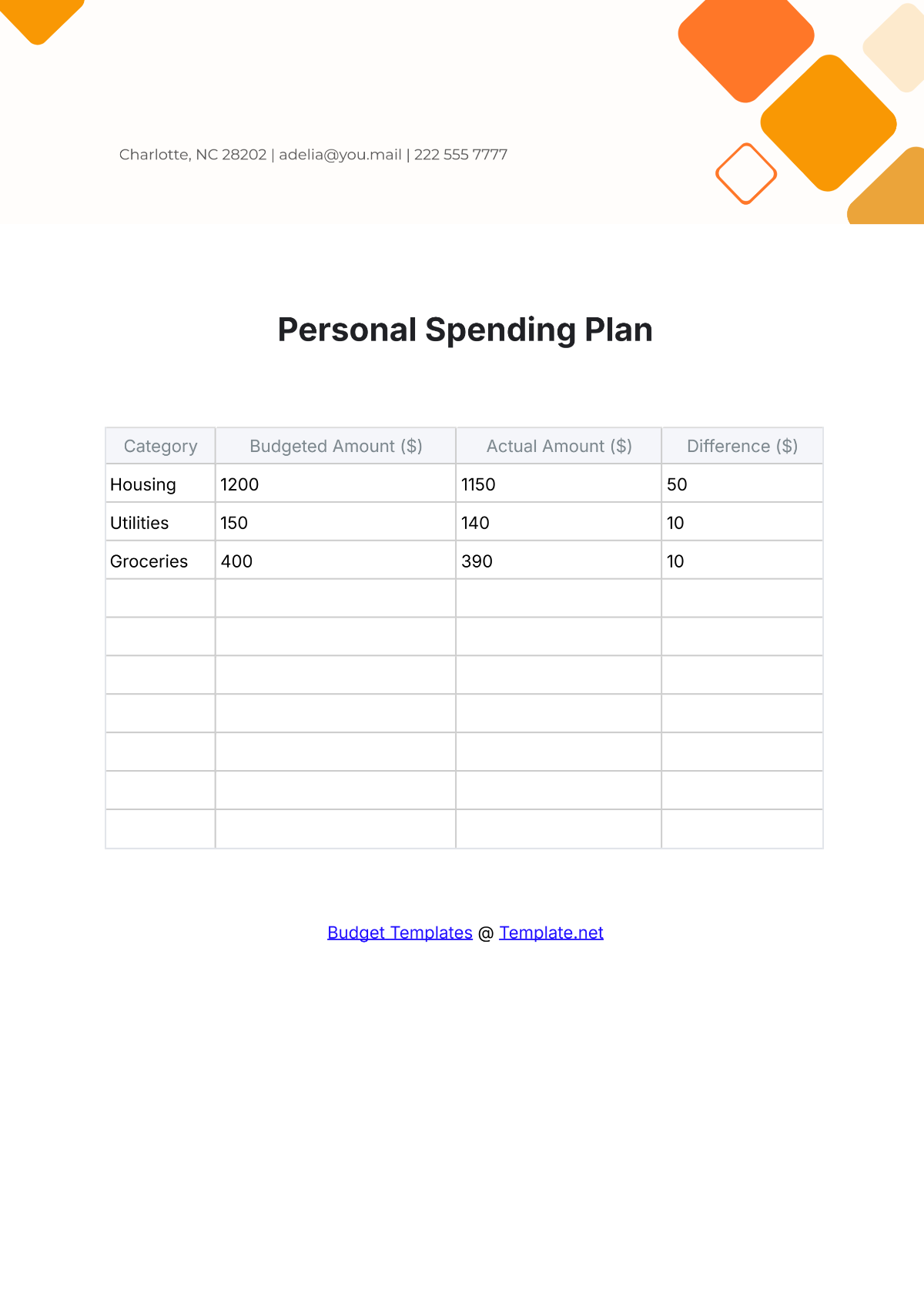

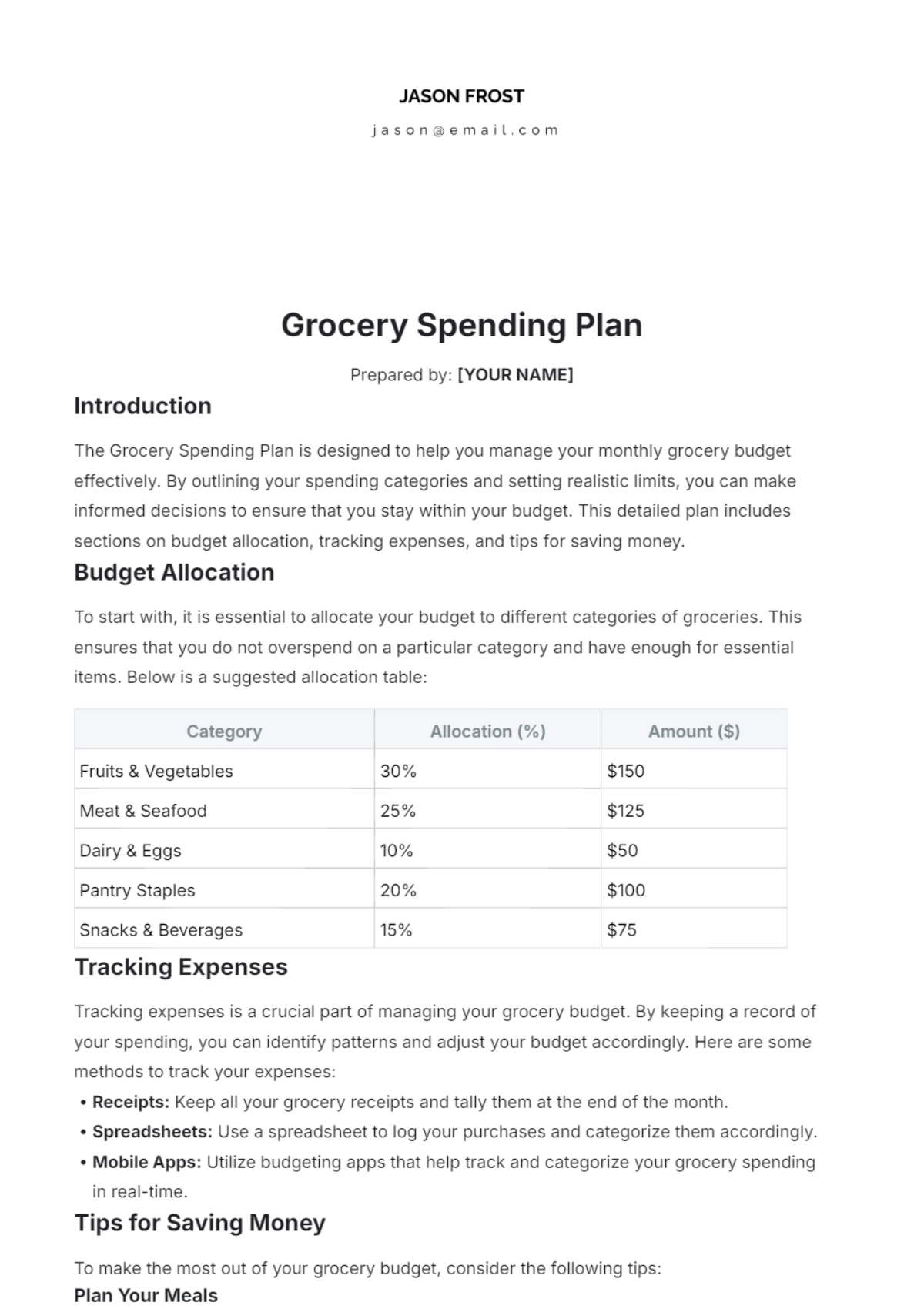

Free Beginner Budget Plan

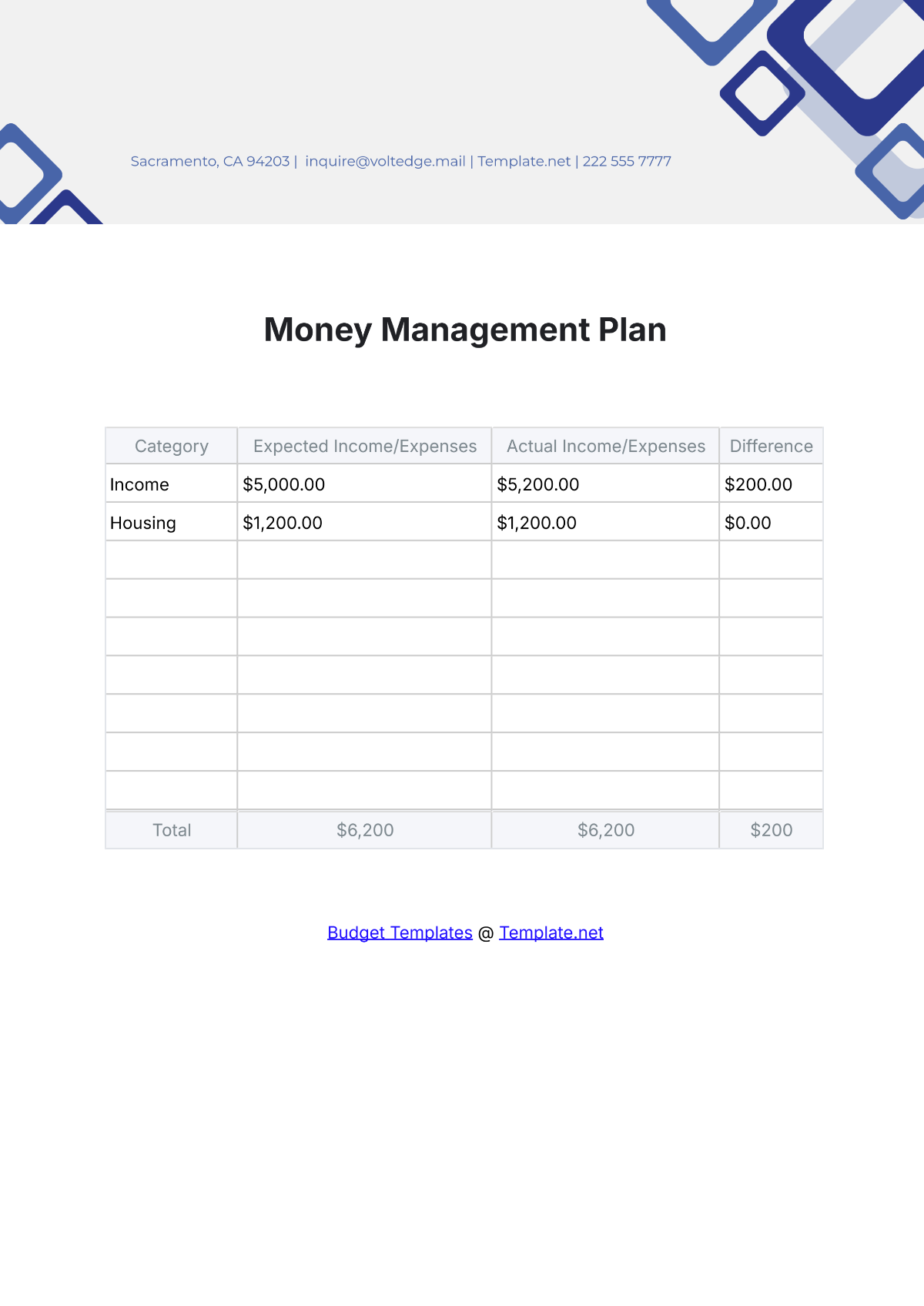

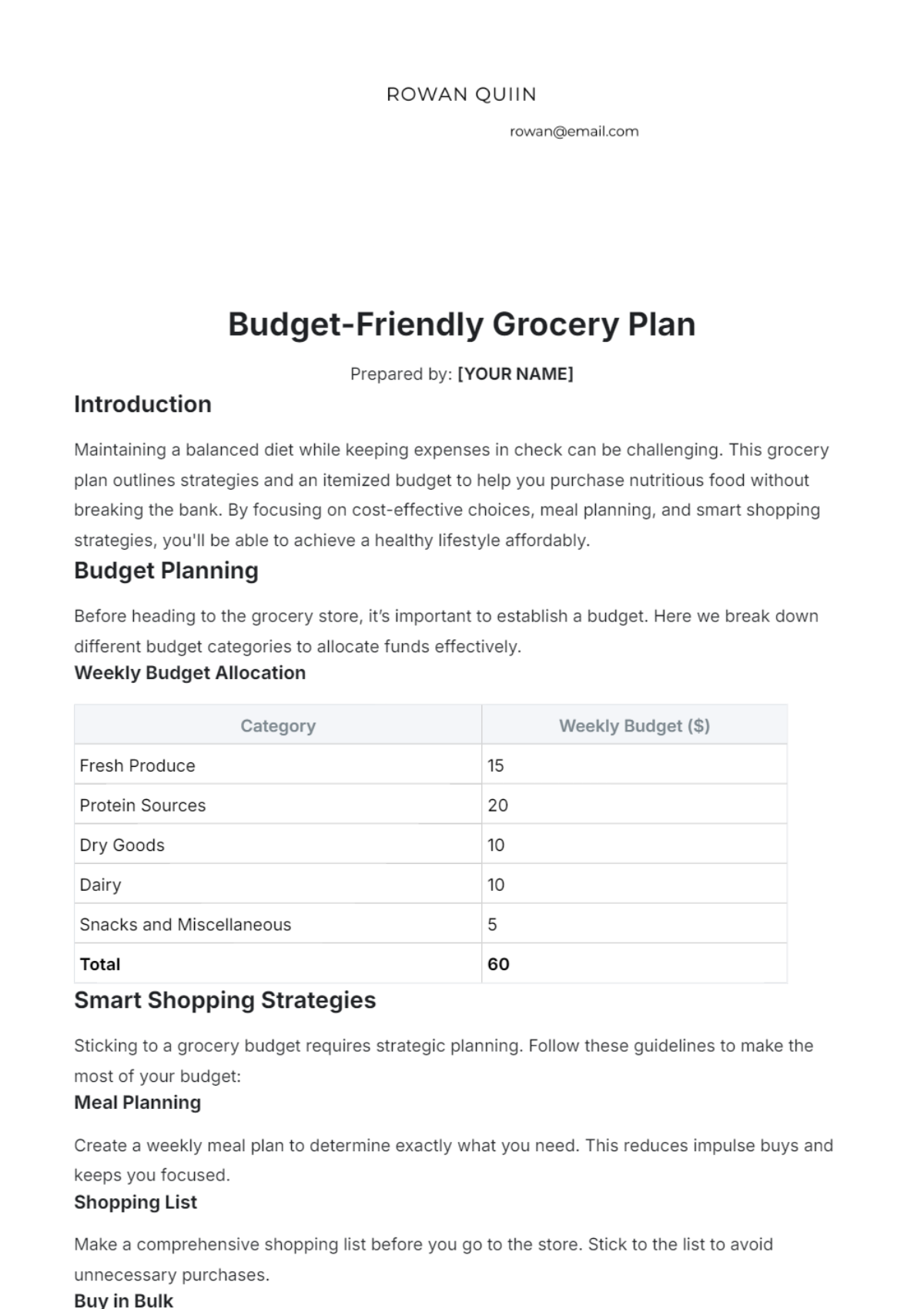

Get started on your financial journey with the Beginner Budget Plan Template from Template.net. This customizable and editable template helps you manage your expenses effortlessly. Utilize the AI Editor Tool to tailor the plan to your needs, ensuring a perfect fit for your budgetary goals. Achieve financial clarity and control with ease today!