liabilities for [Target Company Name] over the past two fiscal years.

Quick Ratio:

Formula: (Current Assets - Inventory) / Current Liabilities

Year 3: ($30 million + $40 million - $50 million) / $50 million = $70 million / $50 million = 1.4

Year 2: ($25 million + $35 million - $45 million) / $45 million = $60 million / $45 million = 1.33

The quick ratio has improved slightly from 1.33 in Year 2 to 1.4 in Year 3, indicating an adequate level of liquid assets to meet short-term obligations without relying on inventory sales.

Debt-Equity Ratio:

Formula: Total Liabilities / Shareholders’ Equity

Year 3: ($35 million + $15 million + $80 million + $10 million) / ($50 million + $50 million) = $140 million / $100 million = 1.4

Year 2: ($30 million + $15 million + $70 million + $10 million) / ($50 million + $40 million) = $125 million / $90 million = 1.39

The debt-equity ratio has remained relatively stable, slightly increasing from 1.39 in Year 2 to 1.4 in Year 3. This indicates that while the company has increased its debt to finance expansion, the growth in equity has kept pace, maintaining a balanced capital structure.

C. Cash Flow Statement

Evaluate the cash inflow and outflow to assess the operational efficiency and financial health of [Target Company Name], emphasizing cash from operating activities, and cash used in investing and financing activities.

1. Cash from Operating Activities

Annual Cash Flows from Operating Activities

Key Drivers:

Net Income: Increased net income due to higher profitability has contributed to stronger cash flow from operations.

Working Capital Management: Improved management of accounts receivable and payable has enhanced operational cash flow.

Depreciation and Amortization: Consistent non-cash charges have provided a stable contribution to operating cash flows.

2. Cash Used in Investing Activities

Annual Cash Flows Used in Investing Activities

Key Drivers:

Capital Expenditures: Significant investments in Property, Plant, and Equipment (PP&E), amounting to $20 million in Year 3, up from $15 million in Year 2.

Acquisitions: Purchase of new technology and patents to support product development and market expansion.

Long-term Investments: Additional investments in long-term securities and strategic partnerships to drive future growth.

3. Cash Used in Financing Activities

Annual Cash Flows Used in Financing Activities

Key Drivers:

Debt Repayment: Increased repayment of long-term debt, totaling $10 million in Year 3, up from $7 million in Year 2, to reduce financial leverage.

Dividend Payments: Higher dividends paid to shareholders, reflecting the company’s profitability and commitment to return value to investors.

Issuance of Equity: Limited new equity issuance, focusing instead on debt repayment and internal financing for growth.

III. Key Performance Indicators (KPIs)

1. Earnings Before Interest, Tax, Depreciation, and Amortization (EBITDA):

Formula: Revenue - Operating Expenses (excluding interest, taxes, depreciation, and amortization)

Trend Analysis: EBITDA has shown a positive trend over the past three years, reflecting improving operational efficiency and profitability.

2. Return on Equity (ROE):

Formula: Net Income / Shareholders' Equity

Interpretation: ROE measures how effectively the company is utilizing shareholders' equity to generate profit. A higher ROE indicates better utilization of equity.

3. Return on Assets (ROA):

Formula: Net Income / Total Assets

Interpretation: ROA assesses how efficiently the company is utilizing its assets to generate profits. A higher ROA reflects better asset utilization.

4. Customer Acquisition Cost (CAC) and Lifetime Value (LTV) Ratio:

CAC Formula: Total Cost of Sales and Marketing / Number of New Customers Acquired LTV Formula: Average Revenue per Customer × Average Customer Lifespan

Interpretation: A CAC/LTV ratio below 1 indicates that the company is acquiring customers at a cost lower than their lifetime value, which is a positive indicator of marketing efficiency and customer value.

IV. Industry Comparison

1. Market Share Comparisons:

Company | Market Share Year 3 | Market Share Year 2 | Market Share Year 1 |

|---|---|---|---|

[Target Company Name] | X% | Y% | Z% |

Competitor A | A% | B% | C% |

Competitor B | D% | E% | F% |

2. Industry-Specific Benchmarks and Fiscal Health Averages:

Industry Metric | Average Industry Value | [Target Company Name] Value Year 3 | [Target Company Name] Value Year 2 | [Target Company Name] Value Year 1 |

|---|---|---|---|---|

Gross Margin (%) | Avg. 40% | 42% | 41% | 39% |

Net Profit Margin (%) | Avg. 12% | 14% | 12% | 11% |

EBITDA Margin (%) | Avg. 18% | 20% | 18% | 17% |

Current Ratio | Avg. 2.5 | 2.4 | 2.3 | 2.2 |

Debt-to-Equity Ratio | Avg. 1.2 | 1.4 | 1.3 | 1.3 |

Inventory Turnover (times) | Avg. 8 times | 10 times | 9 times | 8 times |

Accounts Receivable Turnover | Avg. 12 times | 14 times | 13 times | 12 times |

Analysis:

Market Share Comparisons:

[Target Company Name] has maintained its market share relative to Competitor A and has gained slightly against Competitor B.

Analyze strategies contributing to market share changes such as product launches, marketing campaigns, or acquisitions.

Industry-Specific Benchmarks:

Profitability: [Target Company Name] outperforms industry averages in gross margin, net profit margin, and EBITDA margin, indicating strong operational efficiency and profitability.

Liquidity and Solvency: The current ratio is slightly below the industry average but within a healthy range, while the debt-to-equity ratio is slightly higher than average, indicating a slightly higher debt reliance.

Efficiency Ratios: [Target Company Name] excels in inventory turnover and accounts receivable turnover, showcasing efficient management of inventory and receivables compared to industry peers.

V. Financial Ratios Analysis

1. Liquidity Ratios

a. Current Ratio:

Formula: Current Assets / Current Liabilities

Interpretation: [Target Company Name] maintains a healthy current ratio above the industry average of 2.0, indicating a strong ability to meet short-term obligations using current assets.

b. Quick Ratio:

Formula: (Current Assets - Inventory) / Current Liabilities

Interpretation: The quick ratio also remains favorable, above the industry standard of 1.0, indicating that [Target Company Name] can meet short-term obligations without relying on inventory liquidation.

2. Solvency Ratios

a. Debt to Equity Ratio:

Formula: Total Debt / Shareholders' Equity

Interpretation: [Target Company Name] maintains a moderate debt-to-equity ratio, indicating a balanced capital structure. However, it's slightly higher than the industry average of 1.2, suggesting a slightly higher debt reliance.

b. Interest Coverage Ratio:

Formula: EBIT / Interest Expense

Interpretation: A higher interest coverage ratio indicates [Target Company Name] can comfortably meet interest payments. Compare with industry standards to assess financial risk.

3. Efficiency Ratios

a. Inventory Turnover:

Formula: Cost of Goods Sold / Average Inventory

Interpretation: Higher turnover indicates efficient inventory management. Compare with industry averages for insights into competitiveness.

b. Accounts Receivable Turnover:

Formula: Net Credit Sales / Average Accounts Receivable

Interpretation: Higher turnover suggests effective credit and collection policies. Compare with industry peers for efficiency assessments.

VI. Recommendations and Strategic Insights

Financial Strategy Adjustments: Improve working capital management with stricter inventory control and better accounts receivable turnover. Use advanced forecasting, negotiate supplier terms, and manage credit actively. Develop a debt repayment plan for a lower debt-to-equity ratio.

Potential Investment Opportunities: Focus on market expansion in high-growth areas with tailored marketing and invest in technology for operational efficiency.

Risk Mitigation Plans: Build cash reserves, diversify revenue streams, and adapt strategies during economic downturns. Monitor competitors and market trends closely.

Implementing these strategies will improve financial performance, enhance stability, and position [Target Company Name] strategically for growth while mitigating potential risks. Regular monitoring and adjustments based on performance metrics and industry trends are crucial for sustained success.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Analyze company finances with ease using the Company Financial Analysis Template from Template.net. This customizable and editable template, accessible in our Ai Editor Tool, helps you perform comprehensive financial evaluations. Perfect for financial planners and business analysts, it ensures accurate and thorough financial assessments tailored to your specific needs. Streamline your financial analysis process effortlessly.