Free Restaurant Financial Analysis

I. Introduction

A. Brief Overview of [Your Company Name]

[Your Company Name] is a well-established restaurant located in [City], known for its Italian fusion cuisine. Since its inception in [Year], the restaurant has garnered a loyal customer base and has been a popular choice for diners in the area.

B. Purpose of the Financial Analysis

The purpose of this financial analysis is to provide a comprehensive review of [Your Company Name]'s financial performance over the past year. By analyzing key financial statements and ratios, we aim to gain insights into the restaurant's profitability, liquidity, efficiency, and overall financial health. This analysis will help us make informed decisions and develop strategies to improve financial performance.

II. Financial Statements Analysis

A. Income Statement

1. Revenue Analysis

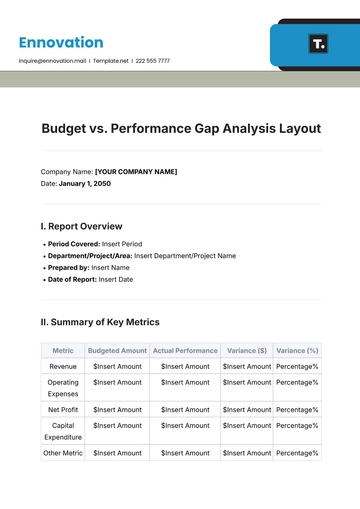

Category | Amount ($) |

|---|---|

Total Revenue | $1,200,000 |

Food Sales | $800,000 |

Beverage Sales | $300,000 |

Other Revenue | $100,000 |

2. Cost of Goods Sold (COGS) Analysis

Category | Amount ($) |

|---|---|

Food COGS | $320,000 |

Beverage COGS | $90,000 |

Other COGS | $30,000 |

Total COGS | $440,000 |

3. Gross Profit Margin Analysis

Gross Profit Margin = (Total Revenue - Total COGS) / Total Revenue

Gross Profit Margin = ($1,200,000 - $440,000) / $1,200,000 = 63.33%

4. Operating Expenses Analysis

Category | Amount ($) |

|---|---|

Labor Costs | $400,000 |

Rent | $120,000 |

Utilities | $30,000 |

Marketing | $50,000 |

Other Expenses | $100,000 |

Total Operating Expenses | $700,000 |

5. Net Profit Analysis

Net Profit = Total Revenue - Total COGS - Total Operating Expenses

Net Profit = $1,200,000 - $440,000 - $700,000 = $60,000

B. Balance Sheet

1. Assets Analysis

Category | Amount ($) |

|---|---|

Cash & Cash Equivalents | $50,000 |

Accounts Receivable | $20,000 |

Inventory | $40,000 |

Property, Plant & Equipment | $500,000 |

Other Assets | $30,000 |

Total Assets | $640,000 |

2. Liabilities Analysis

Category | Amount ($) |

|---|---|

Accounts Payable | $30,000 |

Short-term Loans | $50,000 |

Long-term Loans | $200,000 |

Other Liabilities | $20,000 |

Total Liabilities | $300,000 |

3. Equity Analysis

Category | Amount ($) |

|---|---|

Owner's Equity | $340,000 |

Retained Earnings | $0 |

Total Equity | $340,000 |

C. Cash Flow Statement

The Cash Flow Statement provides a detailed account of the cash inflows and outflows over a specific period. It is divided into three main sections: Operating Activities, Investing Activities, and Financing Activities. Understanding cash flow is critical for assessing the liquidity and financial health of [Your Company Name].

1. Operating Cash Flow Analysis

Operating cash flow measures the cash generated or used by [Your Company Name] in its core business operations. It indicates the ability of the restaurant to generate sufficient cash to maintain and grow operations.

Operating Cash Flow = Net Income + Depreciation - Change in Accounts Receivable - Change in Inventory + Change in Accounts Payable

Operating Cash Flow = $100,000 + $30,000 - $5,000 - $10,000 + $7,000 = $122,000

Category | Amount ($) |

|---|---|

Net Income | $100,000 |

Depreciation | $30,000 |

Change in Accounts Receivable | -$5,000 |

Change in Inventory | -$10,000 |

Change in Accounts Payable | $7,000 |

Total Operating Cash Flow | $122,000 |

2. Investing Cash Flow Analysis

Investing cash flow represents the cash used for investing in assets such as property, equipment, or other investments. It indicates the restaurant's investment in its long-term growth and expansion.

Investing Cash Flow = Cash from Sale of Assets - Cash Used for Investments

Investing Cash Flow = $10,000 - $50,000 = -$40,000

Category | Amount ($) |

|---|---|

Sale of Old Equipment | $10,000 |

Purchase of New Equipment | -$50,000 |

Total Investing Cash Flow | -$40,000 |

3. Financing Cash Flow Analysis

Financing cash flow shows the cash inflows and outflows related to financing activities, such as borrowing, repaying debt, or issuing equity. It provides insight into how [Your Company Name] finances its operations and growth.

Financing Cash Flow = Cash from Borrowing + Cash from Owners - Dividends Paid

Financing Cash Flow = $30,000 - $20,000 + $50,000 - $10,000 = $50,000

Category | Amount ($) |

|---|---|

Proceeds from Short-term Loans | $30,000 |

Repayment of Long-term Loans | -$20,000 |

Owner's Equity Contribution | $50,000 |

Dividends Paid | -$10,000 |

Total Financing Cash Flow | $50,000 |

Total Cash Flow:

Total Operating Cash Flow: $122,000

Total Investing Cash Flow: -$40,000

Total Financing Cash Flow: $50,000

Net Increase in Cash = Total Operating Cash Flow + Total Investing Cash Flow + Total Financing Cash Flow

Net Increase in Cash = $122,000 - $40,000 + $50,000 = $132,000

Category | Amount ($) |

|---|---|

Total Operating Cash Flow | $122,000 |

Total Investing Cash Flow | -$40,000 |

Total Financing Cash Flow | $50,000 |

Net Increase in Cash | $132,000 |

This detailed analysis of the cash flow statement provides a comprehensive view of [Your Company Name]'s cash management, highlighting its ability to generate cash from operations, invest in growth, and manage its financing activities effectively.

III. Financial Ratios Analysis

Financial ratios are useful tools for analyzing [Your Company Name] financial performance and assessing its financial health. They provide insights into various aspects of a company's operations, including profitability, liquidity, efficiency, and solvency. By comparing these ratios to industry benchmarks or historical data, stakeholders can evaluate the company's performance and make informed decisions.

A. Liquidity Ratios

1. Current Ratio

Current Ratio = Current Assets / Current Liabilities

Current Ratio = $500,000 / $250,000 = 2.0

2. Quick Ratio

Quick Ratio = (Current Assets - Inventory) / Current Liabilities

Inventory = $100,000

Quick Ratio = ($500,000 - $100,000) / $250,000 = 1.6

B. Profitability Ratios

1. Gross Profit Margin Ratio

Gross Profit Margin Ratio = (Total Revenue - COGS) / Total Revenue

Total Revenue = $1,000,000

COGS = $400,000

Gross Profit Margin Ratio = ($1,000,000 - $400,000) / $1,000,000 = 0.6 or 60%

2. Net Profit Margin Ratio

Net Profit Margin Ratio = Net Income / Total Revenue

Net Income = $100,000

Net Profit Margin Ratio = $100,000 / $1,000,000 = 0.1 or 10%

3. Return on Assets (ROA) Ratio

ROA Ratio = Net Income / Total Assets

Total Assets = $800,000

ROA Ratio = $100,000 / $800,000 = 0.125 or 12.5%

4. Return on Equity (ROE) Ratio

ROE Ratio = Net Income / Total Equity

Total Equity = $400,000

ROE Ratio = $100,000 / $400,000 = 0.25 or 25%

C. Efficiency Ratios

1. Inventory Turnover Ratio

Inventory Turnover Ratio = COGS / Average Inventory

Average Inventory = ($100,000 + $120,000) / 2 = $110,000

Inventory Turnover Ratio = $400,000 / $110,000 = 3.64

2. Accounts Receivable Turnover Ratio

Accounts Receivable Turnover Ratio = Total Revenue / Average Accounts Receivable

Average Accounts Receivable = ($20,000 + $25,000) / 2 = $22,500

Accounts Receivable Turnover Ratio = $1,000,000 / $22,500 = 44.44

3. Accounts Payable Turnover Ratio

Accounts Payable Turnover Ratio = Total Purchases / Average Accounts Payable

Total Purchases = $600,000

Average Accounts Payable = ($30,000 + $35,000) / 2 = $32,500

Accounts Payable Turnover Ratio = $600,000 / $32,500 = 18.46

D. Leverage Ratios

1. Debt-to-Equity Ratio

Debt-to-Equity Ratio = Total Debt / Total Equity

Total Debt = $300,000

Debt-to-Equity Ratio = $300,000 / $400,000 = 0.75

2. Interest Coverage Ratio

Interest Coverage Ratio = EBIT / Interest Expense

EBIT = $150,000

Interest Expense = $25,000

Interest Coverage Ratio = $150,000 / $25,000 = 6.0

IV. SWOT Analysis

A. Internal Factors

1. Strengths

Strong brand reputation: [Your Company Name] has built a strong reputation for delivering high-quality food and excellent service, resulting in a loyal customer base.

Unique menu offerings: The restaurant offers a unique and diverse menu that sets it apart from competitors, attracting food enthusiasts seeking new culinary experiences.

Efficient cost management: [Your Company Name] has implemented effective cost control measures, ensuring optimal use of resources and maintaining healthy profit margins.

2. Weaknesses

Reliance on seasonal trends: [Your Company Name] may experience fluctuations in revenue due to seasonal variations in customer traffic and demand.

Limited online presence: The restaurant's online presence is limited, potentially hindering its ability to reach a wider audience and compete in the digital marketplace.

B. External Factors

1. Opportunities

Market expansion: [Your Company Name] has the opportunity to expand its presence into new markets or locations, capitalizing on its existing success and reputation.

Introduction of online ordering system: By introducing an online ordering system, [Your Company Name] can cater to the growing demand for convenience among customers and increase sales.

2. Threats

Competition from new restaurants: The restaurant industry is highly competitive, and [Your Company Name] faces the threat of new entrants offering similar or better services.

Economic downturn: Economic downturns can impact consumer spending habits, potentially leading to a decline in sales for [Your Company Name].

V. Conclusion

A. Summary of Findings

Based on the SWOT analysis and financial performance review, [Your Company Name] has several key strengths that have contributed to its success, such as a strong brand reputation and unique menu offerings. However, there are also areas for improvement, such as addressing weaknesses like reliance on seasonal trends and enhancing the online presence.

B. Recommendations

Implement a marketing strategy to promote [Your Company Name]'s unique menu offerings and strengthen its brand reputation.

Invest in technology to improve the online ordering system and enhance the restaurant's digital presence.

Conduct regular market research to stay informed about emerging trends and customer preferences, allowing for proactive adjustments to the menu and services.

C. Future Outlook

With the right strategic decisions and investments, [Your Company Name] is well-positioned to capitalize on its strengths and opportunities, overcoming weaknesses and threats. By focusing on enhancing its competitive advantages and addressing areas for improvement, [Your Company Name] can achieve sustained growth and success in the future.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

This Restaurant Financial Analysis Template will help gain insights into your restaurant's financial health with this comprehensive template from Template.net. Customizable and editable, it helps you analyze revenue, expenses, and profitability trends. Use our Ai Editor Tool to easily input data and generate insightful reports. Make informed decisions to drive your restaurant's success.