Free Restaurant Payment Plan

I. Executive Summary

The Payment Plan at [Your Company Name] is a meticulously crafted strategy aimed at managing financial transactions with utmost efficiency. The primary purpose of this plan is to ensure a seamless transaction experience for our customers, thereby fostering a sense of trust and satisfaction. It outlines the diverse payment options available to our customers, catering to their varied preferences and needs. From traditional methods like cash to modern digital payments, the plan encompasses a wide range of options, ensuring that every customer finds a method that suits them best.

The plan also details the process for handling each type of transaction, ensuring that every payment, regardless of its method, is processed smoothly and accurately. This involves a series of well-defined steps and procedures that are designed to minimize errors and delays. By streamlining these processes, we aim to enhance the efficiency of our operations, thereby reducing wait times and improving the overall customer experience at [Your Company Name].

In addition to improving customer satisfaction and operational efficiency, the plan also places a strong emphasis on financial accuracy and security. It includes measures such as regular audits, use of secure payment gateways, and employee training to ensure that all transactions are accurate and secure. Furthermore, the plan ensures compliance with all relevant legal and financial regulations, demonstrating [Your Company Name]'s commitment to operating with integrity and transparency. This not only protects [Your Company Name] and its customers but also enhances the reputation of [Your Company Name] as a trustworthy and reliable restaurant.

II. Objectives

The Restaurant Payment Plan of [Your Company Name] is designed with several key objectives in mind. These objectives guide the development and implementation of the plan, ensuring that it effectively meets the needs of our customers and our business:

A. Enhancing Customer Convenience

One of the primary objectives of the plan is to enhance customer convenience. We understand that our customers have diverse preferences when it comes to payment methods. Therefore, we aim to provide a variety of options, allowing customers to choose the one that best suits their needs. This not only improves the customer experience but also encourages repeat business.

B. Ensuring Transaction Security

Another crucial objective is to ensure the security of all financial transactions. This includes protecting customer information and preventing fraudulent activity. By implementing robust security measures, we can provide our customers with peace of mind, knowing that their financial information is safe with us.

C. Improving Efficiency

The plan also aims to improve efficiency in our payment processing system. By streamlining the process, we can reduce errors and delays, leading to a smoother, more pleasant experience for our customers. Additionally, improved efficiency can also lead to cost savings for our business.

D. Compliance with Regulations

Lastly, the plan seeks to ensure that we comply with all relevant legal and financial regulations. This is crucial in maintaining our business’s integrity and avoiding potential legal issues. It also demonstrates our commitment to operating our business in a responsible and ethical manner.

III. Payment Options

At [Your Company Name], we understand that flexibility in payment options is a key aspect of customer service in the restaurant industry. We strive to accommodate the diverse preferences of our customers by offering a variety of payment methods.

A. Cash

Cash remains a widely used payment method, especially for customers who prefer traditional transactions. We ensure that our cash handling processes are efficient and secure, providing quick service for our customers who choose to pay with cash.

B. Credit/Debit Cards

Credit and debit cards are popular due to their convenience and widespread use. We have systems in place to process card payments quickly and securely, protecting our customers’ financial information while providing them with a seamless payment experience.

C. Mobile Payment Apps

With the rise of digital wallets and mobile payment apps like Apple Pay and Google Wallet, we have adapted our payment systems to accept these methods. These options provide a contactless and fast payment solution, enhancing the dining experience for tech-savvy customers.

D. Online Payments

For customers who prefer to make reservations and order deliveries online, we offer secure online payment options. This allows customers to make payments at their convenience, even before they step into our restaurant or receive their delivery.

E. Gift Cards

Gift cards are not only a popular gift item but also a convenient payment method. We offer branded gift cards that customers can use themselves or give to others. This also encourages customer loyalty and repeat visits.

Each of these payment options is designed to cater to the unique needs and preferences of our customers, ensuring that everyone can enjoy a convenient and secure payment experience at [Your Company Name].

IV. Transaction Process

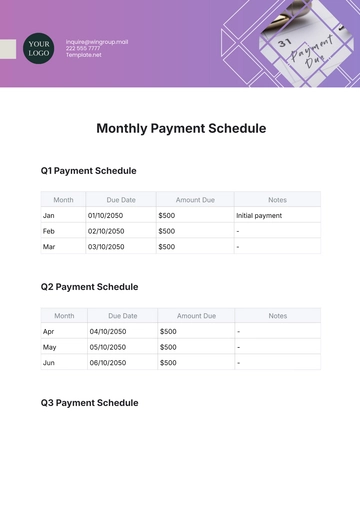

The transaction process is a critical component of the plan. It outlines the steps involved in processing each type of payment, ensuring that all transactions are handled efficiently and securely. The following table provides a detailed overview of the transaction process for each payment method:

Payment Method | Process |

|---|---|

Cash | Customer pays cash at the counter. The cashier verifies the amount, provides change if necessary, and issues a receipt. |

Credit/Debit Cards | Customer swipes or inserts the card into the card reader. The payment is processed through the POS system, and a receipt is provided. |

Mobile Payment Apps | Customer scans the QR code or taps their device on the reader. The payment is processed digitally, and a receipt is emailed to the customer. |

Online Payments | Customer selects items online and proceeds to checkout, where they can choose their preferred online payment method. A digital receipt is sent via email. |

Gift Cards | Customer presents the gift card, which is scanned and the amount is deducted from the card balance. Any remaining balance is printed on the receipt. |

The transaction process for each payment method is designed with the customer’s convenience and security in mind. By detailing the steps involved in each process, we can ensure that all transactions are handled efficiently and securely. This not only enhances the customer’s experience but also improves the overall operational efficiency of [Your Company Name].

Furthermore, it helps us identify areas for improvement and innovation, allowing us to continuously enhance our payment processes to meet the evolving needs of our customers and the industry. This commitment to understanding and improving our transaction processes is a testament to [Your Company Name]'s dedication to customer satisfaction and operational excellence.

V. Financial Accuracy and Security Measures

In the Restaurant Payment Plan of [Your Company Name], we will prioritize financial accuracy and security. We will implement several measures to protect customer data and financial information, which are outlined below:

A. Regular Auditing of Transactions

Audit Frequency: Regular auditing of transactions will be conducted to detect and prevent discrepancies. These audits will be performed daily to ensure that all transactions are accurate and accounted for.

Audit Process: The audit process will involve cross-checking the recorded transactions with the actual cash and card payments received. Any discrepancies will be immediately investigated and resolved.

Audit Team: Our audit team will consist of experienced financial professionals who will be trained to spot any irregularities or potential fraud.

Audit Reports: The results of the audits will be documented in detailed reports, which will be reviewed by management to identify any patterns or areas of concern.

Continuous Improvement: The audit process will be continuously improved based on the findings and feedback from the audit team and management.

B. Use of Secure Payment Gateways and Encryption Technology

Secure Payment Gateways: We will use secure payment gateways for all card and online transactions. These gateways use advanced encryption technology to protect customer data during the transaction process.

Encryption Technology: Encryption technology is used to scramble sensitive information, such as credit card numbers, so that it cannot be read if intercepted during transmission.

PCI Compliance: Our payment gateways will be PCI compliant, meaning they adhere to the Payment Card Industry Data Security Standard (PCI DSS), which sets the standard for secure transactions.

Regular Updates: We will regularly update our payment gateways and encryption technology to protect against new threats and vulnerabilities.

C. Employee Training on Best Practices for Handling Payment Information

Training Program: We will develop a comprehensive training program in place to educate our employees on the best practices for handling payment information. This includes training on how to process transactions, handle cash, and protect customer information.

Data Privacy: Employees will be trained on the importance of data privacy and the legal implications of mishandling customer information.

Fraud Prevention: The training program will also cover fraud prevention, teaching employees how to spot potential fraudulent activity and what to do in such situations.

Continuous Learning: Training is not a one-time event but a continuous process. Employees will receive regular updates and refresher courses to keep their knowledge up-to-date.

Monitoring and Evaluation: Employee performance in handling payment information will be regularly monitored and evaluated. Feedback will be provided to help employees improve their skills and knowledge.

D. Compliance with PCI DSS (Payment Card Industry Data Security Standard)

Understanding PCI DSS: PCI DSS is a set of security standards designed to ensure that all companies that accept, process, store, or transmit credit card information maintain a secure environment.

Adherence to Standards: At [Your Company Name], we will strictly adhere to these standards to protect our customers’ credit card information.

Regular Compliance Checks: We will conduct regular compliance checks to ensure that our systems and processes continue to meet the PCI DSS standards.

Employee Awareness: All employees will be made aware of the PCI DSS standards and their role in maintaining compliance.

Continuous Improvement: We will continuously strive to improve our security measures and stay updated with any changes to the PCI DSS standards.

Reporting and Documentation: Compliance with PCI DSS will be documented and reported as required by the standards.

VI. Conclusion

The Payment Plan at [Your Company Name] serves as a crucial framework designed to effectively manage the payment options of our customers. It aims to improve the overall customer experience and increase the operational efficiency of our restaurant by providing a variety of payment options tailored to fit diverse customer needs and maintaining the highest standards of security during transaction processes. This strategic approach is integral to ensuring customer satisfaction and fostering a reliable payment environment.

By implementing this plan and regularly reviewing its effectiveness, [Your Company Name] remains dedicated to maintaining the utmost levels of financial integrity and providing superior customer service. We are devoted to continuously enhancing our payment processes to adapt effectively to the changing requirements of our customers and to stay abreast of the latest industry developments.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Offer flexible payment options with ease with the Restaurant Payment Plan Template here on Template.net! The editable format makes it easy to update payment options. Customize the plan to fit your restaurant’s policies using the customizable sections. Make use of our AI Editor Tool for a clear and comprehensive plan!

You may also like

- Finance Plan

- Construction Plan

- Sales Plan

- Development Plan

- Career Plan

- Budget Plan

- HR Plan

- Education Plan

- Transition Plan

- Work Plan

- Training Plan

- Communication Plan

- Operation Plan

- Health And Safety Plan

- Strategy Plan

- Professional Development Plan

- Advertising Plan

- Risk Management Plan

- Restaurant Plan

- School Plan

- Nursing Home Patient Care Plan

- Nursing Care Plan

- Plan Event

- Startup Plan

- Social Media Plan

- Staffing Plan

- Annual Plan

- Content Plan

- Payment Plan

- Implementation Plan

- Hotel Plan

- Workout Plan

- Accounting Plan

- Campaign Plan

- Essay Plan

- 30 60 90 Day Plan

- Research Plan

- Recruitment Plan

- 90 Day Plan

- Quarterly Plan

- Emergency Plan

- 5 Year Plan

- Gym Plan

- Personal Plan

- IT and Software Plan

- Treatment Plan

- Real Estate Plan

- Law Firm Plan

- Healthcare Plan

- Improvement Plan

- Media Plan

- 5 Year Business Plan

- Learning Plan

- Marketing Campaign Plan

- Travel Agency Plan

- Cleaning Services Plan

- Interior Design Plan

- Performance Plan

- PR Plan

- Birth Plan

- Life Plan

- SEO Plan

- Disaster Recovery Plan

- Continuity Plan

- Launch Plan

- Legal Plan

- Behavior Plan

- Performance Improvement Plan

- Salon Plan

- Security Plan

- Security Management Plan

- Employee Development Plan

- Quality Plan

- Service Improvement Plan

- Growth Plan

- Incident Response Plan

- Basketball Plan

- Emergency Action Plan

- Product Launch Plan

- Spa Plan

- Employee Training Plan

- Data Analysis Plan

- Employee Action Plan

- Territory Plan

- Audit Plan

- Classroom Plan

- Activity Plan

- Parenting Plan

- Care Plan

- Project Execution Plan

- Exercise Plan

- Internship Plan

- Software Development Plan

- Continuous Improvement Plan

- Leave Plan

- 90 Day Sales Plan

- Advertising Agency Plan

- Employee Transition Plan

- Smart Action Plan

- Workplace Safety Plan

- Behavior Change Plan

- Contingency Plan

- Continuity of Operations Plan

- Health Plan

- Quality Control Plan

- Self Plan

- Sports Development Plan

- Change Management Plan

- Ecommerce Plan

- Personal Financial Plan

- Process Improvement Plan

- 30-60-90 Day Sales Plan

- Crisis Management Plan

- Engagement Plan

- Execution Plan

- Pandemic Plan

- Quality Assurance Plan

- Service Continuity Plan

- Agile Project Plan

- Fundraising Plan

- Job Transition Plan

- Asset Maintenance Plan

- Maintenance Plan

- Software Test Plan

- Staff Training and Development Plan

- 3 Year Plan

- Brand Activation Plan

- Release Plan

- Resource Plan

- Risk Mitigation Plan

- Teacher Plan

- 30 60 90 Day Plan for New Manager

- Food Safety Plan

- Food Truck Plan

- Hiring Plan

- Quality Management Plan

- Wellness Plan

- Behavior Intervention Plan

- Bonus Plan

- Investment Plan

- Maternity Leave Plan

- Pandemic Response Plan

- Succession Planning

- Coaching Plan

- Configuration Management Plan

- Remote Work Plan

- Self Care Plan

- Teaching Plan

- 100-Day Plan

- HACCP Plan

- Student Plan

- Sustainability Plan

- 30 60 90 Day Plan for Interview

- Access Plan

- Site Specific Safety Plan