Free Restaurant Sales Expenses Reimbursement Policy

I. Purpose

The purpose of this policy is to establish a clear and consistent framework for the reimbursement of sales-related expenses incurred by employees of [Your Company Name]. This policy is designed to ensure that all employees are fairly compensated for expenditures made during the performance of their job duties, particularly those expenses directly tied to the promotion and sale of [Your Company Name]'s products and services. It aims to streamline the reimbursement process, reduce administrative burdens, and foster an environment of trust and accountability.

Further, this policy serves to delineate the boundaries of acceptable expenses, providing guidelines that help employees manage spending within company budgets. By defining procedures for submitting, reviewing, and approving expense claims, [Your Company Name] seeks to maintain financial controls and compliance with applicable U.S. laws and regulations, thereby protecting both the interests of the company and its employees.

II. Scope

This policy applies to all employees of [Your Company Name] who incur sales-related expenses in the course of performing their official duties. This encompasses a wide range of roles within the company, including but not limited to, sales representatives, account managers, and business development staff. It is applicable to both full-time and part-time employees, ensuring that anyone acting on behalf of [Your Company Name] in a sales capacity is covered under these guidelines.

The policy covers expenses that are necessary and reasonable for the execution of job responsibilities, such as client meetings, travel, and other sales activities. By setting this scope, [Your Company Name] ensures that all personnel are aware of and can adhere to the reimbursement procedures, promoting a consistent approach to expense management across the company.

III. Eligible Expenses

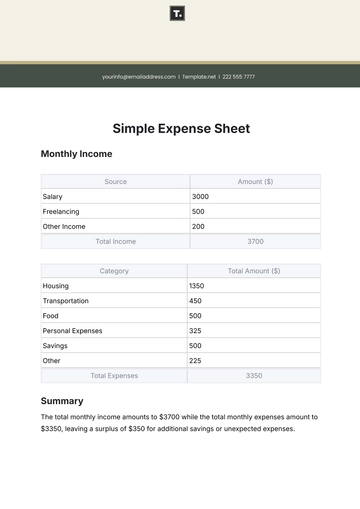

Eligible expenses under this policy are those that are deemed necessary and directly related to sales and business development activities. To ensure transparency and accountability, it is crucial that all expenditures are both reasonable and aligned with the pursuit of [Your Company Name]'s business objectives. The following list details the specific types of expenses that are eligible for reimbursement, provided they meet the outlined criteria and are properly documented:

Meals and entertainment expenses incurred while meeting with clients or prospects.

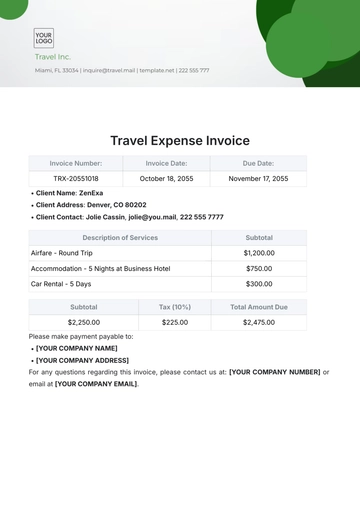

Travel expenses including transportation, lodging, and related fees necessary for client meetings or sales presentations.

Business development materials such as brochures, samples, and promotional items.

Registration fees for industry conferences and trade shows relevant to sales and business development.

IV. Ineligible Expenses

To maintain financial integrity and ensure compliance with company policies, certain expenses are considered ineligible for reimbursement. These are expenses that do not directly contribute to sales activities, lack necessary approvals, or exceed the prescribed spending limits. The aim is to prevent misuse of company resources and to uphold a standard of fiscal responsibility. The specific types of expenses that are not eligible for reimbursement include:

Personal expenses not directly related to sales activities.

Costs incurred without prior approval from a direct supervisor.

Expenses that exceed the established limits without proper justification and approval.

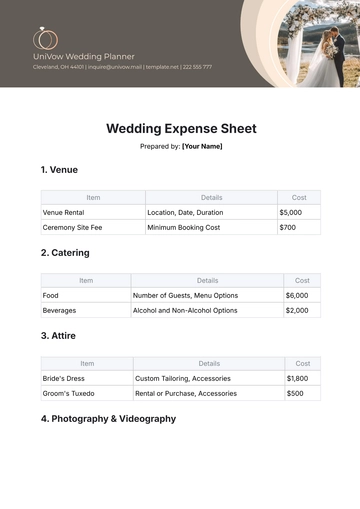

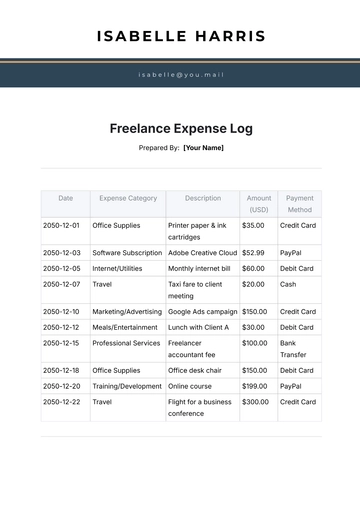

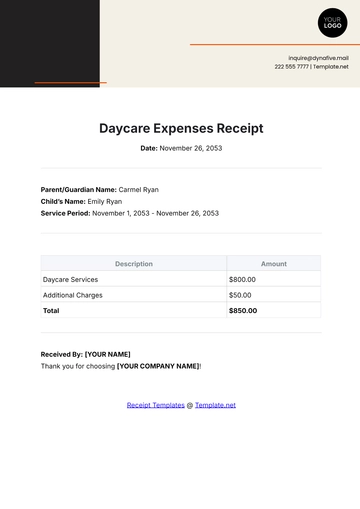

V. Documentation Requirements

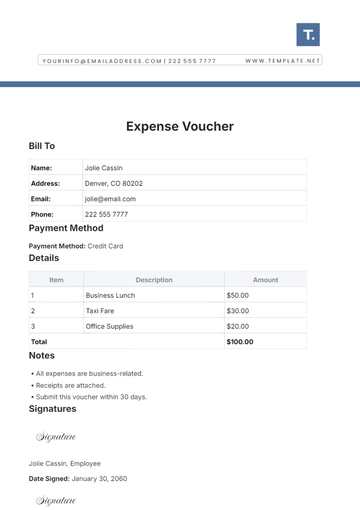

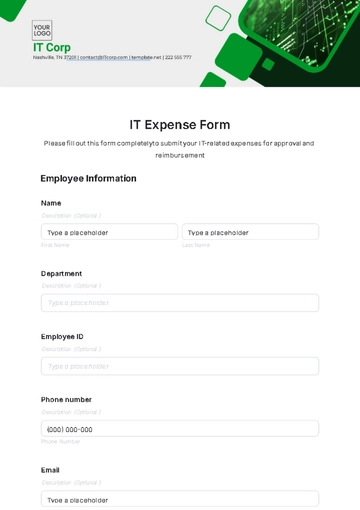

Accurate and thorough documentation is essential for the processing and approval of reimbursement requests. Employees are required to submit detailed evidence supporting each claim to ensure that expenses are verifiable and directly related to business activities. This transparency not only facilitates the reimbursement process but also ensures compliance with [Your Company Name]'s fiscal policies. The required documentation for all expenses includes:

Original receipts or electronic receipts for all expenses.

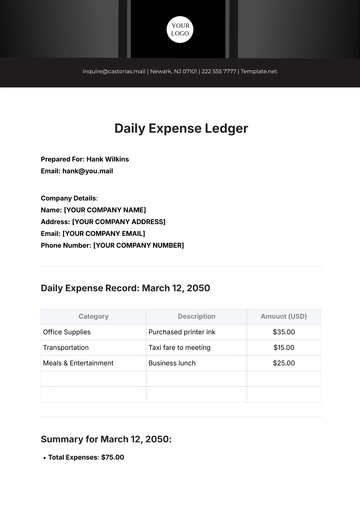

A completed expense report form detailing the nature and purpose of the expenses.

Contact information and business affiliation of clients or prospects involved in the expense.

VI. Approval Process

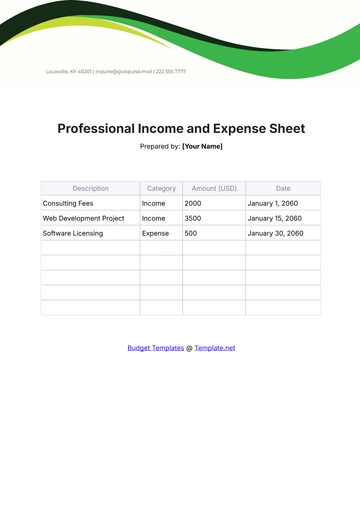

The approval process for reimbursement requests is designed to be rigorous and systematic to ensure that all submissions comply with [Your Company Name]'s financial policies. This multi-step procedure guarantees that each expense is scrutinized for accuracy and relevance to sales activities, enhancing the accountability and transparency of expense management. Here is the step-by-step approval process:

Submit Expense Report - Employee submits all required documentation for the expenses incurred.

Supervisor Review - The direct supervisor examines the documentation to verify its completeness and relevance.

Approval or Correction - Supervisor either approves the report or returns it for necessary revisions.

Forward to Finance - The approved expense report is sent to the Finance Department.

Finance Final Review - Finance conducts a thorough final review to ensure the request adheres to budget and policy constraints.

Process Reimbursement - Upon final approval, Finance processes and disburses the reimbursement.

VII. Reimbursement Limits

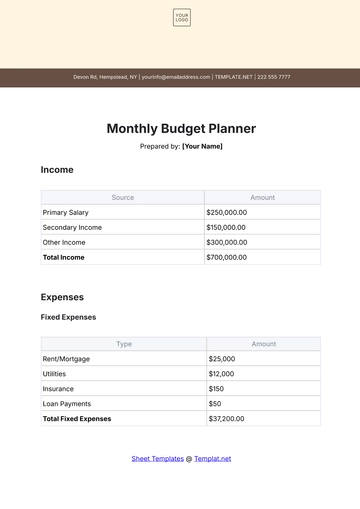

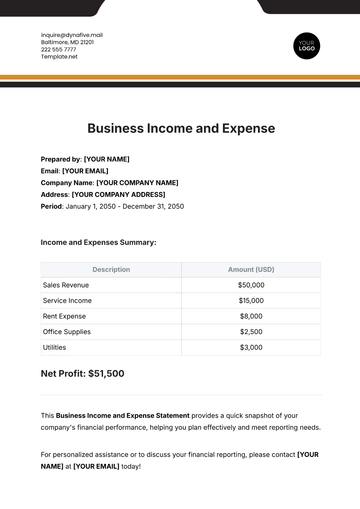

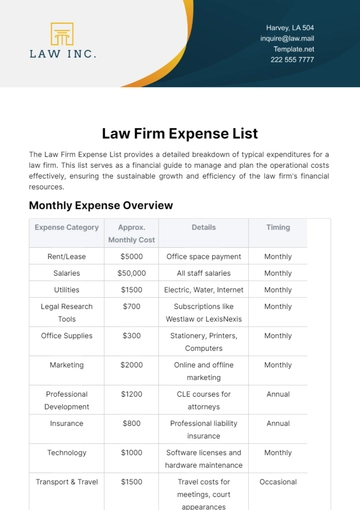

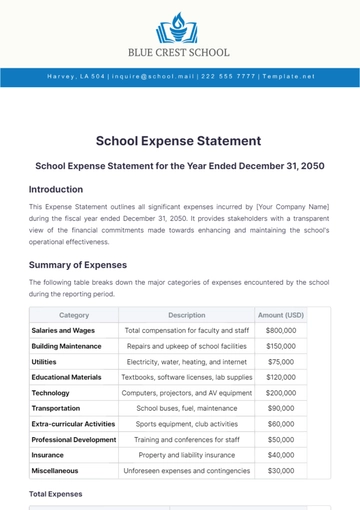

To ensure fiscal responsibility while adequately supporting sales activities, [Your Company Name] has established specific reimbursement limits for various categories of sales expenses. These limits are designed to balance cost control with the necessary flexibility to conduct effective business engagements. They reflect standard industry practices and are intended to cover reasonable costs incurred by employees. Exceptions to these limits require prior written approval to accommodate special circumstances. The standard reimbursement limits are as follows:

Category | Limitation |

|---|---|

Meals and entertainment | Up to $ [0] per person per meal. |

Transportation | Economy class airfare or standard mileage reimbursement rate for personal vehicle use. |

Lodging | Standard room rate at business-class hotels. |

Exceptions to these limits may be made with prior written approval from a direct supervisor or the Finance Department.

VIII. Review and Compliance

To ensure that [Your Company Name]'s Sales Expenses Reimbursement Policy remains current with evolving business practices and legal requirements, it will undergo an annual review. This systematic evaluation helps identify necessary adjustments or enhancements, ensuring the policy aligns with both company objectives and regulatory demands. Any modifications resulting from the review will be effectively communicated to all employees to maintain transparency and coherence in policy implementation.

Compliance with this policy is mandatory for all employees. Violations are taken seriously and will be addressed promptly. Employees found breaching any aspect of this policy may face disciplinary measures, which could include reprimands, repayment of misallocated funds, or even termination of employment, depending on the severity of the infraction. This strict enforcement supports the integrity of the company's financial operations and safeguards its reputation.

IX. Contact Information

For any questions or clarifications regarding this policy, please contact us via email at [Your Company Email].

Thank you for your cooperation and adherence to this policy.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing Template.net's Restaurant Sales Expenses Reimbursement Policy Template – your essential guide for managing expense claims in the food service industry. This editable and customizable template ensures clarity and fairness in reimbursing sales-related expenses. Crafted for convenience, it's editable in our Ai Editor Tool, offering seamless customization. Streamline your restaurant's financial processes with a detailed reimbursement policy that outlines eligible expenses, submission procedures, and approval guidelines, ensuring accurate and timely reimbursements for your sales team.