Budget Analysis

Prepared By: | [YOUR NAME] |

Department: | [YOUR DEPARTMENT] |

Company: | [YOUR COMPANY NAME] |

I. Executive Summary

A. Overview

Objective: Provide a comprehensive analysis of the budget to guide fiscal decision-making for [YOUR COMPANY NAME] in the year 2050.

Scope: Review of the fiscal year 2050 budget, including revenue, operating expenses, and capital expenditures, along with a variance analysis.

Key Findings: The analysis identified significant variances in both revenue and expenses, leading to strategic recommendations for better resource allocation.

B. Key Metrics

Total Budget: $20,000,000

Actual Expenditure: $18,500,000

Variance: $1,500,000

Percentage Variance: 7.5%

II. Budget Overview

A. Financial Summary

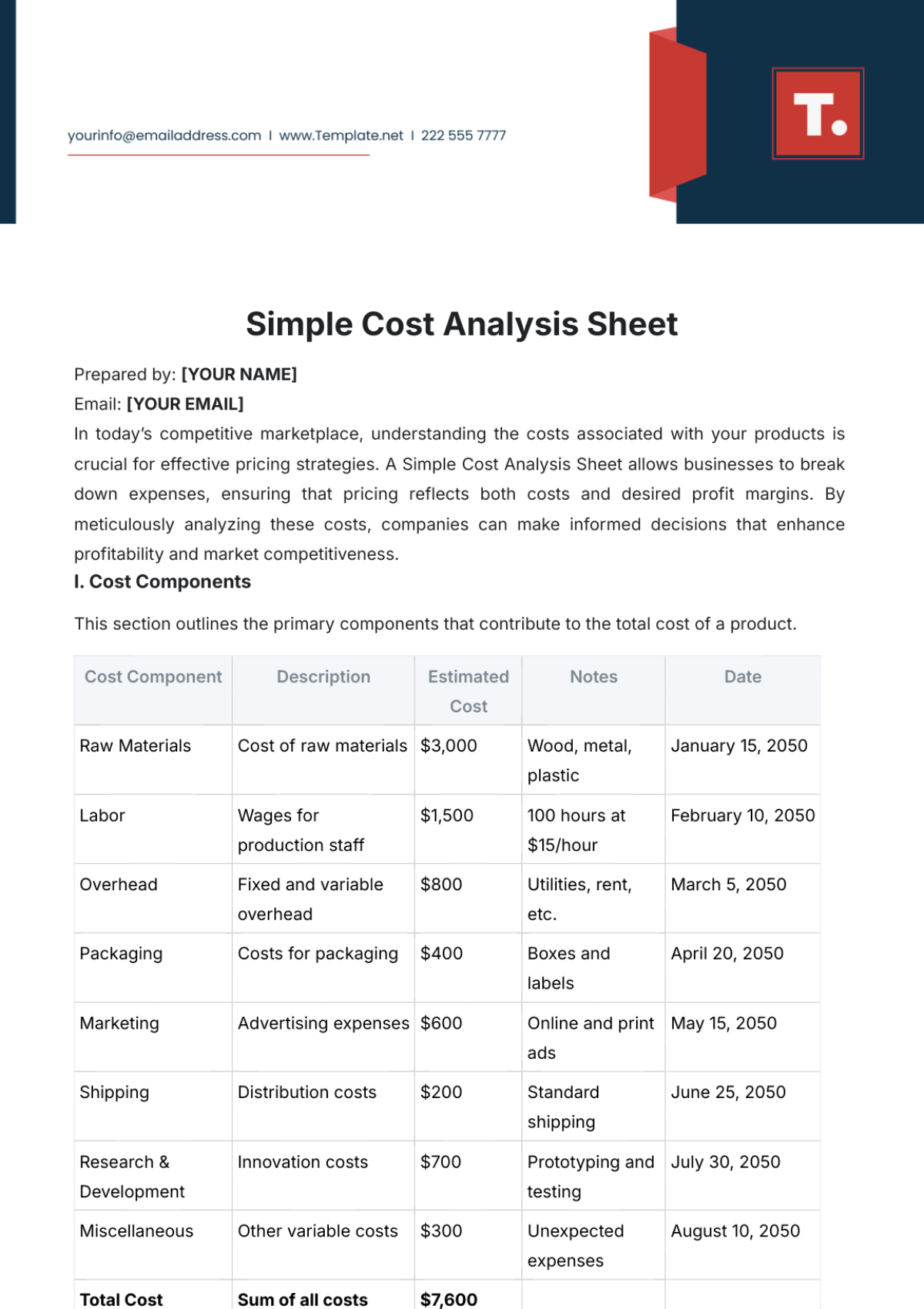

Category | Budgeted Amount | Actual Amount | Variance |

|---|---|---|---|

Revenue | $24,000,000 | $23,000,000 | -$1,000,000 |

Operating Expenses | $12,000,000 | $11,200,000 | -$800,000 |

Capital Expenditure | $8,000,000 | $7,300,000 | -$700,000 |

Total Expenditure | $20,000,000 | $18,500,000 | -$1,500,000 |

Net Income | $4,000,000 | $4,500,000 | +$500,000 |

B. Major Financial Categories

Revenue Streams:

Product Sales: $16,000,000

Service Revenue: $6,000,000

Other Revenue: $1,000,000

Expenditure Breakdown:

Operating Expenses:

Salaries and Wages: $6,000,000

Utilities: $1,000,000

Maintenance: $600,000

Capital Expenditures:

Equipment: $4,000,000

Infrastructure: $3,300,000

C. Detailed Budget Breakdown

Revenue Streams

Revenue Source | Budgeted Amount | Actual Amount | Variance |

|---|---|---|---|

Product Sales | $16,000,000 | $15,500,000 | -$500,000 |

Service Revenue | $6,000,000 | $5,500,000 | -$500,000 |

Other Revenue | $2,000,000 | $2,000,000 | $0 |

Operating Expenses

Expense Category | Budgeted Amount | Actual Amount | Variance | % Variance |

|---|---|---|---|---|

Salaries and Wages | $6,000,000 | $5,800,000 | -$200,000 | -3.33% |

Utilities | $1,000,000 | $950,000 | -$50,000 | -5% |

Maintenance | $600,000 | $550,000 | -$50,000 | -8.33% |

Other Expenses | $4,400,000 | $3,900,000 | -$500,000 | -11.36% |

III. Variance Analysis

A. Revenue Variances

Positive Variances:

Other Revenue met the budgeted $2,000,000 target due to consistent performance in miscellaneous income sources.

Negative Variances:

Product Sales fell short by $500,000, primarily due to decreased market demand in Q3 of 2050.

Service Revenue was $500,000 under budget, attributed to delays in project completions and client onboarding.

B. Expenditure Variances

Operating Expenses:

Over-budget: N/A

Under-budget:

Salaries and Wages: Savings of $200,000 from delayed hiring and attrition.

Utilities: Savings of $50,000 from implementing new energy-efficient systems.

Maintenance: Savings of $50,000 due to renegotiated contracts with maintenance providers.

Capital Expenditures:

Over-budget: N/A

Under-budget:

Equipment purchases were $700,000 less than budgeted due to bulk purchasing discounts and deferred acquisitions.

C. Causes and Implications

Root Causes:

Market fluctuations impact product demand.

Project delays affecting service revenue.

Effective implementation of cost-saving measures across various departments.

Implications for Financial Health:

The positive net income variance indicates a stronger financial position.

Lower expenditure provides opportunities for reinvestment or bolstering reserve funds.

IV. Recommendations

A. Strategic Recommendations

Cost Optimization:

Further, implement cost-saving measures in administrative expenses by automating more routine tasks.

Negotiate longer-term contracts with key suppliers to lock in lower rates and ensure price stability.

Revenue Enhancement:

Launch targeted marketing campaigns aimed at boosting product sales, particularly focusing on the underperforming segments.

Expand service offerings to attract more clients and diversify revenue streams, including exploring potential new markets.

B. Budget Adjustments

Increase Allocations:

Marketing Department: Increase by $500,000 to support aggressive new campaigns aimed at revenue growth.

Research and Development: Increase by $250,000 to accelerate innovation and new product development.

Decrease Allocations:

Administrative Costs: Decrease by $200,000 due to successful automation of routine tasks.

Travel Expenses: Decrease by $100,000 by leveraging virtual meeting technologies and reducing physical travel needs.

C. Monitoring and Control

Regular Monitoring:

Schedule monthly budget reviews with department heads to ensure adherence to budgetary guidelines and prompt identification of variances.

Utilize advanced financial software to monitor real-time expenses and revenue streams, ensuring timely corrective actions.

Control Mechanisms:

Implement stringent approval processes for expenditures exceeding $50,000 to maintain budgetary control.

Set up automated alerts for budget deviations exceeding 5% to facilitate immediate corrective measures.

V. Conclusion

A. Summary of Findings

The budget analysis for the year 2050 revealed a generally positive financial outlook for [YOUR COMPANY NAME], with a net income variance of +12.5%.

Significant savings were identified in both operating and capital expenditures, contributing to a stronger financial position.

Detailed recommendations have been provided for cost optimization and revenue enhancement to address the identified variances.

B. Final Thoughts

[YOUR COMPANY NAME] is committed to maintaining fiscal responsibility and leveraging insights from this analysis to drive strategic growth and long-term sustainability.

Stakeholders are invited to review the detailed findings and collaborate on implementing the proposed recommendations to ensure continued financial success.