Free Personal Payment Plan

I. Introduction

This payment plan, created by [Your Company Name], serves as a structured financial strategy designed to manage an individual's expenses, income, and debt obligations effectively. The goal is to provide a roadmap for managing personal finances, including budgeting, saving, debt repayment, and long-term financial objectives.

II. Client Information

Name: [Client Name]

Email: [Client Email]

Phone: [Client Phone Number]

Address: [Client Address]

III. Budgeting

A detailed breakdown of expected monthly income and expenses. Accurate budgeting ensures efficient management of financial resources and planning for future expenditures.

Category | Estimated Monthly Expenses |

|---|---|

Housing | $1200 |

Utilities | $200 |

Groceries | $400 |

Transportation | $300 |

Insurance | $150 |

Miscellaneous | $250 |

Income

Monthly Salary: $5000

Additional Income: $500 (Side hustle)

IV. Savings Plan

Setting aside a portion of income for future use, emergency funds, and specific savings goals.

Monthly Savings Goal: $500

Emergency Fund Target: $3000

V. Debt Repayment Plan

A systematic approach to managing and paying off debts, including credit cards, loans, and other liabilities.

Debt Type | Total Amount Owed | Monthly Payment | Interest Rate |

|---|---|---|---|

Credit Card | $5000 | $200 | 18% |

Student Loan | $10000 | $150 | 5% |

Auto Loan | $15000 | $300 | 4% |

VI. Long-term Financial Goals

Outline achievable long-term financial goals such as retirement planning, purchasing a home, or funding education.

Goal 1: Save $50,000 for a down payment on a house within 5 years.

Goal 2: Contribute $300/month to retirement savings.

Goal 3: Establish a college savings fund for children's education.

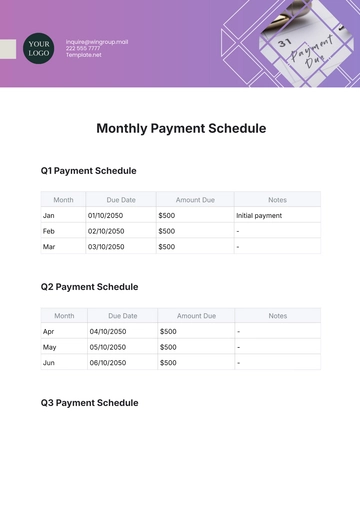

VII. Payment Schedule

A personalized payment schedule to keep track of due dates and ensure timely payments.

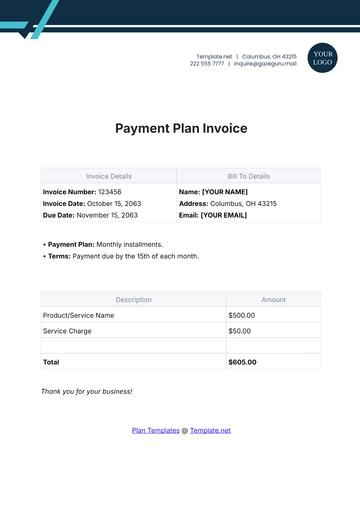

Payment Type | Due Date | Amount |

|---|---|---|

Rent/Mortgage | 1st of each month | $1200 |

Utilities | 15th of each month | $200 |

Credit Card | 5th of each month | $200 |

VIII. Contact Information

For any questions or further assistance, please contact:

Name: [Your Name]

Email: [Your Email]

Phone: [Your Company Number]

Thank you for choosing [Your Company Name] to help you manage your financial future effectively.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Personal Payment Plan Template by Template.net. Tailored for simplicity and efficiency, this editable and customizable template streamlines financial planning. Crafted for versatility, it's editable in our AI Editor too, ensuring seamless customization. Simplify your budgeting process and take control of your finances effortlessly with this indispensable tool. Experience financial freedom today!

You may also like

- Finance Plan

- Construction Plan

- Sales Plan

- Development Plan

- Career Plan

- Budget Plan

- HR Plan

- Education Plan

- Transition Plan

- Work Plan

- Training Plan

- Communication Plan

- Operation Plan

- Health And Safety Plan

- Strategy Plan

- Professional Development Plan

- Advertising Plan

- Risk Management Plan

- Restaurant Plan

- School Plan

- Nursing Home Patient Care Plan

- Nursing Care Plan

- Plan Event

- Startup Plan

- Social Media Plan

- Staffing Plan

- Annual Plan

- Content Plan

- Payment Plan

- Implementation Plan

- Hotel Plan

- Workout Plan

- Accounting Plan

- Campaign Plan

- Essay Plan

- 30 60 90 Day Plan

- Research Plan

- Recruitment Plan

- 90 Day Plan

- Quarterly Plan

- Emergency Plan

- 5 Year Plan

- Gym Plan

- Personal Plan

- IT and Software Plan

- Treatment Plan

- Real Estate Plan

- Law Firm Plan

- Healthcare Plan

- Improvement Plan

- Media Plan

- 5 Year Business Plan

- Learning Plan

- Marketing Campaign Plan

- Travel Agency Plan

- Cleaning Services Plan

- Interior Design Plan

- Performance Plan

- PR Plan

- Birth Plan

- Life Plan

- SEO Plan

- Disaster Recovery Plan

- Continuity Plan

- Launch Plan

- Legal Plan

- Behavior Plan

- Performance Improvement Plan

- Salon Plan

- Security Plan

- Security Management Plan

- Employee Development Plan

- Quality Plan

- Service Improvement Plan

- Growth Plan

- Incident Response Plan

- Basketball Plan

- Emergency Action Plan

- Product Launch Plan

- Spa Plan

- Employee Training Plan

- Data Analysis Plan

- Employee Action Plan

- Territory Plan

- Audit Plan

- Classroom Plan

- Activity Plan

- Parenting Plan

- Care Plan

- Project Execution Plan

- Exercise Plan

- Internship Plan

- Software Development Plan

- Continuous Improvement Plan

- Leave Plan

- 90 Day Sales Plan

- Advertising Agency Plan

- Employee Transition Plan

- Smart Action Plan

- Workplace Safety Plan

- Behavior Change Plan

- Contingency Plan

- Continuity of Operations Plan

- Health Plan

- Quality Control Plan

- Self Plan

- Sports Development Plan

- Change Management Plan

- Ecommerce Plan

- Personal Financial Plan

- Process Improvement Plan

- 30-60-90 Day Sales Plan

- Crisis Management Plan

- Engagement Plan

- Execution Plan

- Pandemic Plan

- Quality Assurance Plan

- Service Continuity Plan

- Agile Project Plan

- Fundraising Plan

- Job Transition Plan

- Asset Maintenance Plan

- Maintenance Plan

- Software Test Plan

- Staff Training and Development Plan

- 3 Year Plan

- Brand Activation Plan

- Release Plan

- Resource Plan

- Risk Mitigation Plan

- Teacher Plan

- 30 60 90 Day Plan for New Manager

- Food Safety Plan

- Food Truck Plan

- Hiring Plan

- Quality Management Plan

- Wellness Plan

- Behavior Intervention Plan

- Bonus Plan

- Investment Plan

- Maternity Leave Plan

- Pandemic Response Plan

- Succession Planning

- Coaching Plan

- Configuration Management Plan

- Remote Work Plan

- Self Care Plan

- Teaching Plan

- 100-Day Plan

- HACCP Plan

- Student Plan

- Sustainability Plan

- 30 60 90 Day Plan for Interview

- Access Plan

- Site Specific Safety Plan