Free Super Saver Trading Plan

I. Introduction

Welcome to our [Your Company Name], designed to guide us, the traders, in navigating the intricate landscape of financial markets. With a keen focus on minimizing costs while steadfastly pursuing our financial aspirations, this plan outlines a strategic approach to trading over the [timeframe]. By harnessing efficient trading practices, we aim to optimize our savings and enhance our overall financial well-being.

II. Financial Goals and Objectives

A. Long-Term Wealth Accumulation

Our paramount objective is the accumulation of wealth over the long term. By maximizing returns while diligently minimizing trading costs and taxes, we aim to steadily build a robust financial foundation for the future.

B. Risk Management

Mitigating risk is integral to our trading philosophy. We seek to align our trading strategy with our risk tolerance, preserving our capital while actively seeking out opportunities for growth and expansion.

C. Financial Independence

Central to our aspirations is the attainment of financial independence. Through disciplined investment practices and prudent decision-making, we strive to reduce dependency on external factors for income, empowering ourselves to chart our financial destiny.

III. Asset Allocation Strategy

Asset Class | Allocation (%) |

|---|---|

Stocks | 60 |

Bonds | 30 |

Real Estate | 10 |

IV. Trading Strategy

A. Diversification

We recognize the importance of diversification in mitigating risk and enhancing portfolio stability. By spreading our investments across various asset classes, we aim to optimize returns while minimizing exposure to market volatility.

B. Dollar-Cost Averaging

Consistency is key to our investment approach. Through the practice of dollar-cost averaging, we commit to investing a fixed amount of capital at regular intervals, regardless of prevailing market conditions. This strategy allows us to smooth out market fluctuations and accumulate assets over time.

C. Tax-Efficient Trading

We are mindful of the impact of taxes on our investment returns. To minimize our tax liabilities, we will employ tax-efficient trading strategies such as harvesting tax losses and maximizing contributions to retirement accounts.

V. Cost Minimization Techniques

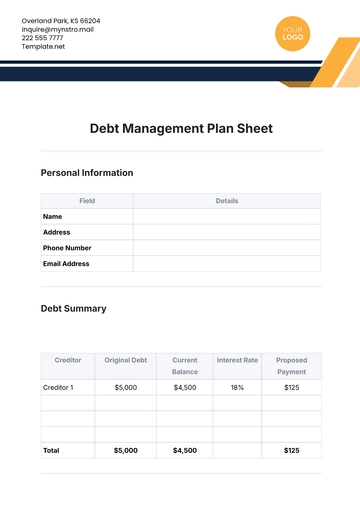

Technique | Description |

|---|---|

Low-Cost Brokerages | We will seek out brokerage firms with competitive commission rates and minimal fees. |

Limit Orders | By utilizing limit orders, we can execute trades at predetermined price levels, avoiding unnecessary expenses. |

Bulk Trading | We will consolidate multiple trades into single transactions whenever feasible, reducing overall transaction costs. |

VI. Monitoring and Review Mechanism

A. Regular Portfolio Review

We understand the importance of staying vigilant in monitoring our portfolio's performance. Through regular reviews, we will assess our investment strategies, rebalance asset allocations, and make necessary adjustments to stay aligned with our financial objectives.

B. Tracking Expenses

Cost awareness is paramount to our success. We will meticulously track trading costs and expenses, identifying opportunities for further cost reduction and optimization to maximize our savings potential.

C. Market Analysis

Staying informed is essential in navigating dynamic market conditions. We will continuously analyze market trends and economic indicators, leveraging insights to adapt our trading plan and capitalize on emerging opportunities while mitigating risks.

VII. Conclusion

In conclusion, this Super Saver Trading Plan empowers us as traders to navigate the complexities of financial markets with confidence and purpose. By adhering to our outlined strategies and embracing a disciplined approach to trading, we are poised to achieve our long-term financial goals, inching closer to financial independence and prosperity.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover and Unlock effortless financial planning with the Super Saver Trading Plan Template from Template.net. This fully customizable and editable template, designed for precision and ease, is perfect for strategizing your trades. Editable in our AI Editor Tool, it ensures seamless personalization to fit your unique needs. Unlock your financial potential today.

You may also like

- Finance Plan

- Construction Plan

- Sales Plan

- Development Plan

- Career Plan

- Budget Plan

- HR Plan

- Education Plan

- Transition Plan

- Work Plan

- Training Plan

- Communication Plan

- Operation Plan

- Health And Safety Plan

- Strategy Plan

- Professional Development Plan

- Advertising Plan

- Risk Management Plan

- Restaurant Plan

- School Plan

- Nursing Home Patient Care Plan

- Nursing Care Plan

- Plan Event

- Startup Plan

- Social Media Plan

- Staffing Plan

- Annual Plan

- Content Plan

- Payment Plan

- Implementation Plan

- Hotel Plan

- Workout Plan

- Accounting Plan

- Campaign Plan

- Essay Plan

- 30 60 90 Day Plan

- Research Plan

- Recruitment Plan

- 90 Day Plan

- Quarterly Plan

- Emergency Plan

- 5 Year Plan

- Gym Plan

- Personal Plan

- IT and Software Plan

- Treatment Plan

- Real Estate Plan

- Law Firm Plan

- Healthcare Plan

- Improvement Plan

- Media Plan

- 5 Year Business Plan

- Learning Plan

- Marketing Campaign Plan

- Travel Agency Plan

- Cleaning Services Plan

- Interior Design Plan

- Performance Plan

- PR Plan

- Birth Plan

- Life Plan

- SEO Plan

- Disaster Recovery Plan

- Continuity Plan

- Launch Plan

- Legal Plan

- Behavior Plan

- Performance Improvement Plan

- Salon Plan

- Security Plan

- Security Management Plan

- Employee Development Plan

- Quality Plan

- Service Improvement Plan

- Growth Plan

- Incident Response Plan

- Basketball Plan

- Emergency Action Plan

- Product Launch Plan

- Spa Plan

- Employee Training Plan

- Data Analysis Plan

- Employee Action Plan

- Territory Plan

- Audit Plan

- Classroom Plan

- Activity Plan

- Parenting Plan

- Care Plan

- Project Execution Plan

- Exercise Plan

- Internship Plan

- Software Development Plan

- Continuous Improvement Plan

- Leave Plan

- 90 Day Sales Plan

- Advertising Agency Plan

- Employee Transition Plan

- Smart Action Plan

- Workplace Safety Plan

- Behavior Change Plan

- Contingency Plan

- Continuity of Operations Plan

- Health Plan

- Quality Control Plan

- Self Plan

- Sports Development Plan

- Change Management Plan

- Ecommerce Plan

- Personal Financial Plan

- Process Improvement Plan

- 30-60-90 Day Sales Plan

- Crisis Management Plan

- Engagement Plan

- Execution Plan

- Pandemic Plan

- Quality Assurance Plan

- Service Continuity Plan

- Agile Project Plan

- Fundraising Plan

- Job Transition Plan

- Asset Maintenance Plan

- Maintenance Plan

- Software Test Plan

- Staff Training and Development Plan

- 3 Year Plan

- Brand Activation Plan

- Release Plan

- Resource Plan

- Risk Mitigation Plan

- Teacher Plan

- 30 60 90 Day Plan for New Manager

- Food Safety Plan

- Food Truck Plan

- Hiring Plan

- Quality Management Plan

- Wellness Plan

- Behavior Intervention Plan

- Bonus Plan

- Investment Plan

- Maternity Leave Plan

- Pandemic Response Plan

- Succession Planning

- Coaching Plan

- Configuration Management Plan

- Remote Work Plan

- Self Care Plan

- Teaching Plan

- 100-Day Plan

- HACCP Plan

- Student Plan

- Sustainability Plan

- 30 60 90 Day Plan for Interview

- Access Plan

- Site Specific Safety Plan