Free Sample Debt Payment Plan

Client Information | Details |

|---|---|

Name | [Your Name] |

Address | [Your Address] |

Date of Birth | [Your Date of Birth] |

Social Security Number | [Your SSN] |

I. Purpose

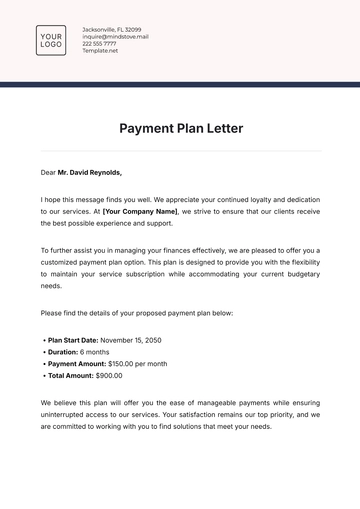

This particular payment plan is offered by [Your Company Name] with the specific intention of aiding our clients in effectively managing and organizing the repayment of their debts in a structured manner.

II. Current Debt Overview

Creditor Name: Chase Bank

Type of Debt: Credit Card

Total Amount Owed: $5,000.00

Minimum Monthly Payment: $100.00

Interest Rate: 18%

Due Date: 15th of each month

III. Financial Assessment

Monthly Income: $3,500.00

Expense Category | Monthly Amount | Details |

|---|---|---|

Housing | $1,200.00 | Rent |

Utilities | $200.00 | Electricity, Water, Gas |

Transportation | $300.00 | Public Transport, Gas, Insurance |

Food | $400.00 | Groceries, Dining Out |

Insurance | $150.00 | Health, Auto |

Debt Payments | $200.00 | Student Loan |

Other | $250.00 | Entertainment, Subscriptions, Miscellaneous |

IV. Debt Repayment Strategy

Prioritize Debts: Based on our assessment, we will prioritize debts by focusing on those with the highest interest rates or smallest balances first, depending on your preference and financial goals.

Budget Allocation: We will allocate a portion of your monthly income towards debt repayment, ensuring it remains sustainable and does not overly strain your finances.

Snowball vs. Avalanche Method: After discussing your preferences, we have decided to [Snowball Method or Avalanche Method] to systematically pay off your debts.

Negotiation: We will explore options for negotiating with creditors to potentially lower interest rates, reduce monthly payments, or negotiate settlements.

Consolidation: We will assess the possibility of consolidating your debts into a single loan with more favorable terms, potentially saving you money on interest.

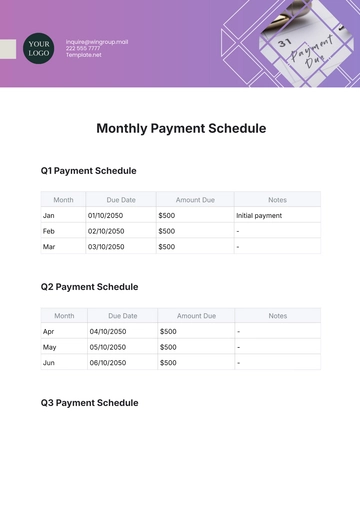

V. Proposed Payment Plan

Monthly Budget Allocation for Debt Repayment:

Total Income: $3,500.00

Total Expenses (excluding debt payments): $2,900.00

Amount Available for Debt Repayment: $600.00

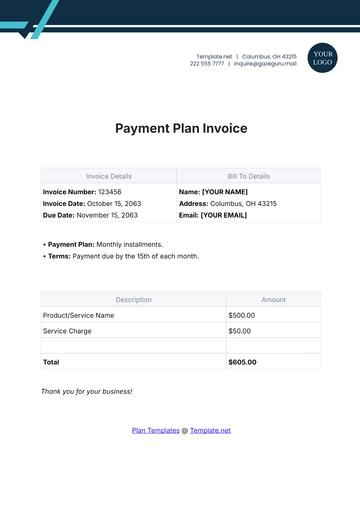

Proposed Monthly Payment for Each Creditor:

Creditor Name | Total Amount Owed | Minimum Monthly Payment | Proposed Monthly Payment | Remaining Balance |

|---|---|---|---|---|

[Creditor 1] | $5,000.00 | $100.00 | $200.00 | $4,800.00 |

[Creditor 2] | $2,500.00 | $50.00 | $100.00 | $2,400.00 |

[Creditor 3] | $3,200.00 | $80.00 | $150.00 | $3,050.00 |

VI. Monitoring and Adjustments

Regular Review: We will schedule quarterly reviews to assess your progress and make any necessary adjustments to the payment plan.

Windfalls: Any unexpected income, such as bonuses or tax refunds, will be considered to accelerate debt repayment.

Emergency Fund: We will work towards building an emergency fund to prevent adding to your debt in case of unforeseen expenses.

Financial Education: We will provide resources and guidance to improve your financial literacy and empower you to make informed decisions.

Client Agreement

I, [Your Name], acknowledge that I have reviewed and understand the proposed debt payment plan. I agree to adhere to the agreed-upon monthly payment schedule and actively participate in the debt repayment process.

[Your Name]

[Date]

[Advisor Name]

[Date]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Take control of your finances with Template.net's Debt Payment Plan Template. Customizable and editable in our AI Editor Tool, this template provides a structured approach to managing and repaying debts. Simplify your financial life and stay on track with this essential tool.

You may also like

- Finance Plan

- Construction Plan

- Sales Plan

- Development Plan

- Career Plan

- Budget Plan

- HR Plan

- Education Plan

- Transition Plan

- Work Plan

- Training Plan

- Communication Plan

- Operation Plan

- Health And Safety Plan

- Strategy Plan

- Professional Development Plan

- Advertising Plan

- Risk Management Plan

- Restaurant Plan

- School Plan

- Nursing Home Patient Care Plan

- Nursing Care Plan

- Plan Event

- Startup Plan

- Social Media Plan

- Staffing Plan

- Annual Plan

- Content Plan

- Payment Plan

- Implementation Plan

- Hotel Plan

- Workout Plan

- Accounting Plan

- Campaign Plan

- Essay Plan

- 30 60 90 Day Plan

- Research Plan

- Recruitment Plan

- 90 Day Plan

- Quarterly Plan

- Emergency Plan

- 5 Year Plan

- Gym Plan

- Personal Plan

- IT and Software Plan

- Treatment Plan

- Real Estate Plan

- Law Firm Plan

- Healthcare Plan

- Improvement Plan

- Media Plan

- 5 Year Business Plan

- Learning Plan

- Marketing Campaign Plan

- Travel Agency Plan

- Cleaning Services Plan

- Interior Design Plan

- Performance Plan

- PR Plan

- Birth Plan

- Life Plan

- SEO Plan

- Disaster Recovery Plan

- Continuity Plan

- Launch Plan

- Legal Plan

- Behavior Plan

- Performance Improvement Plan

- Salon Plan

- Security Plan

- Security Management Plan

- Employee Development Plan

- Quality Plan

- Service Improvement Plan

- Growth Plan

- Incident Response Plan

- Basketball Plan

- Emergency Action Plan

- Product Launch Plan

- Spa Plan

- Employee Training Plan

- Data Analysis Plan

- Employee Action Plan

- Territory Plan

- Audit Plan

- Classroom Plan

- Activity Plan

- Parenting Plan

- Care Plan

- Project Execution Plan

- Exercise Plan

- Internship Plan

- Software Development Plan

- Continuous Improvement Plan

- Leave Plan

- 90 Day Sales Plan

- Advertising Agency Plan

- Employee Transition Plan

- Smart Action Plan

- Workplace Safety Plan

- Behavior Change Plan

- Contingency Plan

- Continuity of Operations Plan

- Health Plan

- Quality Control Plan

- Self Plan

- Sports Development Plan

- Change Management Plan

- Ecommerce Plan

- Personal Financial Plan

- Process Improvement Plan

- 30-60-90 Day Sales Plan

- Crisis Management Plan

- Engagement Plan

- Execution Plan

- Pandemic Plan

- Quality Assurance Plan

- Service Continuity Plan

- Agile Project Plan

- Fundraising Plan

- Job Transition Plan

- Asset Maintenance Plan

- Maintenance Plan

- Software Test Plan

- Staff Training and Development Plan

- 3 Year Plan

- Brand Activation Plan

- Release Plan

- Resource Plan

- Risk Mitigation Plan

- Teacher Plan

- 30 60 90 Day Plan for New Manager

- Food Safety Plan

- Food Truck Plan

- Hiring Plan

- Quality Management Plan

- Wellness Plan

- Behavior Intervention Plan

- Bonus Plan

- Investment Plan

- Maternity Leave Plan

- Pandemic Response Plan

- Succession Planning

- Coaching Plan

- Configuration Management Plan

- Remote Work Plan

- Self Care Plan

- Teaching Plan

- 100-Day Plan

- HACCP Plan

- Student Plan

- Sustainability Plan

- 30 60 90 Day Plan for Interview

- Access Plan

- Site Specific Safety Plan