Cash Flow Analysis

Prepared By: | [Your Name] |

Company: | [Your Company Name] |

Address: | [Your Company Address] |

I. Executive Summary

This document serves as a comprehensive guide to forecasting future cash flows for [YOUR COMPANY NAME], aiming to anticipate funding requirements and address potential cash shortages proactively. By adopting this proactive approach, [YOUR COMPANY NAME] aims to streamline financial planning processes and ensure uninterrupted operational continuity.

II. Analysis Objectives

Forecast monthly cash flows for the upcoming fiscal year to gain clarity on financial requirements.

Identify potential shortfalls and surpluses to facilitate better resource allocation.

Evaluate the efficacy of existing cash management strategies to pinpoint areas for improvement.

Develop actionable recommendations to enhance the stability of cash flow management.

III. Methodology

The following methods were utilized to conduct the comprehensive cash flow analysis:

Collection of historical financial data spanning the last three years to establish a foundation for projections.

Analysis of seasonal trends and their impact on cash flow dynamics to account for cyclicality.

Utilization of statistical tools to project future cash requirements accurately.

Collaboration with department heads to align forecasts with planned initiatives and operational goals.

IV. Cash Flow Forecast

A. Monthly Cash Flow Projection

This section presents a detailed breakdown of projected income, projected expenditure, and net cash flow for each month of the fiscal year, providing a clear overview of expected financial performance.

Month | Projected Income ($) | Projected Expenditure ($) | Net Cash Flow ($) |

|---|---|---|---|

January | $50,000 | $40,000 | $10,000 |

February | $55,000 | $45,000 | $10,000 |

March | $60,000 | $50,000 | $10,000 |

April | $65,000 | $55,000 | $10,000 |

May | $70,000 | $60,000 | $10,000 |

June | $75,000 | $65,000 | $10,000 |

July | $80,000 | $70,000 | $10,000 |

August | $85,000 | $75,000 | $10,000 |

September | $90,000 | $80,000 | $10,000 |

October | $95,000 | $85,000 | $10,000 |

November | $100,000 | $90,000 | $10,000 |

December | $105,000 | $95,000 | $10,000 |

B. Analysis of Variance

A comparative analysis between projected and actual figures is conducted to identify discrepancies and refine future forecasts, ensuring greater accuracy in financial planning.

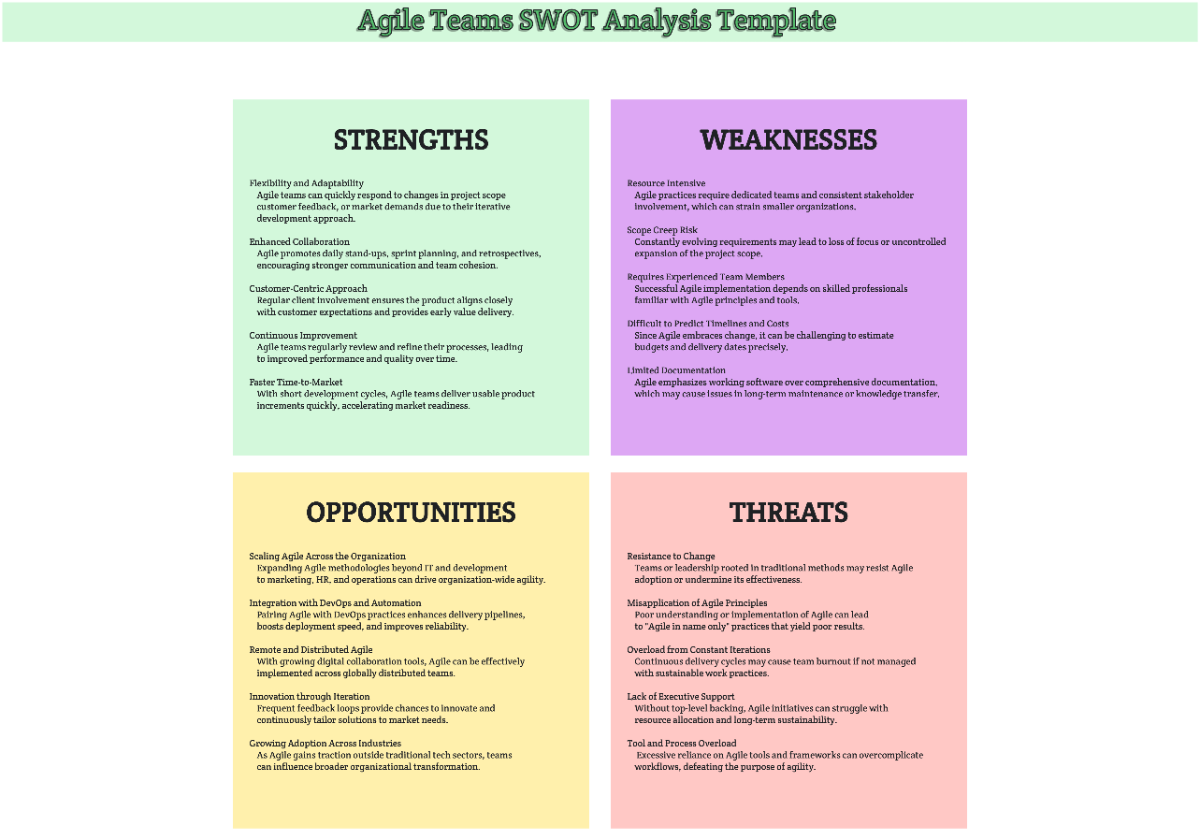

V. Risk Assessment and Management

Risks associated with cash flow fluctuations and strategies to mitigate such risks:

Risk of delayed client payments impacting operating cash: Measures such as incentivizing prompt payments and implementing robust credit control procedures can help alleviate this risk.

Liquidity risks due to unexpected market conditions: Establishing emergency funds and securing lines of credit can provide a buffer against unforeseen market volatility.

Strategies to establish emergency funds and lines of credit: By proactively securing alternative funding sources, [YOUR COMPANY NAME] can mitigate the impact of liquidity challenges.

VI. Recommendations

Strategic actions based on the forecast data to enhance cash flow management:

Optimize invoice timing to align with operational cash needs: By synchronizing invoicing with cash outflows, [YOUR COMPANY NAME] can optimize cash flow cycles.

Review and renegotiate supplier payment terms to prevent cash gaps: Negotiating favorable payment terms with suppliers can help manage cash flow more efficiently.

Invest in software solutions for real-time cash flow monitoring: Leveraging technology to track cash flow in real-time enables [YOUR COMPANY NAME] to respond swiftly to changing financial conditions.

VII. Conclusion

The forecast and analysis presented in this document empower [YOUR COMPANY NAME] with actionable insights to make informed financial decisions, thereby enhancing operational effectiveness and ensuring financial stability in the upcoming fiscal periods. By adopting a proactive approach to cash flow management, [YOUR COMPANY NAME] can navigate uncertainties with confidence and sustain long-term growth.