Airline SWOT Analysis

Prepared by: [Your Name]

Position: [Your Position]

Date: [Date]

Contact Information: [Your Company Email], [Your Company Number]

I. Executive Summary

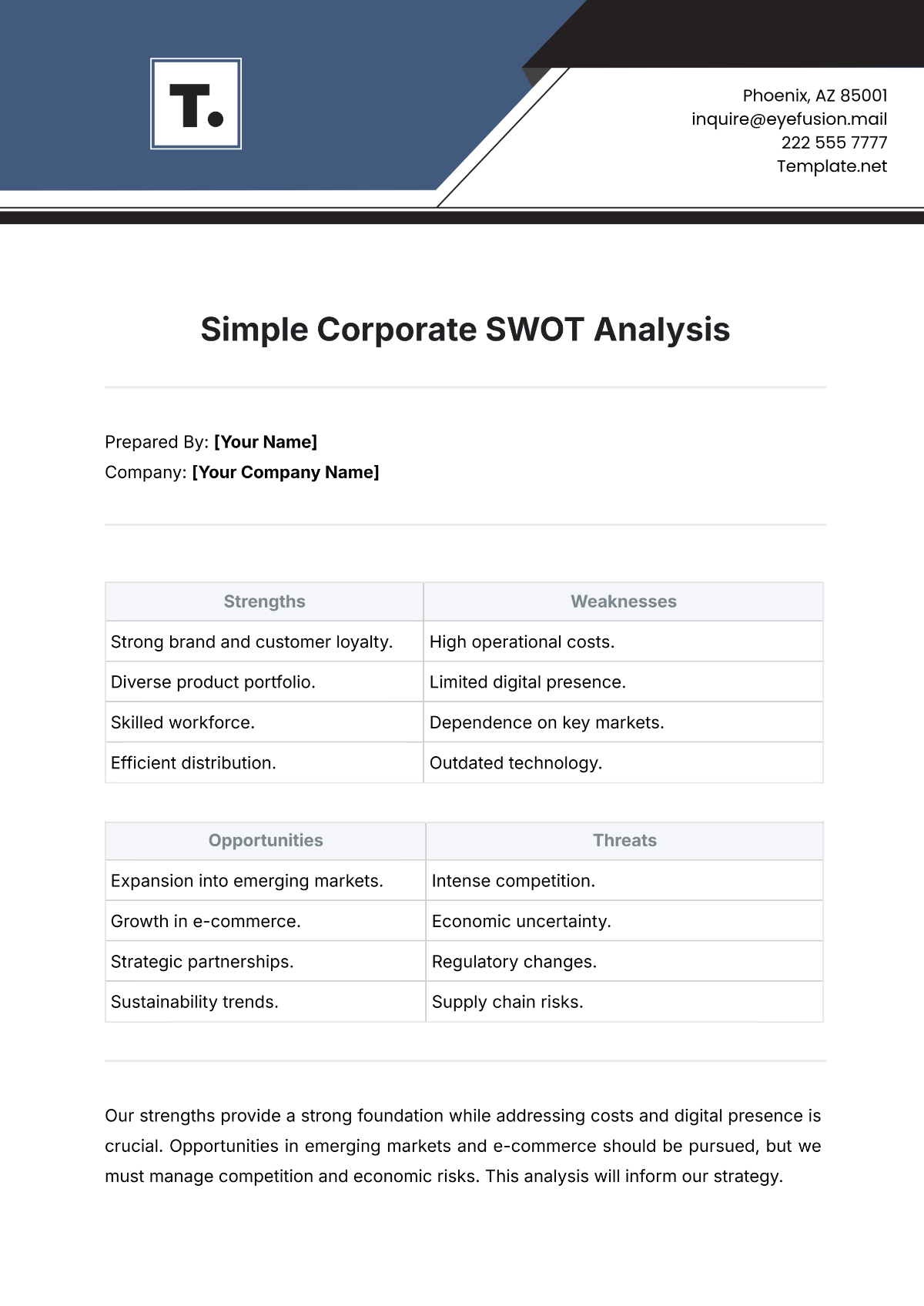

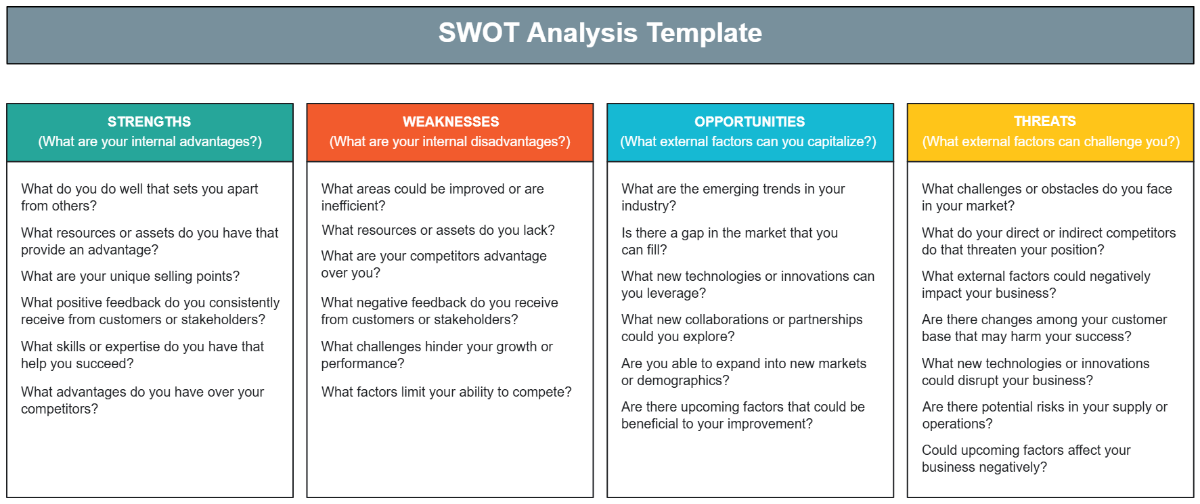

This Airline SWOT Analysis provides an in-depth look at the strengths, weaknesses, opportunities, and threats facing [Global Sky Airlines]. It is designed to aid investment decisions by highlighting critical factors that can influence the airline’s market position and financial performance.

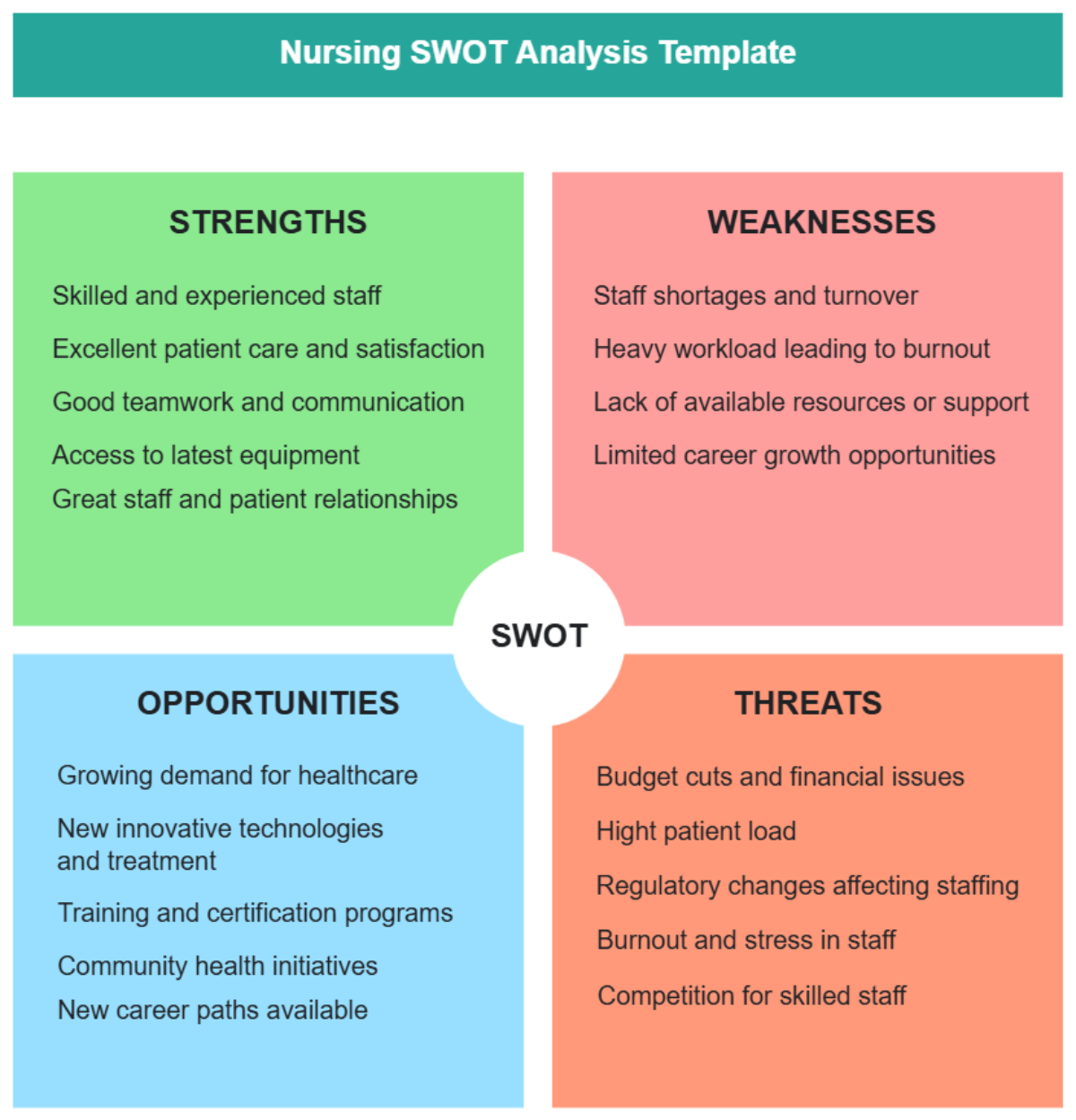

Key Findings

Strengths: Strong global brand, advanced digital systems, extensive route network

Weaknesses: High operational costs, dependency on international markets

Opportunities: Expansion into emerging markets, investment in green technologies

Threats: Regulatory pressures, geopolitical tensions

II. Introduction

The airline industry, pivotal for global connectivity, faces a rapidly changing landscape influenced by economic shifts, technological advancements, and geopolitical contexts. This analysis aims to dissect these elements to gauge investment viability.

III. Company Overview

A. Airline Profile

Name: [Global Sky Airlines]

Headquarters: [New York, USA]

Founded: [2001]

Fleet Size: [450 Aircraft]

Destinations: [350 Destinations]

Employees: [50,000 Employees]

B. Mission and Vision

Mission Statement: To connect the world with excellence in safety, service, and sustainability.

Vision Statement: To be the most trusted and innovative airline, leading the future of aviation.

IV. Analysis Overview

A. Methodology

The SWOT analysis was performed by collecting data from industry reports, market analysis tools, and stakeholder interviews. Key performance metrics across leading airlines were compared to industry standards.

B. Scope

The focus is on commercial airlines with an international presence and annual revenues exceeding $1 billion. The analysis timeframe spans the last five years to incorporate the latest impacts, such as the global pandemic and technological shifts in the sector.

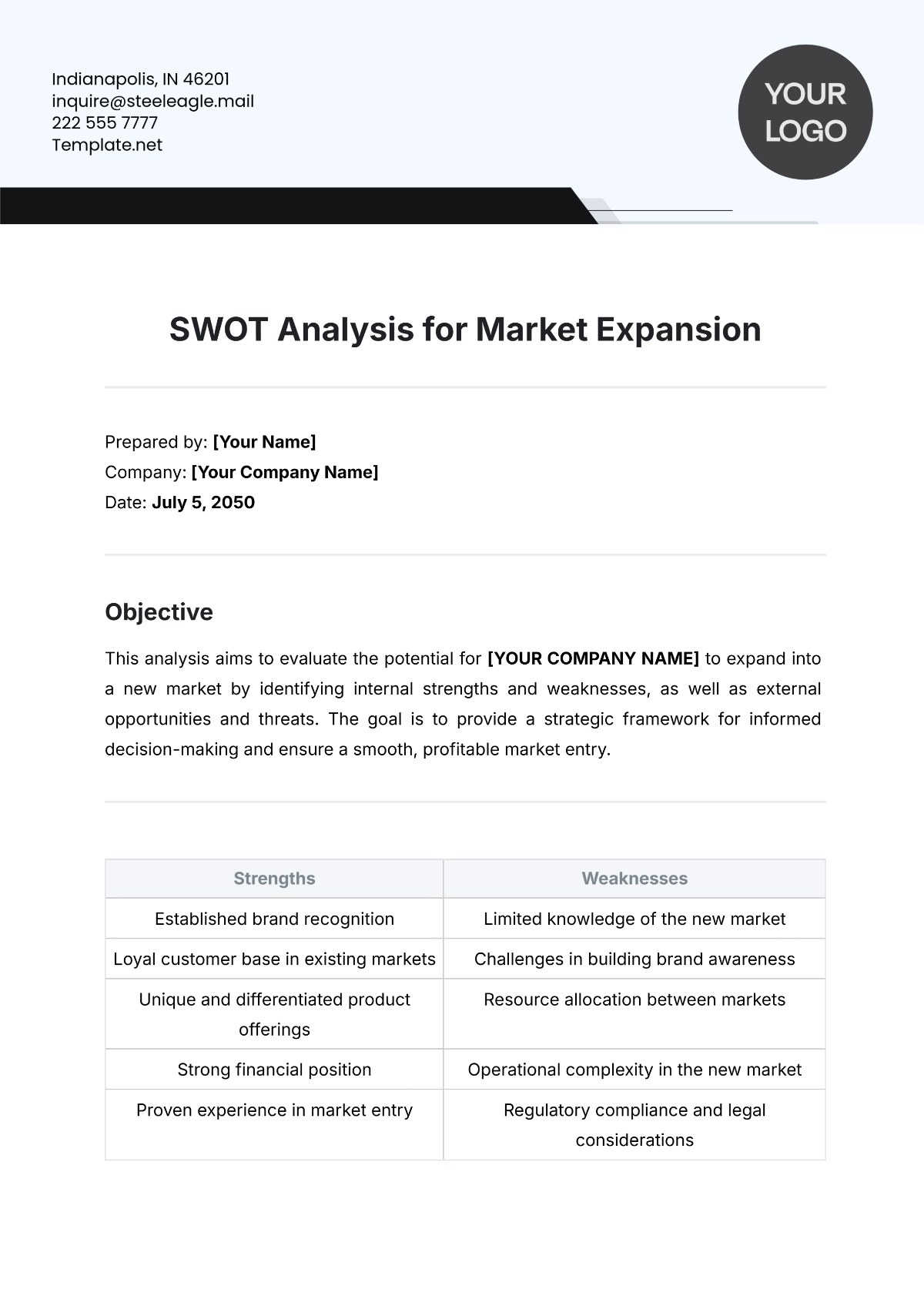

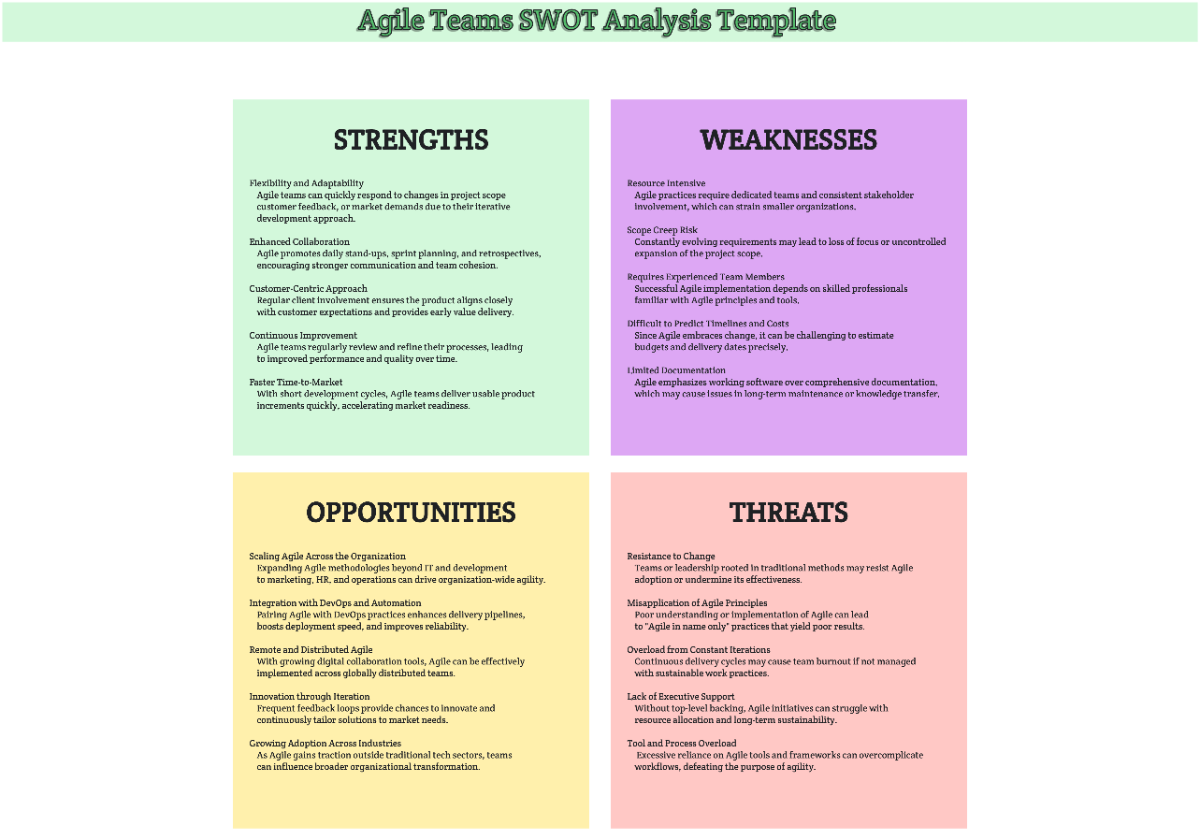

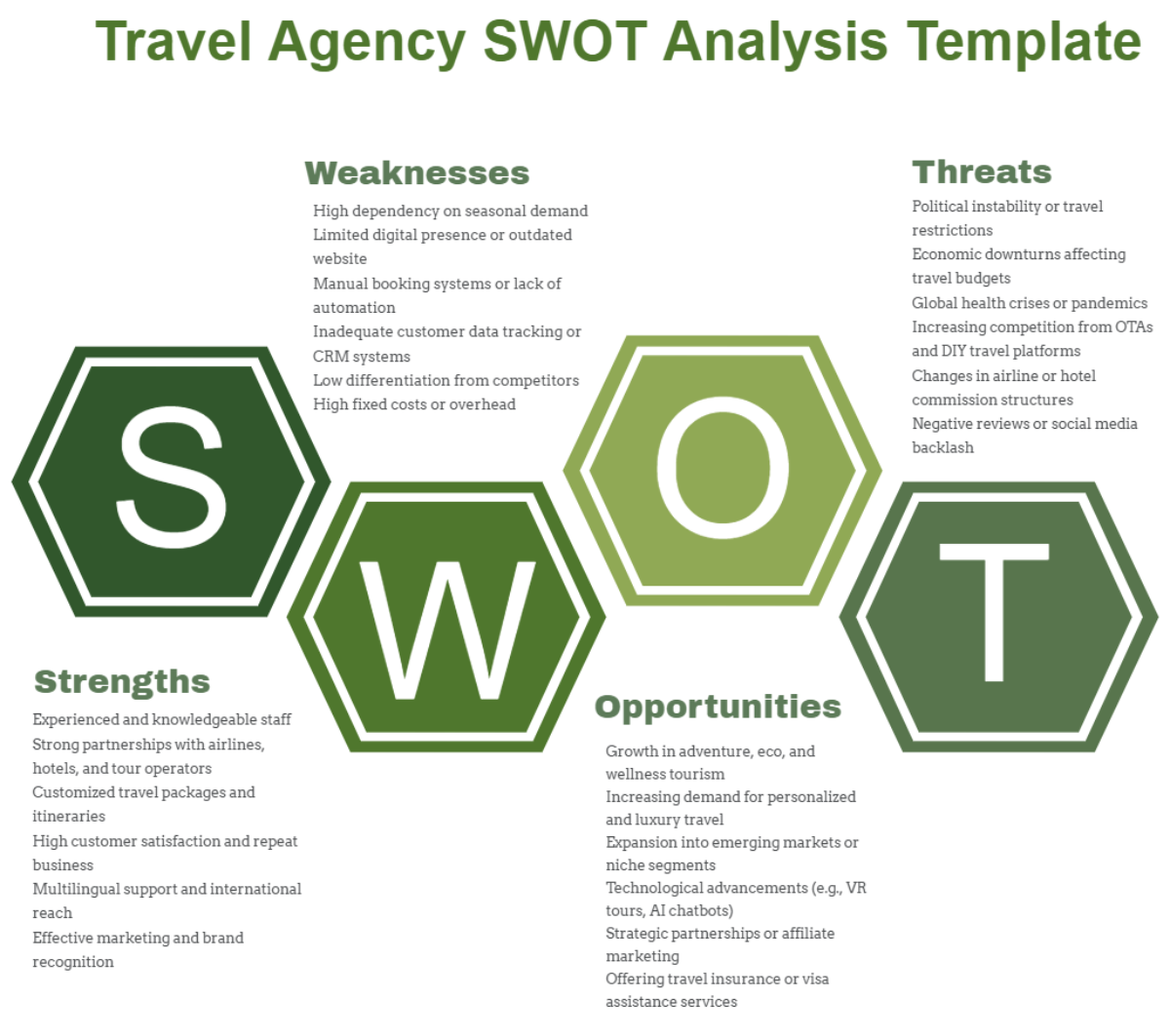

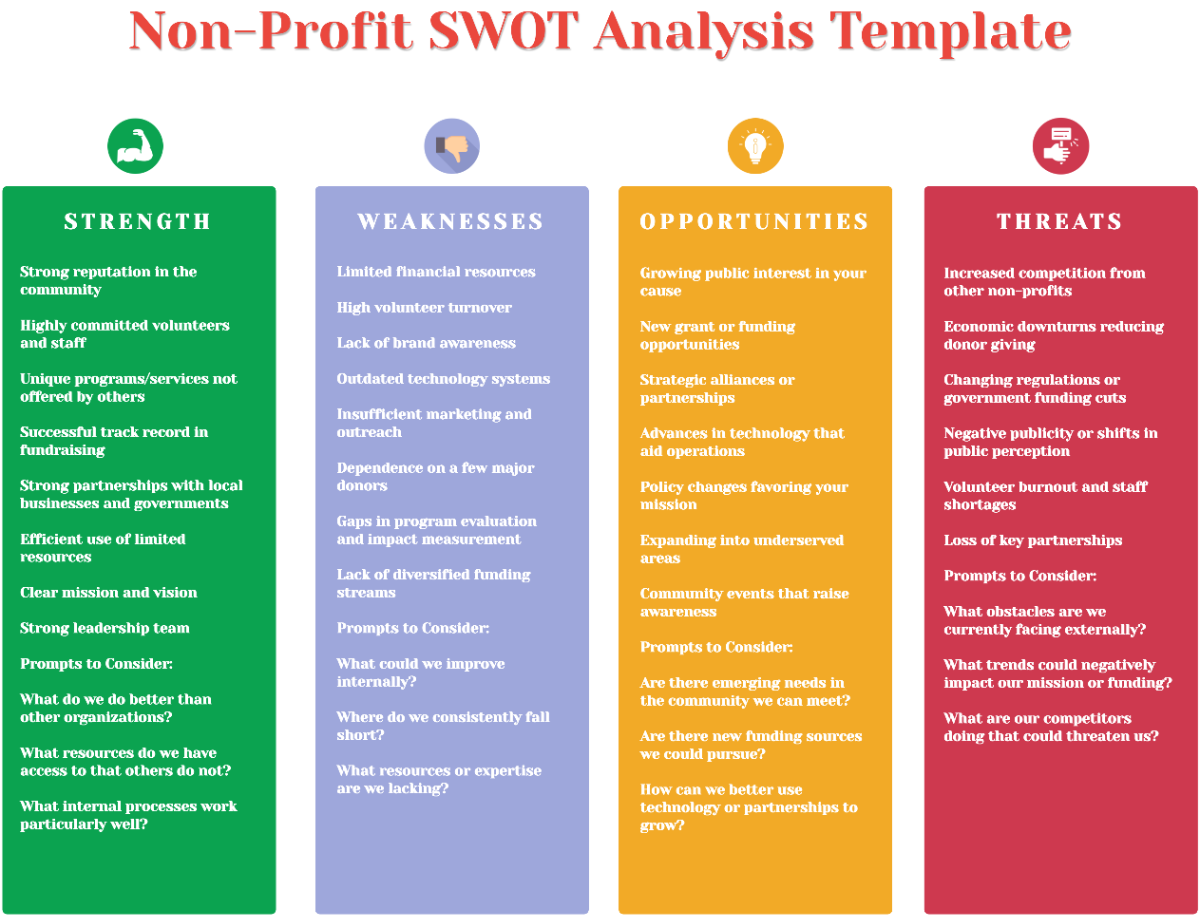

V. SWOT Analysis

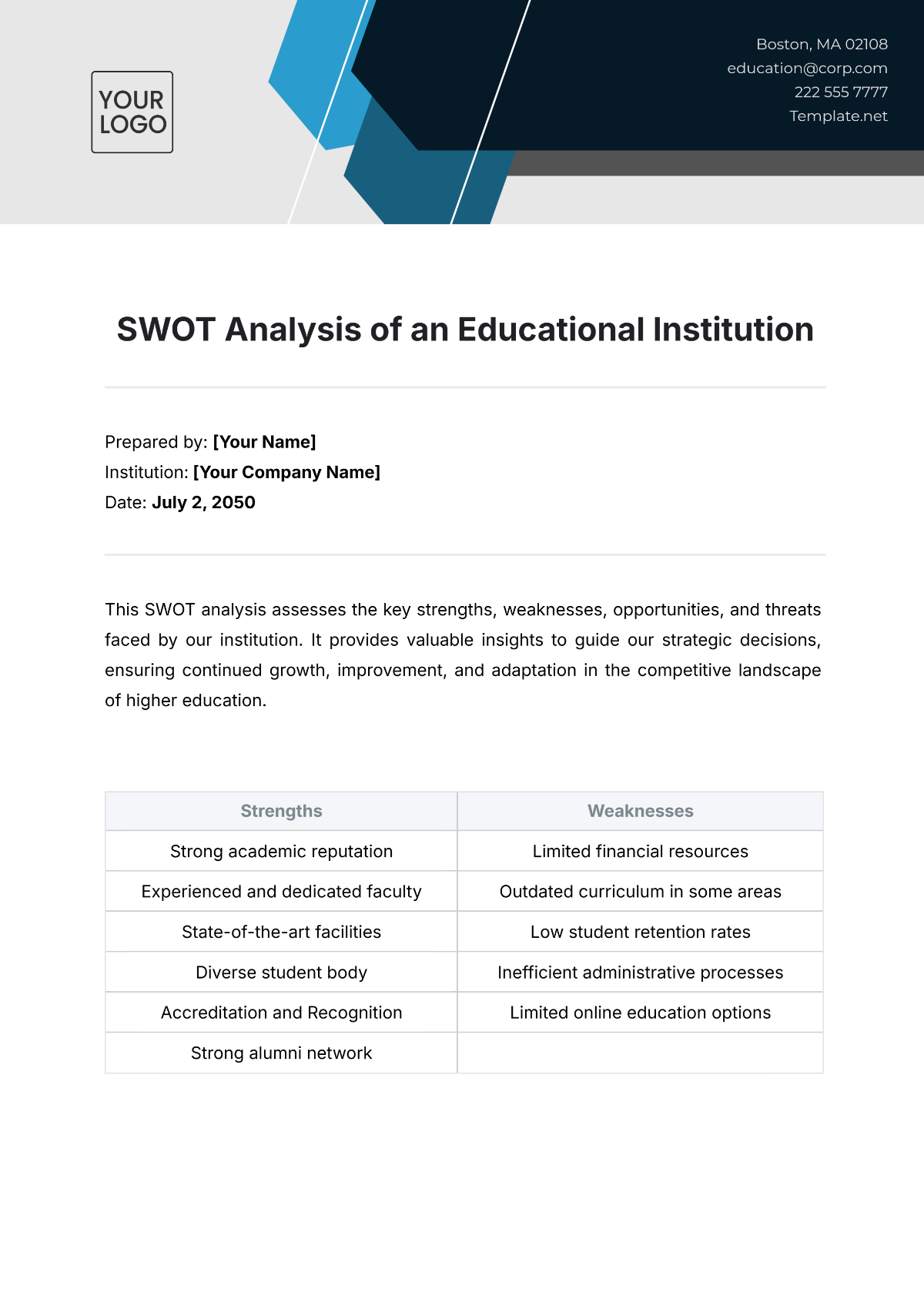

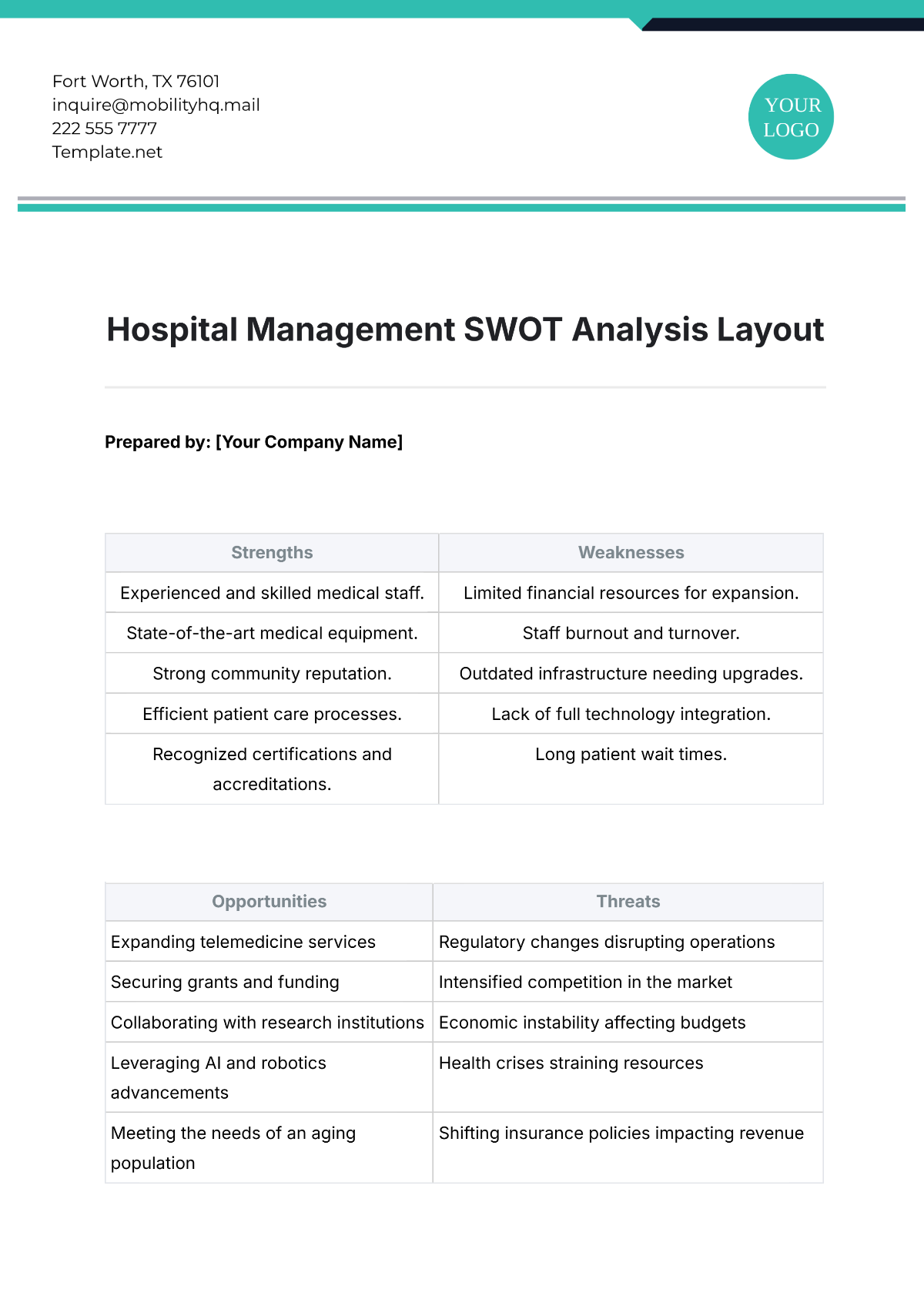

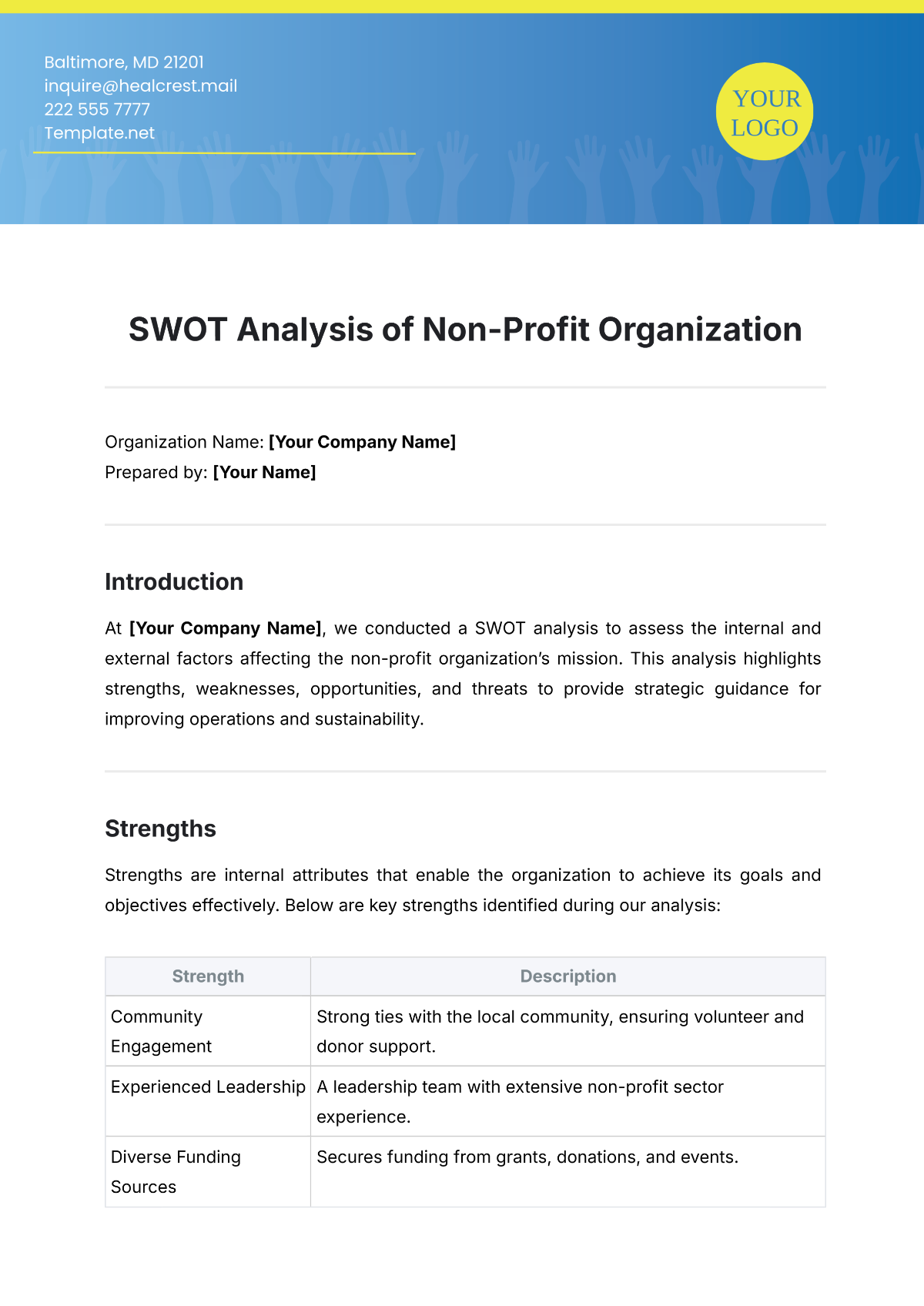

A. Strengths

Strong Brand Recognition

Details: [Global Sky Airlines] is renowned for its excellent service and safety standards, recognized worldwide.

Extensive Route Network

Details: Covers 350 destinations across all continents, providing unmatched connectivity.

Modern Fleet

Details: Fleet includes the latest fuel-efficient aircraft models, reducing operational costs and environmental impact.

Customer Loyalty Programs

Details: SkyMiles program retains a high percentage of repeat customers through valuable rewards and benefits.

B. Weaknesses

High Operating Costs

Details: Maintaining a modern fleet and extensive network results in high fixed and variable costs.

Limited Market Share in Key Regions

Details: Struggles to penetrate the Asia-Pacific market due to strong local competition.

Dependence on Hub Airports

Details: Heavy reliance on major hubs like JFK and LAX increases vulnerability to regional disruptions.

Labor Disputes

Details: Recent negotiations with pilot and cabin crew unions have been contentious, affecting operational stability.

C. Opportunities

Expanding Global Travel Demand

Details: Post-pandemic recovery is leading to increased travel demand, especially in leisure travel.

Alliances and Partnerships

Details: Potential for new code-sharing agreements with emerging airlines in Africa and South America.

Technological Advancements

Details: Investing in AI and IoT to enhance passenger experience and operational efficiency.

Emerging Markets

Details: Opportunities to enter and expand in fast-growing markets like India and Vietnam.

D. Threats

Economic Downturns

Details: Susceptible to global economic cycles which can drastically reduce travel demand.

Regulatory Changes

Details: New environmental regulations could increase compliance costs.

Fuel Price Volatility

Details: Fluctuations in fuel prices can significantly impact profit margins.

Increased Competition

Details: New low-cost carriers entering the market pose a threat to market share and profitability.

VI. Strategic Recommendations

A. Enhancing Strengths

Action Plan: Leverage strong brand and loyalty programs to introduce premium services and exclusive partnerships.

Responsible Team: Marketing Department

B. Mitigating Weaknesses

Action Plan: Implement cost-saving initiatives, including more efficient route planning and staff optimization.

Responsible Team: Operations and HR Departments

C. Capitalizing on Opportunities

Action Plan: Expand fleet with fuel-efficient aircraft to new emerging markets, focusing on underserved regions.

Responsible Team: Strategic Planning and Development

D. Addressing Threats

Action Plan: Diversify fuel contracts and invest in sustainable aviation fuel technologies to mitigate fuel price volatility.

Responsible Team: Procurement and Environmental Strategy Teams

VII. Financial Analysis

A. Current Financial Performance

Revenue: $45 billion (2050)

Net Profit: $3 billion (2050)

EBITDA: $7 billion (2050)

Cash Flow: $2.5 billion (2050)

B. Financial Projections

Revenue Projections: $50 billion (2051), $55 billion (2052)

Profit Margin Projections: 10% (2051), 12% (2052)

Investment Requirements: $5 billion for fleet expansion and technology upgrades over the next five years

VIII. Conclusion

This SWOT analysis provides a comprehensive overview of [Global Sky Airlines]'s current strategic position, highlighting key areas for potential investment. Based on the strengths, weaknesses, opportunities, and threats identified, [Your Company Name] offers the following strategic recommendations to enhance the airline's market position and financial performance.

This document is intended for use by [Your Company Name] and its authorized partners. The information contained herein is confidential and should not be disclosed without prior consent from [Your Company Name].